Once upon a time, sales tax was blissfully simple for eCommerce stores in the United States. In the early days before regulators caught up with the industry, businesses were able to forgo charging sales tax for transactions in states where they had no physical presence. Ecommerce accounting was a much simpler world.

In 2018, things got more complicated when, in South Dakota vs Wayfair, the U.S. Supreme Court ruled that each state could set many of its own rules around sales tax for eCommerce stores. Today, 45 states have state-wide sales tax — each with their own nuanced rules. Beyond those, there are currently more than 11,0000 different city, county, and local tax jurisdictions. It can be difficult to keep track of everything.

Five sales tax pitfalls to avoid

↑ Revenir en hautWith the complexity of sales tax in the U.S., avoiding the common missteps below can help you navigate the majority of sales tax compliance. It’s worth getting ahead of this less-than-exciting part of eCommerce business ownership.

Pitfall #1: Not realizing that you need to collect sales tax

Although it’s been three years since the Wayfair ruling, some businesses still haven’t updated their sales tax practices. If that’s you, and your business hasn’t been collecting or filing, you’ll want to talk to a State and Local Tax consultant (SALT) to understand your liability for past taxes and make a plan for moving forward.

The good news is that state departments of revenue are generally much more forgiving when you go to them than when they figure out the error themselves.

The following scenario is more common: companies know that eCommerce stores have to pay sales tax, but mistakenly believe that they’re exempt because of the kinds of products they sell. This is a common mistake made by SaaS companies and digital merchants.

Regulations tend to move at a slower pace than technology, and for many years sales tax focused almost solely on tangible items like televisions and furniture. But in the past few years, there’s been a rise in products that have no tangible properties at all — for instance, software downloaded from the cloud. There’s no physical CD-ROM to tax for that software, and so in the past, many considered it exempt from sales tax. As states have observed the increase in sales for these non-tangible digital goods, they’re changing their laws to bolster their revenue.

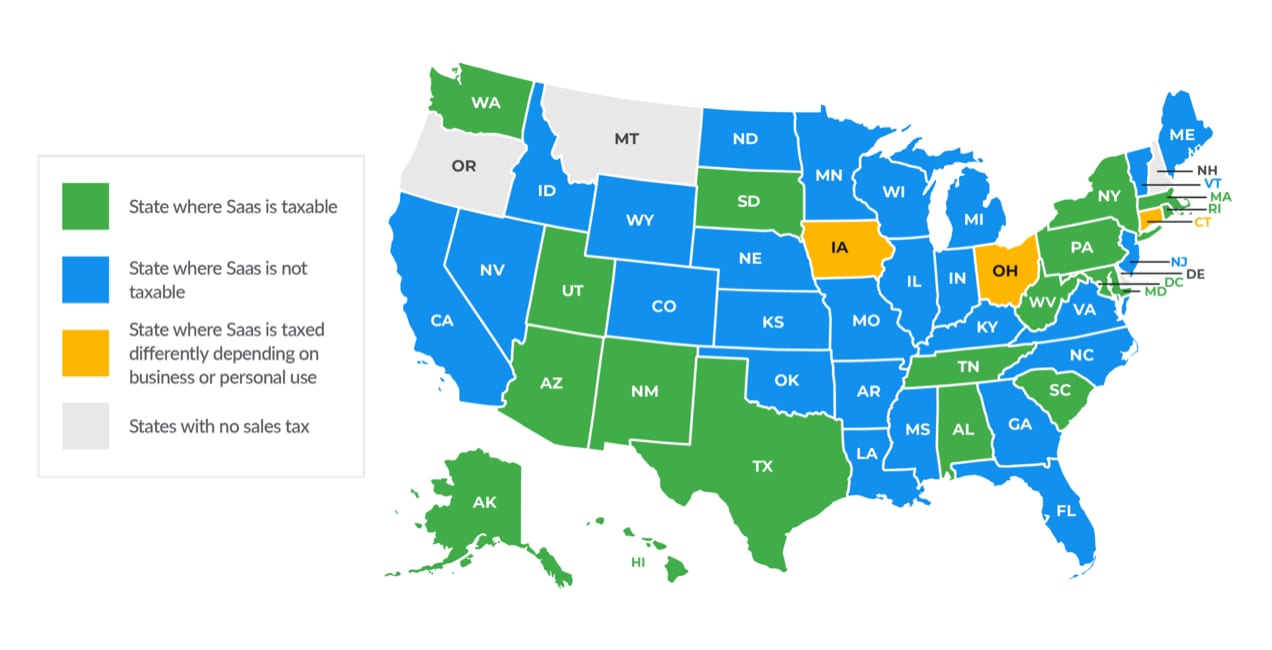

Today, 20 states tax SaaS (software as a service) products. It’s worth looking at a breakdown of how each of them taxes SaaS. Do your products fall under this category? Many states differentiate between digital goods like eBooks and software, so you’ll need to take care to categorize your items appropriately.

Using WooCommerce as a B2B ecommerce platform? You should connect with a tax professional to verify whether you’re subject to the same tax nexus laws as a traditional ecommerce business.

Pitfall #2: Forgetting to track nexus

Nexus is one of the trickiest concepts when it comes to sales tax compliance. Basically, nexus is the threshold in which a state requires a business to collect and remit sales tax. This used to be largely physical (a business presence in a state, for instance) but post-Wayfair, states have put in place economic thresholds in the form of gross sales and number of transactions.

To stay compliant, you’ll need to understand these thresholds and track data for each state so you know where you do and do not need to collect and remit sales tax. If you cross a nexus threshold without knowing it and don’t begin collecting sales tax from your customers, your business will be responsible for paying those taxes out of pocket. And that’s no fun — ask these six retailers.

Pitfall #3: Scattered data and reporting

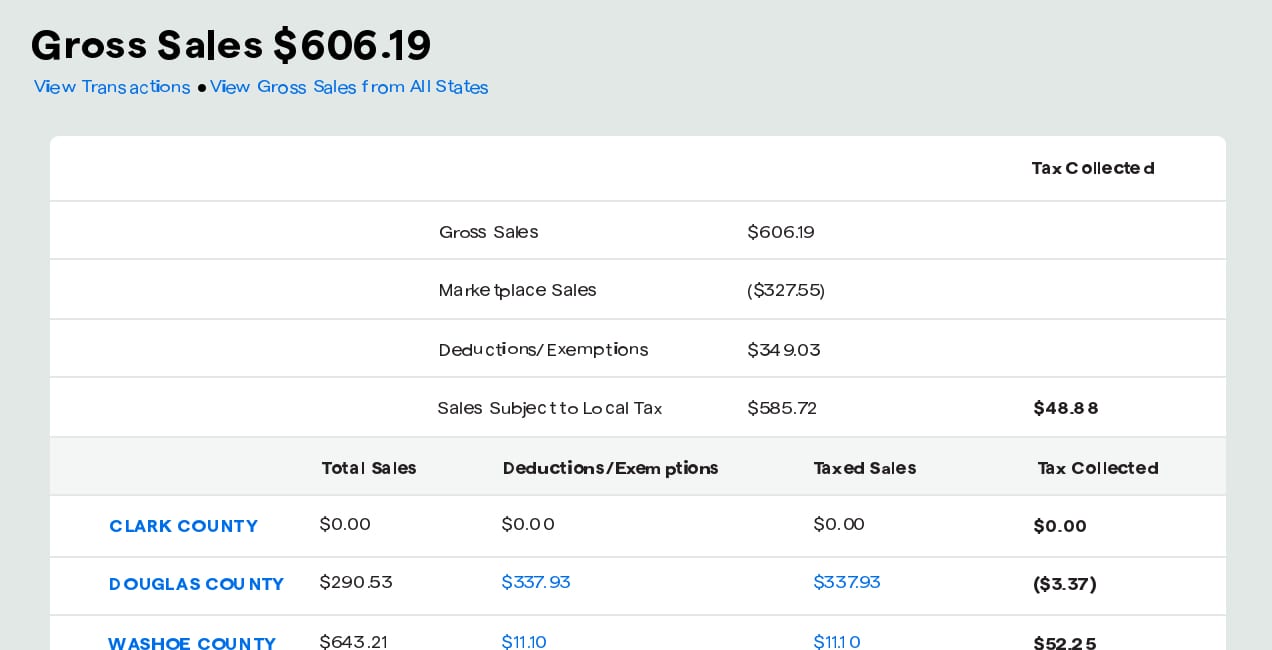

Attempting to track your sales tax compliance and nexus status is more difficult if you’re a multi-channel seller with data living in different silos. This becomes especially challenging if some of your sales channels are through marketplace facilitators like Amazon, eBay, and Etsy. Most states have laws that require these marketplace facilitators to collect and remit sales tax for you. That means you’re responsible for collecting sales tax on your website powered by WooCommerce (don’t worry, software like TaxJar can automate the entire sales tax process) but not as a third-party seller on Amazon.

Different states have different rules when it comes to whether or not your sales on these marketplace facilitators count towards your nexus threshold. As you can see, it can get complicated fast. A sales tax reporting dashboard can give you a single, holistic picture of all of your sales in each channel, as well as what’s been collected for you and what you need to collect yourself. This will save you a lot of time and better enable you to be strategic with your compliance.

Pitfall #4: Misclassifying products (and their tax rate)

Did you know that, in New York, a bagel is tax-free as a grocery staple – but as soon as you slice that same bagel, it’s taxed at 8.75% as a prepared food? And in New Jersey, real fur clothing is considered a luxury item and taxed, but synthetic fur isn’t. Meanwhile, next door in Pennsylvania, both synthetic and real fur is taxable.

Tax codes are filled with this kind of nuance, and every state has different definitions and parameters. It’s important to know precisely how your products are classified in each state. Sales tax software can automate these classifications, but if your company has products that could be open to interpretation in terms of their taxability, you may want to consult a sales tax professional.

Pitfall #5: Missing filing deadlines

Not only are filing deadlines different for every state, for many of those states, filing dates can change as your company grows in size. Typically, the more revenue your business brings in, the more frequently states want you filing taxes.

There are monthly, quarterly, and yearly filing due dates, depending on the state and your company size. The majority of states require taxpayers to file on the 20th day of the month after the taxable period ends. Some states require sales taxpayers to file by the last day of the month following the taxable period, however. There are also a select few that require businesses to file by the 15th or 23rd. This is why you need to pay attention to the filing dates of those states in which you have a nexus.

Automate compliance: save time, reduce errors

↑ Revenir en hautIf all of this seems a bit overwhelming, there’s good news. Sales tax software like TaxJar works seamlessly with WooCommerce and can automate much of the process. This includes the difficult part of sales tax compliance like real-time calculations, aggregated reporting from all of your channels, and filing with each state. The right automated solution will even track your nexus status in every state and warn you when you’re approaching the threshold. It will also keep track of those pesky moving filing dates for you.

If you’re worried that you’re not compliant, now’s the time to act. Schedule a meeting with a SALT advisor to talk through your specific situation and formulate a plan. If you should have been collecting sales tax but haven’t been, they can help you navigate the next steps to minimize fines and penalties.

And if you aren’t already automating sales tax, you should consider it. You’ll save heaps of time that you could be spending on more strategic issues, and you’ll reduce the potential for errors. Because, in the end, we’re all human.

About

Good to know!

Thanks for reading, Don!

WordPress + Woocommerce is awesome i made a free website with higly optimized seo in wordpress

Glad to hear you’ve found success with WordPress and WooCommerce!