Authorization and capture are two of the components that make up payment processing. And while an automated approach is typically the default, sometimes it may be necessary to use manual authorization and capture.

What’s at stake?

Getting paid.

As you’re about to see, in certain types of sales transactions, receiving the customer’s payment isn’t always simple. Managing this process properly can ensure you’re able to properly receive what you’re owed while minimizing friction for customers.

This article will help you determine whether automated or manual authorization and capture is best for your online business, and how to use it. Let’s begin by clarifying these terms.

What is authorization and capture?

↑ Back to topThese two distinct events take place whenever a customer initiates an online payment using a credit card. In most cases, they happen at the same time. But they don’t have to, and in some situations, you as the merchant may want to separate them depending on the use case.

Authorization

Authorization happens when the payment processor contacts the cardholder’s bank to verify that they have enough money to cover the charges owed, and that the card is active.

At this point, the funds have not yet transferred from the customer’s bank to the business, but they are, in essence, reserved for that purpose.

Authorizations are temporary. Typically, they expire after seven days, which means no money changes hands if the capture process doesn’t begin before expiration.

Capture

Capture, also known as the settlement of the payment, happens when the money actually changes hands between the customer’s bank and the merchant. Your bank instructs the payment processor to collect funds from the customer’s bank and transfer them to your account.

Where do authorization and capture sit within the payment process?

↑ Back to topThese processes typically begin immediately after the customer clicks the button to make a payment for their order. This is true whether you use WooPayments or any other payment processor.

By default, these two processes happen at the same time, and that’s best for most businesses. But for certain use cases, as you’re about to see, it’s important to separate them into distinct events.

Manual vs. automated authorization and capture

↑ Back to topBefore we look at separating them, let’s be sure you understand your choices.

When authorization and capture happen at the same time, they’ll always be automated.

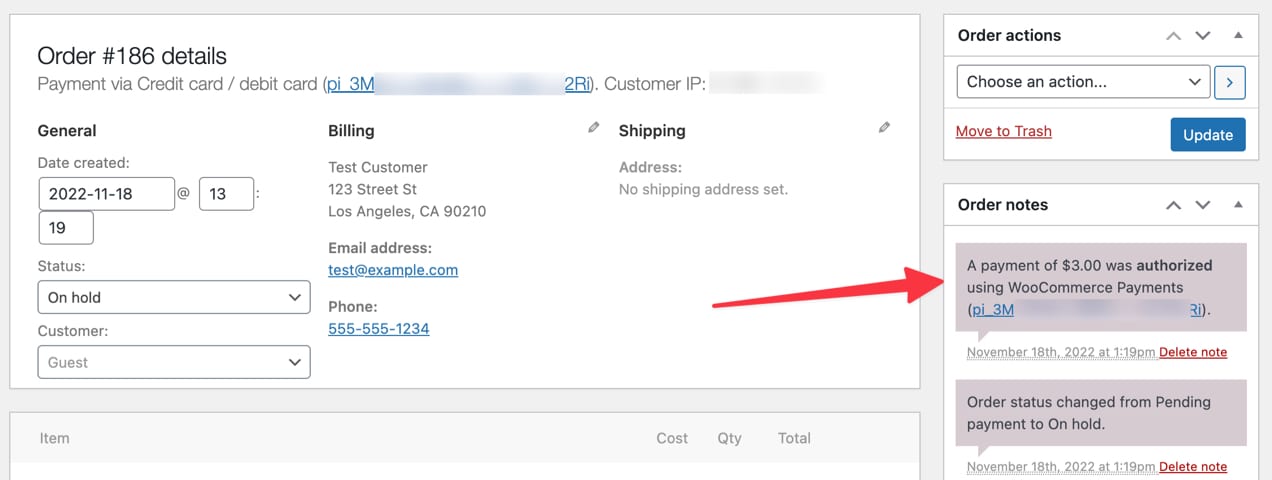

But if you want to separate them into two distinct events, you can make the capture process manual. In that situation, you would have to go into your payment processor and manually initiate the capture process. For WooPayments, you can enable this within the admin settings.

When is manual capture helpful?

Let’s look at some scenarios to help you see when using a manual capture process might be a smart strategy for your business.

Gas or petrol

When you fill up your gas tank, the authorization process happens before you have pumped any gas. The fuel company authorizes your card and then allows you to pump, but it doesn’t capture the charges yet because it doesn’t know how much gas you will buy.

Hotels

In most hotel transactions, the guest’s card gets authorized before or at check-in for an estimated amount based on the number of days they’ve reserved the room. But the capture process usually happens at checkout, when the actual amount owed is known.

Equipment rental businesses

Especially with expensive equipment, most companies will authorize the customer’s card before giving them the item to be rented. This ensures they can cover the charges. Some businesses authorize payment for the actual value of the item, not just the rental fee, in case it gets damaged or stolen. Then, when the item is returned, the actual amount to be charged is captured.

Artisans

Many artisans do custom work and their prices vary from job to job. Oftentimes, the final amount to be charged isn’t known until the work is completed, especially if the labor is charged by the hour. Sometimes they may want to authorize and capture part of the charge up front, and then do the rest once the job is complete.

With these examples in mind, you can begin to imagine scenarios in your own business when separating capture from authorization may be necessary.

If you’re just filling online orders for products and then shipping them, you typically won’t need to separate authorization and capture. But any time the final amount of payment isn’t known up front or the product is shipped at a later date, you may need to authorize payment first, but not necessarily capture it at the same time.

Manual capture disadvantages

There are some risks with manual capture. Let’s review a few things to watch out for.

First, you can’t capture more than the amount you authorize. You can only capture the same or less. So if you’re not sure about the final price, authorizing up front puts you at risk of undercharging. So you’d have to make a second charge, or cancel the first one and restart the process with the higher amount. Neither option will likely make the customer happy.

Second, the authorization expires after seven days. So, in situations with longer wait times between order placement and order fulfillment, if you wait to capture payment until the order is fulfilled, you run the risk of the transfer being declined. In that situation, you may find yourself having shipped the product but unable to collect the funds.

Now, you’ll have to contact the customer to restart the payment process again.

This is why, unless you have a good reason to separate authorization from capture and understand the risks of doing so, you shouldn’t do it.

Lastly, manual capture is only possible with card payments, not local payment methods or apps like Venmo.

Improving manual authorization and capture in WooPayments

↑ Back to topRemember, you can capture less than you authorize, but not more. If you’re doing the process manually, you’ll have to manage this within your payment processor.

That’s one reason why WooPayments is simplifying the manual authorization and capture process. Here’s a complete user guide for how to manage authorization and capture in WooPayments.

Best practices for managing manual authorization and capture

↑ Back to topHere are a few key tips to remember when using the manual process.

1. Don’t use manual authorization and capture without a good reason

This adds friction to your site, increases your workload, and puts you at risk of some of the scenarios described above. If you have a good reason to use manual capture, then you just need to stay on top of it and you’ll be fine.

2. Authorize more than you might need to capture

As mentioned, you can capture less or the same amount, but not more than you authorize. So if the final payment amount isn’t known at the time of purchase, authorize a higher amount than you think you’ll end up charging.

3. Don’t wait to terminate authorization of canceled orders

If the customer cancels their order, don’t wait seven days for the authorization to expire. Cancel it immediately.

4. Check your payments dashboard regularly

Especially in higher transaction businesses, you don’t want to miss capturing any payment if you’re using the manual approach. So check your dashboard consistently. Using manual authorization and capture means you must build this step into your routine.

And again, if you’re using WooPayments, refer to this guide for how to set up and manage the authorization and capture steps in the payment process.

WooPayments: streamlined flexibility for your store

↑ Back to topA major benefit of WooCommerce is your ability to connect to the technologies that best fit your store. When it comes to getting paid, more merchants than ever are turning to WooPayments for its ease of use and flexibility.

You can take payments in 30 countries and accept more than 135 currencies. Allow customers to use digital wallets like Apple Pay, reducing friction and boosting conversions. And many merchants can complete transactions on the go with the WooCommerce Mobile App and card reader.

WooPayments integrates fully with your store’s dashboard so you can manage everything in one place. No more swapping tabs and logging in and out of accounts. Plus, it’s built and backed by the WooCommerce team and comes with priority support.

About