For all the essential value that marketing, inventory management, and employees bring to a business, without an optimal checkout process, sales can’t cross the finish line.

Astonishingly high numbers of online shoppers get all the way to the checkout page, only to abandon their carts. Studies vary a bit, but it happens about 70% of the time1. If you could cut that down to even 50%, how much more revenue would your business make?

PayPal found that a typical large ecommerce site could increase their conversion rates by 35% through better checkout design and this would be worth $260 billion across the US and Europe. This represents an incredible opportunity for you to help increase sales by just improving this one part of your store.

Let’s look at six ways you can increase your revenue and drive more sales by optimizing your online checkout process.

1. Offer one-click checkout

Shoppers abandon their carts for all sorts of reasons. One reason is that the process is too time-consuming or complicated.

Take out unnecessary steps. Remove requirements to create an account during the checkout flow. Reduce fields you don’t need.

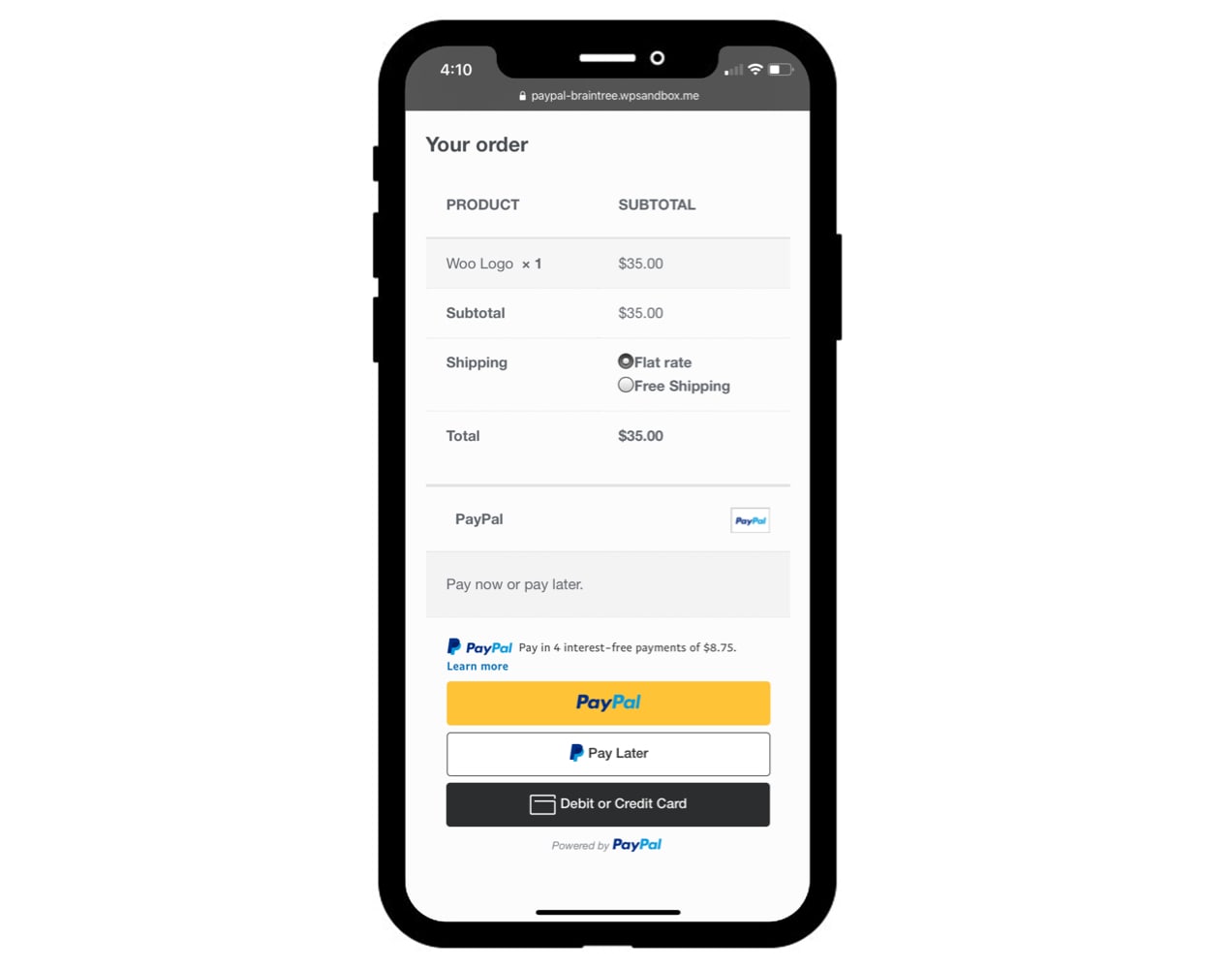

Achieving one-click checkout is possible when you use a payment processor that offers it. The free PayPal Checkout extension is one great option.

2. Optimize the mobile shopping experience

The same study mentioned earlier found that although half of online browsing happens on mobile devices, mobile conversion rates remain far lower than on desktops or tablets. Why? It’s more than just the tiny screens that make it harder to view and compare items and navigate pages. Mobile conversions also slip because of slower page load times, too many fields, limited payment options, and most of all, worries about security.

42% of consumers are not satisfied with mobile checkout experiences, partly due to misalignment between consumer expectations on checkout pages and merchants’ features. Merchants struggle with checkout abandonment due to suboptimal user experiences.2

Security is a big factor too, which is why many shoppers prefer to browse on their phones and buy later. They’re 47% more likely3 to come back if you deliver a good online experience. Make it easy, and you may earn more than a one-time customer.

So what can you do to improve your mobile shopping experience?

Accept multiple payment options. Improve load times by minimizing ads, plugins, and graphics. Speed up the checkout process with PayPal, because it can auto-fill address and payment information, which is often a hassle on mobile.

By speeding up the process and eliminating the need to use a physical credit card, people may be less worried about security.

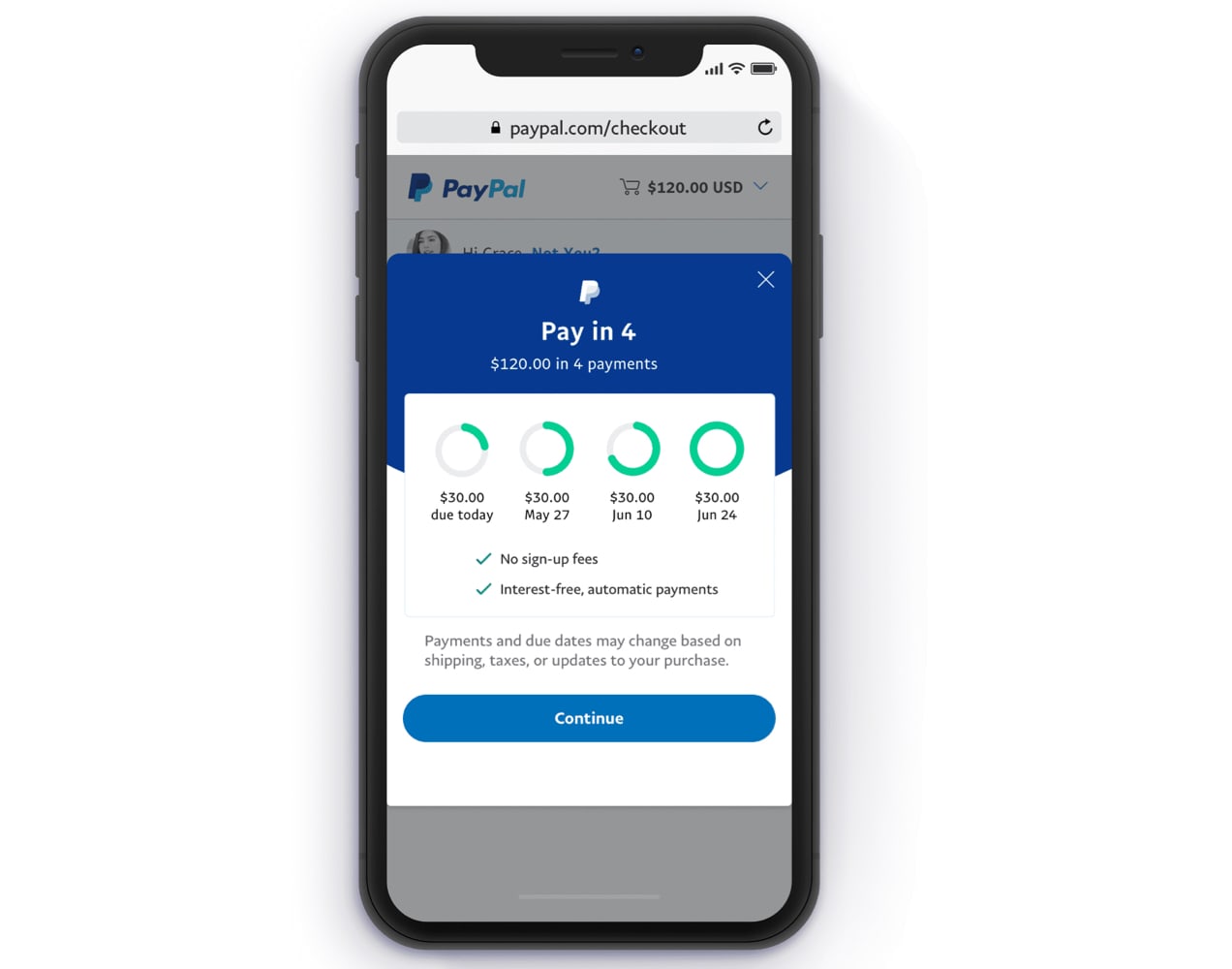

3. Offer and promote “buy now, pay later” as payment options

Consumers want options. They want flexibility. And they want the ability to buy the things they need while still managing their budgets. If you give them that kind of flexibility during your checkout process, customers may be more likely to complete their purchase.

Offering them the option to buy now and pay later is a terrific way to deliver this financial flexibility.

Fortunately, PayPal pay later options are included in PayPal Checkout at no additional cost:

- Pay later is a short-term financing offering that lets customers pay for purchases in interest-free payments, while businesses get paid up front.4

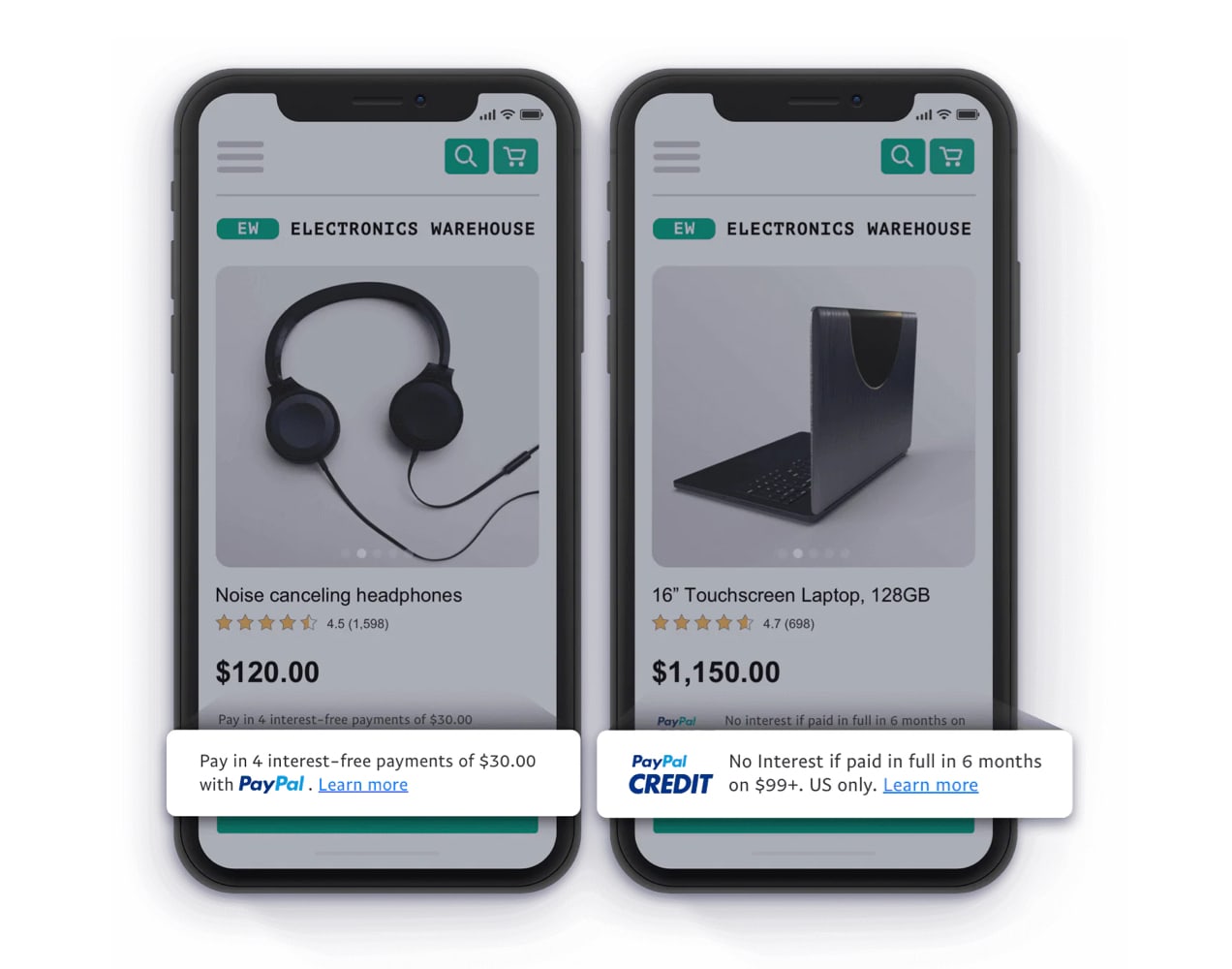

- PayPal Credit5 (U.S. only) offers special financing for larger purchases. Customers can pay over time while businesses get paid up front.

Businesses that promoted PayPal Credit on their site saw a 21% increase in sales compared to those who did not.6

Have you been wondering how your checkout process could achieve a marketing goal like increasing average order size? By adding messaging about PayPal pay later options. The PayPal Checkout extension helps you include dynamic messaging on your store, which means it changes to display the right offer based on the product viewed — either PayPal pay later or PayPal Credit.

When using PayPal Credit messaging on their website, businesses saw a 56% increase in their overall average PayPal order size.7 That’s huge!

PayPal pay later can also provide a boost for shops. 64% of consumers say that they’re more likely to make a purchase at a retailer that offers interest-free payment options.8

That could mean more sales conversions and more money.

4. Offer subscription and recurring payment services

In 2020, subscription ecommerce sales reached nearly 20 billion dollars9 in the United States alone and sales are expected to swell to more than 30 billion by 2024.

Finding a way to add a subscription or membership option to your business is a very smart move. You can easily set this up with Woo Subscriptions and PayPal Checkout.

McKinsey identified three types of subscription models. Find the one that makes the most sense for your business:

- Replenishment – sell commodity items like razors and dog food.

- Curation – offer great variety and selection to members. This works well in apparel, beauty, and food.

- Access – create a special club or exclusive opportunities and discounts.

In terms of marketing, replenishment appeals to the “save time and money” impulse almost everyone shares. Curation appeals to the thrill of being surprised and delighted by variety and unique items. Access appeals to the desire to feel special.

5. Offer upsells and add-ons

Putting relevant product suggestions, gift ideas, accessories, and other well-timed offers on the checkout page is a great way to close the sale and potentially increase the order size.

Special shipping offers are one way to implement this strategy.

WooCommerce offers some great extensions for upsells and add-ons, such as Product Add-Ons and Product Recommendations.

Learn more about implementing effective upsells.

6. Increase trust and security

82% of consumers believe payment information security is very important when considering how to pay for an online or mobile purchase.8

That means that you should choose your words carefully. “Secure checkout” is better than just “checkout.” You “verify” your email address, not “re-enter” it. Trust seals, badges, return policies, guarantees – these things can make all the difference in winning trust and giving consumers confidence in the security of your website’s checkout process.

Making it easy to upgrade your checkout process

PayPal helps you upgrade your checkout process with their free PayPal Checkout extension. PayPal Checkout includes PayPal, Venmo, and buy now, pay later options, as well as major debit cards, credit cards, and local payment methods, all in one checkout experience for your customers.

It lets customers pay in one click without leaving your website in 26 different currencies. And it includes pay later options like PayPal pay later and PayPal Credit.

Using PayPal can improve the shopping experience and reduce cart abandonment, resulting in increased sales.

**

The content of this article is provided for informational purposes only. You should always obtain independent business, tax, financial, and legal advice before making any business decision.

- US Retail ECommerce Performance Metrics, Salesforce Commerce Cloud, eMarketer Insider Intelligence, July 2020, accessed Dec 09, 2020.

- Commissioned study conducted by Forrester Consulting on behalf of PayPal, September 2020.

- Navigating a New Era of Payments, Ipsos MORI Conjoint Research, accessed Dec 09, 2020.

- About Pay Later (Pay in 4 in the U.S.): Consumer late fee may apply for missed payments and varies by consumer’s state of residency. Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457.

- PayPal Credit is subject to consumer credit approval.

- Average annual incremental sales based on PayPal’s analysis of internal data among 210 small and middle market merchants with annual online sales up to $37MM with messaging and buttons against a broader group of merchants that did not, with 24 mo. continuous DCC volume between January 2016 and November 2019.

- Average lift in overall PayPal AOV for merchants with PayPal Credit messaging vs. those without, 2019 PayPal internal data.

- Online study commissioned by PayPal and conducted by Logica Research in May 2020 involving 2000 US consumers, half were PayPal Credit users and half were non-PayPal Credit users May 2020.

- US Subscription Ecommerce Sales, eMarketer Insider Intelligence, March 2020, accessed Dec. 09, 2020.

I have a storefront on Etsy. PayPal is one of the options. However, Etsy is using Klarna (if you spend $50 or more, you can pay in 4 installments— I believe it’s a payment owed every 2 weeks). Will Etsy allow a PayPal extension?

Also, Etsy’s abandoned cart feature doesn’t work for all sellers. I’m not sure why & they don’t allow us to see who has abandoned their cart, so I can’t reach out to any of them directly.

I’m open to any suggestions and comments. Perhaps, Woo Commerce could conduct an Etsy shopping cart study!!! I bet it would help a great deal.

Highest Regards,

Laurie

Hi there, Laurie

I’m afraid that’s something you’d need to take up with the folks at Etsy. For what it’s worth, WooCommerce integrates with both PayPal and Klarna, so you’d have the flexibility to offer either to your customers if you feel a switch of platforms would be a good fit for your store.

Sorry to hear about your abandoned cart frustrations on that platform – it must be extremely counterproductive when you’re trying to run a business. It’s an important part of eCommerce success in my book! It’s one of the best ways to grow your store. I’d encourage you to take a peek at the abandoned cart options for Woo as a comparison.

Thanks for stopping by – wishing you and your business every success this year!

Thanks.

Any chance that Stripe will have a one-click checkout like the Paypal option?

Any chance of a plugin being developed to install the Fast payment gateway?

Is it recommended to have both Stripe and Paypal options?

Is it recommended to have both Stripe and Paypal options on mobile?

Thanks

I too would like the answers to these questions as I am also a user of both Payment Gateways.

My thanks also…

Thanks for your comment, David.

We’re currently exploring functionality around this – stay tuned!

Not at this time – but Fast does have an integration for Woo, so it may be worth reaching out to them. 🙂

We recommend more than one payment gateway for your store. Why? The global reach of combining gateways can be impactful to your business – and if one technology goes down, you won’t lose sales.

For mobile, this is up to you – it depends on your personal preference and/or business requirements. You can unlock Apple Pay and Google Pay via Stripe for faster checkout on mobile AND have PayPal to cater to your customers who prefer using it.

All the best for your store!