The holidays are coming, and we have some good news!

There exists a single strategy that can accomplish five key goals for your store: convert more customers, explode your average order value, increase customer loyalty, decrease returns, and reduce cart abandonment.

You already know the holidays are the biggest shopping season of the year. What you need is a way to increase your revenue without adding much more work for yourself, and that’s where Buy Now, Pay Later (BNPL) payment options come in.

If you don’t have much time before the holiday season, adding BNPL options may be the most impactful improvement you can make to your store. And it’s a pretty straightforward task.

How Buy Now, Pay Later works

↑ Back to topInstead of paying for an item all at once, customers can pay for it in installments. But unlike payment plans that require banks, long applications, and complicated credit checks, BNPL uses a much simpler, nearly-instant approval process for customers. While the customer pays in installments, the store owner receives the full amount of the purchase upfront.

There are a variety of options, but the basic idea of BNPL usually includes:

- Interest-free or low-interest payments

- Payments spread out over a short time period, from weeks to a few months

- The ability for customers to choose the payment amount, number, and frequency of payments, and manage their payments through the service provider app or website

You can add BNPL functionality to your store via a service provider like Affirm, Afterpay, or Klarna. You will need to create a merchant account with your chosen service provider, and have their WooCommerce extension installed and connected to your store. Most have built-in options to promote the payment option at check-out.

According to C&R Research, 60% of consumers say they have used a BNPL service. Why has this service become so popular? Let’s take a look.

Three reasons to give your customers a Buy Now, Pay Later option

↑ Back to top1. Customers prefer it – especially younger ones

Consumers say they prefer BNPL to using credit cards because:

- It’s easier to make payments

- It offers greater flexibility than credit cards

- It has more favorable interest rates

- There’s an easy approval process and it doesn’t impact credit scores

BNPL allows customers to buy more stuff without breaking their budgets. Many prefer to use it even though they could afford to pay for their purchases all at once.

It’s most popular among younger people, with 69% of millennial shoppers and 42% of Gen Z shoppers being more likely to make a purchase if they can do it using BNPL, according to data from Afterpay.

2. It reduces cart abandonment

BNPL service provider Klarna says that “offering shoppers the freedom to buy what they love and pay later can help boost average order value and conversions, as well as decrease cart abandonment rates.”

This makes sense because one reason people abandon carts is that the combined price of all their items is higher than they expected. By giving them the option to spread the payments out over a few months, it softens the impact.

3. It makes more money for your business – especially during the holidays

There’s a lot to say about this – especially regarding the upcoming holiday season. As you will see below, BNPL increases the amount people spend and the number of purchases they make by boosting affordability and helping customers to be able to spend more today. At the end of the day, increasing your revenue is probably your main objective. If that’s the case, BNPL is a great way to make that happen.

Boost your holiday revenue with Buy Now, Pay Later

↑ Back to topBNPL is starting to look like one of the biggest game-changers for merchants in several years.

Look at these numbers from an Afterpay survey:

An average BNPL user spent $1141 during the holiday season in 2020. The average spent by shoppers using traditional payment methods? $150. That’s over 7 times as much money from BNPL users!

Also, shoppers using BNPL made an average of five purchases. Other shoppers averaged three.

Those are pretty staggering numbers. It’s rare to see one single strategy have such an impact.

Which BNPL service option should you use?

↑ Back to topWooCommerce enables you to use three of the most reputable and globally-established BNPL providers. Each serves particular regions of the world. Here’s the breakdown, as well as a few perks of each:

Affirm is currently available for merchants in the United States.

They currently work with over 29,000 businesses, which have seen a 20% lift in conversions on average, 10% more revenue per customer, and an astounding 85% increase in average order value.

Affirm dynamically provides each customer with the most relevant payment options — whether that means split pay, installments, or both. Customers will know how much they’ll pay, when they’ll pay it, and how many payments they’ll make in total. See the image for an example of how Affirm looks when the customer checks out on your site.

There are no fees and no compounding interest. Affirm allows order values between $50 and $17,500, and they approve 20% more consumers than other BNPL services. Plus, you can be up and running in less than an hour.

Learn how to set up Affirm on WooCommerce.

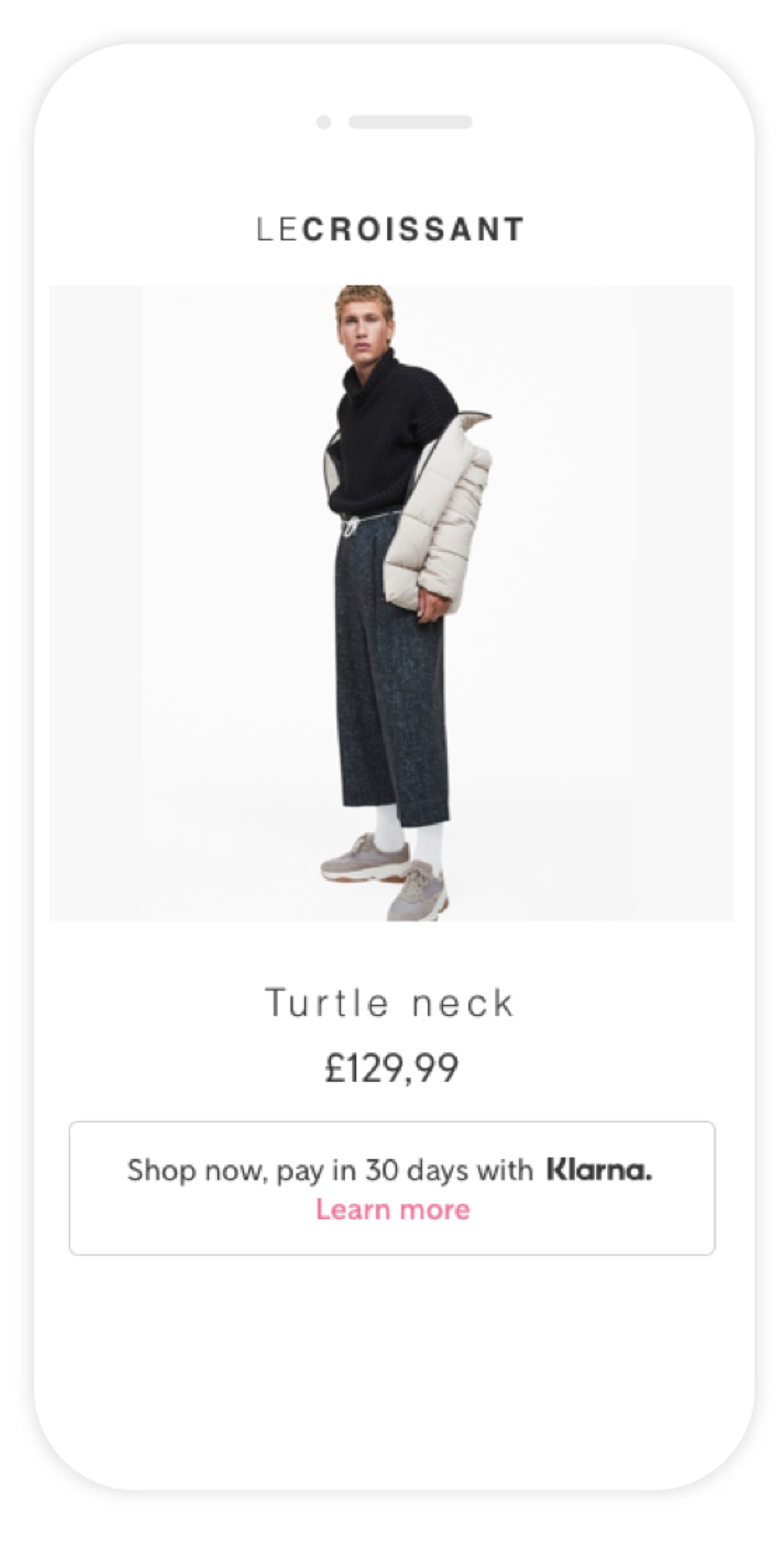

Klarna is a great choice, whether you operate out of the EU, UK, U.S., or Australia.

They serve over 90 million consumers and 200,000 businesses across 20 countries. And they take on all the credit and fraud risks so your business is protected. Some of their clients have seen 36-61% increases in average order value.

Klarna offers four distinct payment options:

- Pay later lets you split your payment into four (US) or three (UK) smaller, interest-free amounts

- ‘Pay in 30 days’ lets them try products before paying

- ‘Monthly financing’ is also an option for larger purchases

- ‘Pay now’ lets customers make fast and secure one-click payments

Klarna also helps drive traffic to your site using their own marketing efforts and their app. Some of their clients have seen a 40% increase in new customers since working with Klarna.

Learn how to set up Klarna for WooCommerce.

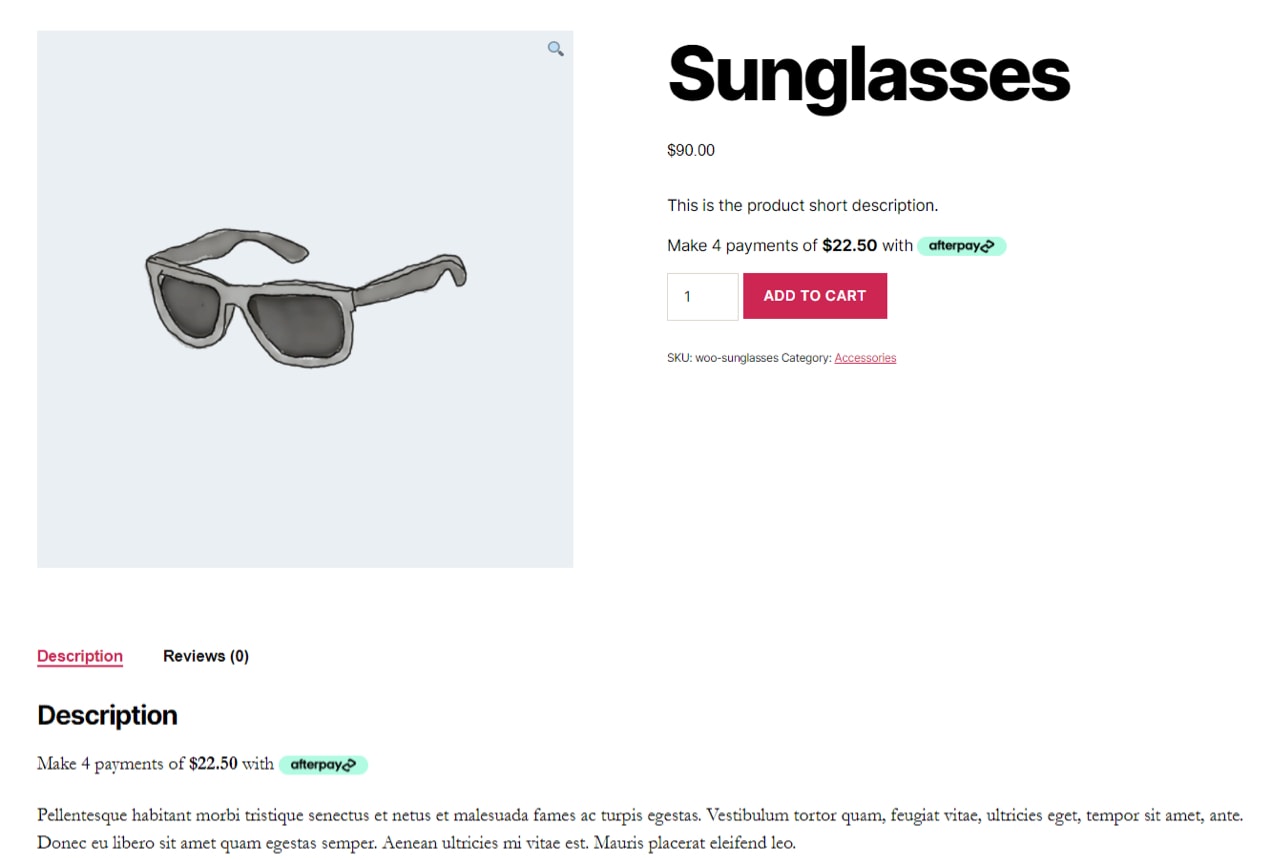

Afterpay is available for stores in Australia, Canada, New Zealand, or the U.S.

Afterpay works with 98,000 merchants globally. They’ve served nearly 30 million customers and, in 2020, they sent 35 million referrals – every month – to their clients. Those clients see an average increase of 25% in conversions and experience fewer returns. Afterpay helps provide direct access to Millennial & Gen Z shoppers, with 77% of their shoppers between 18 and 39 years.

Like the others, your business is paid within days of a purchase, and Afterpay takes on all the credit and fraud risks.

Afterpay lets customers make four payments over a two-month period. Their payment plans are always interest-free. They also limit the amount new customers can spend at first, to make sure the customer isn’t a payment risk. The more a customer uses the service, the more they’re allowed to spend.

Afterpay approves over 90% of customer transactions because their AI-powered risk model uses data from millions of shoppers and tens of thousands of businesses around the world. No external credit checks and no application fees make Afterpay a popular payment service for consumers.

Learn how to set up Afterpay on WooCommerce.

How to maximize your holiday marketing success with Buy Now, Pay Later

↑ Back to topPromote early and often

You can begin promoting BNPL right from your homepage, as well as on your product pages, checkout pages, landing pages, and in your emails.

Make sure to add payment messaging throughout your website to raise awareness for shoppers “up funnel.” According to Affirm, most customers will decide to buy with a BNPL payment option before they see the option at checkout.

Use clear and compelling language

Use language like “pay in installments” on your product and checkout pages.

Paul Frantz, VP of Customer Success at Affirm, said one company used the phrase “as low as 0% APR” in their promotions and saw a 260% increase in average order value.

“These promotions can reduce friction at checkout and drive more sales for your business, especially when you market them to customers as a part of your holiday campaigns,” says Frantz.

Another campaign used the phrase “gift now, pay later” in their Black Friday and Cyber Monday emails. Black Friday conversions doubled from that company’s average, and the Cyber Monday emails converted at five times the average.

Feature it in all Black Friday and Cyber Monday marketing

For the biggest shopping days, people already plan to spend more than usual. So they’ll appreciate the option to use BNPL. Now, instead of huge bills all at once, they’ll get to spread it out over a few weeks or months.

Make BNPL a centerpiece of your holiday marketing. Don’t bury it at the bottom of pages. Create graphics for it. Emphasize it. Draw attention to it. Add it in a large font and with bright colors to campaign graphics. Make BNPL a deciding factor between you and your competitors.

Install a BNPL extension today

For WooCommerce users, getting started with BNPL is straightforward. Just choose the service you want and install the extension onto your dashboard. From there, setup takes a few minutes and you can start promoting it to customers.

To sum it up, pay-over-time options are fast becoming a ‘must-have’ store feature and there’s no better time to add BNPL to your store than leading up to the peak holiday season. Meet your shopper’s expectations this holiday season by offering a variety of payment options online and a smooth purchasing experience.

About