NOTE: After April 23, 2025, WooPayments will automatically allow JCB card payments for all merchants, in Japan or otherwise. As such, this page is now considered out-of-date, and we’ll be removing it in the near future.

WooPayments provides merchants with the ability to accept payments via the most common credit and debit card brands — including Japan Credit Bureau (also known as “JCB”).

Can I accept JCB cards?

↑ Back to topAs a merchant, the ability to accept JCB card payments depends on where your business is located:

- If your business is based in a region outside of Japan, you can accept JCB cards immediately.

- If your business is based in Japan, Japanese government regulations require merchants in Japan to apply for this capability.

NOTE: Japan-based merchants can only accept JCB payments in Japanese yen (JPY). Merchants in other supported countries can accept JCB payments in a wide variety of currencies.

JCB requirements for Japanese merchants

↑ Back to topBefore enabling JCB, please be sure that your site has a “Commercial Disclosure” (特定商取引法に基づく表記) page.

You can find guidance from the Consumer Affairs Agency about the Commercial Disclosure page here and here.

Commercial Disclosure page requirements

↑ Back to topThe Commercial Disclosure page requires specific information to comply with Consumer Affairs Agency regulations.

The requirements for this page are:

- The title of the page should be “Commercial Disclosure” (特定商取引法に基づく表記) or “Mail Order Sales Disclosure” (通信販売に関する表示事項).

- Make the page accessible from your homepage and the payment area.

- For example, you could place a link to it in your site’s footer area.

Additionally, the Commercial Disclosure page must contain all of the following information:

- Your full legal name or the registered trade name of your business.

- The address of your business.

- This address should match the registry.

- If you are a sole proprietor, you can omit an address by saying: “We will disclose without delay if requested.”

- A phone number that your customers can use to contact you in Japanese.

- If you are a sole proprietor, you can omit an address by saying: “We will disclose without delay if requested.”

- An email address your customers can use to contact you.

- The head of your organization/business or a designated company representative.

- Any fees that your customers may be subject to in addition to the cost of the product or service itself.

- This includes, but is not limited to, shipping costs, processing fees, etc.

- An explanation of how you handle exchanges and refunds.

- All Japanese merchants accepting JCB must maintain a fair refund policy.

- Please prepare two separate explanations: one is for handling an item that is defective, and the other one is for handling an item that is not defective.

- When the goods will be delivered to the customer or when the service will be provided after the customer has placed an order.

- All payment methods available for customers to pay for the service.

- The period that customers are expected to make payments.

- Sale price of the product or service, including consumption tax.

- If you are selling products or services only for a certain period of time (such as before an event), state this on the disclosure page.

- If you are only selling a fixed number of your product, or if there are other restrictions on sales, state this on the disclosure page.

- If you are selling software, state the system requirements (e.g., disk space, operating system, etc.).

How can Japanese merchants apply to enable JCB?

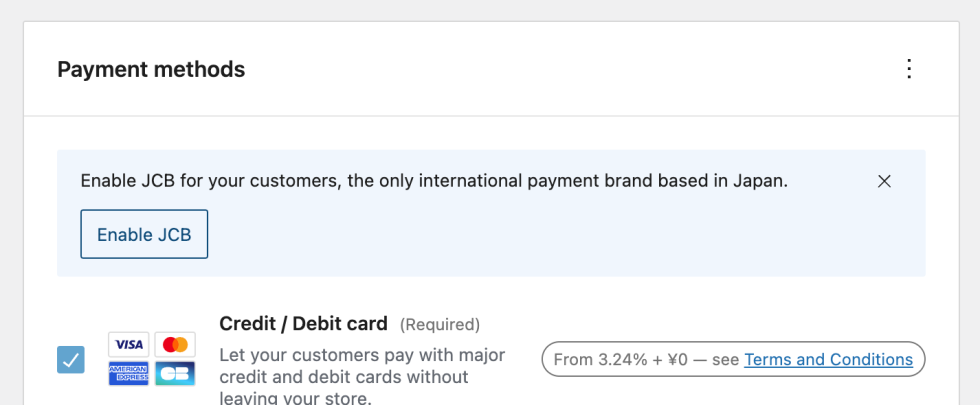

↑ Back to topIf you are a merchant based in Japan, you should see the Enable JCB button under Payments > Settings:

Please ensure that your site has a “Commercial Disclosure” (特定商取引法に基づく表記) page prior to selecting the Enable JCB button.

NOTE: It typically takes JCB about two days to review each request and enable the capability.

What if other information is required?

↑ Back to topIt’s possible that JCB will require additional information from you. In this case, our support staff will email you to gather this information.

It might also help to make sure that your account isn’t restricted or missing any information, since that can affect payment method availability as well.