Active installs

400

A assinatura inclui

Suporte

Credit Line or Credits for WooCommerce allows you to offer a Line of Credit to your customers using which they can buy the products in your shop now and pay later.

When your customers browse products on your site, there’s always a chance that they will postpone purchasing because of insufficient funds. With credits, they won’t have to abandon their carts. They can purchase on the spot. What’s more, you can choose to charge interest on transactions made with credits. This can increase your site’s revenue.

Offering credits is a show of good faith and can help boost future sales from repeat customers.

Satisfied customers are more likely to refer new customers to your site.

Your customers won’t have to postpone purchases due to insufficient funds. Plus, they won’t have to keep their payment credentials on hand at all times—they can use credits instead.

If you choose not to charge interest, your customers will only be responsible for repaying the regular price of a product.

You can offer customers up to 58 days from the date of purchase to repay the credits they used.

This plugin comes up with 2 fund types.

Admin Funds

Virtual Funds

Admin Funds

In this type, to offer a credit line to the customers, first you(admin) has to load funds to your admin account and from admin account it can be transferred to customers account. In this type, you will have a statistics on total funds approved to customers.

Virtual Funds

In this type Funds can be issued without any limitation from admin side.

This plugin supports three ways to offer Credit Line to customers,

Auto Approval

Application Based Approval

Complete Manual

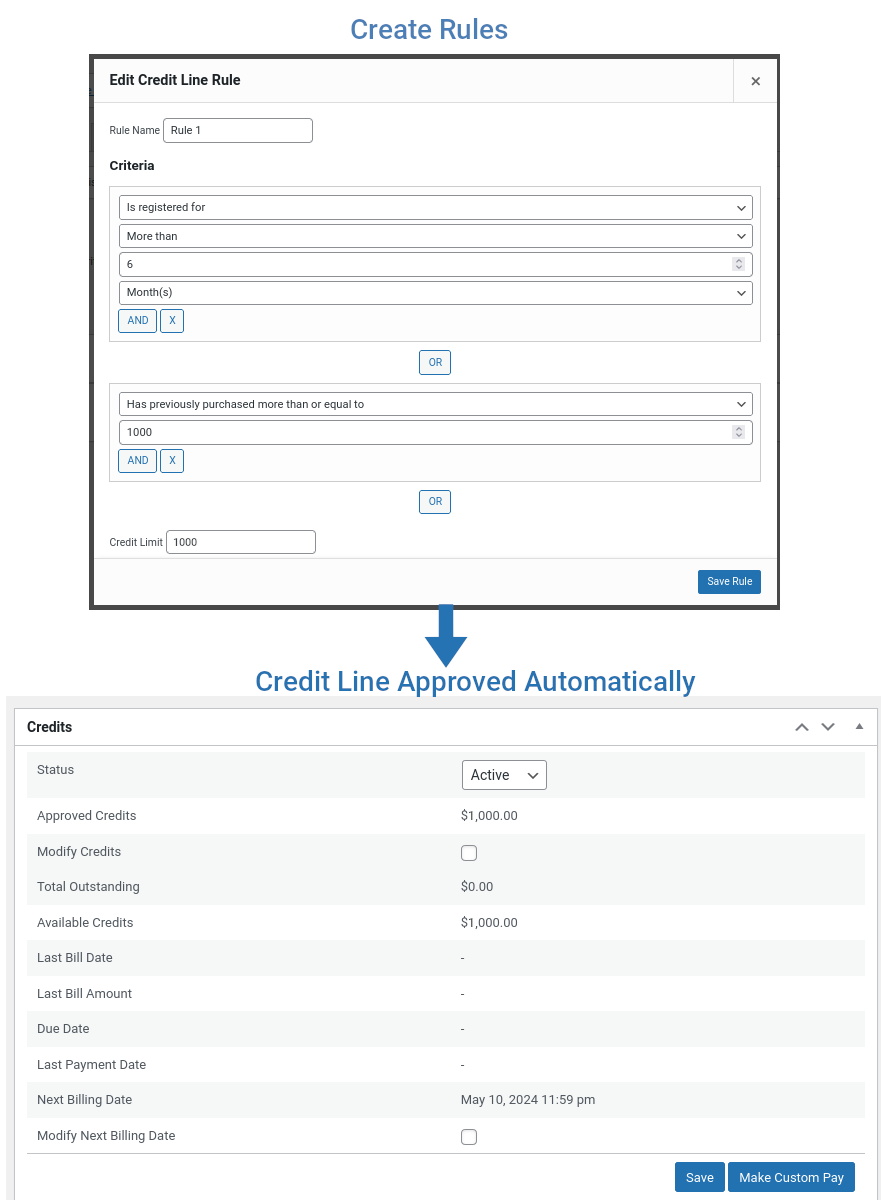

Auto Approval

Based on Criteria set by site admin, Credit Line can be approved for all the customers on the site automatically.

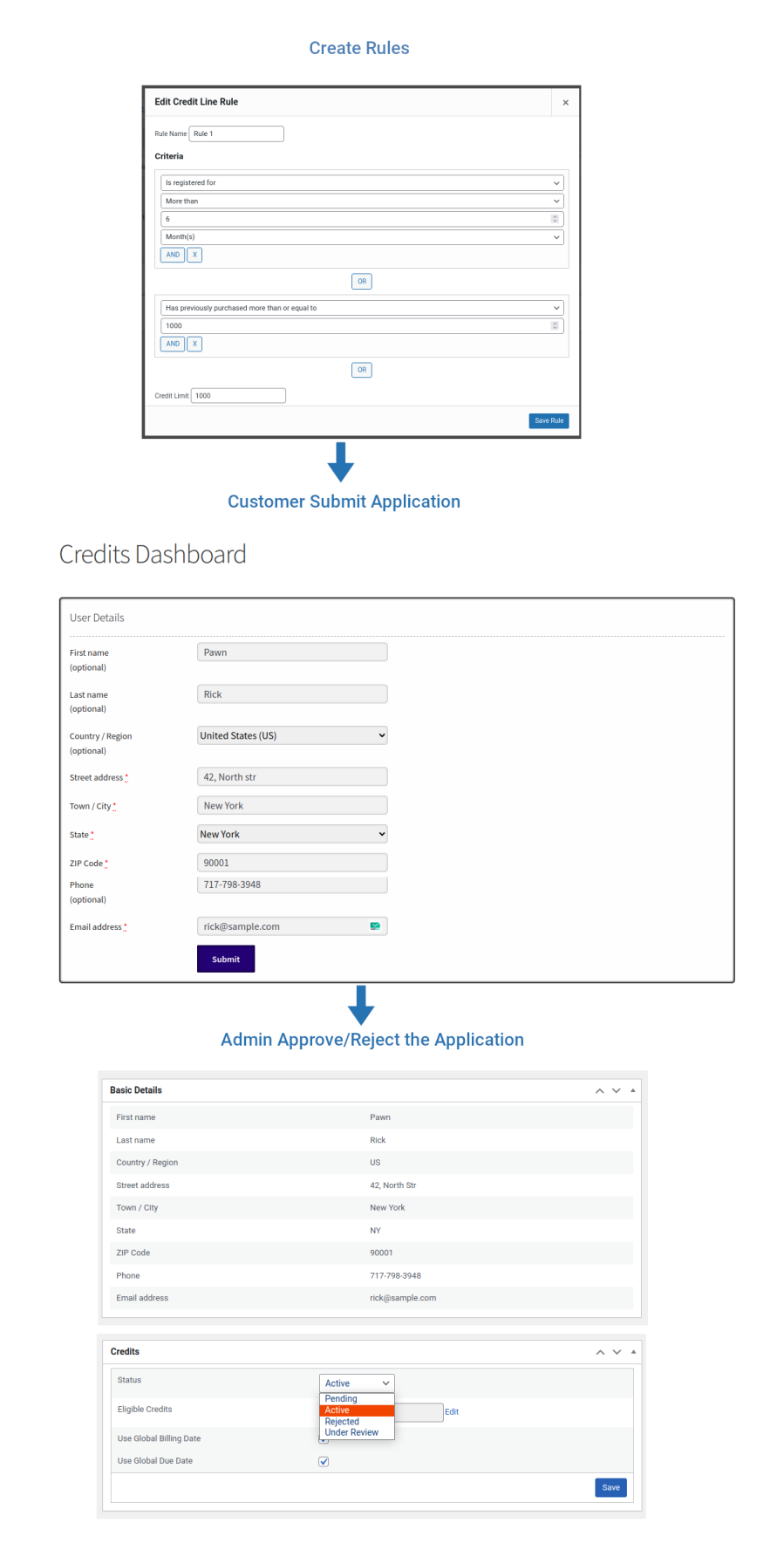

Application Based Approval – Manual Approval

Customers will have to submit the application and the site admin will have to review the application and approve or reject the customer’s application.

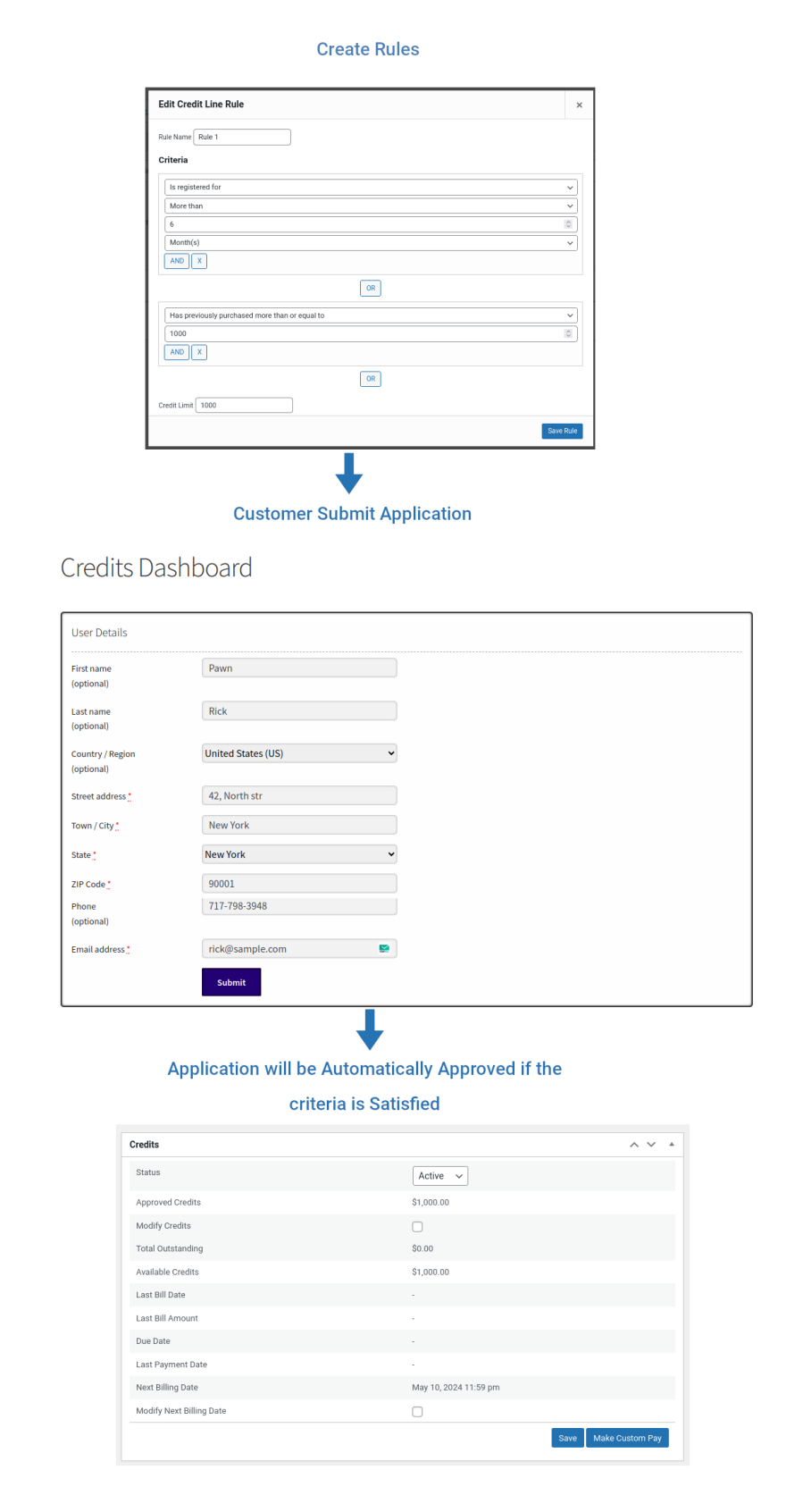

Application Based Approval – Auto Approval

Customers will have to submit the application and if the Criteria set by site admin matches, then the Credit Line will be automatically approved automatically.

Complete Manual

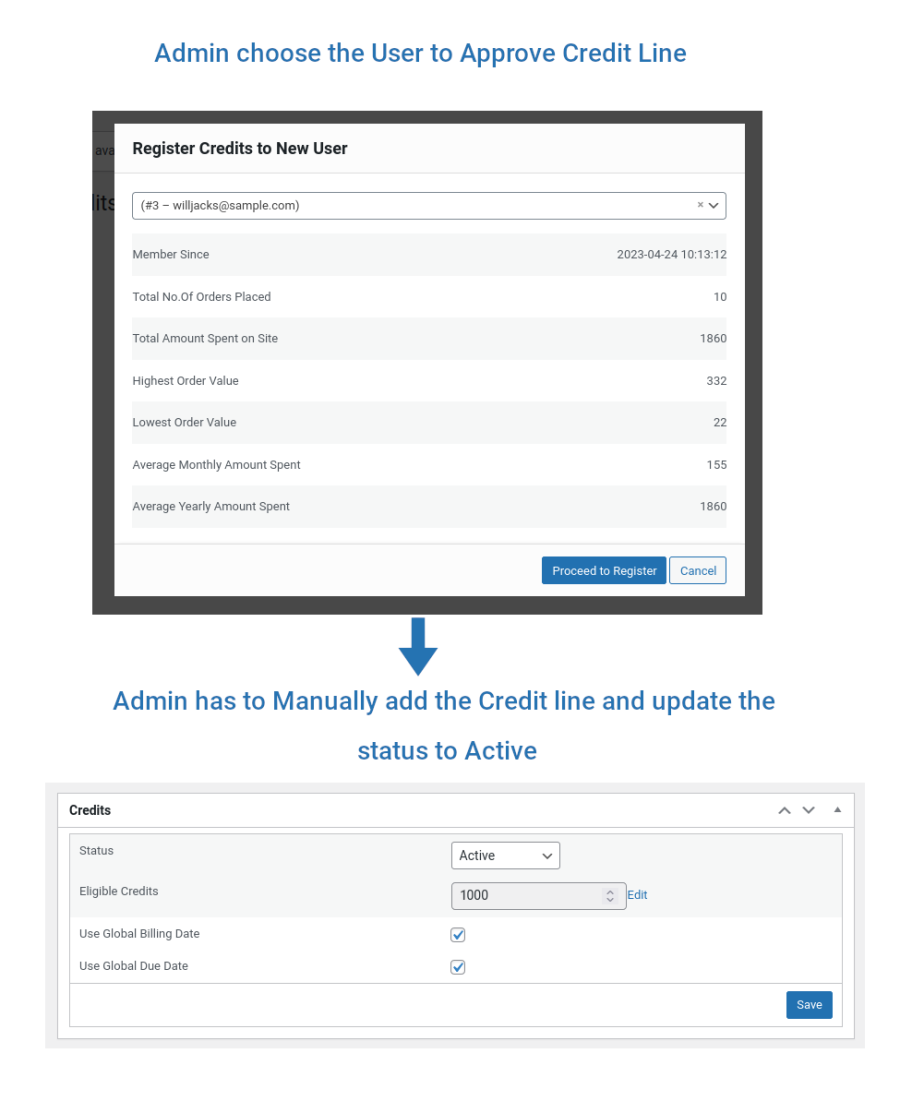

Admin can manually create a Credits account for any customer on the site and they can add Credit Line to the customer as per their wish.

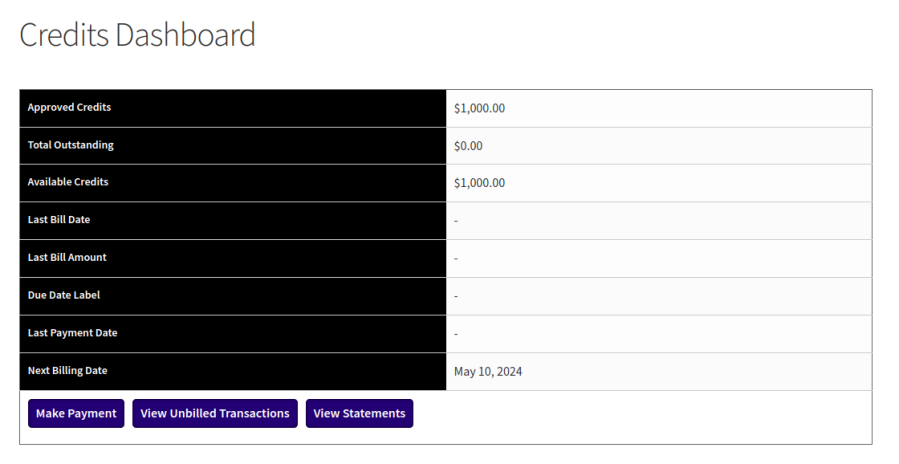

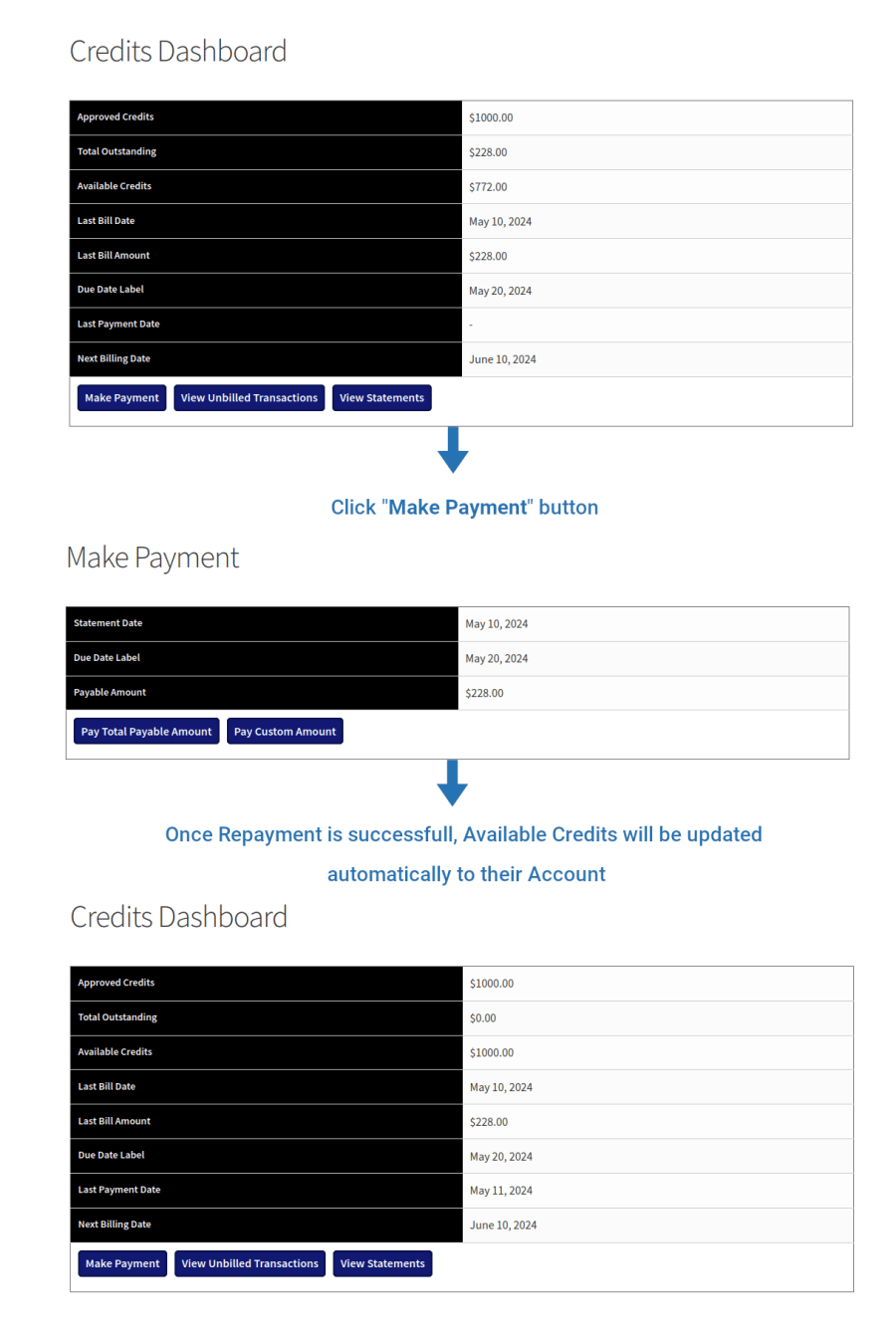

Once Credit Line is approved for the customer, they can view the details in their Credits Dashboard. In Credits Dashboard, customers will be able to Make Payment(Advance Payment, Custom Amount Bill Payment, Full Bill Payment), View Unbilled Transactions, View Statements.

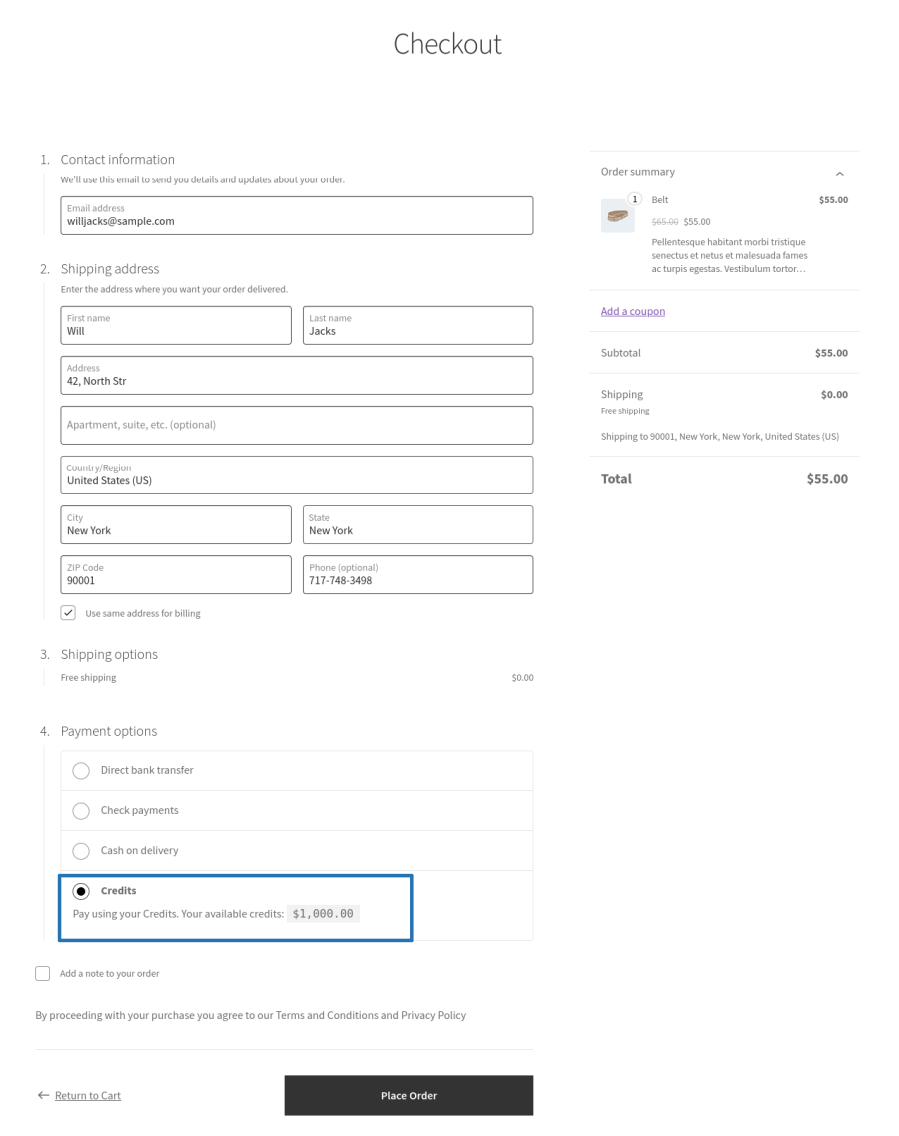

Customers can place orders using the “Credits” payment method which will be available in Checkout if they have enough Credits available in their account. In case if the order amount is more than their Available Credits, the payment method will be hidden for the customer.

Admin can globally set the billing date and on the set date bill will be generated for all the customers. Admin can also edit the billing date of each customer.

Once the bill is generated, customers will be notified by email with a link to download their statement. At this point their due date also will be set as per the admin configuration. Admin can also edit the due of each customer.

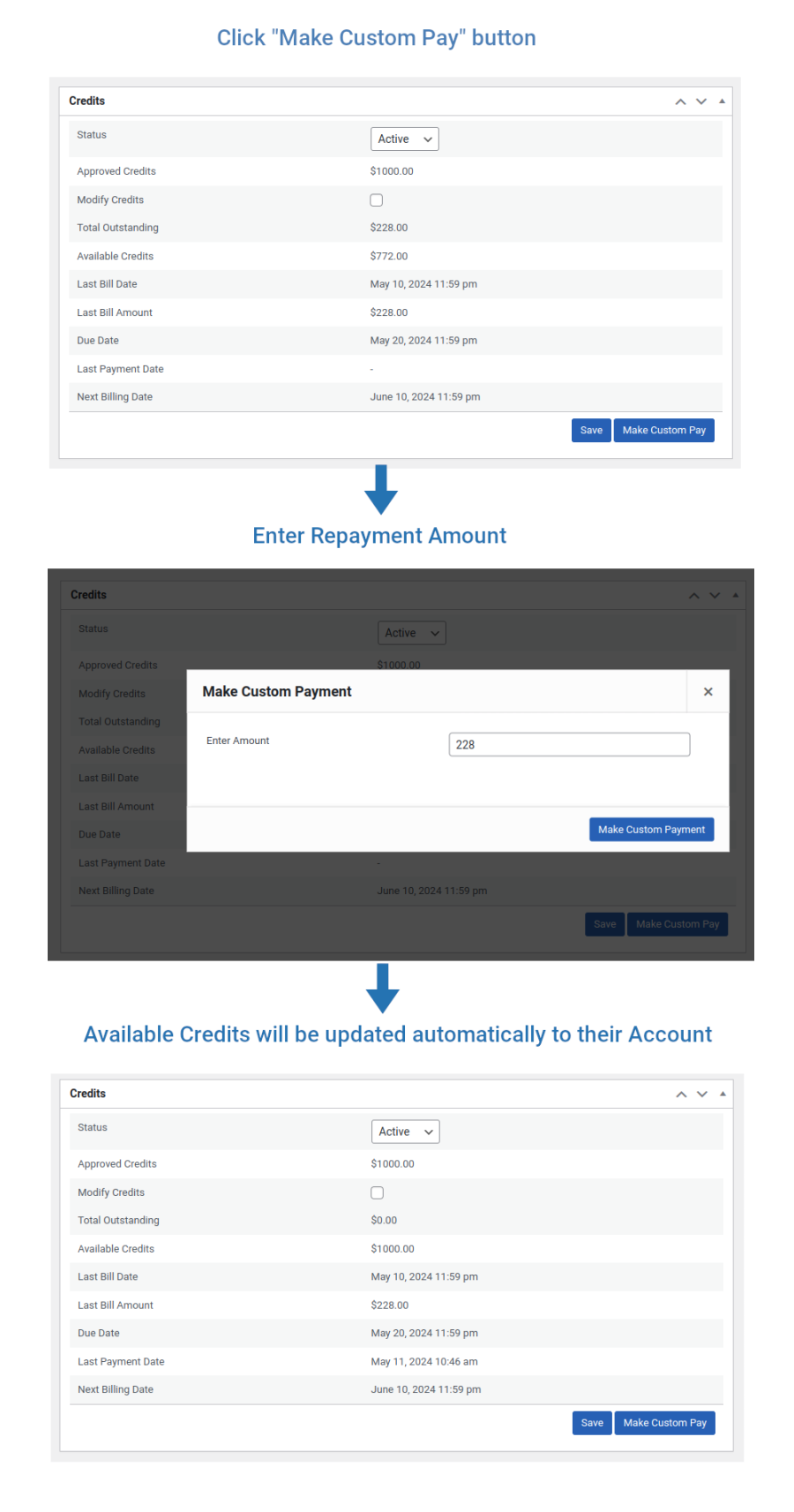

After reviewing the bill, customers will have to pay their bill amount on/before the due date. Customers can pay their bill amount from their Credits Dashboard. Customers can also make advance payment and custom amount payment as per their convenience from their Credits dashboard.

If admin have received the payment in offline mode(i.e. outside WooCommerce), then admin can make the payment on behalf of the customer.

If the customers doesn’t make the repayment even after the due date, their Credits account status will be moved to “Overdue” and Late Payment(optional fee which has to be set by admin) will be debited from their account automatically. Admin can also block customers Credits usage if the status is Overdue.

This whole process will be repeated every month.

1. Create predefined rules with multiple rule sets to give different credit line based on different criteria.

2. Automatically increase credit line to eligible customers.

3. Approve credit line automatically.

4. Application form can be created with multiple form fields support.

5. Approve credit line automatically as soon as the application form is submitted by the customer.

6. Approve credit line manually once the application form is submitted by the customer.

7. Application form can be shown only for specific customers.

8. Give credit line to customers from admin funds or from virtual funds.

9. Monthly billing and repayment.

10. Up to 58 days of repayment period.

11. Possible to charge interest for credit usage.

12. A fixed amount of percentage of credits used can be charged as interest.

13. A Late payment fee can be charged if payment is not made within the due date.

14. User level option to disable late payment fee for certain customers.

15. Option to disable specific payment methods for repayment of credits.

16. Separate page for credits dashboard.

17. Option to display credits dashboard in My Account page.

18. Custom logo can be displayed in bill statement.

19. Order status can be predefined for the orders placed using the Credits payment method.

20. For orders placed using the Credits payment method, when to debit funds(on reaching which order status) can be predefined.

21. Bill can be generated in PDF or HTML file format.

22. Customers can be allowed to place orders using Credits only if the cart total is more than the set value.

23. Option for the Admin to modify a customer’s billing date or repayment date.

24. Option to allow customers to use their Credits for placing orders in overdue status.

25. Option for the customer to make advance payment.

26. Option for the customer to pay a custom amount or make the full payment.

27. Compatibility with WooCommerce Subscriptions: Option for the customer to automatically renew their subscriptions using the Credit Line.

In “Admin Funds”, the site admin has to load credits to their own account in order to give credit line to other customers. In case if there is no enough credits in your account, you won’t be able to give a credit line to the customers.

In “Virtual Funds”, site admin doesn’t need to load credits to their account. A Credit line can be given to customers.

It is not possible to style the bill statement.

Updating the status to “Refunded” won’t credit the refund amount to the customer account. Follow the below steps while processing the refund to credit the refund amount directly to the customer’s account.

Bill will be generated automatically using cron. Please cross check whether cron is running properly on your site. If the cron is not running, then that is the reason why the bill is not generating.

We are getting customer details using the Email address and hence it is not possible to disable the email address field and it is not possible to give the email address field as optional.

Weekly billing is not possible. Only monthly billing is possible.

It is not possible. Only a specific date of the month can be set as a repayment date.

Categorias

Extension information

Quality Checks

Compatibilidade

Países