Subscription includes

Support

Role Based Tax enables you to customize tax policies for locations, assign unique tax rates to specific customer groups, and customize taxes, price displays, suffix and more.

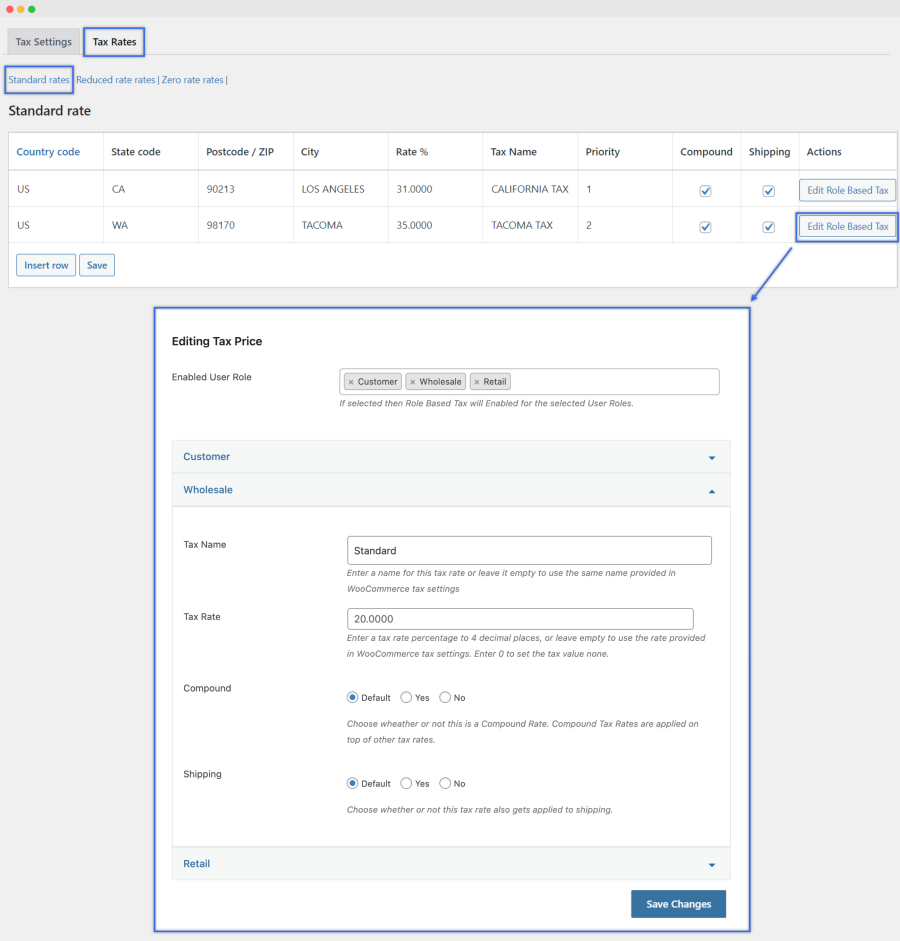

Set up tax rates based on roles: If you sell products to different customer types, such as retail or wholesale, you may need to adjust your tax rates based on the tax laws of a location.

Meet tax display requirements: The tax laws in some areas require you to display prices with or without taxes shown based on customer roles (retail, wholesale, etc.). Role Based Tax allows you to easily configure tax-display settings based on user roles.

Tax exemptions or special tax rates: You can assign tax exemptions or set reduced tax rates based on user roles with Role Based Tax.

With Role Based Tax, you can adjust tax rates based on user roles, including standard, reduced, and tax-exempt. In addition, you can choose to assign or exempt coupons and shipping from taxes.

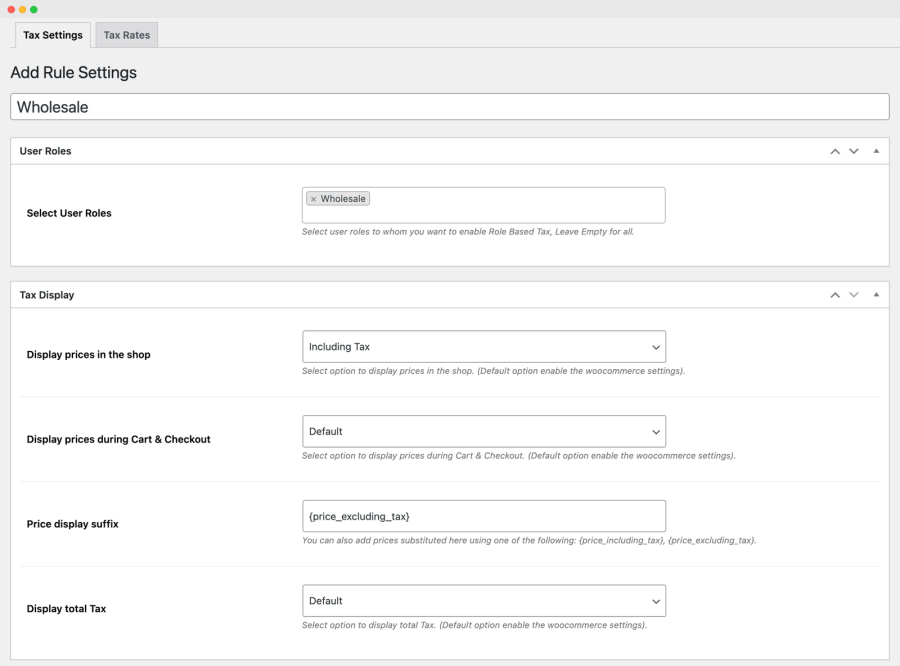

Along with tax rates, you can customize the following tax display settings based on user roles.

Show prices inclusive or exclusive of taxes Role Based Tax gives you control over how you display prices in your shop, Cart, and on the Checkout page. You can tailor the visibility of prices based on user roles.

Customize price suffixes Display personalized pricing information to your customers by adding different price suffixes for specific user roles.

Customize tax information on the Cart page Display taxes as a single summary total or per-item list on the Cart page.

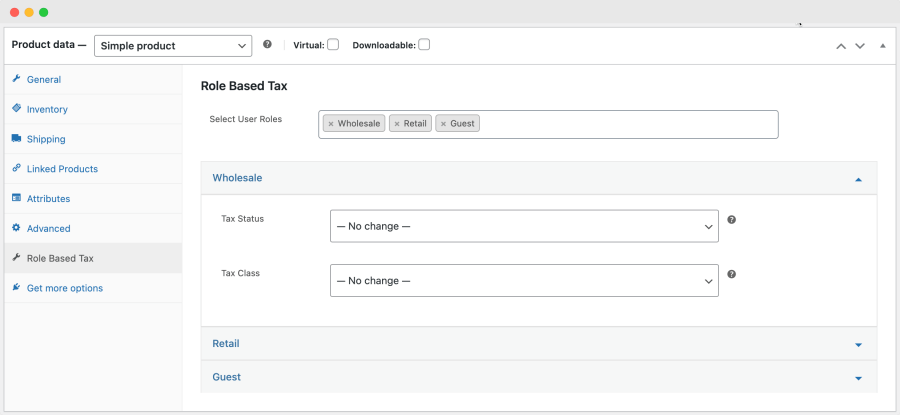

Using product-level settings, you can customize your product’s tax status and class based on user roles.

Tax statuses include:

You can select a tax rate after you mark a product as taxable. Tax rates include:

Categories

Extension information

Quality Checks

Countries