When the currency of a customer payment differs from the currency of your bank account on file, WooPayments charges a currency conversion fee as part of the transaction. An additional fee may also be charged if the card used to pay for the transaction was issued outside your country or region. Please see our full list of fees for a breakdown by country.

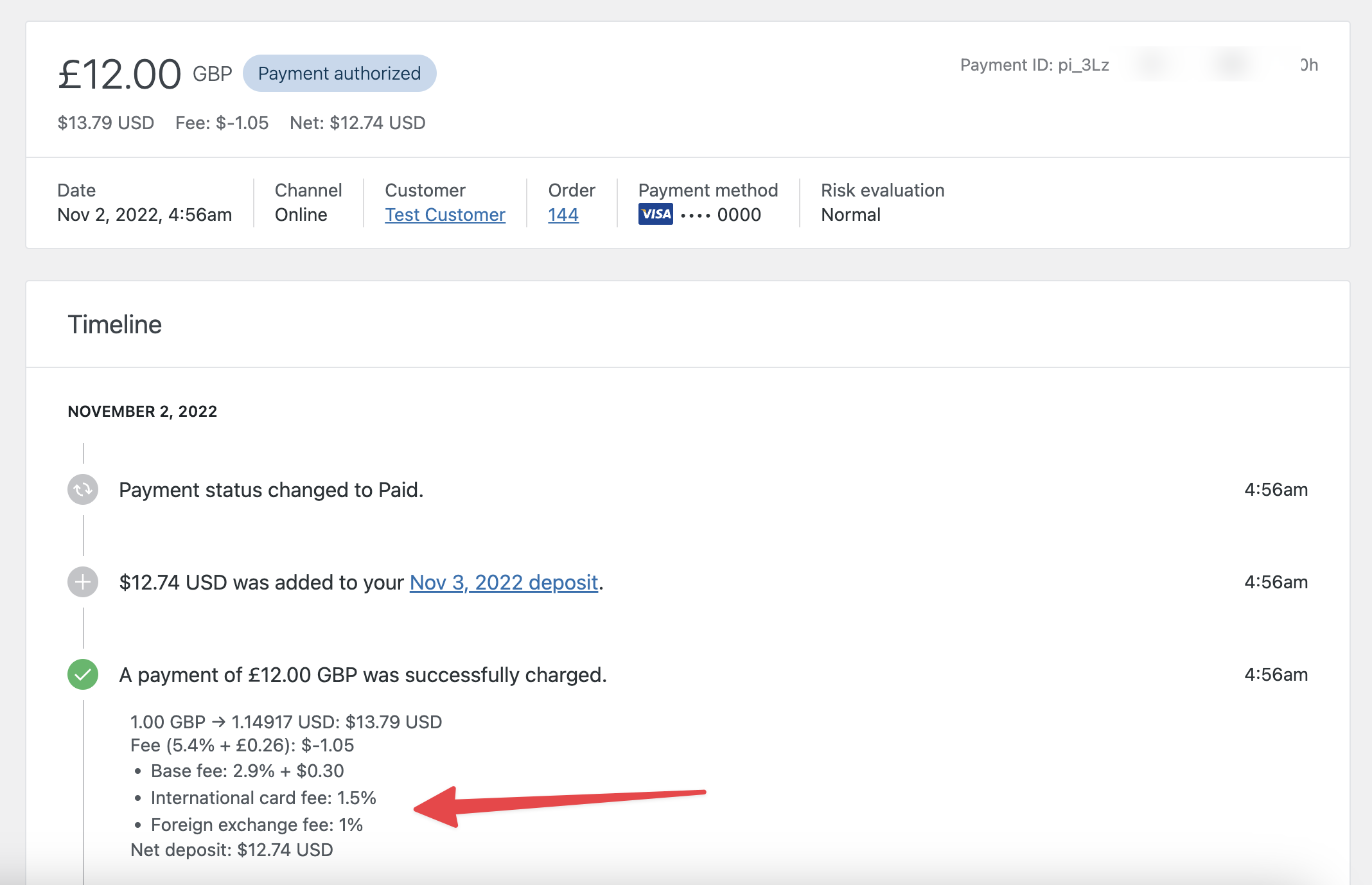

As an example, if a U.S. merchant also accepts payments in GBP from customers based in the United Kingdom, they may incur the following fees:

- An additional 1.5% for accepting payment via a card issued outside the U.S.

- An additional 1% for currency conversion from GBP to USD.

The screenshot below shows an example of what such a transaction would look like under the Payments > Transactions page. Both the international card fee and currency conversion fee are show in the detailed transaction view.

Historical behavior

↑ Back to topThe fees charged for currency conversion have not changed since multi-currency transactions were first made available. However, the way the fee is charged and presented has changed as WooPayments has evolved.

Prior to June 7, 2021, the currency conversion fee was built into the foreign exchange rate used for the transaction. Under this system, to determine the exchange rate for a transaction, WooPayments would use the mid-market foreign rate and add an additional 1–2% to that rate. It then applied that to the charge amount to determine the equivalent amount in the deposit currency.

Because the fee was built into the exchange rate, the timeline view on the transaction details screen did not include the currency conversion fee in the fees breakdown. Instead, it was factored into the exchange rate displayed on this screen. This same behavior exists for all transactions made prior to June 7, 2021.

From June 7, 2021 onward, the currency conversion fee was no longer charged as part of the foreign exchange rate. Instead, it was added as a separate fee line item to the transaction. This made it easier to present the full fee associated with the transaction in the fees on the timeline view on the transaction details screen.