Missed our Sales Tax 101 webinar with TaxJar? Not to worry: we’ve collected your most pressing questions about collecting and managing sales tax into this FAQ, plus made the slides available for download (for free!). Have a look…

Over the course of the last few weeks, we’ve been lucky enough to work with the folks at TaxJar on a webinar about sales tax for store owners. It’s been an eye-opening experience, to say the least, even for those of us with experience managing an eCommerce store. Who knew tax could be so complex?

We’ve been keeping an eye out for the most commonly asked questions about sales tax, and now we’ve compiled them all into one spot. This post will give you quick rundown of what you should know about state sales tax, plus links to resources where you can learn more.

If you’re new to tax in your online store or just have a few questions about your situation, read on to have all your pressing questions answered — and to get a free download of the webinar slide deck.

Sales tax in a nutshell: why it exists and how it works

↑ Back to topIf you sell in or into the United States, you might wonder why sales tax exists in the first place. And no, the answer’s not “to be a pain.”

45 of the 50 states in the US (as well as the District of Columbia) collect sales tax. States typically put the taxes collected from purchases toward government employee salaries, police and fire departments, and road and public resource improvements.

You’re probably used to paying an extra few cents per purchase when shopping in person, but online taxes are still evolving and changing.

Collecting sales tax is first dependent on whether or not your state has sales tax in the first place (see the map above). So if you’re based in Florida and you sell to a Florida customer, you’d collect tax. If you’re in Alaska and you sell to an Alaska customer, you wouldn’t.

But what if you’re based in Alaska and you sell to someone in Florida, or vice-versa? Well, that’s where things get a bit more complicated, and nexus comes into play.

What the heck is “nexus”?

Nexus is basically a fancy way of referring to a state where you have “significant presence,” or where your business operates in some fashion.

Nexus can have a big impact on the sales tax you collect online. As Mark explained in his introduction to sales tax for WooCommerce, if you have nexus in a state, you have to collect sales tax for that state.

So if you’re based in Alaska and sell to someone in Florida, you only have to collect sales tax from the Florida customer if you have nexus there. If you don’t, you’re home free.

When you have nexus, and when you don’t

Figuring out when to charge tax is hard enough. But you also have to be aware of everywhere that you have nexus — and it could be more states than you think.

You have nexus, by default, in the state where your business is based. But you might also have nexus in states where you:

- Have employees

- Have a warehouse

- Have a vendor with a drop-shipping relationship

- Have an occasional trade show presence

Each state has different definitions of what defines nexus. You can check the list here to find out what is and isn’t considered a nexus-causing activity for your state(s).

How to find the correct tax rates to charge customers

↑ Back to topKnowing when you should charge sales tax is half the battle. Charging the correct tax rates to your customers is something else you’ll need to tackle.

As we talked about in this post, determining the right rate to charge can be tricky because sales tax is governed at the individual state level. This means that not only rates, but also tax rules and regulations differ from state to state.

The best way to find the right rate to charge is to check with the states where you have nexus. In the process, you’ll also find out if these states have state tax only, or if they also require you to charge additional tax based on county, city, or a special district.

Some states are destination-based, others are origin-based

An additional complicating factor: some states ask you to collect sales tax based on the destination state’s rate, while others want you to collect based on the origin state’s rate.

If you’re lucky enough to live in one of the states where you don’t have sales tax, none of this will matter to you. But if you work or have nexus in one of these other states, it’s one more factor you’ll have to consider.

TaxJar has much more helpful information on sorting out destination vs. origin-based tax — including what and when to charge — right here.

How to handle tax if you’re shipping to the US from another country

One common question we’ve been hearing since we started these posts on state sales tax (cheers to you all for asking it!) is how much of this information applies to non-US sellers.

There are two things you should know:

- If you are based outside of the United States, you only need to charge a US sales tax if you have nexus in one of the states

- The absolute best thing you can do if you have questions regarding selling into the US from your country is to consult a licensed tax professional

Here’s a fantastic Q&A that has a little more information on what international sellers should and shouldn’t do when it comes to nexus in the states, plus a follow-up article you might find useful.

If you’re not dealing with the US at all and just want to know more about tax in your country, we’d love to hear a bit more about where you’re located and what you want to know — it might help us put together our next post (or webinar!).

How to handle tax on products that don’t ship (that is, digital goods)

You might be wondering how to handle tax on products that don’t physically travel anywhere, specifically digital downloads or some online bookings.

Taxation of digital goods are handled differently in every state. Many states now ask you to tax digital goods, but there might be some distinctions. For example, if you’re “renting” a digital item — like a movie or download that expires — there might not be any tax. But a permanent digital purchase would always be taxed.

TaxJar’s suggestion for now, while the states figure out how to handle this, is to check with each individual state in which you have nexus regarding their policy. You can find a list of states with contact information for tax offices right here.

Filing your taxes: when and how to file

↑ Back to topAlong with the different tax rates, regulations, and standards set by each state, there are also different preferences on when and how often to file your taxes. (It figures, right?)

Check with the states in which you have nexus to determine how often you should be filing. Some states will have you file as often as monthly, but others will request quarterly or annual filings instead.

Not happy filing every month? You can always ask to have your filing frequency changed. Give your state taxing authority a call and ask if this is possible — you never know until you try!

As far as the filing process is concerned, a simple Google search should turn up each state’s online sales tax reporting form. Or, if you’re using an extension like TaxJar, the filing process will be handled for you.

If your nexus changes, your filing should change with it

One thing to keep in mind is that any changes to your nexus will also affect your filing status. This might mean removing a state if you no longer have an employee there, or adding a new one if you have established a drop-ship relationship there.

The moment you establish nexus in a state, you should file for the appropriate tax permit. This will keep you in the clear (see below for details on how this might cause trouble).

On the other hand, when you lose nexus in a state, you should check with the state to determine when you should stop filing. Some states have “trailing nexus,” which means you won’t actually lose your nexus until a few weeks or even months after your physical presence is removed. It all depends on their regulations.

The beginning of the year is a great time to re-check your nexus situation and file for any additional permits you might need. Here’s how you can give yourself a yearly tax checkup in just five steps.

What you need to avoid tax trouble (or an audit)

↑ Back to topThe very first thing you should do when you realize you have nexus — and before you collect even a single cent of tax — is register for a permit. Here’s how you can do that in your state.

One thing that states definitely frown upon is collecting sales tax without a permit. While you might have had the best intentions at heart, it’s technically extra revenue that you aren’t allowed to collect.

Another way to stay out of trouble is to keep an eye on the validity of your tax permits. They do expire, and again, collecting tax without a valid permit can get you into trouble. You’ll also want to make sure you cancel any permits you no longer need, and stop collecting tax once your nexus has ended in any state.

Finally, as Mark mentioned on yesterday’s webinar, when it comes to filing, your best effort is better than no effort at all. Paying $96 on a $100 balance is much better than paying $5. As long as you make your best effort and do things by the book, you’ll likely never have to worry about an audit.

Avoid sales tax headaches with help from the pros at TaxJar

↑ Back to topAll this tax talk is enough to make your head spin. But there are plenty of resources made to help you set up your store, collect taxes, and file without a hitch, whether you choose to do it all yourself or turn to a trusted partner.

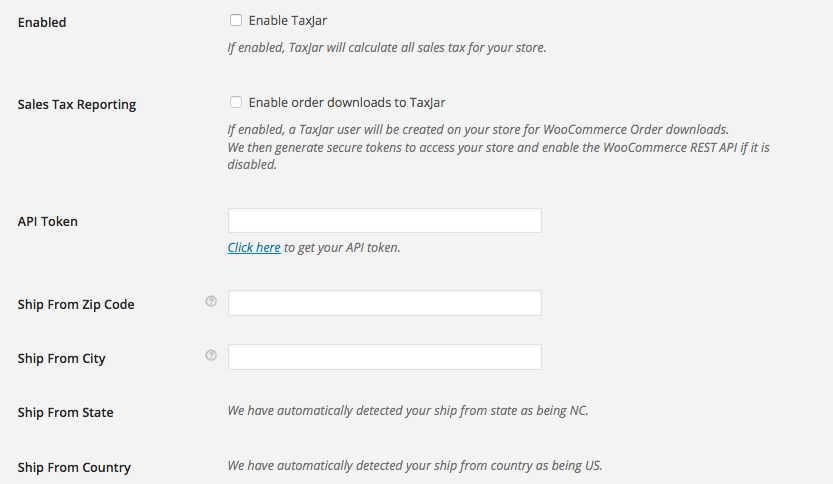

If you’re using WooCommerce, the TaxJar extension can eliminate the need to even think about sales tax. TaxJar not only automates the process of charging the right tax rates, but also keeps track of what you’ve collected so you can file fast, accurate returns with each state.

Not using WooCommerce? Not to worry: TaxJar’s blog is chock full of helpful info and solutions for store owners looking to make sense of their tax situation no matter which platform they’re using.

And, of course, we’ve got something special for anyone who missed out on yesterday’s webinar. Get educated on sales tax straight from Mark Faggiano, TaxJar’s founder and CEO, with a PDF download of his slide deck. Just fill out your email below to download it for free!

[wtsfc list=”7cf3611cfa” heading=”Need a helping hand with sales tax? Get the slides from our #woowebinar with TaxJar in just one click.” subheading=”Enter your email below to download a PDF copy of the slides from our Sales Tax 101 for Store Owners webinar. You’ll also be signed up to receive emails from WooCommerce that will give you great tips on improving your store.” button=”Download the PDF”]

Woo! The slides are yours. Just click here to download your copy of Sales Tax 101 for Store Owners. Lose the PDF? Come back to this post at any time to download it again.

[/wtsfc]

Have any other tax questions for us? Feel free to drop them in the comments below and we’ll be happy to get you an answer. Thanks for stopping by!

About

Hello,

I am in need of a plugin that would enable connection between our server and any ecommerce site for voucher redemption.

We partner with online merchants where our close or open loop voucher is accepted as a means of paying for (redeeming) product or services.

Kindly help.

Regards,

Olaniyi Olalemi

Founder/CEO

Collecting tax with WooCommerce has been easy! But I found myself missing something when it came to file my taxes in California – I need my total tax-eligible sales; that is to say, a list and total of my sales that were shipped to California.

I worked around it, but it’s just so close to being the complete solution I want!

I have known many from this valuable topic . This topic on mainly collecting tax is very informative here . I think Collecting tax with WooCommerce is very easy!