Neueste Version

3.3.2

Aktive Installationen

800K+

Das Abonnement beinhaltet

Support

New to PayPal?

Get step-by-step instructions on how to add it to your store or watch the how-to video below.

Need to update from an older PayPal extension? Learn how to move to PayPal Payments.

PayPal’s brand recognition helps give customers the confidence to buy. PayPal Payments is the official extension for WooCommerce that lets you offer PayPal, Venmo, Pay Later options, Fastlane, and more — all designed to help you maximize conversions.

Help increase conversion by automatically offering PayPal buttons on product pages and at checkout. Consumers are nearly three times more likely to purchase when you offer PayPal.1

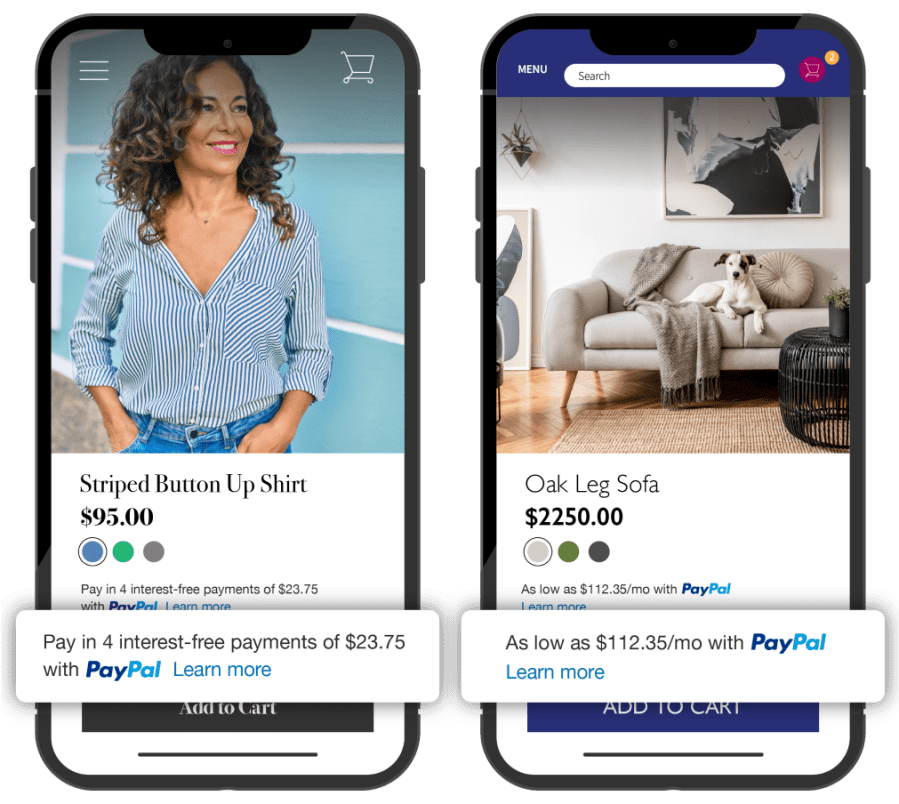

Let customers pay over time while you get paid up front. We’ve seen a 35% increase in cart size with Pay Later offers, when compared to standard PayPal transactions.2

Turn on Pay Later messaging to automatically present the most relevant Pay Later option as your customers browse, shop, and check out. With repeat customers making up 66% of all US Pay Later transactions5, it’s no surprise that Pay Later can help attract and retain customers.

Available in Australia, France, Germany, Italy, Spain, United Kingdom, and United States.

Appeal to Venmo customers by letting customers pay for purchases the same way they pay their friends and tap into 92 million active Venmo accounts.3

Available in United States only.

![]()

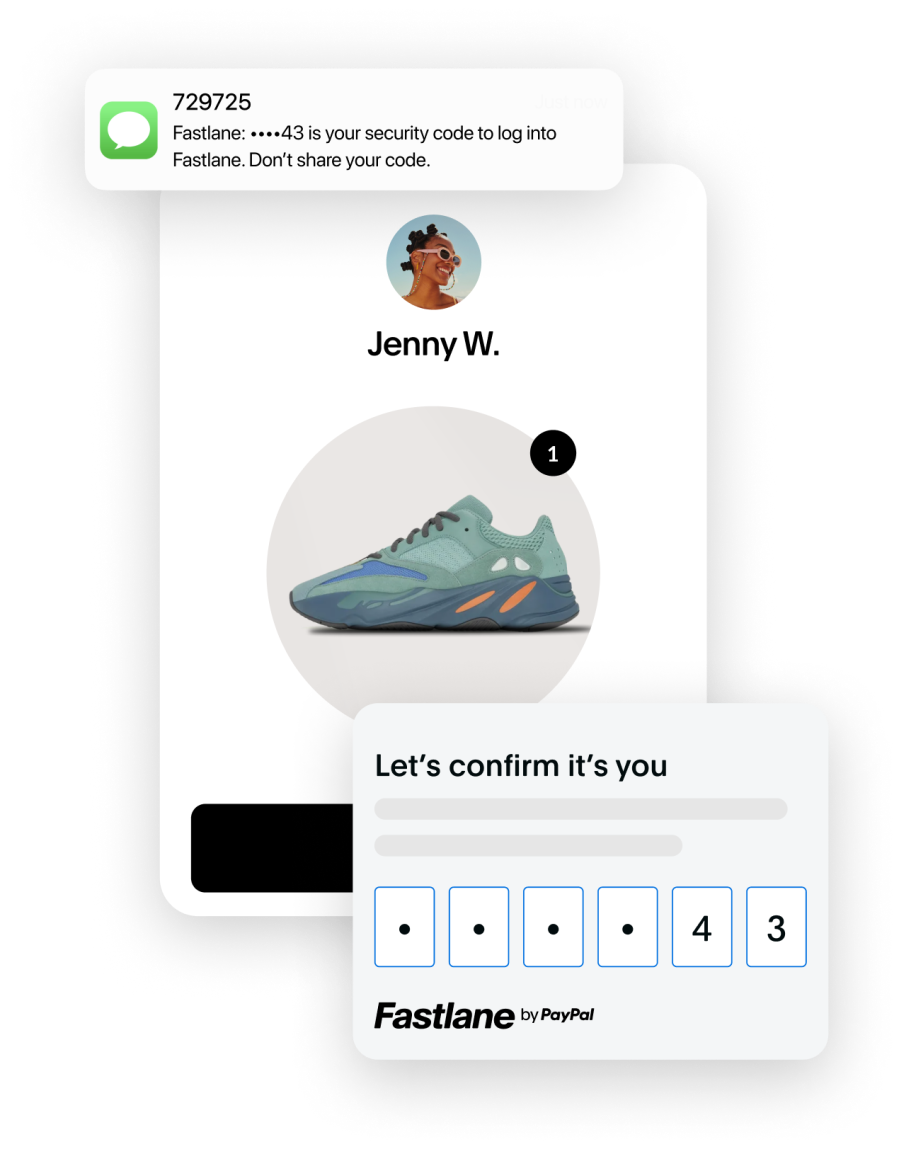

Speed up checkout by recognizing millions of guest shoppers and allowing them to autofill their checkout details. No store accounts or PayPal user accounts required.

Fastlane users convert at nearly 80%.4

Offer locally recognized payment methods to help build trust and reach international customers, including Payment Upon Invoice (PUI), a payment option available only for purchases completed in Germany.

PayPal Payments provides two different card processing options on WooCommerce:

Card transactions are managed by PayPal in a prebuilt user experience, which simplifies your compliance requirements. Suitable for all business and personal seller accounts.

Get everything that comes with PayPal’s standard integration, along with the ability to customize the look, feel, and placement of your debit and credit card payment fields. You can also use fraud protection tools to set up your own risk tolerance filters.

20+ years of experience

200+ markets around the globe

100+ different currencies

Instant access to fundsAccess card payments, send money or make a payment from your bank account. You’re credited immediately while the payment is processing. Funds settle instantly into your PayPal business account. |

|

Fraud detectionSave time and money by letting PayPal help you handle the risk of fraudulent transactions with our fraud, chargeback, and Seller Protection capabilities (on eligible transactions†). Our AI technology works hard to monitor all of your transactions — so you can focus on what matters most. †Available on eligible purchases. Limits apply. |

|

Global compliancePayPal payment solutions help you meet your global compliance standards, such as PCI and PSD2, bringing international markets within reach for your business. Our platform has built-in compliance with two-factor authentication provided by cards (3D Secure). We include automatic updates as security protocols change. |

* For Australian users, the PayPal service is provided by PayPal Australia Pty Limited AFSL 304962. Any information provided is general only and does not take into account your objectives, financial situation or needs. Please read and consider the CFSGPDS (paypal.com.au) before acquiring or using the service. See website for TMD. PayPal Pay in 4 is a continuing credit contract provided by PayPal Credit Pty Limited (ABN 66 600 629 258) and is subject to merchant and customer eligibility criteria. Full terms and details are available in the PayPal Credit Guide, TMD and PayPal Pay in 4 Facility Agreement on our website.

1 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39.

2 Globally, Pay Later AOVs are 35%+ higher than standard PayPal AOVs for SMBs. Internal Data Analysis of 68,374 SMB across integrated partners and non integrated partners, November 2022. Data inclusive of PayPal Pay Later product use across 7 markets.

3 PayPal Internal Data – 2023.

4 Based on PayPal internal data from March 15 to April 14, 2024. Applicable to shoppers who used Fastlane’s autofill.

5 Based on PayPal internal data from Jan 2022 – Dec 2022.

6 Morning Consult — The 15 Most Trusted Brands Globally. March 2021. Morning Consult surveyed over 330,000 consumers across 10 international markets to provide a global view on the current state of consumer trust across brands.

Kategorien

Extension information

Quality Checks

Kompatibilität

Länder

Anforderungen