Financing is an important part of the business world — one that can be intimidating to first-time and experienced entrepreneurs alike. But as your fledgling idea turns into reality or your part-time gig starts to demand full-time attention, the need for financing will probably make its way into view. It’s an exciting time!

There are all kinds of ways to access financing — crowdfunding, personal savings, credit cards, friends and family, and more. We’re going to look at three of the most common types of financing and a few things you need to consider.

Note that the decision to access financing is an important one. It has far-reaching and long-term consequences that can extend to your personal financial security. WooCommerce doesn’t make any official recommendations to stores as each and every situation is unique. Consider things carefully and seek the independent, objective advice of a financial professional.

Common kinds of financing

↑ Revenir en hautDebt financing: This is when you take a loan from a bank or other institution. Usually, you’ll agree to pay back the loan in equal payments over a term (period of time). The bank charges interest as their fee. You’ll probably be required to put up some form of collateral (something with a relatively stable, predictable, and tangible value like a building, piece of equipment, vehicle, or other form of property) which the bank can take over to help recover their costs if you’re unable to pay back the loan.

Equity financing: When you think of shows like Shark Tank, most of the deals they make are equity-based. This is where you give up partial ownership of your business in exchange for cash and other things of value like your new business partner’s expertise or connections.

Revenue-based financing: This is when an organization provides an unsecured loan (meaning you don’t put up any collateral like with debt-based financing) based on your store’s previous sales history. This loan is paid back to the lender a little at a time through a percentage of each individual purchase until the debt and fees have been repaid.

Why consider financing?

↑ Revenir en hautMost companies get financing to help them start or expand quickly. However, some will seek financing when they’re attempting to stay in business or turn around their efforts. This can be a slippery slope.

Assuming you’re starting a new store or growing one that’s already on the path to success, financing might be a smart move. Here are common reasons for financing:

You need to finance a major purchase order

Your dream has come true and a trusted buyer wants to make a massive purchase from your store. Once the excitement has subsided, you might be met with the question of how you’re ever going to fulfill such a large commitment.

This is one of the most ideal scenarios for financing because you have a relatively guaranteed source of revenue waiting on the other side. Since you’ll be able to pay back the loan quickly (in months instead of years) you may be able to find financing for a low cost.

You’re ready for growth

You have a substantial track record of sales and your numbers keep growing. You find yourself struggling to keep up with orders. Maybe you’ve even had to limit the number of daily orders you take because you don’t have the systems or resources in place to handle all of them. This is an entrepreneur’s dream problem, but it’s still a problem. Thankfully, it’s one that can be solved with financing.

You want to improve your margins

For eCommerce brands, inventory is often purchased in advance. Yes, some utilize print-on-demand eCommerce solutions and those can be perfect when you’re getting started.

But most stores, as they grow and gain confidence in predicting sales, like to make large volume purchases in advance. Why? The margins can be a lot better.

But this is where growth pains get worse. As you make larger orders, your margins improve, but you spend a significant amount of money out of pocket long before you make a single retail sale. It could be months between paying for production and breaking even. And if you’re trying to grow, you’ll be stretching your accounts pretty thin.

Financing can help solve this problem because you can invest more in larger inventory purchases. This means better margins and more (eventual) profit.

Common considerations for eCommerce financing

↑ Revenir en hautIf you decide that you want to take on financing, you’ll need to choose between several options. Each form of financing comes with its own pros and cons. Evaluate each based on what’s most important to you — ownership, control, risk, etc. — and find the solution with the right mix for your situation.

Below, we’ve explored how each of the three major financing types impact common considerations.

Ownership and control

Favors: Debt and revenue-based financing

Disfavors: Equity financing

When you finance your needs through debt or a revenue-based model, you get to retain full ownership of your company, but if you finance with equity, you give up a portion. There’s no single calculation for determining the value of your company, but common metrics include past revenue, proprietary technology, and more. If you’re confident in the future of your idea, every percent of ownership matters. Though it might be tempting to give away 10% for a $10,000 check right now, if that 10% is worth ten million in a few years, you’ll probably regret the decision.

This also means you get to be the ultimate decision maker. You’re the boss. Take the entire team out to random, expensive reward dinners. Or pinch every penny with a lock on the water cooler. You get to make the calls and nobody’s standing in your way. If you have a strong vision this is an important reason to keep your equity. For businesses with a lot of subjective decision making (like those that involve design) control is second to none.

But keep in mind that, unfortunately, 100% ownership means that you also have 100% responsibility. Every area of the business ultimately relies on you. If you’re the only person with ownership, the extra late nights putting in sweat equity to make it through a slump or fulfill a busy season will all be on you.

Personal Risk

Favors: Equity and revenue-based financing

When you take on an equity partner, they’re committing to share in the rewards as your company grows, but they’re also sharing in the risk. If it fails, you aren’t personally responsible for paying the partner back their investment. While this is an unfavorable arrangement for them, they’re making the investment with the expectation that the return is unlimited — it could be worth billions someday.

Revenue-based financing is also favorable for store owners who want to minimize risk. Since the loan is repaid through each individual sale, if orders slow, so does the amount being repaid. If the store fails completely, the owner is not obligated to pay back the lender.

Disfavors: Debt-based financing

If you take a traditional, debt-based loan, the institution will “secure” the loan with some form of collateral. If business tanks, they can claim the collateral to help repay the loan. Most business owners will put up some form of personal property like a house, car, or something else of substantial value. A debt-based agreement comes at great personal risk to the borrower.

Additional expertise

Favors: Equity-based financing (sometimes) and Wayflyer

If you bring on an equity partner, depending on the partner and the agreement, you might benefit from additional expertise and business experience. In fact, many agreements account for this. There might be a portion of cash exchanged, but also an additional portion of equity exchanged for the investor’s personal value. If your new partner can make introductions, close deals, or advise in invaluable ways, this could be incredibly powerful. In fact, it might be something that your money literally can’t buy from someone else.

While most other forms of financing don’t come with help in the form of additional expertise, Wayflyer, a revenue-based financing option, does. Wayflyer provides you with a dedicated Success Manager as well as access to their team of data scientists — who are experts in eCommerce — to help you overcome common challenges faced when growing online.

If you don’t just need money but also additional help and expertise, an equity investment or partnership with Wayflyer provides cash and someone willing (and highly motivated) to help you succeed.

Disfavors: Debt and (traditional) revenue-based financing

If you finance through a debt or revenue-based agreement, that’s all you get. It’s unlikely that your lender will be able to advise you on inventory or marketing decisions. They don’t know your audience and their expertise starts and stops with financing.

Cash flow

Favors: Equity financing

Investors are usually interested in the long-term growth and value of your store. Your company doesn’t have a direct obligation to pay the investor back. So all of your revenue can be used to continue business operations. Keeping your monthly obligations low allows your business to act more nimbly and fund continued growth.

Disfavors: Debt and revenue-based financing

Unlike equity financing, you’ll have to start paying back debt financing almost immediately. You’ve instantly added another monthly bill. With revenue-based financing, you start paying back your loan with the very next sale.

If you’re going to use the money in a way that will boost revenue immediately (like a new marketing campaign or fulfillment of a major order), then this could be a good move. But if your use for financing won’t pay off for many months or even years (like a complicated new product), the monthly obligation could cause more headaches than it’s worth. Because of this potential downside, most revenue-based financing institutions won’t provide funding for long-term investments like product development.

One final note: Revenue-based financing edges out debt-based financing because, since repayment is based on daily sales, you’ll pay less on days when sales are slow. But with debt, you’re responsible for a minimum payment regardless of your sales that month.

Ease of access

Favors: Revenue-based financing

Revenue-based financers look closely at your previous sales, along with your plans for the money, and then usually make a quick decision. Companies like Wayflyer integrate with WooCommerce, which makes handing over the data they need incredibly easy.

Disfavors: Equity and debt-based financing

Debt-based financing is a bit harder to acquire. Usually, you’ll want to meet with several banks to understand your options. Each will require an extensive amount of paperwork — like a business plan — as well as documentation of personal assets they can use as collateral. Since most banks don’t directly integrate with eCommerce platforms, you’ll have to gather everything they need manually.

Quality investors are not as easy to find. They’ll require many of the same documents, but since they don’t have collateral to protect their investment, they’ll want to know much more about your business, personal expertise, and plans. You might have to partner with someone to help you connect with the right investors. Then, expect to make a lot of pitches before you find the right fit. It requires a major time commitment, but if equity-based financing is your best option, it can be worth the effort.

The rising star of revenue-based financing

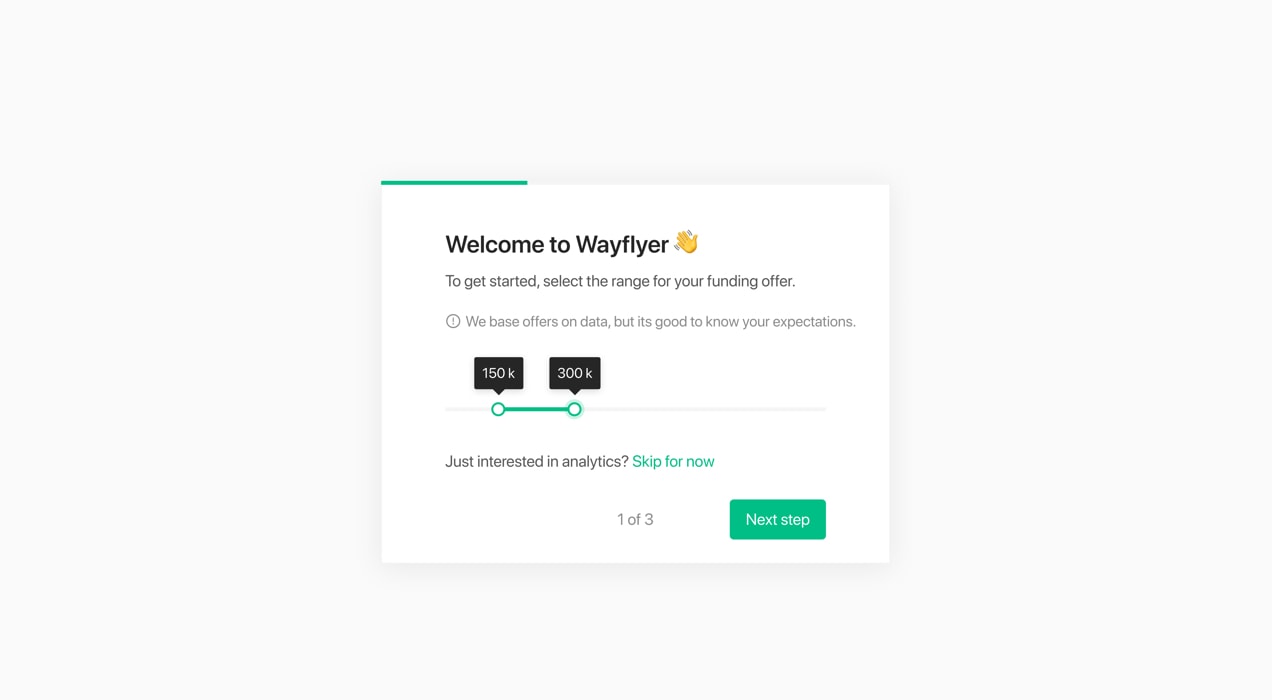

↑ Revenir en hautIf you decide that revenue-based financing is your best option, you’ll want to consider Wayflyer. They work with WooCommerce every day, so they can gather the information they need to make a decision quickly. Store owners can get offers in hours. Yes, hours.

This is a great option if you have a successful track record, but aren’t a giant store. But, it’s also great for pretty big companies. They provide financing up to $10 million.

Aiden Corbett, co-founder of Wayflyer, explains, “As WooCommerce works to democratize eCommerce, Wayflyer works to democratize the financing needs for growing eCommerce businesses, making it a perfect match for entrepreneurs looking to build companies online. We’re excited to join the WooCommerce community to bring affordable growth capital and support the next generation of great brands to find their audience, maximize returns on their capital, and build their businesses to unrestricted new heights.”

Once you accept funding, Wayflyer will withdraw a percent of your daily sales directly from your bank account until you’ve satisfied your agreement. If you have a slow day, you’ll pay less, and if you have a record day, you’ll pay more. This flexibility — along with their less intimidating application process — makes it a popular option for both new and experienced stores.

About