Want to spend more time managing your WooCommerce store, and overseeing day-to-day business, than handling taxes? The road to compliance need not be paved with bumps and setbacks. It can be as simple as syncing WooCommerce with a software solution and automating the sales tax collection process.

Before thinking about automation, you need to understand the basics. Thankfully, Internet sales tax is just a pass-through tax exchanged between seller and state. You’re not on the hook for paying anything out of your own pocket. You are, however, responsible for collecting the right amount, in the right state, and remitting in a timely manner.

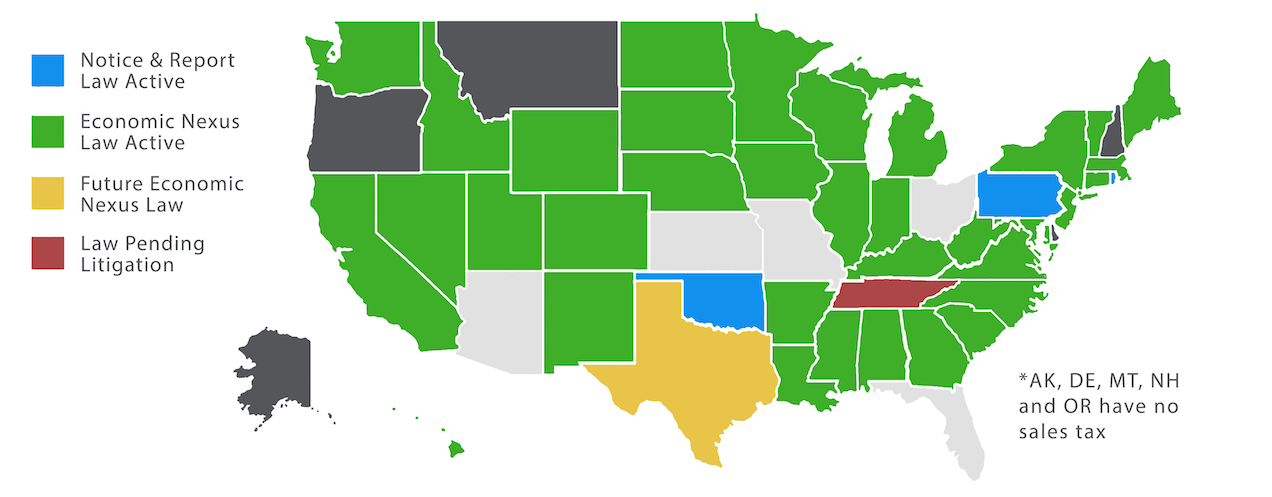

The Evolution of Economic Nexus

↑ Back to topPrior to June 2018, online sellers were basically exempt from paying sales tax outside their home state or in a state where they had a significant presence via inventory, employees, or home office. Because remote sellers can easily sell goods across state lines, states in the U.S. began to realize the missed revenue opportunity and challenged the law in the landmark case, South Dakota vs. Wayfair.

This June 2018 Supreme Court decision granted states the authority to set their own definition of nexus or significant activity in their state. As a result, economic nexus was born. Remote sellers with sales from $100,000 to $500,000 depending on the state, or some combination of transactions and sales, are obliged to pay sales tax.

Complexities of Sales Tax

↑ Back to topSales tax can get tricky because it is determined at the state level and not a one-size-fits-all federal law. That means online sellers need to:

- Remember the different economic nexus thresholds in each state and keep up with ever-changing legislation.

- Track multiple due dates and filing frequencies.

- Know tax codes, which vary from product to product.

- Apply the correct tax rate according to street address. ZIP codes don’t provide enough accuracy to calculate sales tax at checkout.

What’s the solution? One word: Automation.

How Automation Simplifies Sales Tax

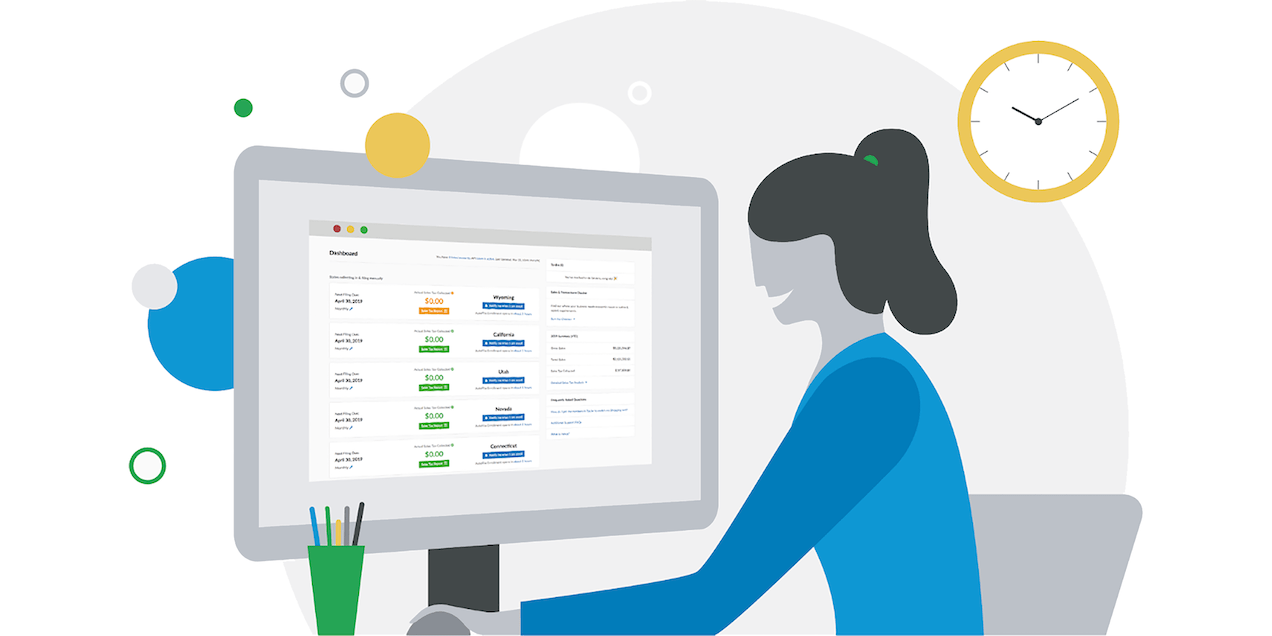

↑ Back to topThe right sales tax software can provide peace of mind. TaxJar, once integrated with WooCommerce, will automatically:

- Calculate the correct sales tax rates at checkout and generate an accurate, sales tax report by state.

- File on time in every state, with AutoFile.

- Provide updated nexus alerts.

Multi-channel users also need to calculate sales tax across multiple platforms in more than one state. TaxJar tracks where you sell and which platforms you use, and quickly generates state-specific reports for easy filing.

Not only does automation save time and headaches, but it allows you to focus on growing your business.

Sales tax need not be intimidating or time consuming. By learning the basics and integrating your WooCommerce store with a trusted solution such as TaxJar, you can set it and forget it through automation.

Download the TaxJar for WooCommerce extension, and try TaxJar free for 30 days. No credit card required. Upgrade, downgrade or cancel anytime.

About

I love this idea, BUT at the same time I don’t. The reason is because twice in the last few months I’ve received notices that somebody messed up for my state on collecting the proper tax. That worries me to the nth degree. If I can’t rely on proper tax collecting, then I need to keep up with it myself. At least for now.

In Colorado, TaxJar support told me they don’t support automation for businesses who sell less than 100k to Colorado buyers. They said they don’t plan to either.

I don’t know what if any options there are four Colorado based small businesses. But tax jar isn’t one of them.