WooCommerce Marketplace

Grow your business with hundreds of solutions for your store.

Discover our favorites

See moreNew and noteworthy

See moreA hand-picked selection of new and interesting extensions in the Marketplace.

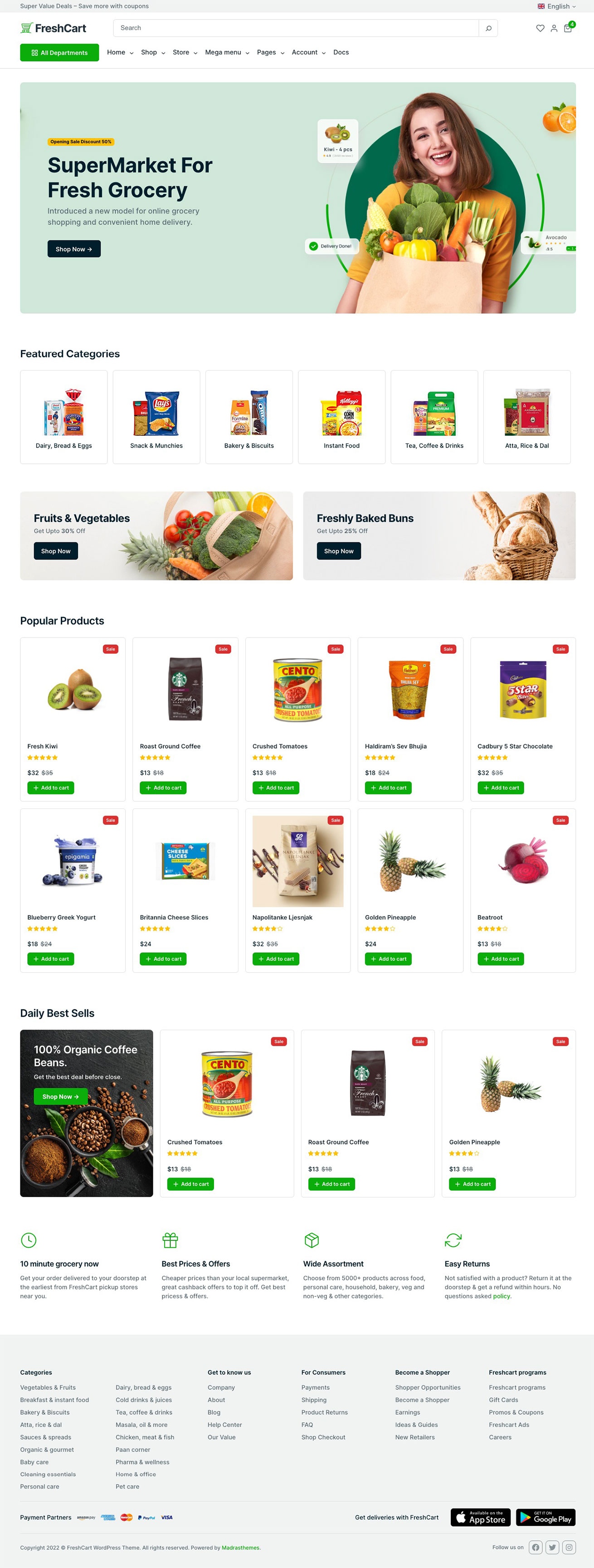

Themes

See moreBrowse beautiful and effective themes for your WooCommerce store.

Payment solutions

See moreAccept secure payments through the world’s leading payment processors and gateways.

Shipping, Delivery and Fulfillment

Store Management

Trending products

Featured collections

See moreCurated extension collections to get you started.

Additional payment methods

See moreAdd alternative ways for your customers to pay to your checkout in addition to your primary payment solution.

Grow your business

See moreExplore the tools and integrations you need to market your store and grow your business.