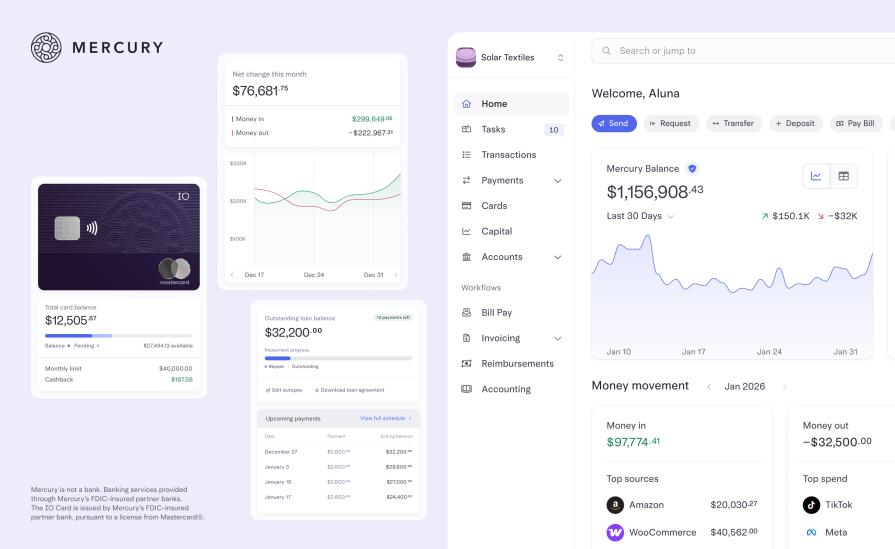

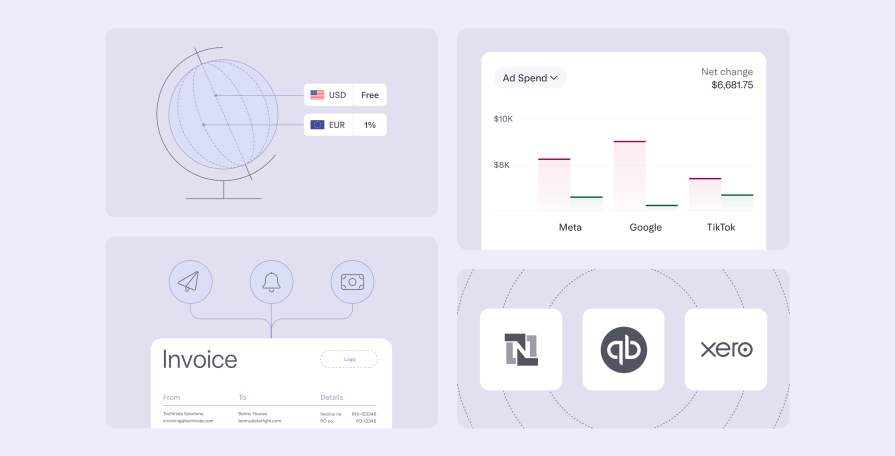

Banking*, cards, and capital — together in one powerful platform. With Mercury, ecommerce founders get banking paired with powerful financial software to give you the speed and instincts it usually takes years of business experience to earn.

A single platform for everything your business does with money. With no required fees or minimums, every dollar stays focused on scaling your business.

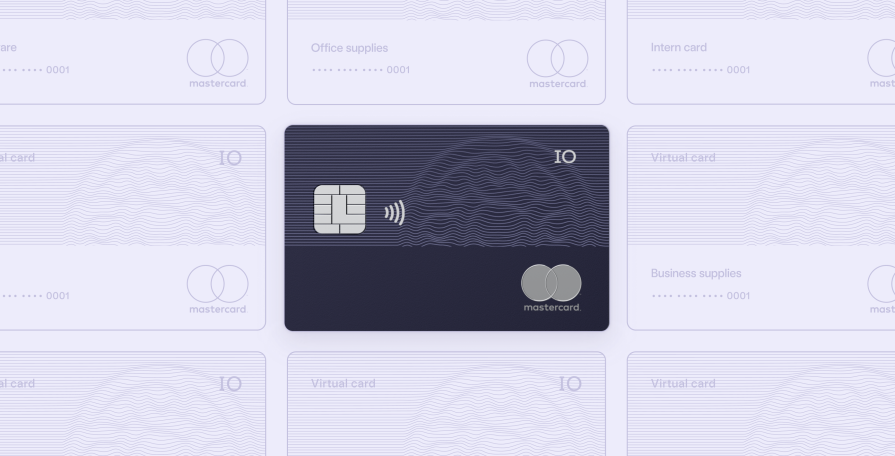

Turn everyday spend into growth with Mercury’s IO credit card**, eligible for most customers on day one.

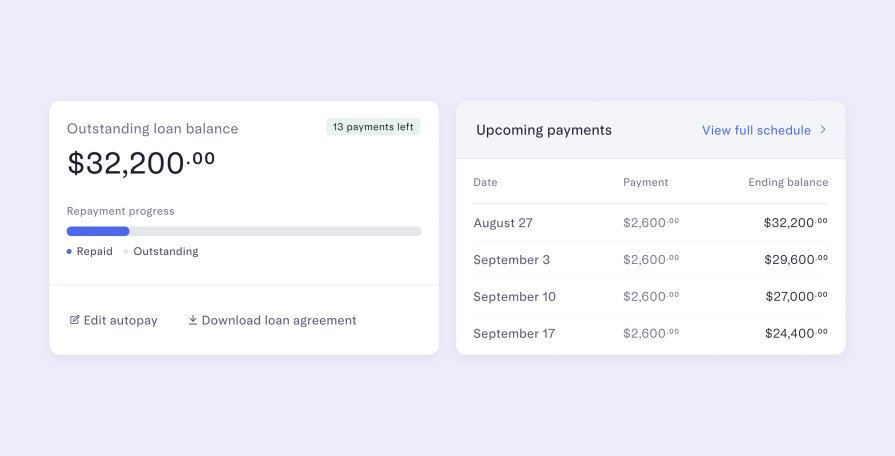

Close the cash flow gap between upfront costs and future sales with fast, flexible financing. Access up to $3M USD in working capital*** based on revenue across all your sales channels.

With Mercury, you get a fast, best-in-class financial platform designed for how ecommerce actually works.

*Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group and Column N.A., Members FDIC. FDIC deposit insurance covers the failure of an insured bank. Deposits in checking and savings accounts are FDIC-insured through Choice Financial Group and Column N.A. and their Sweep Program Network Banks. Certain conditions must be satisfied for pass-through FDIC insurance to apply. Learn more here.

**The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®. To receive cash back, your Mercury accounts must be open and in good standing, meaning they cannot be suspended, restricted, past due, or otherwise in default.

***Loan amounts are subject to eligibility and credit criteria. Mercury’s Venture Debt and Working Capital loans are originated by Mercury Lending, LLC (NMLS: 2606284) and serviced by Mercury Servicing, LLC (NMLS: 2606285). Mercury Lending and Mercury Servicing are wholly-owned, separately managed subsidiaries of Mercury Technologies, Inc. At this time, we are unable to offer working capital or venture debt loans to businesses operating in California.

Once you open a Mercury business account, copy the routing and account numbers into your store's WP Admin dashboard at WooCommerce › Payments › Payout settings.

You’ll need your company’s official formation documents, your IRS-issued EIN document (for US entities only), and a government ID (e.g. a passport or US driver’s license) for each founder or majority owner of your company. You'll also need to provide some information about your company and each company owner.

Customers must have some type of existing or planned operations in the U.S. and a U.S. or international address for their principal place of business. This can be a residential address, but may not be a registered agent, PO box, or UPS box address. Upon applying, they will review to ensure you have up-to-date formation documents and otherwise satisfy onboarding requirements.

Mercury cannot currently support accounts for businesses with founders or financial controllers living in certain countries and regions.

Mercury checking and savings deposits are FDIC-insured for up to $5M* USD through their partner banks and their use of sweep networks.

Most US-based businesses qualify for an IO** credit account on their first day with Mercury. Customers start with daily repayment schedules until they reach a total Mercury balance of $15k USD, at which point they can qualify for higher limits and choose between monthly or daily repayment schedules.

The best way to find out if you’re eligible for a working capital loan*** is by going through Mercury’s quick eligibility questionnaire, but here are a couple requirements: