These passive income ideas are more attainable than you might think. Imagine waking up to find your bank account growing, even as you sip your morning coffee. Picture a life where your income isn’t tied to clocking in and out, but rather, flows in while you pursue your passions, hobbies, or travel the world.

The passive income landscape is evolving in 2024, offering countless opportunities for those willing to put in the work. This millennial couple, for example, earns over $420,000 with their six streams of income.

But it isn’t about how many income streams you have. It’s about building sustainable passive income streams that allow you to live life on your terms.

In this article, we’ll explore 22 exciting passive income ideas, each offering a unique path to financial independence. Whether you’re a creative spirit, a tech-savvy entrepreneur, or simply someone looking for a smarter way to generate cash flow, there’s something here for you.

Digital products and online ventures

↑ Back to top1. Create and sell online courses

An online course allows you to share your knowledge and expertise with a global audience while generating passive income.

While it requires an initial investment of time and effort in planning, content creation, and production, you can sell it to an unlimited number of students once you’ve created a course.

Or, instead of selling one-time courses, you could create a membership or subscription program where students pay a recurring fee for ongoing access to a library of pre-built courses (or access to new ones you release each week). This strategy represents an even more stable, recurring revenue opportunity.

But where do you start?

First, consider the platforms available for hosting an online course.

WooCommerce is a great platform for powering nearly any kind of online commerce idea — including an online course! When combined with the Sensei LMS (learning management system) add-on, you get all the functionality needed to create and sell engaging online courses. This includes the ability to add images, videos, and downloadable content. You can also create quizzes, manage and grade students, and track their progress.

Choose a subject that you’re passionate and knowledgeable about. Whether it’s cooking, photography, web development, or personal finance, there’s an audience eager to learn from you.

2. Write and publish eBooks

Do you know a ridiculous amount about a niche topic? Are your friends always calling to ask for advice about certain subjects? Turn that knowledge into passive income by writing an eBook!

Creating and publishing an eBook is relatively inexpensive compared to traditional print publishing. You also have control over the content, pricing, and promotion.

You can sell ebooks on Amazon Kindle Direct Publishing (KDP), retailers like Apple iBooks, Barnes & Noble’s Nook Press, and Kobo Writing Life, or keep an even greater percentage of revenue by selling through your own website using WooCommerce.

3. Develop and sell software or apps

Developing and selling software or apps can be a highly-profitable passive income stream for those with programming skills or the ability to hire developers. Creating a helpful, easy-to-use, and innovative app or software can attract a large audience and generate steady revenue.

360 Reality Audio, for example, sells music production software. Shoppers can purchase a license from their website and gain access to the software, updates, and support.

How do you start? Identify a problem or need in the market that your software or app can address. Then, research your target audience and competitors to make sure you offer something unique.

Develop a minimum viable product to test your concept and gather user feedback. Refine your software or app based on user input and market demands.

Of course, you also have to choose a monetization strategy. Options include offering a free version with in-app purchases, a subscription-based model, or a one-time purchase price.

Last, publish your software or app on relevant platforms, such as the Apple App Store, Google Play Store, or your own website. And implement a marketing strategy to attract users and drive sales, including app store optimization, social media marketing, and targeted advertising.

4. Build a membership website

A membership website is a gated online platform that restricts access to exclusive content or services to paying subscribers. Members typically pay a recurring fee (monthly, annually, or quarterly) to gain access to premium content like online courses, tutorials, articles, forums, or community features.

Entrepreneurs can scale their business by continually adding new content and attracting more members over time. Though, once a program is built, owners can often go long stretches with minimal upkeep or work — presenting the opportunity for passive (or even partially-passive) income.

WordPress is a great platform for building a membership site. You can restrict your content to members, but you can also “drip” that content over time to schedule when members have access. Sell access to memberships, include them with product purchases, manually assign memberships, and completely integrate exclusive perks within your store.

A popular South African magazine, FairLady, does just this with access to their health and fitness program — 12 Weeks to Sleek — available only to paying members. Built with WooCommerce, they created a custom plugin to display the meal and exercise plan in the correct order for each member based on the results of a fitness assessment. With an open source ecommerce tool like WooCommerce, you can truly customize and build any solution for any reason.

5. Try affiliate marketing

Affiliate marketing is a performance-based marketing strategy where individuals (affiliates) promote other people’s or companies’ products or services in exchange for a commission.

You share unique affiliate links on your website, blog, or your social media presence. When someone clicks on the link and makes a purchase, the affiliate earns a percentage of the sale.

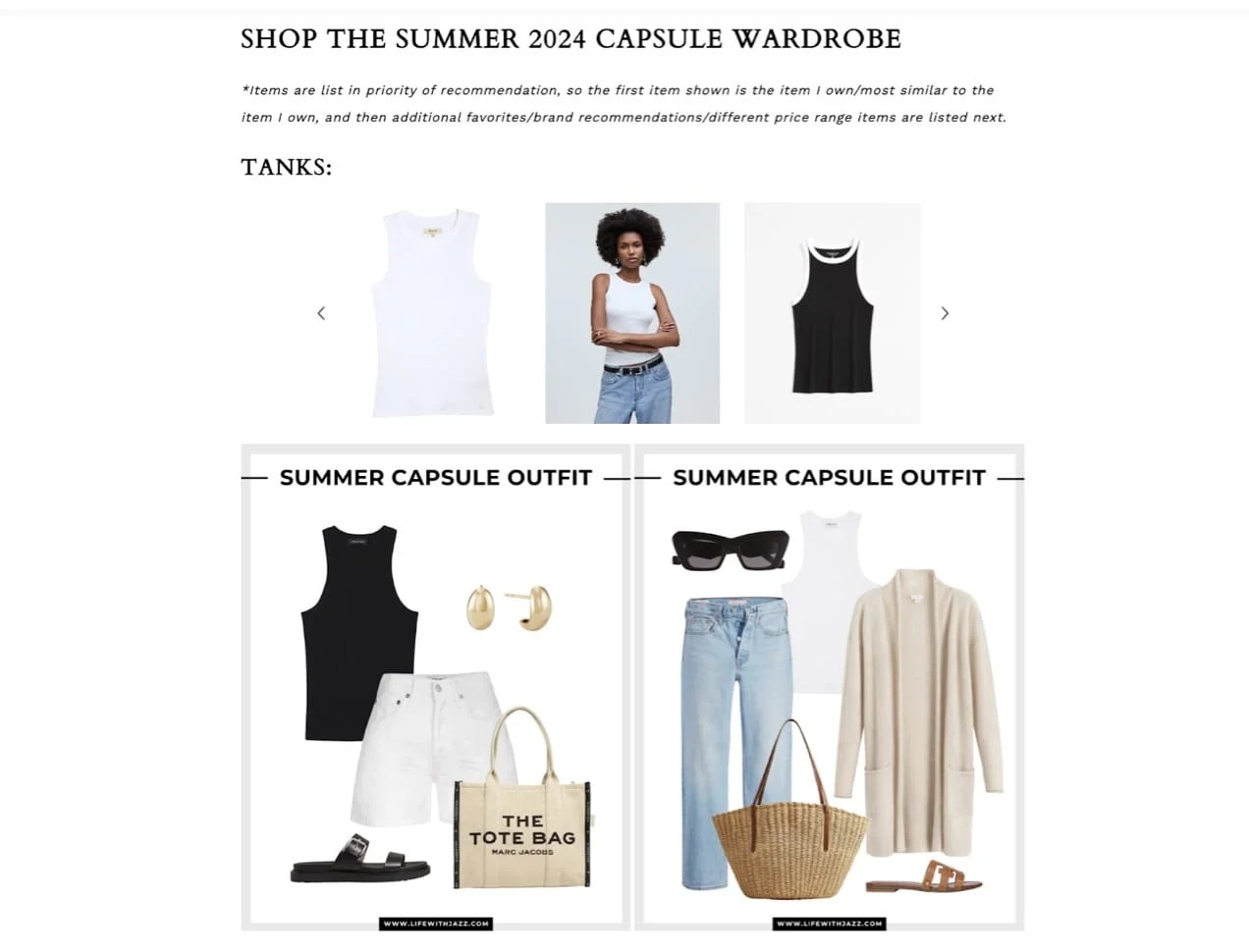

For example, here’s how style influencer, Life with Jazz, promotes clothing links on her blog.

Unlike creating your own products, affiliate marketing requires minimal investment. You don’t need to develop, manufacture, or ship products. You can even promote multiple products across various niches and create multiple streams of passive income.

Focus on building trust with your audience by promoting products that align with your values and expertise. Be transparent about your affiliate relationships and prioritize providing authentic, valuable content.

Creative pursuits and content creation

↑ Back to top6. Sell stock photography and videography

If you have a passion for photography or videography, selling stock images and footage can be great passive income ideas. Create high-quality, in-demand content and make it available on stock media platforms to earn passive income each time someone licenses your work.

You can also use WooCommerce to sell digital downloads directly from your own website, giving you more control over pricing and customer relationships. This is a fantastic option for selling exclusive or premium content, or even offering bundles and special deals to attract more buyers.

How to start selling stock assets:

- Create high-quality content. Invest in good equipment and editing software. Learn photography and videography techniques to produce visually appealing and marketable content.

- Choose a stock platform or set up your website. Several platforms like Shutterstock, iStock, Getty Images, or Adobe Stock offer opportunities to sell your work. Research and compare their commission rates, terms, and conditions. You can also sell images on your own site with WooCommerce, maintaining more control and earning more profits.The downside is the lack of built-in audience, however, you may be able to grow your own site while also selling to stock image platforms. Just be sure to use exclusive images for each or otherwise abide by the terms and conditions of stock platforms.

- Use keywords and metadata. Use relevant keywords and metadata to describe your content accurately. This will help potential buyers find your work easily.

- Promote your portfolio. Create an online portfolio to showcase your best work and attract clients. Share your portfolio on social media and other relevant platforms.

Building a successful stock portfolio takes time and effort. Regularly upload new content to increase your visibility and earning potential.

Lastly, familiarize yourself with copyright laws and licensing agreements to avoid any legal issues.

7. Start a podcast

Podcasting has become a popular medium for entertainment, education, and news consumption.

One of the most common ways to create passive income from podcasting is through ad revenue. These ads can be pre-roll (at the beginning), mid-roll (in the middle), or post-roll (at the end).

To earn ad revenue, you can join ad networks like Midroll or Podcorn, which connect podcasters with advertisers. Alternatively, you can seek out direct sponsorship deals similar to those influencers often strike with brands.

Sponsorships involve partnering with brands relevant to your podcast’s niche. Sponsors typically pay a flat fee for a series of episodes or for a specific period. In return, you’ll mention the sponsor in your episodes, often with a dedicated ad read.

For example, this podcast episode from parenting podcast, Good Inside with Dr. Becky is sponsored by Airbnb.

Offering premium content to paying subscribers is another effective way to monetize your podcast. This can include:

- Bonus episodes. Create exclusive episodes only available to subscribers.

- Early access. Let subscribers listen to episodes before they’re released to the public.

- Ad-free episodes. Provide an ad-free listening experience for subscribers.

- Behind-the-scenes content. Share exclusive interviews, bloopers, or additional content not available in regular episodes.

- Community access. Create a private online community for subscribers to interact with you and other fans.

And here’s where the magic of a WooCommerce-powered website comes in. Your website can serve as your podcast’s central hub, where you can integrate episodes, sell merchandise, display ads, and gather email subscribers.

You can even stream your podcast directly from your site or sell digital downloads of premium content or memberships to exclusive areas with additional perks like chat forums. Building your podcast around your own website, powered by WooCommerce, gives you an additional asset to work with, allowing you to build a multichannel strategy and diversify your passive income streams.

While podcasting can present the opportunity for passive income, or at least income that requires minimal work with very flexible hours, you’ll need to put in some upfront work.

To succeed, create high-quality, consistently-released content that resonates with your target audience and maximize your passive income potential. Invest in decent recording equipment, develop a strong brand identity, and promote your podcast through social media, guest appearances, and cross-promotion with other podcasters in your niche.

8. Create digital art and design

The digital art and design industries offer numerous passive income ideas. Artists and designers can use their skills and creativity to design digital products they can sell repeatedly, generating income over time.

Examples of popular digital products:

- Prints and wall art. You can sell digital artwork as high-resolution files that buyers can print themselves and frame.

- Digital illustrations. You can license original illustrations for use in books, magazines, websites, or other digital projects.

- Graphic design templates. Create customizable templates for social media posts, presentations, brochures, or website designs that can be sold on marketplaces like Creative Market or Etsy.

- Fonts and typefaces. Design original fonts and typefaces that shoppers can license for personal or commercial use.

- Textures and patterns. Shoppers can use digital textures and patterns in graphic design, web design, or as backgrounds for various creative projects.

- Stock photos and videos. Your audience can license high-quality photos and videos through stock agencies like Shutterstock or iStock.

- Website themes and templates. You can sell custom website themes and templates on platforms like ThemeForest.

Consider the legal and financial aspects of selling digital art and design assets. Ensure that you have the necessary rights and licenses for any elements you use in your designs, such as fonts, images, or templates.

Be transparent about the usage terms and conditions for your assets, and consider offering different licensing options (e.g., personal or commercial use).

9. Blog

Blogging can be a rewarding way to earn passive income, but it requires careful planning, consistent effort, and a focus on providing value to your readers.

Choosing the right niche is crucial for the success of your blog. A niche is a specific topic or area of interest that you’ll focus your content on. It’s important to select a niche that:

- You’re passionate about. This will make it easier to create engaging content consistently.

- Has a sizable audience. There should be enough people interested in your niche to generate traffic and potential income.

- Has monetization potential. Research affiliate programs, advertising opportunities, or potential products you can create or promote within your niche.

Here’s an example of a blog, Clean Mama, that focuses just on cleaning:

Ways to monetize your blog:

- Advertising. Display ads on your blog through ad programs like WordAds. You earn revenue based on impressions (views) or clicks.

- Affiliate marketing and sponsorships. Promote other people’s products or services on your blog and earn a commission for each sale made through your unique affiliate links.

- Selling your own products or services. Create and sell your own digital or physical products, such as ebooks, courses, templates, or consulting services.

- Donations. The Name Your Price extension for WooCommerce allows people to determine how much they want to contribute, while WooPayments makes it possible to accept a variety of methods and currencies.

Prioritize the user experience and maintain the integrity of your content when monetizing your blog. Ensure any ads, affiliates, or products you promote are relevant, trustworthy, and genuinely beneficial to your readers. Build a loyal following that trusts your recommendations and supports your blogging journey by maintaining transparency.

10. Start a YouTube channel

Creating a YouTube channel can be a viable path to passive income. It’s not truly passive in the beginning, but once you’ve built an audience and a library of content, it can generate income even when you’re not actively creating new videos.

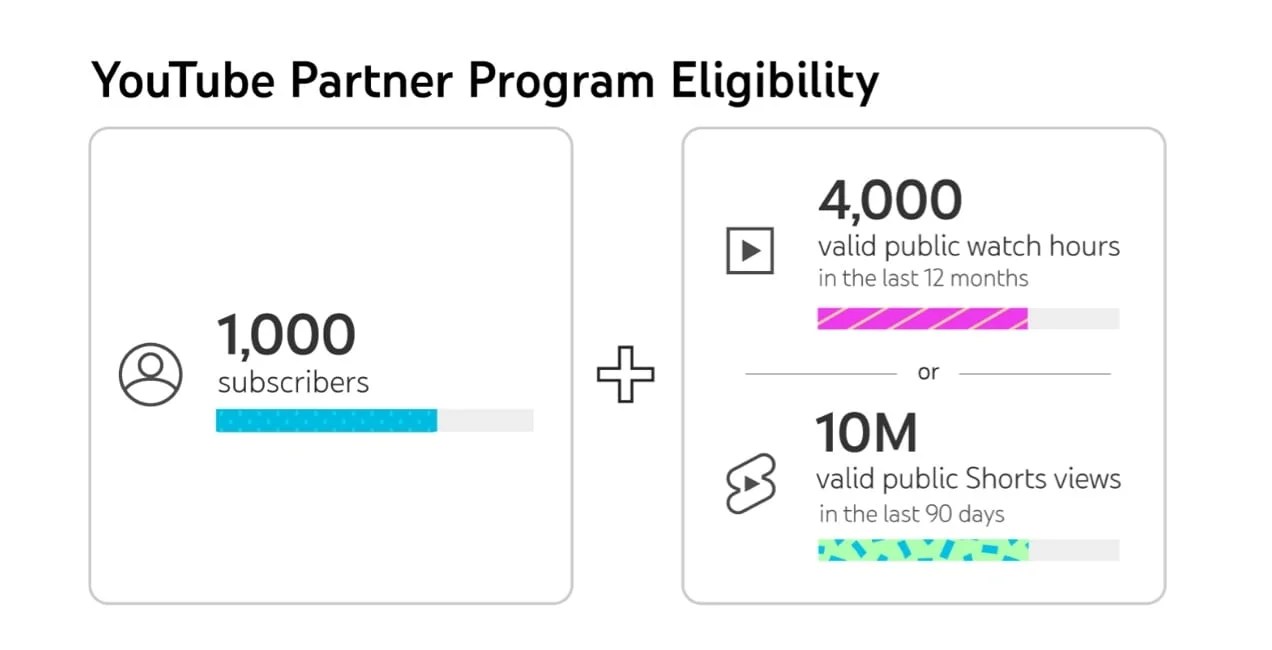

YouTube’s Partner Program allows for earning money from ads displayed on their videos. Revenue is based on views and clicks, and rates can vary depending on your niche and audience demographics.

As your channel grows, you can collaborate with brands for sponsored content or product placements. This can be a lucrative source of income, especially if your audience aligns with the brand’s target market.

You can also promote products or services relevant to your niche and earn a commission for each sale made through your unique affiliate links in video descriptions or pinned comments.

If you eventually become a brand, create and sell merchandise related to your channel, such as T-shirts, mugs, or other products. This can be a great way to connect with your audience and generate additional revenue.

How to start a YouTube channel:

- Choose a niche. Select a niche you’re passionate about and that has an audience interested in the content you’ll create.

- Create high-quality content. Invest in good video and audio equipment, learn video editing, and focus on creating engaging and valuable content.

- Optimize for search. Use relevant keywords in titles, descriptions, and tags to improve your videos’ visibility in search results.

- Promote your channel. Share your videos on social media, embed them on your website, and collaborate with other YouTubers to reach a wider audience.

- Engage with your audience. Respond to comments, participate in discussions, and encourage others in the community to do the same.

Building a successful YouTube channel takes time and effort. But with consistent dedication to creating high-quality content, engaging with your audience, and exploring different monetization strategies, it can become a sustainable source of passive income.

11. Become a social media influencer

Being a social media influencer presents a potentially lucrative path to passive income.

Partnering with brands for sponsored content is a common way for influencers to earn income. This can involve creating posts featuring products or services, hosting giveaways, or participating in brand campaigns.

Influencers can also promote products or services through unique affiliate links and earn a commission on sales generated through their referrals.

Sustainable success requires more than just posting engaging content on platforms like Instagram, TikTok, or YouTube.

Why?

Relying solely on a single platform can be risky, as algorithms change, platforms can lose popularity, or accounts can even be demonetized or banned.

To safeguard their income stream and create a sustainable online presence, influencers should focus on building something they wholly own: an audience on their own website built with WordPress.

Unlike social media platforms, you have complete ownership and control over a WordPress site, and you can connect WooCommerce to add the ability to sell products, accept donations, create a paid members-only area, and more.

You decide the content, design, and monetization strategies without being subject to platform policies or algorithm changes.

12. Record audiobooks

Recording audiobooks can be a fantastic way to generate passive income — especially if you have a great voice, a passion for storytelling, and a knack for bringing characters to life.

Once you record and publish an audiobook, it can generate income over a long period with minimal additional effort.

To get started, all you need to do is record a short demo showcasing your voice and narration style.

You can find audiobook narration work on platforms like ACX (Audiobook Creation Exchange) or Upwork. Submit your demo reel and audition for projects that align with your interests and voice type.

It’s also a good idea to create a website or online profile to showcase your work and attract clients. Dedicate yourself to continual improvement and attend industry events to refine your skills and marketing strategies and to connect with authors, publishers, and other narrators.

13. Sell handmade products

This is another one that’s not completely passive, but it does allow you to generate revenue while you sleep or even take a week of vacation.

Selling handmade products can also be a fulfilling venture, monetizing your creative abilities and artistic passion.

For customers, they offer a unique appeal, often carrying a personal touch that mass-produced items lack. This can attract a high-end customer base willing to pay a premium for quality craftsmanship.

You can create products at your own pace, allowing you to balance your craft with other commitments. As your business grows, you can expand your product line or hire help to increase production and sales.

Where do you start?

Identify your niche and the types of products you want to create. This could include jewelry, clothing, accessories, home decor, or specialty food items.

You may be familiar with platforms like Etsy. While that’s a popular choice for a first-time storefront, most will want to eventually make their own website their central hub.

This is where WooCommerce shines when compared to Etsy.

Building your store on WooCommerce, which doesn’t exclude you from also listing items on Etsy, lets you escape listing fees, commissions, and restrictions on how to promote or present products.

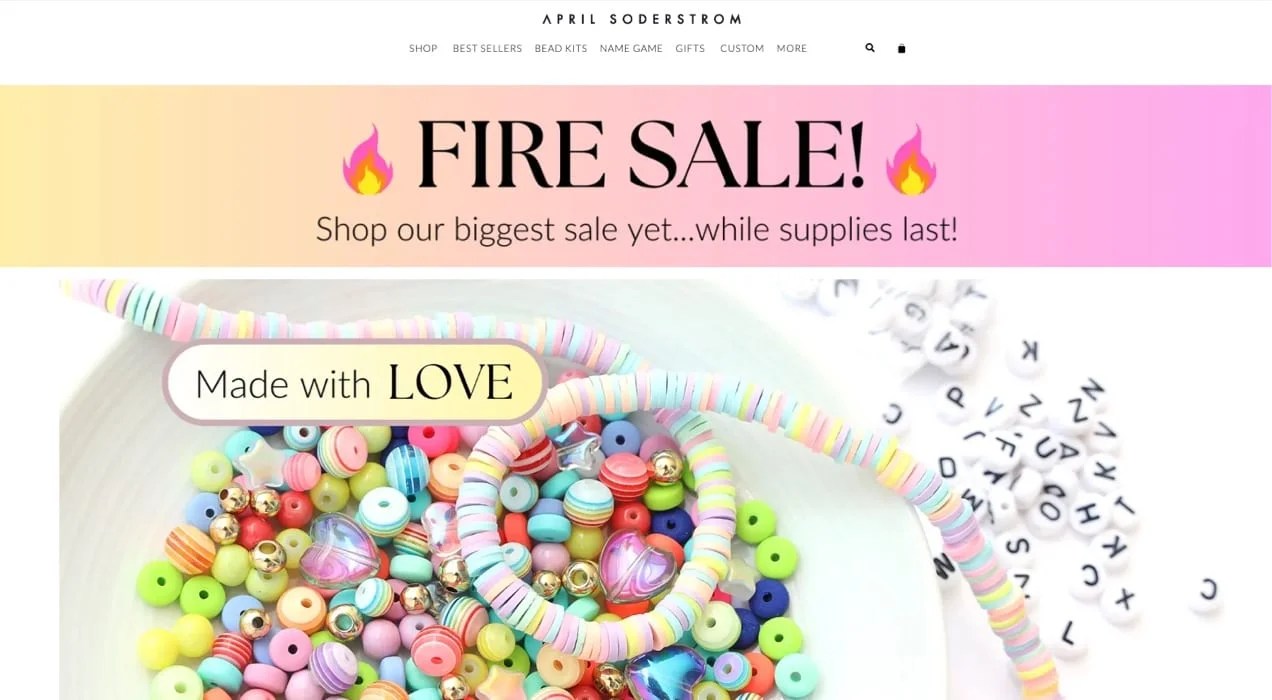

Handmade jewelry brand, April Soderstrom, serves as a great example. This thriving company uses WooCommerce to power sales day and night.

Financial and alternative investments

↑ Back to top14. Invest in rental properties

The concept is simple: purchase a property, find reliable tenants, and collect rental income month after month. But the benefits don’t stop there. As you pay down your mortgage and property values appreciate, you’ll also be building equity and increasing your net worth over time.

It requires a hefty upfront investment, though, so it’s crucial to do your homework.

Research and identify the right market and rental property type for your investment goals. Consider factors like location, demand for rental property, property values, and potential rental income. Don’t forget to evaluate the condition of the rental property, the local job market, and the overall economic stability of the area. Get your financial advisor on board to check what you can afford.

Once you’ve found a suitable property, secure financing and complete the purchase process. Before seeking tenants, ensure the property meets all local safety and habitability standards and make any necessary repairs or upgrades. This upfront work can help you attract quality, long-term renters.

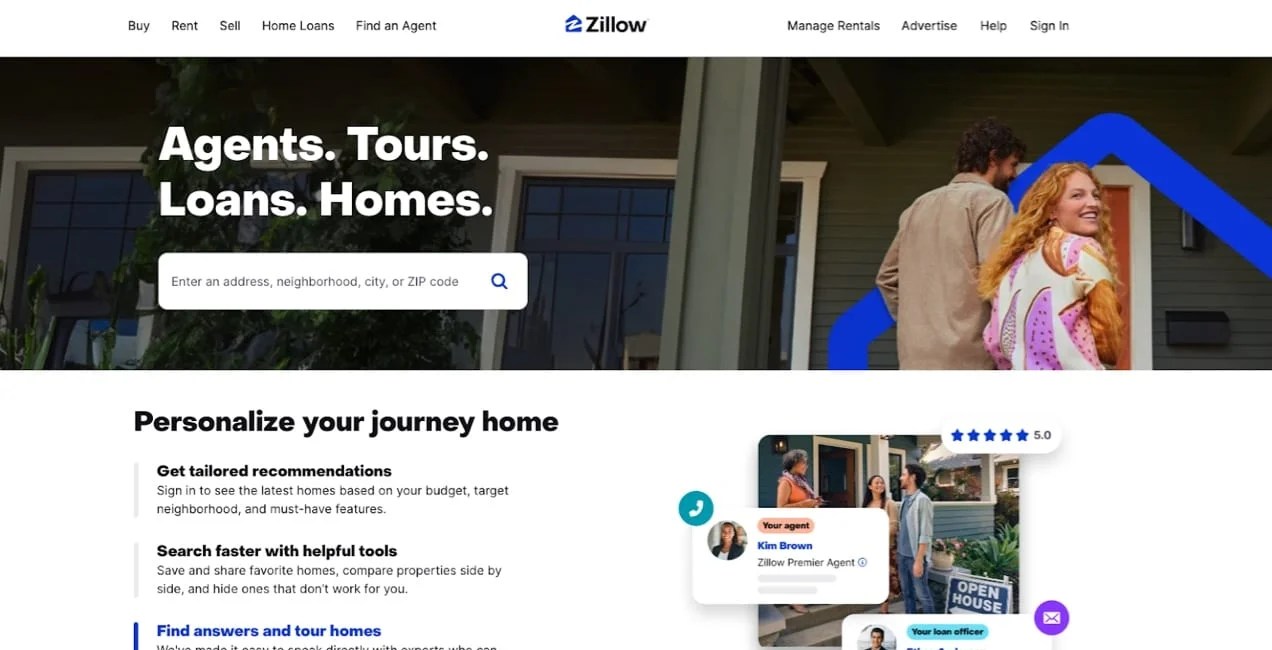

When it comes to finding tenants, listing your property on popular rental websites like Zillow, Apartments.com, or local classifieds can be effective. Create an appealing listing with high-quality photos and detailed information about the property.

If the thought of screening tenants, drafting leases, and handling maintenance requests seems daunting, consider working with a property management company. They can handle the day-to-day tasks of being a landlord. like collecting rental income, which can be particularly helpful for new investors or those managing properties from a distance.

15. Form a REIT (real estate investment trust)

Real Estate Investment Trusts (REITs) offer a way to get into real estate investing without directly managing any properties. They’re companies that own, operate, or finance income-generating real estate assets.

Here are several types of REITs:

- Equity REITs. Own and operate income-producing real estate properties.

- Mortgage REITs. This type of real estate investing focuses on mortgages and mortgage-backed securities.

- Hybrid REITs. Combine both equity and mortgage investments.

- Publicly-traded REITs. These are listed on stock exchanges and accessible to individual investors.

- Non-traded REITs. These are not listed on stock exchanges and are typically sold through brokers.

Benefits of REITs:

- Diversification. REITs offer instant diversification within the real estate sector, as they invest in a wide range of property types and locations.

- Liquidity. Unlike direct real estate investments, REIT shares can be easily bought and sold on stock exchanges, providing liquidity.

- Professional management. REITs are managed by experienced professionals who handle property acquisition, management, and financing.

REITs offer a unique opportunity to tap into the commercial real estate market without the hassle of owning and managing properties yourself. Imagine being able to invest in sprawling shopping malls, towering office buildings, or luxurious hotels with just a few clicks.

They raise capital by selling shares on stock exchanges or through private placements. But here’s where it gets interesting: these collected funds are then used to purchase or finance a diverse range of commercial real estate properties. So, you’re not just investing in one building — you’re gaining exposure to an entire portfolio of assets.

16. Rent out unused space

Renting out unused space is a fairly simple way to generate passive income, especially if you have extra rooms, storage space, or parking spots. Here are some popular options:

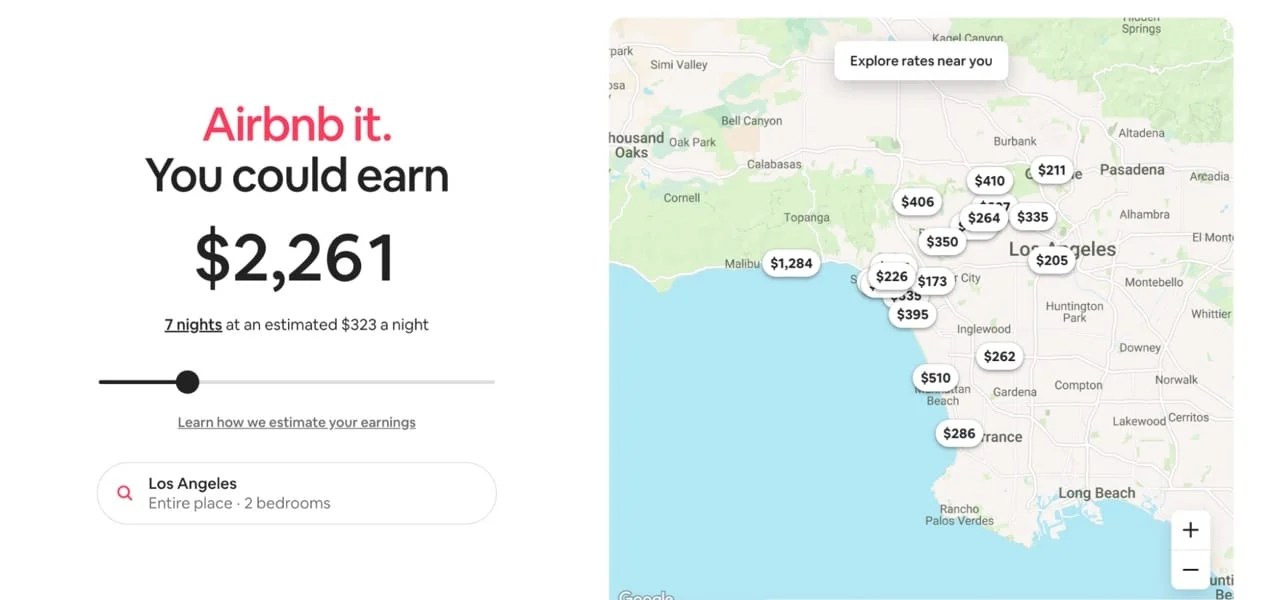

One popular option for renting out unused space is to list your spare room or entire home on short-term rental platforms like Airbnb or Vrbo. These platforms connect travelers and visitors with local hosts, allowing you to earn money by providing short-term accommodations in your unused space.

Another option for monetizing unused space is to rent out storage areas, such as a garage, basement, or attic, to individuals or businesses in need of extra storage. Platforms like Neighbor.com and SpareFoot.com allow you to list your available storage space and connect with potential renters in your area.

If you have an unused parking spot or driveway, you can also create a passive income stream and earn rental income by making it available to commuters, tourists, or nearby residents. Websites like SpotHero, JustPark, and ParkingSpotter enable you to list your parking space and set your own rates, making earning money easy from an otherwise idle asset.

Consider these tips for renting out unused space and earning passive income:

- Ensure that your space is clean, well-maintained, and properly-equipped to meet the needs of your target renters.

- Invest in high-quality photos and detailed descriptions to showcase your room or parking space and attract potential renters.

- Set competitive rates based on local market conditions, amenities, and the unique features of your space.

- Communicate clearly with renters and provide prompt and professional service to build positive reviews and encourage repeat bookings.

- Stay compliant with local zoning laws, tax requirements, and any applicable regulations related to short-term rentals or storage.

By renting out unused space, you can turn idle assets into a steady passive income stream while helping others in need of storage, parking, or unique venues. It’s a win-win situation that can be a valuable addition to your passive income sources.

17. Invest in dividend stocks

Stocks are shares in ownership of publicly-traded companies. Investors profit when the value of the stocks rise (or fall, technically, but that’s rare) and they sell their shares. The income from this is known as capital gains. This is a common part of long-term financial planning, but a senior wealth advisor will advise you to look at something else — dividend stocks — if you’re trying to produce consistent revenue.

Dividend stocks are shares in companies that regularly release a portion of profit back to shareholders (typically on a quarterly basis).

Dividend stocks provide a reliable source of passive income, as companies that share dividends are usually very large and stable, and maintain consistent dividend payouts. Just note that dividends are often just cents, or possibly a dollar or two, per share. So the initial investment of your own money to gain enough shares for substantial dividend revenue will be significant.

Here’s how to start investing in dividend stocks:

- Research and make a selection:

- Look for companies on the stock market with a history of stable or increasing dividend payments.

- Consider the dividend yield, which is the annual dividend payment divided by the stock price.

- Assess the company’s financial health, growth prospects, and competitive position in the market.

- Choose an investment account:

- Open a brokerage account that allows you to buy and sell individual stocks.

- Consider a dividend reinvestment plan (DRIP), offered by some companies, which automatically reinvests what you earn after companies pay dividends to your account.

- Build a diversified portfolio:

- Invest in a variety of dividend-paying stocks across different sectors to spread risk.

- Consider investing in dividend-focused ETFs or mutual funds for instant diversification.

- Monitor and adjust:

- Keep track of your dividend stocks’ performance and adjust your portfolio as needed.

- Pay attention to company news and announcements that could affect dividend payouts.

Investing in dividend stocks can be a rewarding strategy for generating passive income and building long-term wealth.

Just remember: We’re not financial experts and we’re not qualified to serve as your financial advisor or provide individual investment advice for your financial goals. Before you begin an investment strategy or consider any alternative investments, consult with a qualified professional and perform your own research.

18. Park your money in a high yield savings account

Having a savings account is great for securely storing your money, but what if it could work for you without the risks associated with typical investing? This is what a high yield savings account provides.

In 2024, for example, it’s possible to find an interest rate over 5%. Talk to any financial advisor or certified financial planner and they’ll tell you that this is an incredible rate.

What’s the catch of this kind of savings account? In most cases, to maximize the interest paid, you’ll have to contribute a minimum investment amount (a few thousand dollars or more) and leave your money for a minimum length of time (six months or so) or withdraw for a lower interest rate.

If you’re self-employed, you may already set aside money for taxes. This is a good way to earn something extra by changing very little.

High yield savings accounts are also a strong option for risk-averse or time-strapped people who don’t want to invest in something that might not work out or don’t have the time to put in the up-front work into the other ideas listed in this article.

19. Invest in money market funds

A money market fund investment is another great way to allocate your savings towards something that can increase in value. It’s a heavily-regulated, low-risk opportunity that can provide similar returns as a high yield savings account.

However, rates are usually a tad lower in exchange for shorter-term lengths and more withdrawal freedom than a high yield savings account.

Other passive income ideas and opportunities

↑ Back to top20. Invest in vending machines

Have you considered investing in vending machines?

It’s a simple concept. You purchase the machines, stock them with popular products, and place them in high-traffic locations.

For starters, they require minimal maintenance. After the upfront investment and setup, your primary tasks are restocking and occasional cleaning. Plus, you have incredible flexibility. You choose what products to sell, where to place your machines, and how often to restock.

Here’s how to get started with vending machines:

- Research and planning. Identify high-traffic areas with a thirst for snacks and drinks. Think office buildings, gyms, schools, or even busy street corners. Who’s your target audience? What products will they crave?

- Acquiring machines and inventory. Buy or lease? New or used? Research different models, and find the perfect fit for your budget and product selection. Then, stock up on items that keep customers coming back for more.

- Installation and maintenance. Find coveted spots with maximum visibility and foot traffic. Negotiate deals with property owners, and get your machines up and running. Don’t forget to schedule regular restocking and cleaning to keep things fresh and inviting.

- Marketing and promotion. Eye-catching signage and tempting promotions lure customers in. Think marketing strategies like discounts, loyalty programs, or bundled deals — anything to boost those sales.

Lastly, consider partnering with an established vending machine operator or franchise to benefit from their expertise and support. Or, hire a route service to handle the day-to-day operations, allowing you to focus on growing your business and generating passive income.

21. Buy and sell websites

Buying and selling websites can be a lucrative venture, akin to flipping houses, but digitally.

Essentially, you’ll be on the lookout for undervalued or underperforming websites with potential for growth. Once you’ve found a promising site, you’ll acquire it, work your magic to improve its performance, and then sell it for a profit.

So, how do you get started?

Begin by familiarizing yourself with website valuations and the factors that influence a site’s worth, such as traffic, revenue, and growth potential. Explore online marketplaces like Flippa and Empire Flippers to get a feel for the types of websites being bought and sold.

But don’t just jump in without performing some research.

Take the time to educate yourself on the various strategies for improving a website’s performance, such as search engine optimization (SEO), content optimization, and monetization strategies. The more you know, the better equipped you’ll be to identify promising opportunities and maximize your returns.

Once you’ve found a website that ticks all the boxes, conduct thorough due diligence to verify the site’s traffic, revenue, and potential for growth. Negotiate a fair price with the seller, and complete the transfer of ownership.

Now, here’s where the real work begins:

Roll up your sleeves and start implementing your improvement strategies. Optimize the site’s content and structure for search engines, enhance the user experience, and explore new monetization opportunities. The goal is to boost the site’s traffic, revenue, and overall value.

Once your website is ready and sold off, use the profits from your sale to acquire new sites.

22. Create a job board

Creating a job board can be a lucrative venture, connecting employers seeking talent with job seekers looking for opportunities.

How does it work? Simple: You create a website where employers can post job listings for a fee, and job seekers can browse and apply for those positions. As the intermediary, you’ll earn money from each job listing posted on your site.

Once your job board gains traction and builds a reputation, it can become a go-to resource for both employers and job seekers in your niche. This means a steady stream of passive income for you!

First, identify a niche or industry where there’s a demand for job listings. This could be anything from tech startups to creative freelancers to remote work opportunities.

Next, build your website. Choose a user-friendly platform like WordPress and invest in a professional design that’s easy to navigate. Include features like search filters, job categories, and email alerts to enhance the user experience.

Then, reach out to employers in your niche and offer them an introductory deal to post their job listings on your site. Use social media, email marketing, and content marketing to attract job seekers and build your audience.

To really maximize your passive income potential, consider offering additional services like featured job listings or resume writing services. The more value you can provide to both employers and job seekers, the more loyal your user base will become.

This can become a self-sustaining passive income business. Employers will keep coming back to post their job listings, and job seekers will keep flocking to your site for the latest opportunities.

Take control of your financial future

↑ Back to topThe path to passive income requires dedication, a willingness to learn, and the courage to step outside your comfort zone. But with the right mindset and passive income ideas, you can create a life where your income works for you, not the other way around.

And remember, if you’re looking to build a thriving online business or expand an existing business, WooCommerce can empower you to create and manage a powerful online store with ease. In fact, WooCommerce is your golden key to scaling nearly any passive income strategy.

About