Payments built on trust,

with PayPal

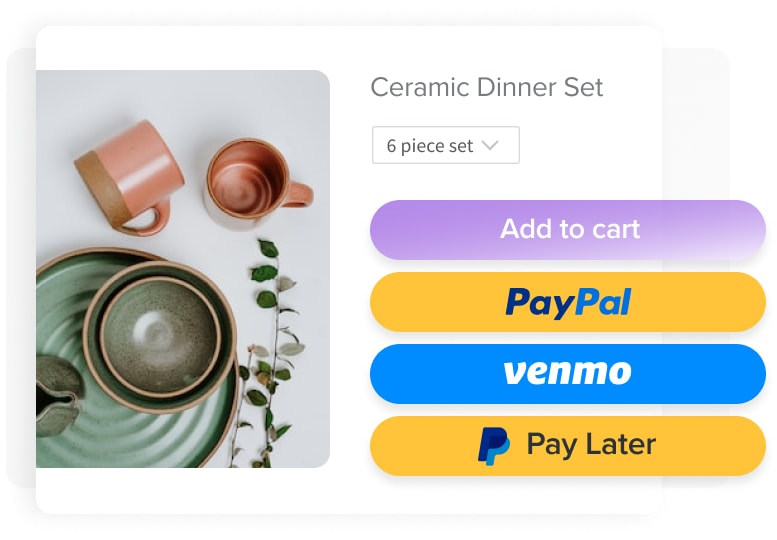

One checkout solution, many ways to pay

PayPal’s all-in-one checkout solution lets you offer PayPal, Venmo*, PayPal Pay Later, and more to help maximize conversion. Wherever your business takes you, create connections and build trust when you let customers pay how they want.

*Venmo available only in the U.S.

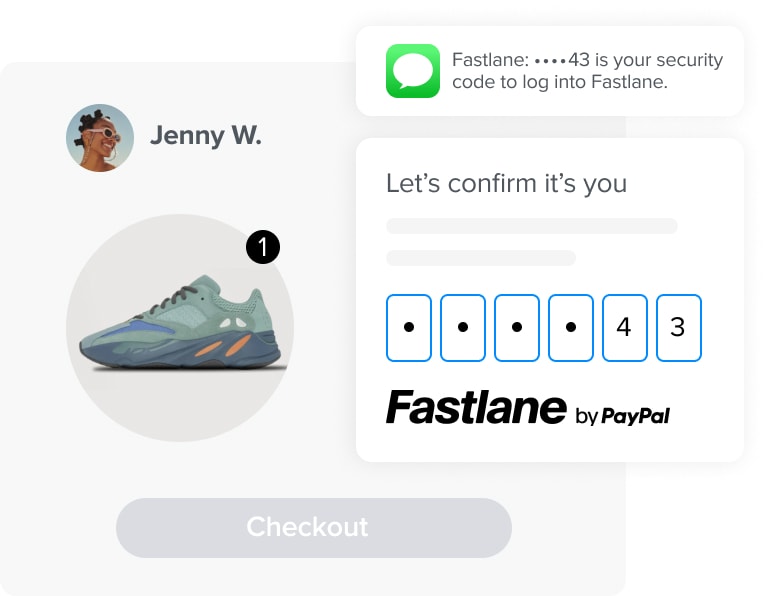

Drive conversion with fast and simple guest checkout

Fastlane converts users at nearly 80%²

Speed up checkout for millions of guest shoppers and allow them to autofill their payment details — no store login or PayPal user accounts required.

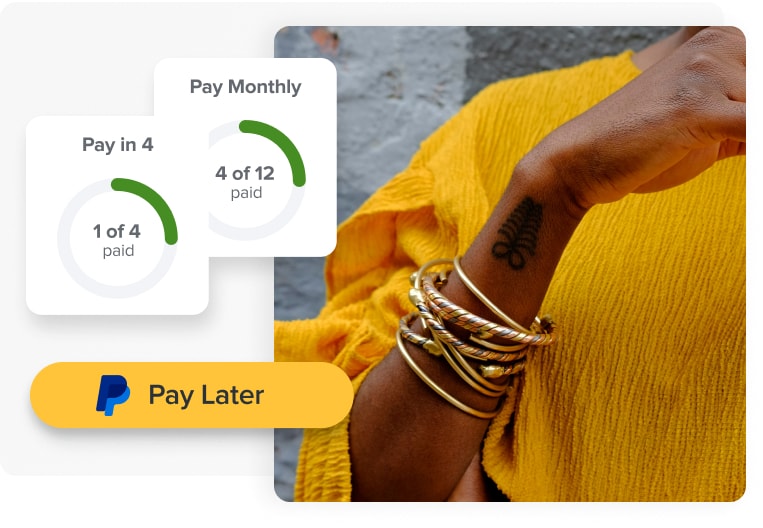

PayPal Pay Later: a win for your customers,

a boost for your business

Allow customers to pay over time while you get paid up front. Turn on Pay Later messaging to automatically show customers the most relevant installment option as they browse, shop, and check out. With repeat business making up 66% of all US Pay Later transactions3, it’s no surprise that Pay Later can help attract and retain customers.

49% of users say they’ve abandoned a purchase because PayPal wasn’t an option4

Venmo users spend 2x more annually on online purchases than other online buyers5

74% of BNPL users say that seeing a BNPL message while shopping encouraged them to complete a purchase6

Stand out with Venmo

Tap into 92 million active Venmo accounts7

Let customers pay for purchases the same way they pay their friends with Venmo, included as part of PayPal Payments. Help bring more visibility to your business with a payment method customers can easily share.

US only.

Start selling

with the name shoppers trust

¹ Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022–March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions and 1,001 non-PayPal transactions.

² Based on PayPal internal data from March 15 to April 14, 2024. Applicable to shoppers who used Fastlane’s autofill.

3 Based on PayPal internal data from Jan 2022 – Dec 2022.

4 An online study commissioned by PayPal and conducted by Netfluential in November 2020, involving 1,000 US online shoppers ages 18-39 (among PayPal users, n=682).

5 Globally, Pay Later AOVs are 35%+ higher than standard PayPal AOVs for SMBs. Internal Data Analysis of 68,374 SMB across integrated partners and non integrated partners, November 2022. Data inclusive of PayPal Pay Later product use across 7 markets.

6 TRC online survey commissioned by PayPal in April 2021 involving 1,000 US consumers ages 18+ (among BNPL users, n=282).

7 PayPal Internal Data – 2023.