Active installs

1K+

Subscription includes

Support

Account Funds lets you create a complete store credit, cashback, and customer rewards system for WooCommerce. Award cashback on purchases, reward milestone actions like signups and reviews, issue refunds as store credit, sell prepaid store credit products, and let customers top up their balance. Everything you need to keep revenue in your ecosystem and customers coming back.

Points-based WooCommerce loyalty programs add complexity. Customers need to understand conversion rates, remember point values, and do math at checkout. Store credit is simpler: $10 credit means $10 off. No confusion, no friction.

Account Funds advantages over WooCommerce points and rewards plugins:

Award cashback on all orders to encourage repeat purchases. Customers who have a store credit balance are significantly more likely to return than those who don’t, since they’ve already got money in your store.

Give store credit when customers create an account. This converts guest checkouts into registered customers you can market to, and the credit balance gives them a reason to come back.

Award store credit for each product review. You’re building social proof while giving customers a reason to engage after purchase. Set it to $2, $5, or whatever makes sense for your margins.

Offer refunds as store credit instead of processing payment gateway refunds. You keep the revenue in your ecosystem while resolving customer issues faster than traditional refund processing.

Sell store credit products as WooCommerce gift cards. Customers can purchase credit for themselves or as gifts for others, and the balance applies automatically at checkout without coupon codes.

Let business customers prepay for orders. They add $500 to their account, you fulfill orders against that balance. This simplifies invoicing for repeat B2B customers and reduces payment friction on every order.

Grant monthly store credit to members using WooCommerce Subscriptions or Constellation. A $25/month membership that includes $10 store credit encourages members to make additional purchases beyond just claiming their membership benefit.

For customers: Store credit appears as a payment method at checkout. They can use their full balance or combine it with another payment method for partial payment. Their balance is visible in My Account and throughout the shopping experience.

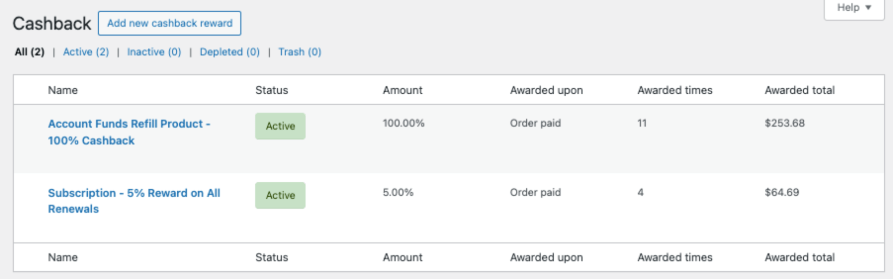

For store owners: Create cashback and milestone rewards from dedicated admin screens under Account Funds. Set eligibility rules, award caps, and active/inactive status. View all customer balances from the WordPress Users screen, and process refunds to store credit with one click from any order.

See deposits, redemptions, and balances over time. Filter by date range, view per-customer transaction history, and understand how store credit flows through your business. Reports show total deposits, usage rates, and outstanding liabilities for accounting purposes.

Yes. When configuring rewards, you can set expiration periods. Credit expires based on when it was earned, not when the reward was created.

Yes. Customers can use store credit to pay for subscription renewals, and you can award store credit as part of an ongoing subscription or membership benefit.

Yes. In Account Funds settings, you can customize the customer-facing label to “Account funds,” “Store points,” “Wallet balance,” or whatever term fits your brand.

Yes. When partial payment is enabled, customers can apply their store credit balance and pay the remaining amount with any active WooCommerce payment gateway: Stripe, PayPal, Square, or any other.

Store credit works as a payment method for all products. For cashback rewards specifically, you can configure eligibility rules to include or exclude specific products, categories, and product types.

Yes. Account Funds extends the WooCommerce REST API to include customer balances and transaction data, which is useful for mobile apps, external integrations, or custom reporting dashboards.

Yes, if you allow it. Many stores keep it simple and let shoppers choose either funds or another method.

You can credit refunds back to the customer’s original payment method or their account balance for a faster resolution and immediate reuse. You have full control.

Show the option only to logged‑in users or specific roles like wholesale customers using an extension like Constellation by Kestrel to restrict access to specific members.

Categories

Extension information

Quality Checks

Compatibility

Countries