Setting up an online store is an exciting time. It’s tempting to focus all of your energy on the fun parts, like designing page layouts and writing attention-grabbing product descriptions. But it’s just as important to attend to the more practical aspects, such as tax calculations.

First and foremost, it’s vital to understand the tax rules in your region, and it’s recommended to meet with a tax professional regarding the best practices for your specific situation. Once you know what the correct rates are, you can use native WooCommerce features to manually add sales tax calculations to your online store. Alternatively, you can purchase an extension to automate the process.

In this post, we’ll discuss the importance of calculating taxes for your WooCommerce products. Then, we’ll show you how to implement sales tax for your items and answer some frequently asked questions.

Why tax calculation is so important

Every country has its own regulations when it comes to sales tax. If you’re based in the U.S., these even vary from one state to another.

In many cases, if you make more than a certain amount per year, you’re obliged to pay taxes. Other times, your tax requirements are based on a nexus, where your employees live, or even where your shipping originates. Once you know your obligations, you also have to figure out how to apply the correct tax rates for each sale.

For example, if your business is registered in the U.K., the tax rates are as follows:

- Standard rate: 20%

- Reduced rate: 5%

- Zero rate: 0%

The reduced and zero rates apply to necessities like children’s clothes and food items.

In the U.S., sales tax is calculated as a percentage of the price of an item. Most states charge different percentages on various goods, and also have reduced or zero rates for certain products.

In other words, taxes can be quite complicated. Failing to set them up properly could result in fines and other penalties.

How to calculate sales tax for your online store

The process of calculating taxes will depend on the country, region, or state you’re based in. Some locations have more straightforward rates than others.

If you’re in the U.K., the government website has a complete list of VAT rates for different types of products. It also lists items that are exempt from tax.

For E.U.-based companies, the rates vary from one country to another. But the standard rate cannot be less than 15%, and the reduced rate cannot be less than 5%.

In the U.S., calculating sales tax can be more complicated. Each state has its own economic nexus threshold, which means that only vendors that make over a specific amount per year or meet other conditions need to pay sales tax.

As a U.S. vendor, there are other factors that can affect your tax calculations, including:

- State sales tax. Each state has its own sales tax rate. Some states have a single statewide rate, while others allow local jurisdictions to impose additional taxes.

- Local sales tax. Counties and cities within a state may levy additional sales taxes, on top of the state rate.

- Product taxability. Certain products may be exempt from sales tax or taxed at a reduced rate depending on state laws. For instance, groceries and clothing might be taxed differently than electronics and luxury items.

Therefore, you may need to employ an accountant or tax expert to help you accurately calculate tax based on your unique situation and varying national and local taxes. Alternatively, you could use a WooCommerce tax extension that will automate the process for you (more on this shortly).

How to set up sales tax on your WooCommerce site

At this point, let’s take a closer look at how to set up sales tax in WooCommerce. First we’ll look at how to do so manually, if you already know the correct tax rates. Then we’ll review some WooCommerce extensions that you can use to simplify this process.

1. Use the default WooCommerce tax settings

By default, WooCommerce enables you to set up sales tax rates for your products. Here’s a step-by-step process for using this feature.

Step 1: Enable WooCommerce taxes and configure the tax options

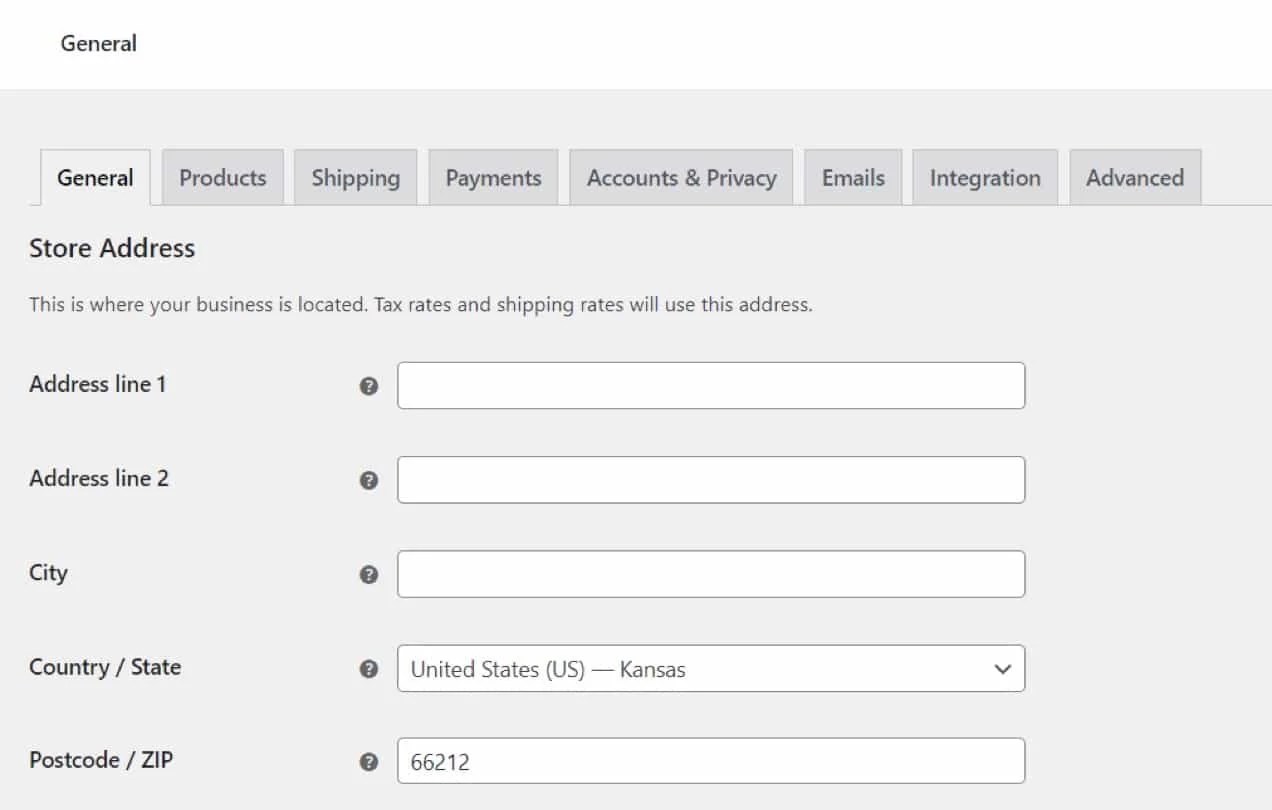

First, you may need to enable taxes for your store. In your WordPress dashboard, navigate to WooCommerce → Settings.

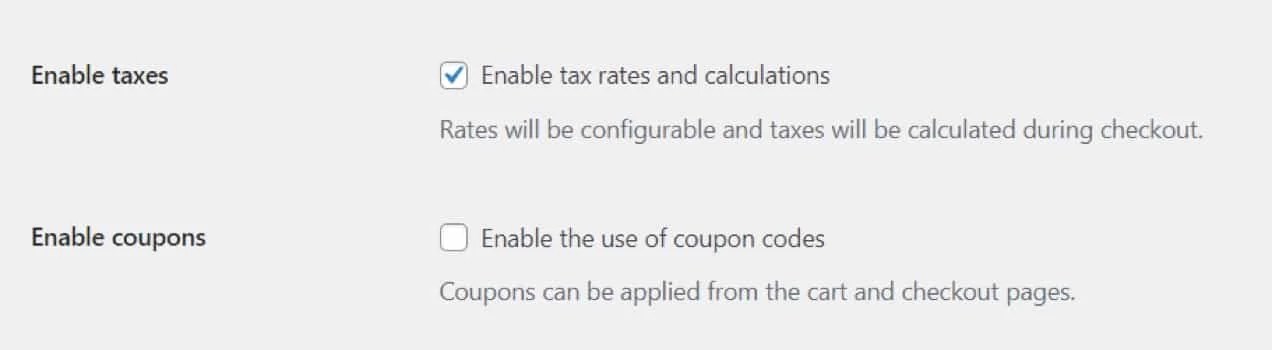

Under the General tab, look for the “Enable taxes” option and check the accompanying box.

Scroll down to the bottom of the page and click on Save changes.

Now, if you scroll back up to the top, you’ll see a newly created Tax tab. If you click on it, you’ll see your tax options.

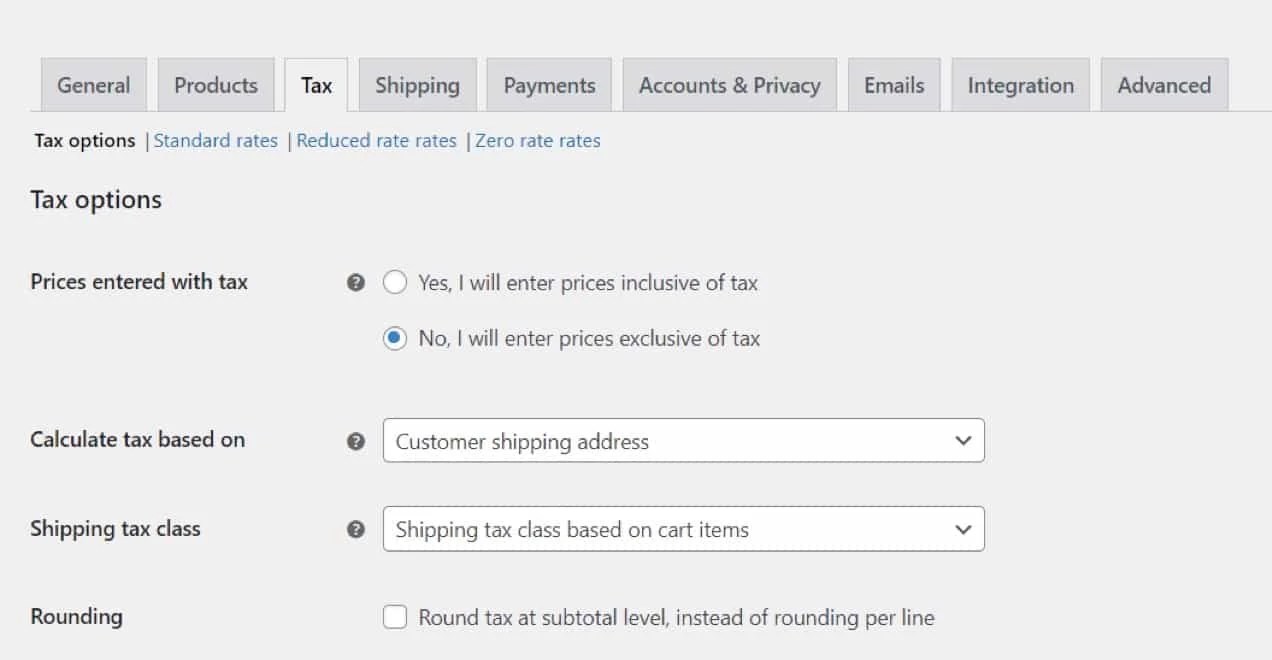

First, you’ll need to decide whether the product prices will be inclusive or exclusive of tax. If you opt for the latter, the taxes will be calculated and added to the customer’s bill at checkout.

Next, you’ll want to select how tax is calculated. The options include:

- Customer billing address

- Customer shipping address (default)

- Store base address

If you choose the last option, taxes will be based on your store’s area rather than your customer’s location. This means that customers will pay the same percentage of tax on each product, regardless of where they’re shopping from.

WooCommerce also asks you to choose a shipping tax class. By default, there are four options:

- Shipping tax class based on cart items

- Standard

- Reduced rate

- Zero rate

In most cases, the first option is best. It means that the shipping tax will be based on the tax class of the items in the cart. So if baby clothes are sold at a reduced tax rate, that same rate will also be applied to the shipping cost.

You also have the option to enable tax rounding at the subtotal level, rather than per line. This means that, instead of rounding the tax for each line item in the cart, the tax calculation will be applied to the subtotal of the entire order. If a customer has multiple items in their cart, the tax for each item will be calculated first, and then the taxes will be added together and rounded at the end.

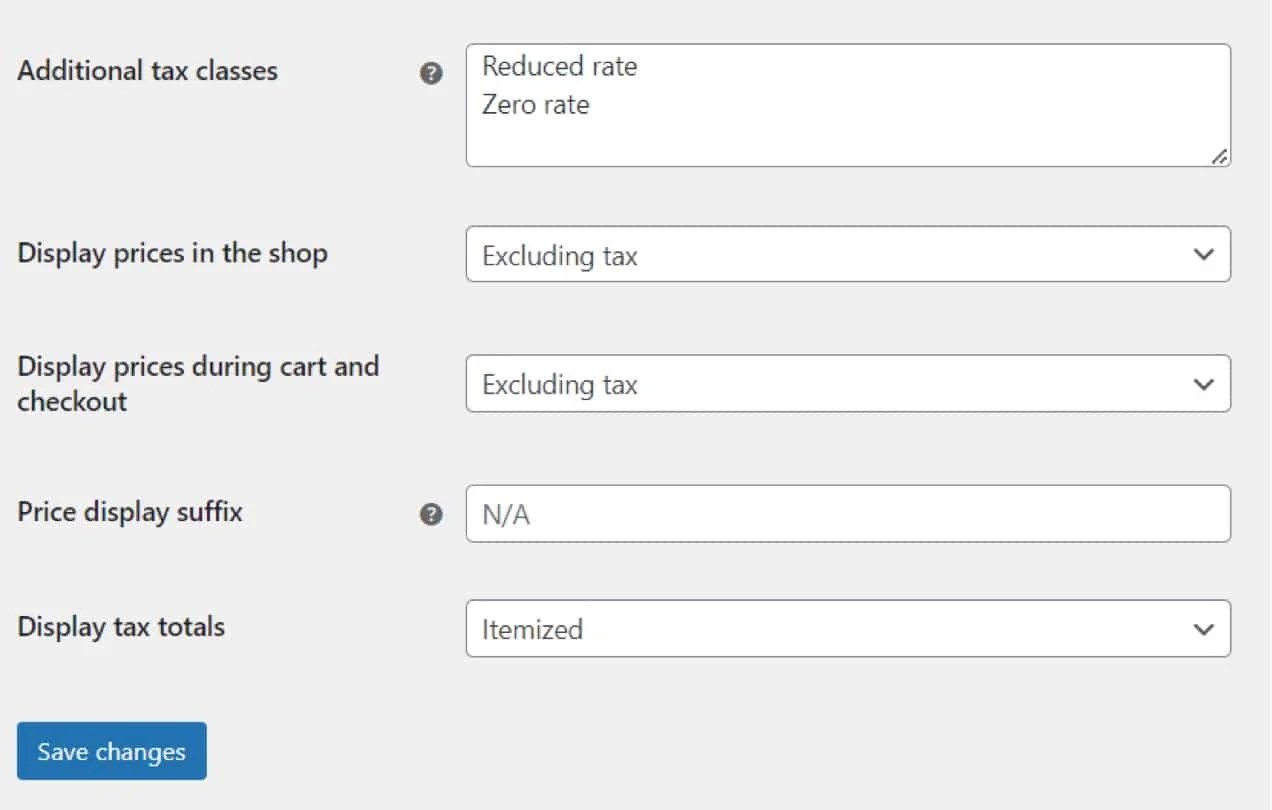

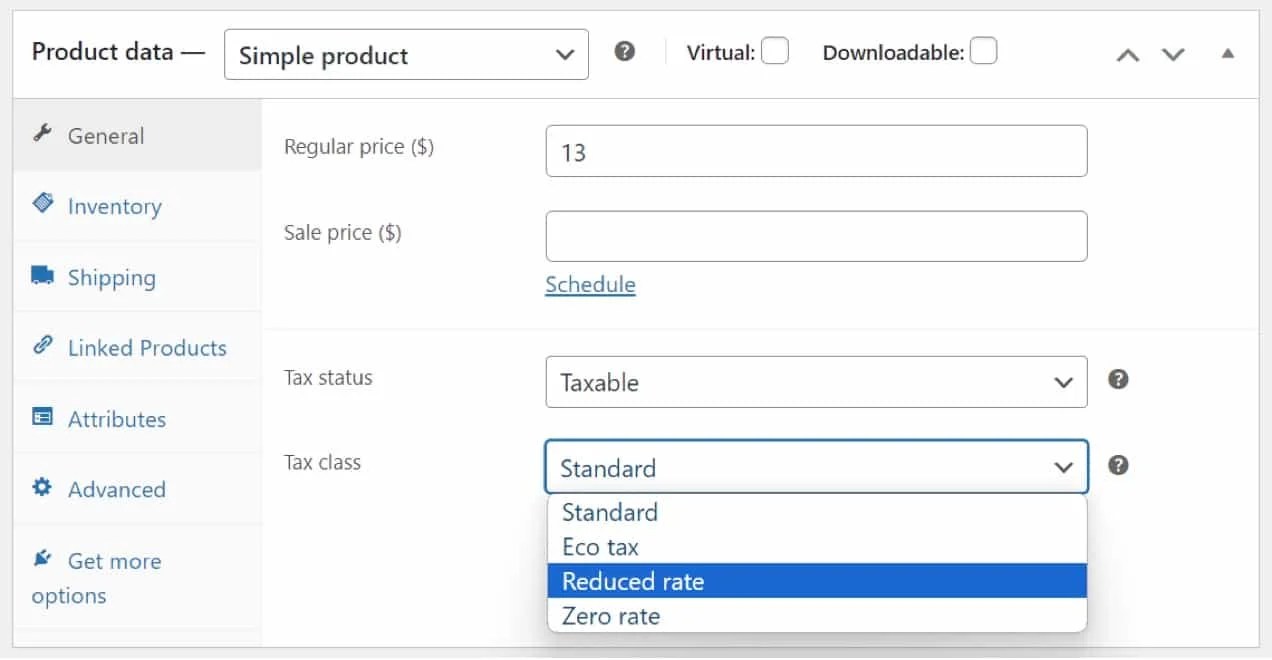

Next you’ll see the option to add more tax classes. By default, WooCommerce comes with three tax rates: standard, reduced, and zero. As mentioned earlier, these tax classes are used in the U.K. and E.U. If you’re based in the U.S., your state may have additional tax classes.

If that’s the case, you can create those tax classes in the box provided.

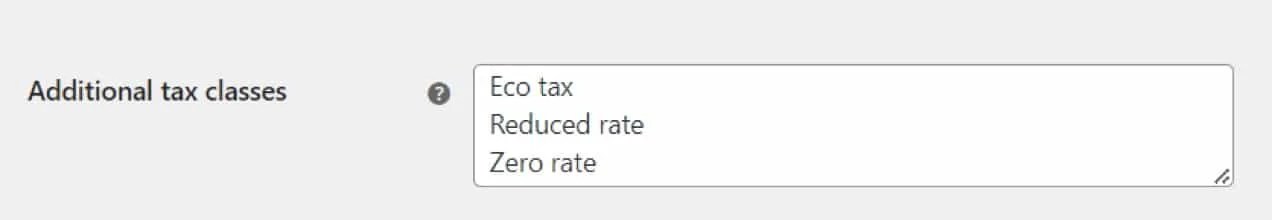

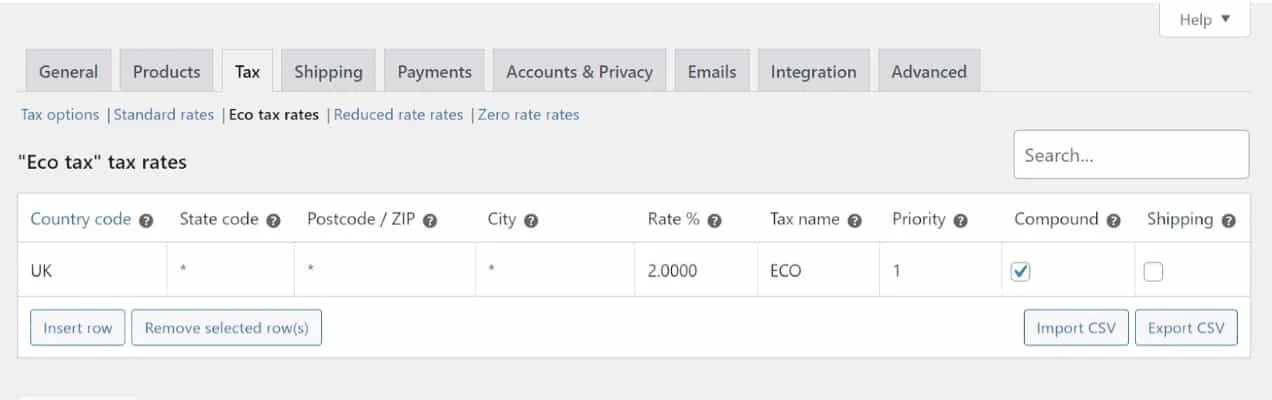

Let’s say your region has introduced an ‘eco tax’ on certain products. You can add this to the field.

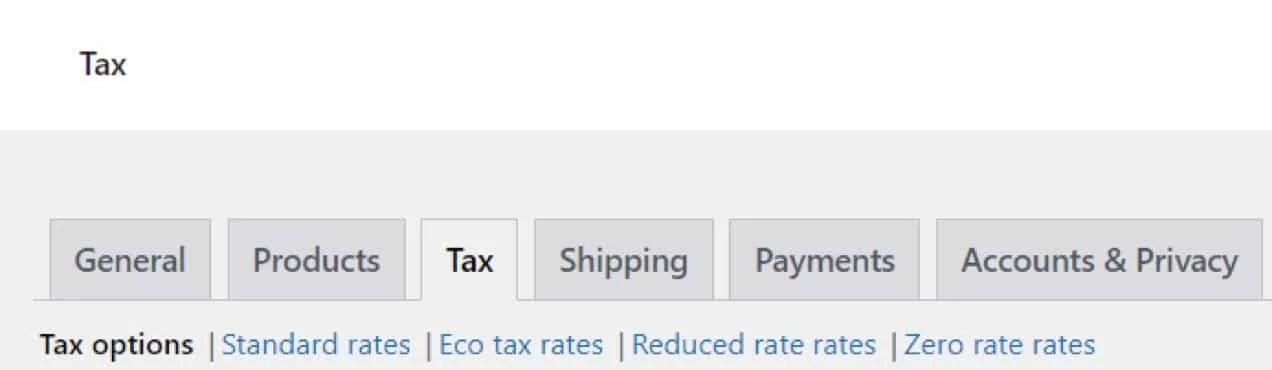

Once you save your changes, you’ll see a tab for the newly created tax, next to the existing tax classes.

Later in this tutorial, you’ll learn how to configure these tax classes. For now, you’ll need to work through the rest of the tax options.

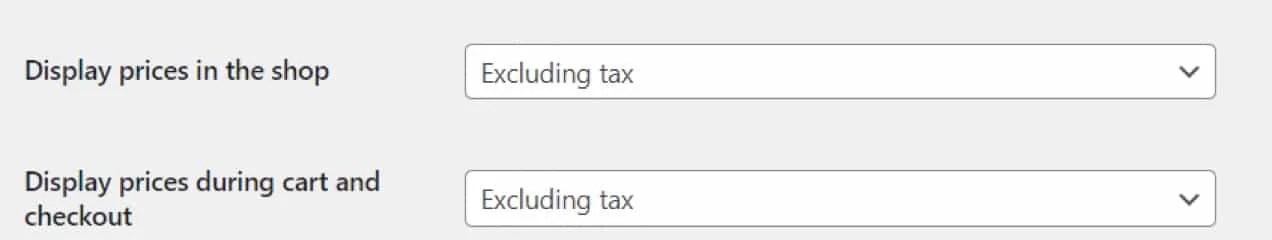

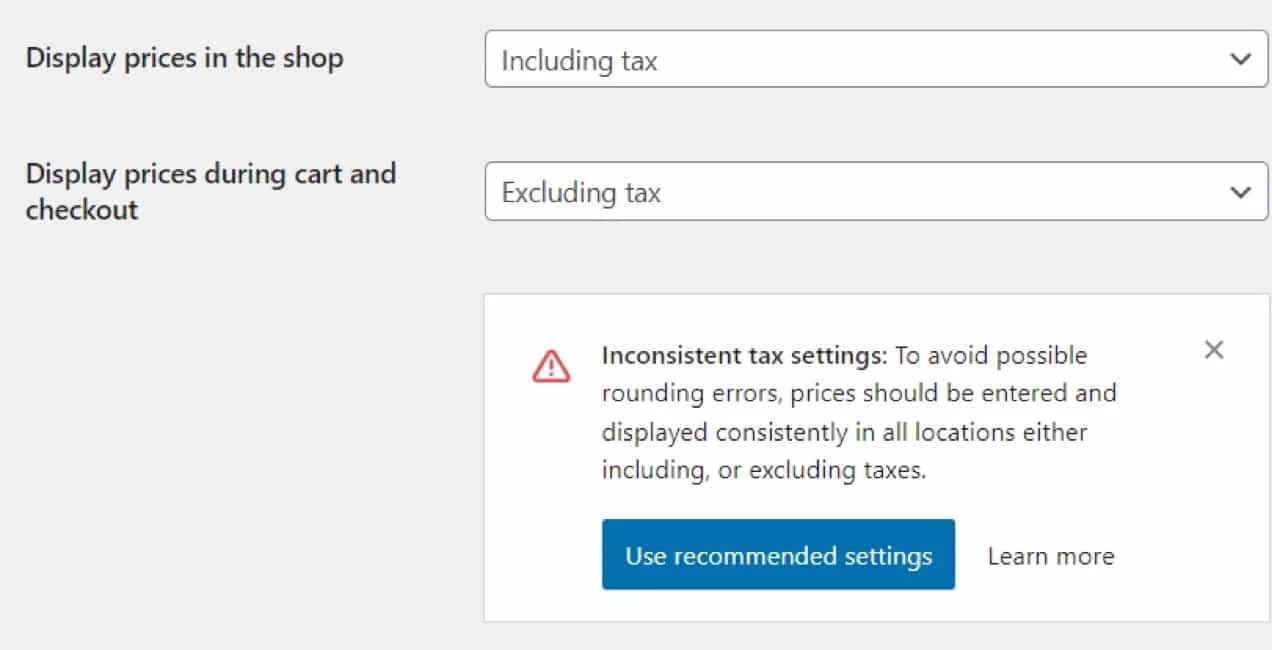

WooCommerce gives you the option to display prices in your shop inclusive or exclusive of tax. Likewise, you can choose whether prices in the cart and at checkout include or exclude tax.

If earlier you chose to enter prices exclusive of tax, then it makes sense to select the same options here. Likewise, if you chose to enter prices inclusive of tax, you’ll want to select “Including tax”.

In fact, if these settings are not consistent, you’ll be warned of possible rounding errors.

You can also set the label for your prices, so customers will know whether they’re inclusive or exclusive of tax. Simply enter {price_including_tax} or {price_excluding_tax}, depending on your preference.

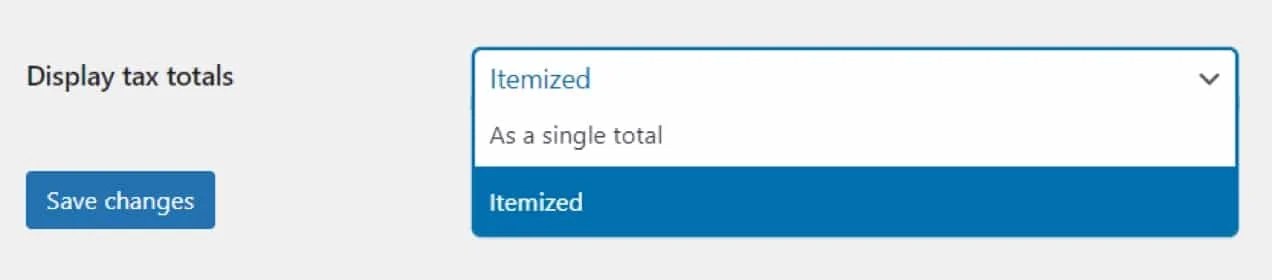

Finally, you’ll want to choose whether you display tax totals as a single amount at checkout, or as an itemized list:

To keep things simple for customers, you may want to choose “As a single total”. This is standard in many ecommerce stores. But it may be better to itemize taxes if your store includes products sold at several different tax rates.

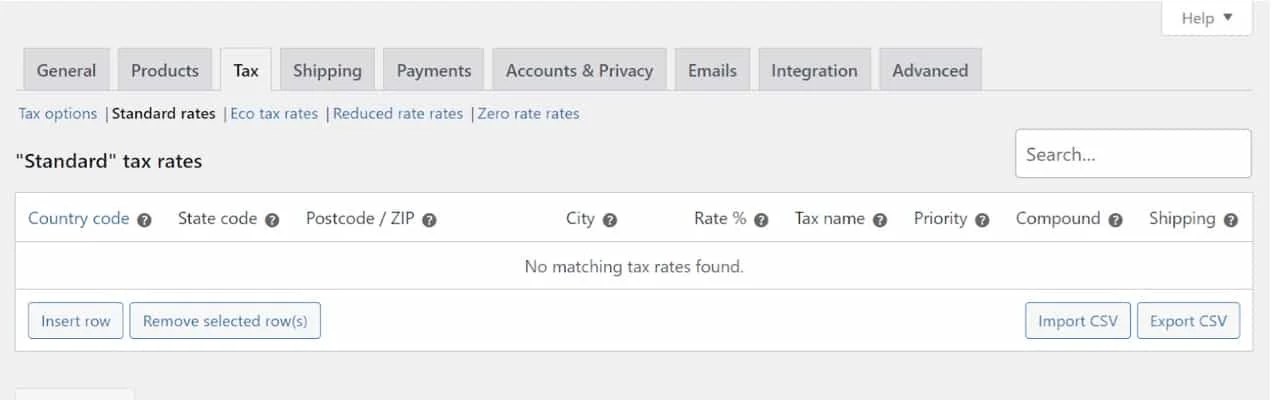

Step 2: Set up your tax rates

Now that you’ve configured your tax settings, it’s time to set up your tax rates. You’ll need to carry out this process for each tax rate your store uses (although it will work the same in each case). This tutorial will show you how to set up standard tax rates, and will also use a U.S.-based store as an example.

Under the Tax tab, select the tax class you want to set up.

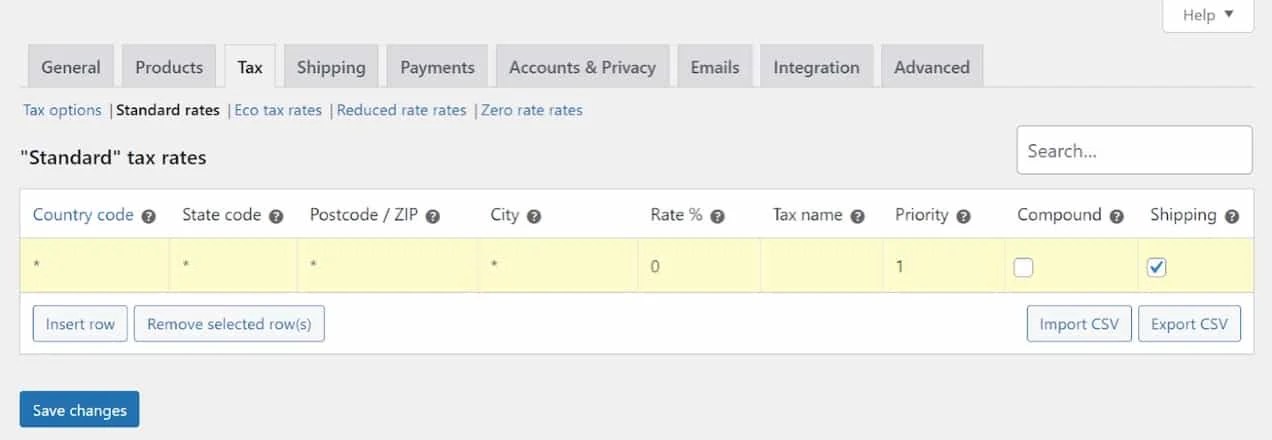

Then click on Insert row, and you can start filling in the fields for the tax rate.

These are the details you need to enter:

- Country code. Here, you’ll need to specify a two-digit country code for the rate. You can use ISO 3166-1 alpha-2 codes to look up the official codes for each country. If you don’t want to specify a country, leave this field blank.

- State code. If you’re based in the U.S., you may also have to enter a two-digit state code for the rate.

- ZIP/Postcode. WooCommerce also lets you enter the postcodes that this rate will apply to. You can separate each code with a semicolon, and use wildcards and ranges. For instance, you can enter “30” to apply the rate to all zip codes starting with those two digits.

- City. Alternatively, you can specify the city (or cities) where this tax rate is applicable.

- Rate. Here you’ll want to enter the tax rate using three decimal places. For example, you’d enter “20.000” for a standard tax rate of 20%.

- Tax Name. Here you can enter a name for your tax rate, like “VAT”.

- Priority. You’ll also need to choose a priority for this tax rate. For instance, enter “1” if this tax rate should supersede all other rates in your store. If you want to define multiple tax rates for the same area, you’ll need to specify a different priority for each rate.

- Compound. You’ll need to check this box if you want the rate to be applied on top of all other taxes.

- Shipping. Finally, you’ll need to select this box if you want to apply the same tax rate to shipping charges.

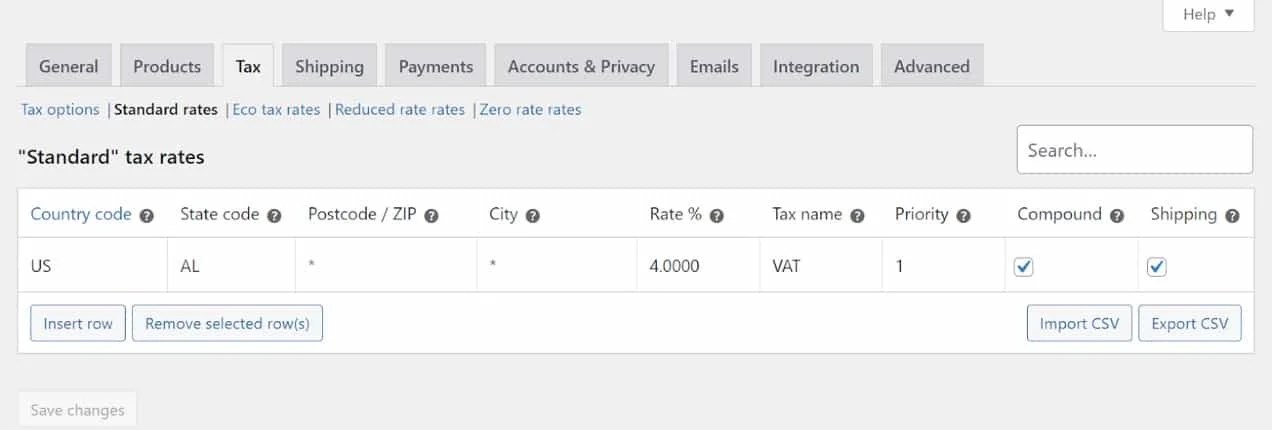

When you’re done, click on Save changes. Here’s what the results may look like for a store based in Alabama.

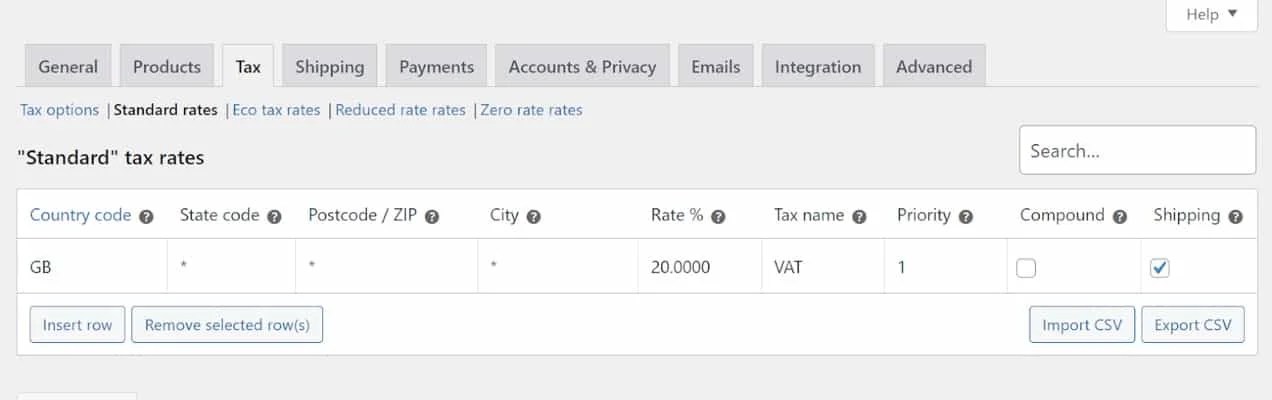

Meanwhile, here’s what the standard tax setup might look like for a store based in the U.K., where the standard rate is 20%.

When you were configuring your tax options, you were asked to choose whether the tax would be calculated based on the customer’s shipping or billing address, or on your store’s location. If you chose the latter, then you may only need to specify one standard tax rate (for your location).

On the other hand, if taxes are calculated based on each customer’s location, you may need to enter tax rates for different regions. For instance, if you cater to U.S. customers and tax will be calculated based on their addresses, then you’ll likely need to set up a tax rate for each state.

Of course, this will be very time-consuming. Fortunately, there are WooCommerce extensions that will automatically apply the correct tax rates based on country, city, and other attributes. You’ll learn more about these tools in the next section.

If you want to set up additional tax classes, simply click on Reduced rate rates or Zero rate rates, and follow the same process. This also applies to any other tax classes you set up on the Tax Options page.

As you may have noticed, you also have the option to import a CSV file that contains your tax rate details. This can save you a lot of time if you already have that information compiled.

It’s also a good idea to export your tax rates, using the Export CSV option. This way, you’ll have a safe copy of all your tax details. Plus, if you want to use the same tax rates on another website, you can simply import the CSV file instead of entering all the information manually.

Step 3: Apply the new tax rates to your products

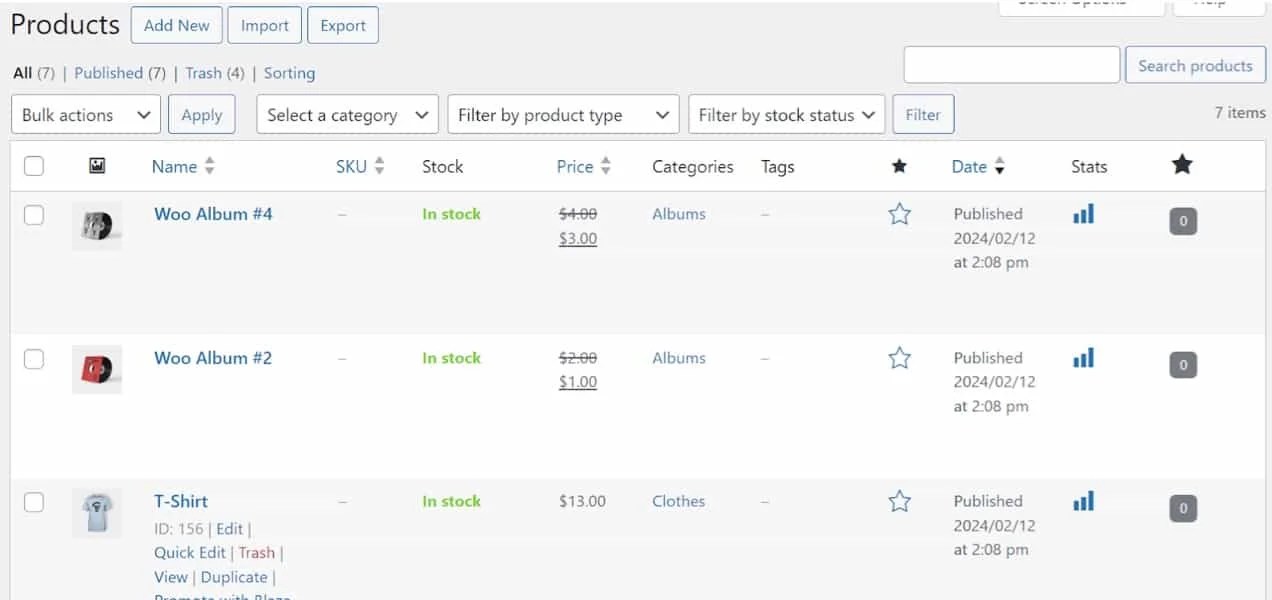

Now that you’ve created your sales tax rates, you’ll need to apply them to the correct items. Go to Products → All Products, locate the item you want to apply the tax to, and select Edit.

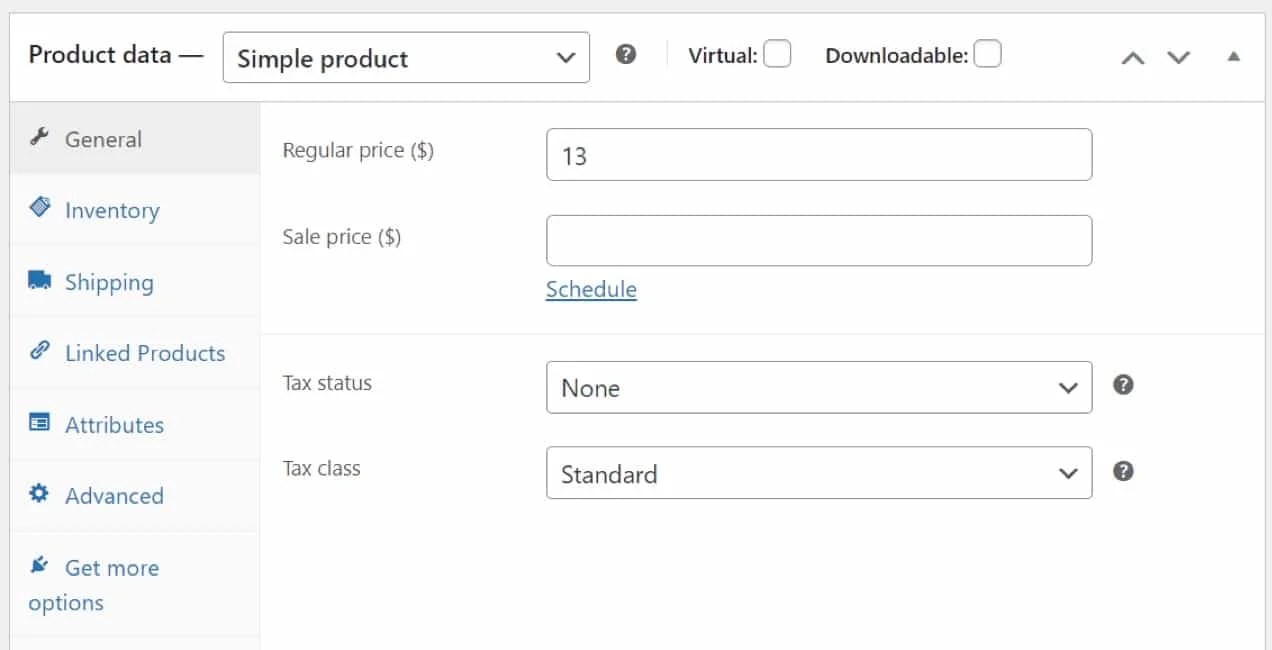

On the product page, scroll down to the Product data section and make sure the General tab is selected.

The drop-down menu for Tax status gives you three options: “None”, “Taxable”, and “Shipping only”. With that last option, only the cost of shipping will be taxed.

If you selected “Taxable” or “Shipping only”, you’ll need to choose a tax class.

For instance, if you’re based in the U.K. and you’re selling baby clothes, you’ll likely select “Reduced rate” for those items.

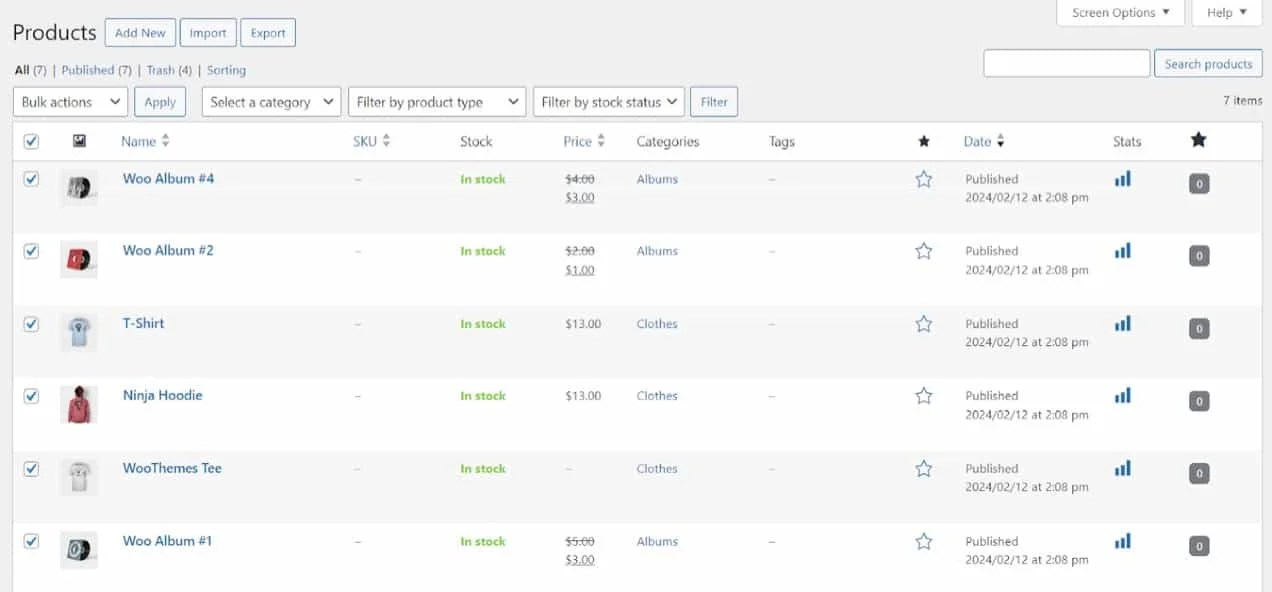

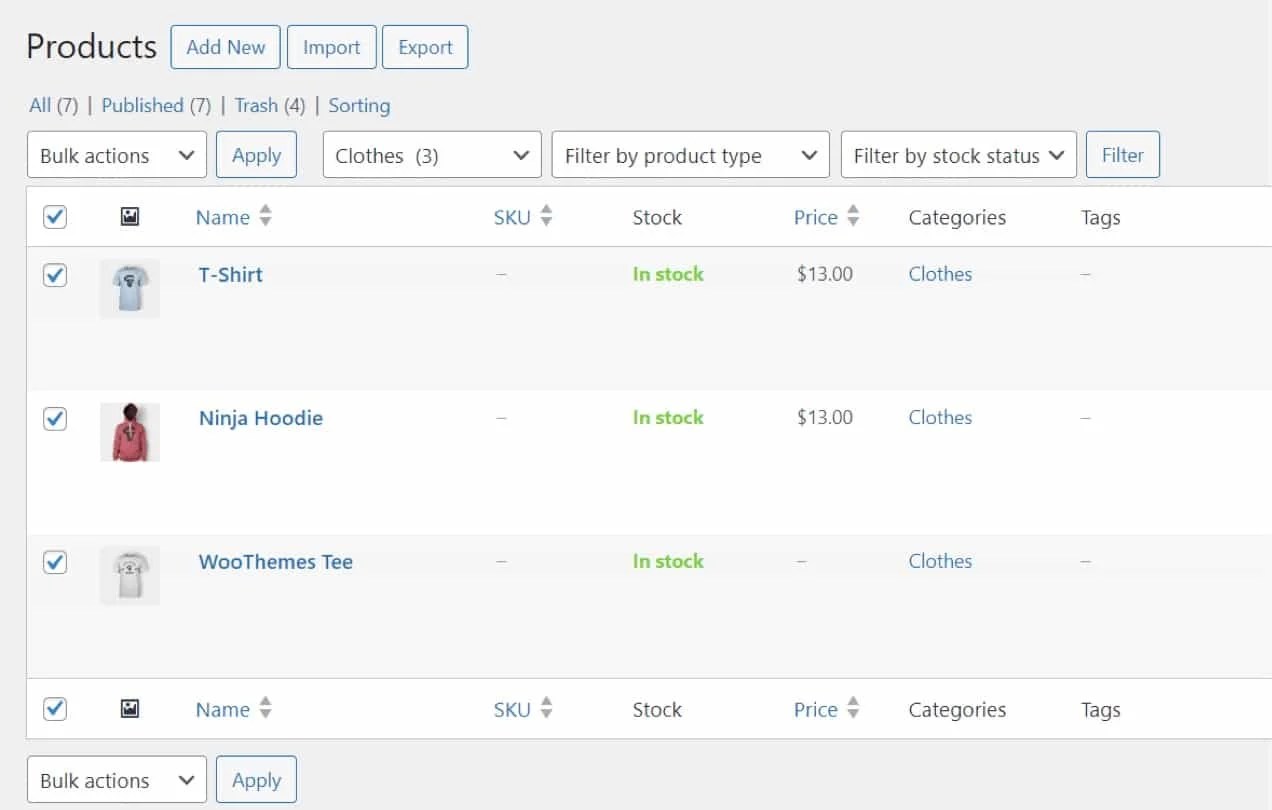

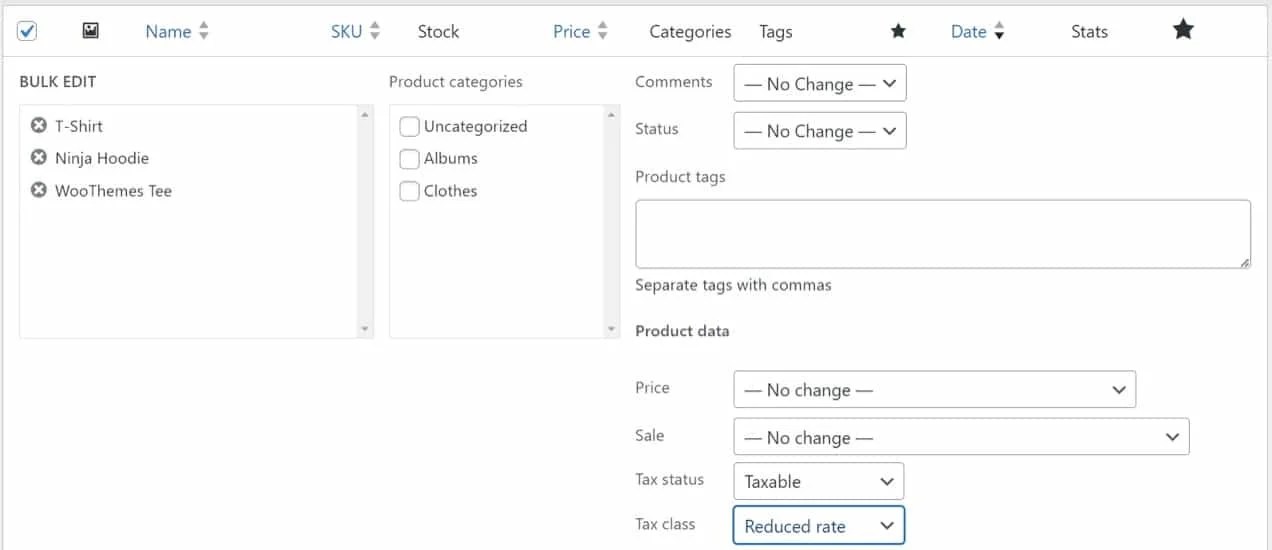

Now, you’re probably wondering if there’s a way to apply tax statuses and classes to all products at once, rather than editing them one by one. WooCommerce enables you to bulk edit all products, or items in a specific category. You can also bulk update items based on product type and stock status.

To do so, navigate to the Products page and check the first box (beneath Bulk actions) to select all of the items.

You can also use the available filters to select specific products only. For instance, if your clothing items are eligible for a different tax class than your other products, you can choose to bulk edit that category by itself.

In the Bulk actions menu, select Edit and hit Apply. Then look for the “Tax status” and “Tax class” fields, and use the drop-down menus to select the correct details.

When you’re ready, click on Update. That’s it — you’ve now added sales tax to your products!

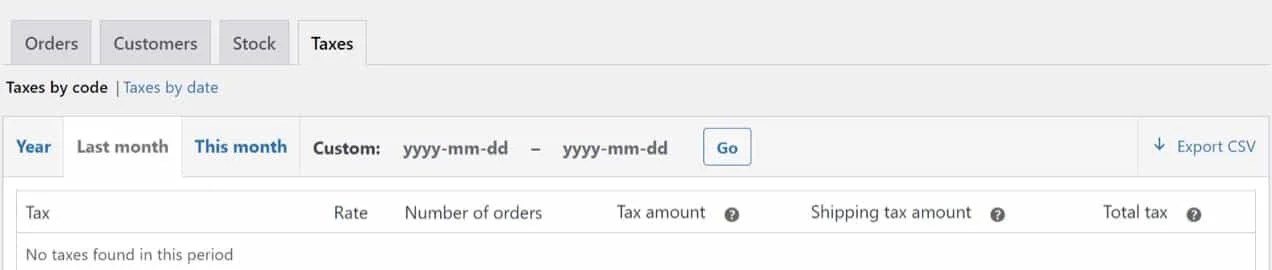

WooCommerce also provides tax reports. To access them, go to WooCommerce → Reports → Taxes. There you can view taxes by code or by year.

Of course, if you’ve just set up your store or taxes, you won’t have any recorded data yet. But knowing where to find this information can be helpful for filing tax returns in the future.

2: Use a WooCommerce tax extension

If you need to set up multiple tax rates, you might prefer to use a tool that automates the process, rather than doing everything manually. Here are three WooCommerce extensions that can help:

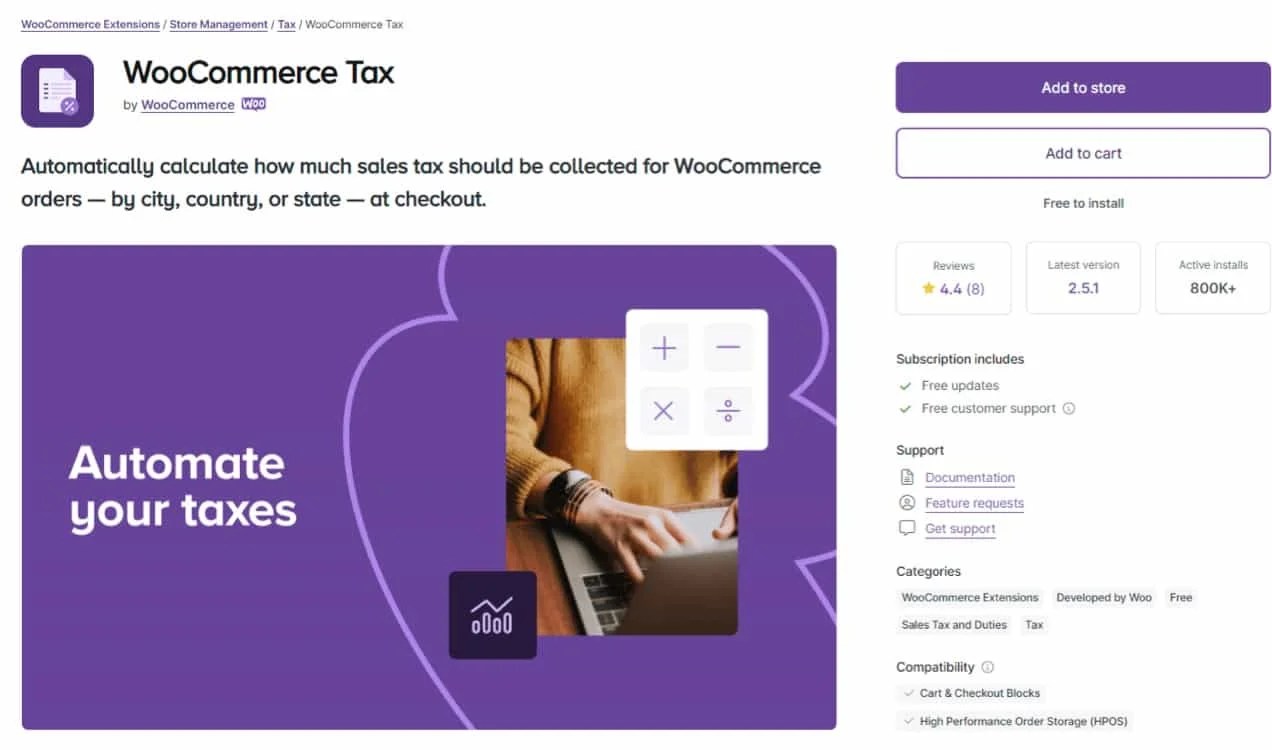

1. WooCommerce Tax

This is the official tax extension for WooCommerce. It automatically calculates the sales tax on orders at checkout, based on each customer’s city, country, or state.

This extension offers support for various countries, including Canada, the U.S., and the U.K. It’s also available for businesses located in the E.U.

WooCommerce Tax is completely free, but it only supports one store location. If you operate in multiple countries or states, you’ll need to consider a different tool.

2. TaxJar

TaxJar is a premium extension that’s designed for businesses with more advanced tax requirements. It automates various tasks for you, including tax calculations, nexus tracking, and filing.

This extension calculates sales tax rates at checkout. It also uses your sales data to determine whether you have exceeded the economic nexus threshold in each state (which is very handy for U.S.-based businesses).

If you have multiple outlets, TaxJar will automatically collect sales tax from all of your locations. It can also submit your tax returns to the states where your business is registered.

3. Avalara AvaTax

Avalara is a software company that automates tax compliance for businesses. Its WooCommerce extension, AvaTax, generates tax rates for your store, tracks your economic nexus, and collects sales data from all of your channels for tax filing purposes.

With AvaTax, you can automatically charge the appropriate tax rates based on your store’s location and your customers’ addresses. Additionally, it calculates customs duties and import taxes in real time. This can help you avoid surprising customers with additional fees.

Frequently asked questions

This article has covered what you’ll need to know about WooCommerce taxes. Before wrapping up, this last section will review some of the basics in case you still have questions.

Can I import WooCommerce tax rates from another site?

Yes, WooCommerce enables you to import tax rates as a CSV file. To do this, go to WooCommerce → Settings → Taxes, and select the relevant tax class.

Click on the Import CSV button, choose the file with your tax rates, and select Upload file and import. Then navigate back to the relevant tax class to see the imported rates. Note that you can also export your WooCommerce rates as a CSV file.

Does WooCommerce automatically collect sales tax?

By default, WooCommerce doesn’t automatically collect taxes. You’ll need to manually set up tax classes and rates for your store, and apply them to your products or use an extension to help.

How can I enable automated taxes with WooCommerce?

You can use a WooCommerce extension to automate tax calculations. For instance, you might opt for the official WooCommerce Tax extension, which is available for free and can be used by businesses in various locations, including the U.S., U.K., and E.U. Once you install the extension, you can simply enable automated taxes, and it will start calculating the sales tax at checkout.

If you’re looking for more advanced features, you might consider purchasing a premium extension like TaxJar. This will automatically collect sales tax from multiple store locations, and track your economic nexus to help ensure that you’re paying the right tax amount.

Should I charge taxes for shipping fees?

Laws on shipping tax vary by state and country. The final tax is also determined by the delivery method (like the type of courier you use), whether the products being shipped are taxable or exempt, and several other factors. Therefore, you’ll want to consult with a tax expert before deciding whether to charge taxes on shipping fees.

If you’re based in the U.S., each state has its own shipping tax regulations. If you’re delivering products to different countries, you’ll also need to consider the import duties and any additional shipping charges.

Set up your sales tax with confidence

Setting up sales tax correctly is an important part of running any online business. You’ll need to check the tax regulations on both product sales and shipping in your area, and make sure that your store complies with these laws.

If you have a WooCommerce store, you can set up tax rates manually through the plugin’s default features. You also get access to plenty of customization options, like whether to display prices inclusive or exclusive of tax. You can even set up additional tax classes if you offer various types of products

If you want to automate tax calculations, you might want to use a dedicated extension. This can help you save time, and ensure that your store is tax-compliant!