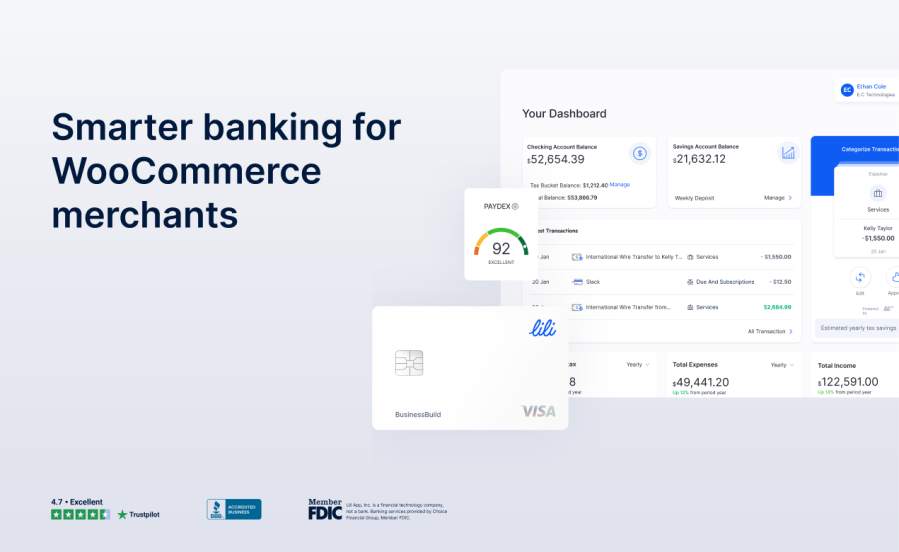

For Woo merchants aiming to scale smarter, Lili connects your store to an award-winning banking platform built for ecommerce. Whether you’re a US seller or an international entrepreneur with a US-based business, you can open an account with no hidden fees or minimum balance, send and receive international wires, build your credit profile through BusinessBuild, auto-save taxes from every sale, earn 3.00% Annual Percentage Yield on savings, and give your whole team a single dashboard to run your store’s money.

No hidden fees, no overdraft fees4, and no minimum deposit or balance required. Seamlessly send and receive money using standard and express ACH, domestic and international wire, or by integrating payment apps or external bank accounts. Grow your balance with a savings account that earns you 3.00% Annual Percentage Yield3.

Secure the inventory, ads, and shipping capacity you’ll need for high-volume periods. BusinessBuild tracks and reports your account activity to Dun & Bradstreet, offers real-time score monitoring, and includes a secured credit card, so you can qualify for better terms when holiday demand surges. No credit check, no extra apps, no guesswork.*

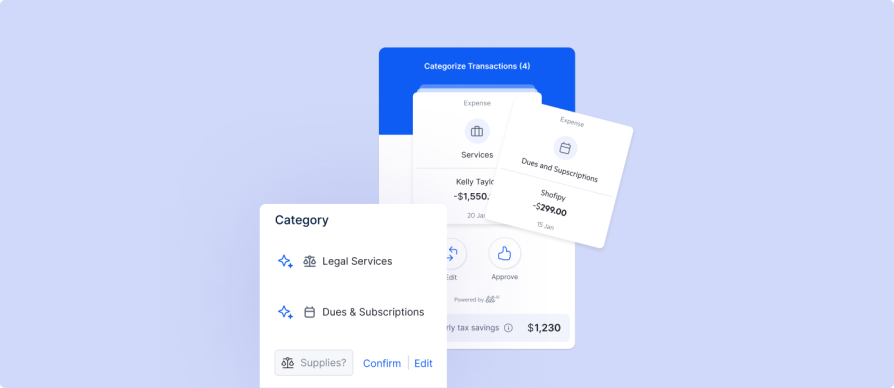

Lili automatically sets aside the right percentage from each Woo order for sales tax, so filing season never catches your cash flow off guard. Instantly categorize every transaction to streamline your books, then watch auto-generated P&L, cash-flow, and expense reports update in real time.

Banking, business credit, and accounting — together in one powerful platform, built for entrepreneurs who expect more.

Once you open a Lili business checking account, copy the routing and account numbers into WooCommerce › Payments › Payout settings, and every future settlement lands in your Lili dashboard (no extra extensions required).

Lili Basic has no monthly account fee, no minimum balance, and no hidden charges; optional Pro, Smart, and Premium plans, as well Lili's BusinessBuild add-on, add advanced features for a flat monthly price.

Yes. You can send or receive international wires to and from over 30 countries — $25 outbound and $15 inbound - directly inside your Lili account.

Yes, Lili is available outside of the US for residents of select supported countries. You can apply for an account if you have a US-registered business (Sole Proprietorships are not supported). Lili currently accepts applications from residents of (a) Australia, Canada, Germany, Israel, Netherlands, New Zealand, Spain, Sweden, and the United Kingdom, if you apply directly, or (b) Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Denmark, Finland, France, Germany, Greece, India, Ireland, Israel, Italy, Mexico, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, UK, and Uruguay, if you form a US-registered business through our authorized business formation partners (who will direct you to apply for a Lili bank account).

Absolutely. The BusinessBuild Program automatically reports eligible activity to Dun & Bradstreet, includes real-time credit monitoring, and offers a secured credit card plus training resource - all built into your dashboard.

Yes. Team Access lets you invite co-owners or accountants and assign role-based permissions, so everyone sees the right data without sharing logins.

Once the funds hit, you can move them (automatically or manually) into a Savings Account, which earns 3 % APY—roughly seven times the US average.

Lili is a financial platform designed specifically for businesses, offering a combination of advanced business banking with built-in credit building, accounting and tax preparation software to help business owners better streamline and simplify their finances. Lili is available on desktop via the Lili web platform, as well as via a mobile app on iOS and Android mobile devices.

Lili is a financial technology company, not a bank. Banking services are provided by Sunrise Banks, N.A., Member FDIC. The Lili Visa® Debit Card is issued by Sunrise Banks, N.A., Member FDIC, pursuant to a license from Visa U.S.A., Inc. The Card may be used everywhere Visa debit cards are accepted.

*BusinessBuild is an add-on feature available to all Lili Accounts, except sole proprietorships. After a one-month free trial, account holders will be charged $18 per month for the next three months, then $30 per month thereafter. By integrating your Lili Account through the D&B Credit Insights banking integration feature, there may be potential for you to positively impact your Delinquency and Failure Scores. Dun & Bradstreet requires a minimum of six months of business banking transaction history to be able to potentially impact these scores.

Wire Transfer service provided by Column Bank N.A., Member FDIC. All wires are subject to acceptance criteria and risk-based review and may be rejected at the sole discretion of Column Bank N. A. or Lili App Inc.

1 Eligibility for cashback awards is available to Lili Pro, Lili Smart, and Lili Premium account holders only; applicable monthly account fees apply. For details, please refer to your Sunrise Banks Account Agreement.

2 Accounting, tax preparation and invoicing software is available to Lili Smart and Lili Premium account holders only; applicable monthly account fees apply. For details, please refer to your Sunrise Banks Account Agreement.

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of January 1, 2025. Must have at least $0.01 in savings to earn interest. The APY applies to balances of up to and including $1,000,000. Any portions of a balance over $1,000,000 will not earn interest or have a yield. Available to Lili Pro, Lili Smart, and Lili Premium account holders only; applicable monthly account fees apply.

4 BalanceUp is a discretionary overdraft program for debit card purchases only, offered for Lili Pro, Lili Smart, and Lili Premium Account holders; applicable monthly account fees apply. You must meet eligibility requirements and enroll in the program. Once enrolled, your Account must remain in good standing with a deposit and spending history that meets our discretionary requirements to maintain access to the feature. BalanceUp overdraft limits of $20-$200 are provided at our sole discretion, and may be revoked any time, with or without notice. Please refer to our BalanceUP Service Disclosure for more details.

5 Early access to ACH transfer funds depends on the timing of the payer’s submission of transfers. Lili will generally post these transfers on the day they are received which can be up to 2 days earlier than the payer’s scheduled payment date.

6 Up to $1,000 per cardholder per 24 hours period. Some locations have lower limits and retailer fees may vary ($4.95 max). Note that Lili does not charge transaction fees.

7 Lili AI and other reports related to income and expenses provided by Lili can be used to assist with your accounting. Final categorization of income and expenses for tax purposes is your responsibility. Lili is not a tax preparer and does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your specific situation.

8 Lili does not charge debit card fees related to foreign transactions, in-network ATM usage, or card inactivity, or require a minimum balance. The Lili Visa® Debit Card is included in all account plans, and remains fee-free with the Lili Basic plan. Applicable monthly account fees apply for the Lili Pro, Lili Smart, and Lili Premium plans. For details, please refer to your Sunrise Banks Account Agreement.

9 International wire transfers are only available to legal entity customers (LLCs, corporations, and partnerships). Transfers can be made to and from select countries. Please check your app for the most up-to-date list. Fees apply. Learn more here Sunrise Banks Account Agreement.

© 2025 Lili App Inc. All Rights Reserved.