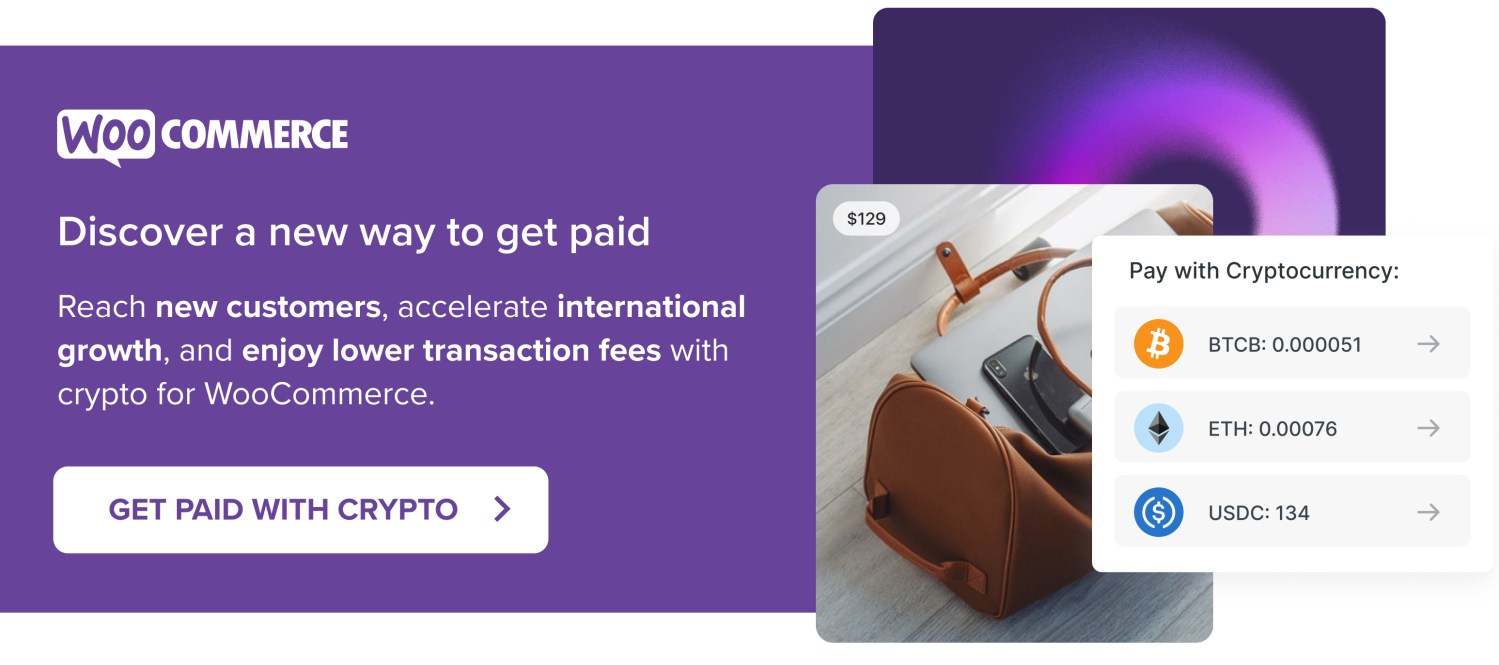

Accepting cryptocurrency on your ecommerce store can open up new opportunities for expanding your audience while reducing transaction fees and improving cash flow. If you’re excited about the benefits of accepting cryptocurrency on your WooCommerce store and are ready to get started, this article is for you.

We’ll guide you through some of the key decisions you’ll need to make and outline the features available from different types of solutions. Plus, we’ll demystify a little jargon along the way.

Understanding the two approaches of crypto payments

↑ Back to topIf you want to accept cryptocurrency on your site, you generally have two options:

- Crypto lite: If you’d like to accept cryptocurrency for payments, but have little interest beyond that, this is for you. You’ll look for solutions that simply ensure you get the correct amount of money in your bank account as quickly and affordably as possible.

- Something more: This category can get complicated quickly. If you want to keep some or all of your crypto as crypto, accept a wider range of currencies, or sell NFTs, you’ll need more advanced solutions.

Choosing between a custodial and non-custodial crypto payments provider

↑ Back to topWhen it comes to accepting cryptocurrency on your WooCommerce site, the most important decision you’ll have to make is whether to choose a custodial or non-custodial payments provider.

This goes hand-in-hand with your choice of “crypto lite” or “something more.”

Custodial crypto payments providers

For many merchants, this option offers peace of mind and a familiar user experience. You’ll have access to support, can rely on terms of service, and can take advantage of more features (such as automatic settlement to your bank) because your service provider manages your crypto accounts on your behalf.

If you pursue “crypto lite,” custodial crypto payments providers are the only choice.

The benefits of a custodial crypto payments providers include:

- A fully-integrated WooCommerce extension

- The ability to accept one or more cryptocurrencies from customers

- Settlements sent directly to your bank account in fiat currency

- Account access with an email and password

- Support services

- Low transaction fees and protection from refunds and chargebacks

Non-custodial crypto payments providers

If you’re well-versed in cryptocurrency and want access to advanced capabilities, you may want to consider a non-custodial solution. With non-custodial solutions, you’ll have full control and sole responsibility over the security and management of your crypto accounts. This is not something to take lightly, but for qualified store owners, it unlocks the full potential of cryptocurrency.

The benefits of a non-custodial crypto payments provider:

- Access and control of your crypto as soon as it’s received – no waiting for settlement by a third party.

- Fewer restrictions from terms and conditions – no one can suspend or cancel your account or services.

- Actions that are subject only to applicable laws and your own capabilities. You can sell whatever you’d like to whoever you’d like and manage your cryptocurrency however you see fit.

- Sole responsibility for your account’s security – no third-party data breaches or hacks can affect your funds.

Crypto vocab check

Fiat currency: Currency issued by a government (e.g. USD, EUR, GBP).

Cryptocurrency: Currency secured by cryptographic principles (e.g. BTC, ETH, DOGE).

Stablecoin: A type of cryptocurrency that’s pegged to a fiat currency. (e.g. USDC where 1 USDC = 1 USD).

Features of crypto payments providers

↑ Back to topThere are plenty of features to consider when choosing between a custodial and non-custodial provider.

Below, you’ll find a full list of features and considerations to illustrate the differences between the options. When using the table, it’s important to understand that this is a high-level guide to what’s possible. Not all partners will offer every feature.

| Feature | Custodial | Non-custodial |

| Contract with a third party You sign up for a service with a corporation governed by terms of service. | Y | N |

| Account recovery If you lose access to your account, you can request a password reset or access account recovery services from the provider. | Y | N |

| Support You’ll be able to access and receive support from the provider. | Y | N |

| Automatic exchange to stablecoin/other crypto You can choose to have crypto automatically converted to a different crypto or stablecoin. | Y | Y |

| Automatic exchange to fiat You can choose to have crypto automatically converted to fiat. Note that exchange rate calculations and rates will vary by partner. | Y | N |

| Automatic settlement to your bank You can choose to have your funds settled automatically to your bank. | Y | N |

| Receive the exact value in fiat currency This helps avoid exposure to crypto price fluctuations. Non-custodial solutions can mitigate – but not eliminate – volatility by choosing to only accept stablecoins. | Y | N |

| Merchant-specific features Some providers offer features to save merchants time and energy. These include things like risk profiling (to help make sure you don’t receive funds from bad actors), under/overpayment protection, and email invoicing. | Y | N |

| Transaction finalization protection Blockchains rely on ‘blocks’ to be produced in order to finalize transactions. The more blocks that are produced after a particular transaction, the more secure that transaction is. Protection helps avoid sending out goods and then having a transaction revert. | Y | N |

| Funds insurance Both custodial and non-custodial solutions carry a risk of hacking. Funds insurance can protect those using a custodial solution. However, protection varies widely and merchants should carefully research partners’ insurance and refund policies. | Y | N |

| No automatic chargebacks or refunds Chargebacks and automatic refunds are features offered by traditional payment networks. Crypto removes the risk of chargeback fraud and avoids having funds removed from your account by a third party. However, as we mentioned in our introductory post, you’ll still need to resolve disputes. | Y | Y |

| Supports subscriptions/recurring payments Customers paying with cryptocurrency will need to authorize every transaction. So recurring payments are not possible, but some custodial solutions offer tools to automatically generate and send invoices based on a schedule. | N | N |

| Low transaction fees Both custodial and non-custodial payment providers typically offer significantly lower transaction fees (1-1.5%) than traditional payment providers (2-3.5%). | Y | Y |

| Exposure to crypto network (e.g. gas) fees Direct cryptocurrency transactions come with their own network fees – with Ethereum, these are known as ‘gas’ fees. Some payment processors absorb these fees; some pass them on. | N | Y |

| Sole control You are the only person who can make outgoing transactions from your account. No other entity/person can authorize transactions unless they gain access to your private key. | N | Y |

| Accept any cryptocurrency on any network Crypto payments processors support a different range of crypto networks and coins. With custodial solutions, you’re constrained by the currencies they support. Non-custodial solutions can offer a wider range of options. | N | Y |

| WooCommerce integration It’s one thing to receive a payment, it’s another to know which customer made the payment and for which order. Our partners offer robust WooCommerce integrations covering everything from configuration to daily management. | Y | Y |

Review your options and choose the right cryptocurrency payments provider for your store

↑ Back to topCryptocurrency solutions can seem confusing, but it’s worth the effort to provide payment options that best suit yours and your customers’ needs. Take the time to navigate through the pros and cons of the two types of crypto payments providers, then consider which specific provider is the right fit for your business.

About