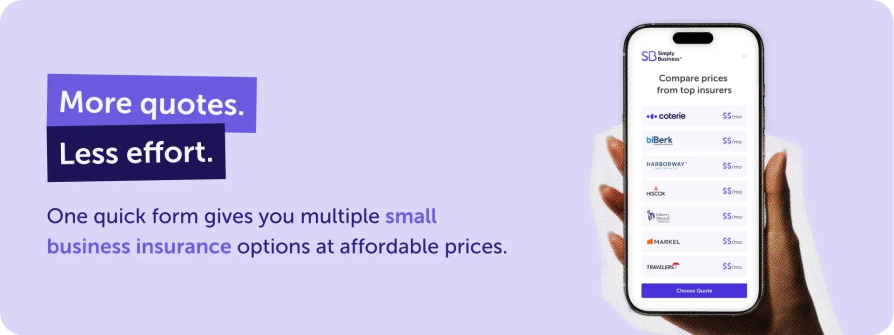

Simply Business makes it simple to find the right insurance coverage at the right price, in minutes. With our digital marketplace, you can find and buy the business insurance you need, and get matched with policy recommendations from trusted insurers. Online, any time. Get a quote now.

We’re trusted by over one million businesses worldwide. Our user-friendly platform and commitment to excellence consistently earn us a 4.6/5-star rating on Trustpilot. While our digital marketplace makes buying fast and simple, we ensure you’re never alone in the process: licensed insurance agents are available to provide expert advice and answer complex coverage questions.

Find tools, tips, and time-saving templates to help you run your business in our Resource Center.

*Displayed price is an estimate based on the 10th percentile of General Liability policies sold by Simply Business between January-June 2025, divided evenly across a 12 month policy term. Actual price and payment terms, including an initial down payment, may vary based on your state, insurance provider, and business.

**Actual savings may vary based on the nature of a customer’s business, its location, and insurance provider appetite. Savings percentage is calculated using the average price difference of quotes from the Simply Business panel of insurance providers.

We insure over 400 types of small businesses across a number of trades and industries.

Simply Business offers a wide variety of coverage options geared toward protecting small businesses, including:

We specialize in tailored coverage options for small businesses. Our quote tool makes policy recommendations based on the details you provide about what you do. Then you can select the coverage you want, and compare prices from our panel of trusted insurers.

Getting a quote with Simply Business is always free. There’s no pressure to commit, no spam calls, and the entire process can be done online, at any time.

When you start a quote, you’ll need to tell us some details about your business. These include, but are not limited to:

The quote tool will guide you through the questions, and the whole process should only take a few minutes.

Monthly or yearly payment plans are available for select coverages and insurers. Your exact payment plan options will depend on your policy selection.

Legal requirements vary by state, so it’s worth checking to see what your particular state requires. Most states do require workers’ comp insurance if you have full- or part-time employees. It’s also possible that you’ll need proof of insurance to lease a space or work on a customer’s property.

Comprehensive insurance that includes general liability, professional liability, and workers’ compensation can cover:

It can, but the Simply Business quote tool takes your location into consideration when searching for quotes. Plus, licensed insurance agents on the phone can answer questions and help you better understand your state’s requirements.