As an ecommerce business owner, you have a variety of tax responsibilities, and these will vary depending on where your online store operates. But of all the ecommerce tax obligations you have to deal with, the one that requires the most attention is sales tax.

Income taxes and various other taxes are relatively simple to understand compared to sales tax. They can still be difficult to work through, but with a good tax accountant or bookkeeper, you can coast through it. But sales tax? This one requires more attention to keep up with it.

The good news is, if you’re having to deal with difficult ecommerce sales tax issues, that means your annual sales are growing! So while it’s true you must invest quite a bit of effort to properly manage sales taxes, in many ways it’s a good problem to have. After all, if you didn’t owe any sales taxes, that means you made no sales.

The challenges of ecommerce sales tax

↑ Volver al principioIncome tax is, by comparison, relatively simple. Here’s your revenue. There’s your business expenses. This is your profit. Use this tax rate to do the tax calculation. Done.

But ecommerce sales tax has many more factors at play than with a traditional brick and mortar retail location. Here are a few of the biggest challenges you have to deal with:

Countries

Each country has its own sales tax rates and processes. Some have more functional government systems than others. If your ecommerce business sells products in multiple countries, you’ll have to work out the sales tax details for each of them.

US states

In the United States, for a while, online businesses got away with charging no sales tax. Those days are over. And now, instead of just one national tax rate, every state has its own. Some states charge no sales taxes. Others have different rates depending on cities and counties.

With 50 states, if you’re selling across the whole country, you have to comply with 50 different state sales tax requirements.

Ongoing tasks

Unlike income tax, which happens just once a year for most people, sales tax is never-ending. Every transaction, you have to collect tax. And what you charge the customer will change depending on where your business is located, where the customer is, and sometimes other factors, too.

Changing laws

Different states have grappled with the difficulty of digital sales taxes in various ways. And those ways don’t always remain the same. With elected officials coming and going, different attitudes about online business, and the perception of missing tax revenue for governments, sales tax laws regarding digital transactions change a lot more often than for businesses with physical locations.

Exempt items

Some products qualify for sales tax exemptions. But again, it isn’t universally agreed upon which items should qualify. For example, some states exempt feminine hygiene products, but others don’t. And these exemptions can also change. If your online store sells a variety of items, some might require no sales tax, in some places. For now.

With all these challenges, where do you begin?

Let’s start at the country level.

US vs European sales taxes

↑ Volver al principioCurrently, the biggest difference between the United States and European countries is the VAT — the value-added tax. About 170 countries, including the European Union, charge a VAT instead of a sales tax. The two types of taxes function similarly in terms of the revenue they generate, but the process for how they work is quite different.

International ecommerce tax — VAT

What is VAT? The idea with a value-added tax is that the tax gets applied at each stage of production.

Imagine an ecommerce business selling organic shake mixes. The business works with a factory to manufacture and package their product. The factory works with international food distribution companies. The food distribution companies work with farmers at the source.

With a value-added tax, each of these links in the chain pays a portion of the tax owed. And by the time it gets to the consumer, they pay the combined total of all the taxes paid along the way.

Who has to pay the VAT?

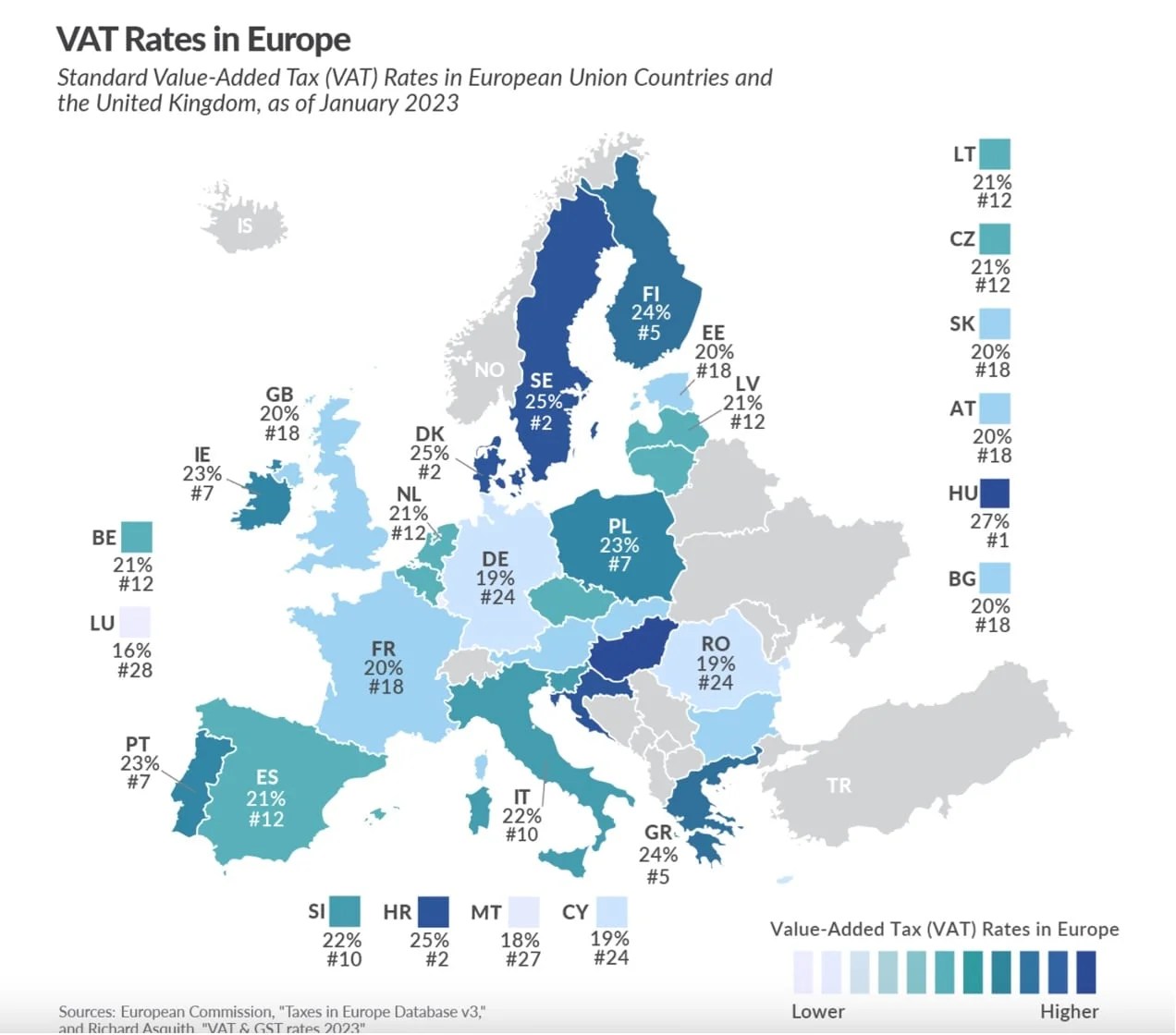

Every country charges its own VAT.

If your ecommerce business sells products in a country that uses a VAT, you have to collect taxes and remit them to that country’s government. For some countries, there may be substantial sales thresholds that determine which businesses need to pay. This is known as a registration threshold. A small business owner might be exempt.

But for countries where you have a permanent establishment, the threshold no longer applies and you are required to pay the VAT. Some say a VAT is simpler than a sales tax, but not everyone agrees.

What are the VAT rates?

As you might have guessed — it’s complicated. Each country charges its own VAT rates. And those rates might not be consistent depending on the products sold and various other factors. For example, Poland’s main VAT rate is 23%, but it is lower in certain situations such as food products.

Here’s a map of Europe showing what each country charges for VAT.

How does my ecommerce business pay the VAT?

To comply with VAT requirements, first your business needs to register with each country in which it does enough business to meet minimum thresholds.

Then, set up your bookkeeping software so it calculates the tax rates charged by each country where you will be paying a VAT.

Last, get your bookkeeping software to integrate with your ecommerce platform so your customers will be charged the proper VAT rate at the point of sale. That allows you to collect taxes owed, and from there you’ll be able to calculate what you owe to the various countries, and remit it to them.

US ecommerce tax — sales taxes

The US uses sales taxes instead of value-added taxes. A sales tax charges the customer a percentage of the purchase amount at the point of sale. Then, the business remits the tax to the relevant governing authorities, which could be states, cities, or counties. Or all three.

It differs from a VAT in that the business selling the product to the customer is responsible for paying the entire sales tax. With a VAT, that business can write off the portions of the tax that have already been paid by other businesses earlier in the product development process.

Ecommerce business owners selling in the United States need to figure out how sales tax works. Otherwise, you’ll be on the hook for the full amount of tax owed, in addition to possible fines.

The complications of US online sales tax laws

↑ Volver al principioThere are seven major complications in US sales tax laws for ecommerce businesses. For example, they charge different rates. They exempt different items. The dates you must pay sales tax vary. Sometimes they give sales tax holidays. And these actually make more work for you.

And on top of all this, like with different countries, you don’t need to collect sales tax in every state — even if you do business there. Some states, such as Oregon, charge no sales taxes at all. The requirements for which online businesses collect sales tax are complicated, and it all begins with the idea of a nexus.

Let’s start there and go through the seven complications.

1. Sales tax nexus

For most of us who have started businesses, we never imagined needing to learn the meanings of strange new words like “nexus”. Yet, here we are. Understanding nexus is the beginning of figuring out your ecommerce sales tax questions.

What is nexus?

For purposes of sales tax, nexus means your business has either a physical or economic presence in a state and is actually doing business there. Because you are selling products in that state, the government believes your business should have to collect sales tax.

The reasons for nexus make sense. Before nexus laws came into being, brick and mortar businesses were collecting sales tax, but online businesses could ignore it. This gave online businesses an unfair advantage, because from the consumer’s perspective, they could buy the product online for less money, even if the prices were the same.

So, since 2018, nexus laws have been enacted in nearly every US state.

What does it mean to “do business”?

It could mean several things — some obvious, some surprising:

- Opening a location there

- Hiring employees or contractors who live there, even if they work remotely

- Using third party affiliates located in that state

- Storing goods in a warehouse located there

Do you sell through Amazon? Which Amazon warehouses are your goods kept in? You may have a nexus in that state.

How are physical and economic nexus different?

There are two types of nexus — physical and economic. Physical nexus used to be all that mattered, before online businesses and the internet. So, the idea of collecting taxes for remote purchases only mattered for mail-order, and most states didn’t bother unless that company was based in their state. That’s physical nexus.

Physical nexus means your business has a physical presence, in the form of actual locations and buildings or employees working remotely, in a state. Remote workers have complicated the idea of physical nexus to some degree. If you have six employees working in six different states, but your inventory and physical location is in a seventh, should those other states count as physical nexus? Each state is different.

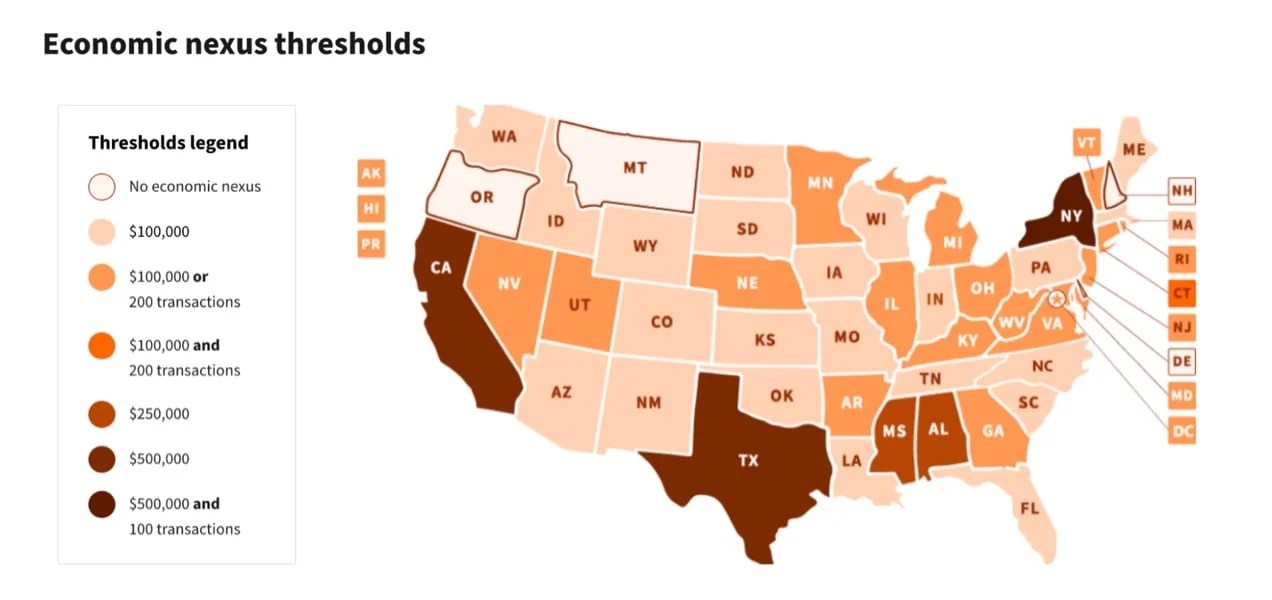

Economic nexus means you are doing business in that state, in some form. Many states have a minimum economic nexus threshold. If your online sales revenue to that state is below the threshold, you don’t have to pay sales tax to that state.

For example, if you’re selling products to people in Texas, but your business is located in Ohio, you have physical nexus in Ohio and economic nexus in Texas. Of course, if you’re in Texas and only sell to people in Texas, then all your nexus lives in Texas. 🎵 🤠 🎵

How do you find out if you have a nexus in a state?

This part’s pretty easy. To find out, simply look up the sales tax laws in each state.

Here’s a list of every state’s economic nexus laws. Keep in mind these laws can change, and it’s a good idea to revisit this topic about once a year.

And here’s a list of each state’s sales tax nexus laws.

Keep these resources handy so you can quickly review any changes that may happen year to year, and make appropriate adjustments in your sales tax collection process.

What should your business do when you have a nexus?

First, register for a sales tax permit in each state where you expect your business to have a nexus. That way you’ll be ready to collect and remit sales taxes when the time comes.

If it turns out you don’t have nexus in a state, such as if you end up not making enough sales in that state to meet the economic nexus threshold, filing for the permit isn’t going to hurt you and you’ll be ready for whenever you need it. Each state has its own filing process.

Second, every time a customer from that state makes a purchase from your online store, charge sales tax. Ideally, you will then secure those funds in reserve so that when the time comes to pay sales tax to each state, you can easily do so.

Third, pay attention to the dates and deadlines for when each state requires you to remit sales tax collections.

And fourth, each time that date arrives for each state, file sales tax returns. Here’s a handy resource that explains how to file sales taxes in every state. Don’t lose this!

2. Origin vs destination

What about your home state, where your business is located? Physical store presence or not, your business is based somewhere. And for this, there are two ways states define themselves for purposes of collecting sales tax from businesses.

Origin-based states

Origin-based states require businesses to charge the same flat sales tax rate for all customers, regardless of where those customers live.

As you can probably guess, this is the easier of the two methods for businesses. The only complication here comes from city, county, and other local sales taxes. If your business is located in a city, county, or district that has its own tax rate, you would add that on to the state percentage.

For example, Utah is an origin-based state — one of 12 such states. Utah’s current sales tax is 6.1%. If your ecommerce business is based out of Utah, you’d charge sales tax for all your Utah customers at 6.1%. If your business is located in a city in Utah that charges its own 1% sales tax, you would then have to charge all your Utah customers 7.1% sales tax.

Again, customers out of state are handled differently. That’s what the physical and economic nexus threshold laws are for. But for in-state customers, this is how you’d collect sales taxes if you’re in an origin-based state.

Destination-based states

As you might have guessed, destination-based states determine how much sales tax to collect based on where the customer is, not the business. Again — this is all for customers within your state.

Let’s use Minnesota this time. Minnesota’s tax rate is 6.875%. Let’s say your business is located in a city in Minnesota with no local sales tax. But, you have customers buying from your online store all over the state. Those cities and counties may all charge their own sales taxes, and your business would have to charge sales taxes at a different rate for each customer — based on wherever they live.

That means county lines, city borders, and special tax districts all matter now. 39 states are currently destination-based states.

What if you have nexus in multiple states?

Some states consider businesses “remote sellers” if they have nexus in that state but aren’t located there. And as a remote seller, you may be treated as a destination-based seller, even if the state is an origin-based state, such as Tennessee.

In that instance, you would collect taxes according to the location of the buyer. This article from TaxJar explains about this in more detail.

What if you are selling to the US from outside of it?

If you have US customers, but your business is located in a different country, does any of this matter?

Well, it might. If your business is found to have nexus in any US states, then you would need to charge sales taxes for your customers who live in those states.

For example, suppose your business is based in Kenya. If your products are stored in a warehouse in Missouri, there’s a chance Missouri will consider you to have a nexus there.

This is why this article led with the question of nexus. All sales tax questions begin there.

3. Sales tax holidays

This sounds like a cool perk you can offer your customers, right? “No sales tax” is a great marketing campaign headline. And if states are giving you a holiday from collecting and remitting sales tax, even better, because the marketing offer won’t cost you any money.

Well, just hold on there a minute before getting too excited.

Yes, a sales tax holiday sounds great. But the details can get messy, real fast. Here are a few reasons.

You have to update your systems

All the systems you set up to make your sales tax collection process work will have to be altered. Remember, you collect sales tax at the point of sale. In your online store, that means you have to remove the sales tax — only for customers from the state with the tax holiday — and only for the few days it’s in effect.

Then, you have to collect sales tax again when the holiday ends.

This can require temporary updates to your ecommerce platform, checkout page, post-purchase receipts, and bookkeeping software.

There’s no consistency among states

With so many states having tax holidays at totally random times, this may be something you end up hassling with frequently. So, here’s a good thought — if you’re dealing with sales tax holidays in numerous states, that means you are making internet sales in all those states, too. It helps to remind yourself that this is happening because your online store is doing well.

Only certain items are exempted — it depends on the state

Some states might give blanket sales tax holidays that apply to all products normally subject to sales tax. But others only exempt certain types of products. You’ll have to dive into all these details every year and see which sales tax exemptions apply to your business, for each state where you have a nexus.

Things are inconsistent year to year

Some states have sales tax laws in place that fix the dates for their tax holidays. For those, you can more or less predict them year to year. But other tax holidays might arise on the whims of an elected official running for re-election that year. There is little consistency year to year for some of these holidays, so you have to stay on top of it.

4. Changing tax rates

It might surprise you how often states tinker with their tax rates. It can happen for a whole host of reasons.

State governments might decide to just increase the overall sales tax rate to raise more revenue. They could also choose to lower it, but… that’s a lot more rare.

If state sales taxes change, that’s the simplest type of change and the easiest for you to incorporate into your sales tax collection processes. But states can change them in other ways, too.

They might change the state sale tax for particular items or industries, such as digital products. They might switch from being an origin or destination-based state. They could change the economic nexus threshold. That’s not a change in rates, but it could mean you’d have to collect and remit sales tax for a new batch of customers.

This is why, about once a year, it’s a very smart idea to set aside time to check up on the sales tax changes for each state.

5. States, counties, cities, districts

It’s not just states. Cities, counties, and special tax districts can change their tax laws and rates at any time. They can alter their local tax rates. Change how they handle sales taxes for certain industries. Alter the requirements for certain types of businesses. Raise or lower economic nexus thresholds for remote sellers. State and local governments can change their tax laws whenever they want.

In other words, nothing is permanent. So you have to keep up with different sales tax laws every year to remain in sales tax compliance.

Now, if you happen to live in an origin-based state, some of the stress from local sales taxes may not reach you. In that instance, unless the local tax authority where your business operates changes your tax obligations, you’ll be able to stick with the statewide sales tax rates.

6. Types of products

Certain products tend to get picked on more than others by state and local governments. Often it’s ones like alcohol, firearms, or digital products that may have a sales tax levied upon them. Sometimes service-based products, like coaching, can fall under the sales tax umbrella. Online education programs that sell additional resources might also be required to collect sales tax.

And at other times, products that were previously taxed may receive sales tax exemptions. Products that become frequent targets for sales tax relief include feminine hygiene products and diapers.

The bottom line is, if you have products or services that are exempt from sales tax, don’t assume it will remain that way forever. Each state can change the rules any time they want, and you have to adapt.

7. Varying remittance requirements

Some states require you to remit sales taxes once a month. Others do it quarterly or annually. And like anything tax-related, this could change next year.

You can look up when you’re required to file sales tax returns for each state. Or, if you have questions, give each state’s tax collection department a call. Here’s a list of phone numbers for each state’s taxing authority.

How can an ecommerce business manage all this?

↑ Volver al principioOkay.

You made it this far, and you’re still breathing. Sales tax has become quite complicated because of the rise in online sales. The question is, what should you do in response to what you’ve just read?

Here’s the main thing:

You want to remain in compliance with state and local sales tax laws, and any applicable VAT requirements, so you can grow your ecommerce business and remain in good standing in all the states and countries you’re selling to. So how do you manage all this? For many online sellers, it feels like too much. And for many, it is.

Here are a few things you can do to manage sales tax collection:

Use sales tax automation software

Probably one of the best things you can do is to use some form of sales tax software.

Tax software does the heavy lifting for the tasks that become very overwhelming for many online sellers. Especially if you’re selling online in nearly every state, or in multiple countries, you will be spinning a lot of plates to keep up on the sales tax requirements.

Automation software will keep up with all the changing requirements from every tax jurisdiction that affects your business, especially local jurisdictions that you often don’t know exist.

Sales tax software will:

- Monitor changes in sales tax rates

- Tell you what to do if you open up a market in a new tax district

- Keep track of tax holidays and other changes to sales tax laws

It also will keep your backend systems updated, so your checkout page will always charge sales tax at the right amount for each customer — whether they come from another country, an origin-based state, or a destination-based state.

And, tax software will file and remit sales tax to each state and local tax authority, so you don’t miss a deadline.

If you build your online store with WooCommerce, there are a variety of tax compliance extensions to choose from.

Use these resources and suggestions

If you are a small business owner, you may not feel the need for tax software just yet. Or, maybe you’re good with bookkeeping and enjoy having your hand in things like taxes and finances, and you want to know what’s going on with your business.

In either of these cases, you can succeed at managing your sales tax obligations on your own. It is possible. Here are a few tips:

Stay current

For small ecommerce businesses, there’s a good chance you aren’t selling enough products to most states to meet the economic nexus threshold. So, if you also don’t have a physical presence in any state but your own, keeping up with your state sales tax requirements may not require a ton of work once you get it set up on your checkout page and in your bookkeeping software.

Here’s what to do:

First, determine if your state is origin-based or destination-based, and conduct your business accordingly.

Then, the main thing to keep in mind is, your business hopefully will grow. So, be aware of which states have the lowest economic nexus thresholds. As your annual sales start to rise, those may be the first states you have to start working with.

And, keep up with your own state’s sales tax laws, because those already apply to you, and always will. Know the deadlines for when to file sales tax in your state and any local jurisdictions.

Monitor changes in tax rates

For every state or country where you do business, schedule time each year to update yourself on VAT and sales tax laws in those locations. If you stay on top of changes as they happen, including economic nexus threshold changes and tax holidays, you can update your ecommerce platform and bookkeeping software so everything continues running smoothly.

Again, this will take some work. But if you have a nose for this sort of thing, you can certainly manage it on your own or with the help of an employee.

Restrict your activities to avoid unnecessary nexus

Now that you know how nexus works, you can beat them at their own game. For example, you could make sure your warehousing remains in your state. You can delay working with affiliates who are out of state. You can avoid using out-of-state vendors for dropshipping.

Basically, minimize anything that might make a state government think you have a physical presence there. That will reduce some of the sales tax challenges we’ve discussed here.

Consider other ways to save on taxes

In addition to simplifying your sales taxes, you can also try to save money on other taxes. And please keep in mind, we are not tax professionals or lawyers. See a tax accountant or other tax professional to get firm answers and information regarding how to save on taxes.

Business expenses

Are you taking full advantage of tax deductions for business expenses? There are obvious deductions for things like health insurance plans for employees, payroll, and costs of goods sold.

But you can also deduct other business expenses. For example, do you take clients or vendors out for meals? You can deduct that expense. Traveling to a trade show or industry convention?

You can deduct your transportation, lodging, food, and event-related costs.

Keep your receipts

The key for things like this is to be sure and keep track of your receipts. Some of these may be physical paper receipts. Keep them in a separate file for business expenses. Other receipts will be sent only via email or perhaps SMS. Keep those in a digital folder.

Home office tax deduction

If your ecommerce business operates out of your home, there is a tax deduction for this that depends on the square footage of the office area.

Keep business separate

Whenever spending any money on behalf of your business, use business debit and credit cards, and business bank accounts. Keep all business expenses separate from personal ones. That makes it easy and transparent for what counts as a business expense.

Here are a few more tax deduction strategies.

Keep up with your ecommerce sales tax requirements

↑ Volver al principioYou now know all the main issues related to staying current with sales taxes. You learned how tax automation software can help collect and remit sales tax, and the work it will take to calculate the amount of sales tax to charge each customer if you choose to do it yourself.

You understand the idea of an economic nexus threshold, and the difference between origin-based and destination-based state sales tax laws.

What should you do next?

- Make a point to add sales tax management to your schedule.

- Remember to keep up with tax law changes.

- Put the dates you’re required to file and remit sales tax on your calendar — for each state in which you have a physical nexus or meet the economic nexus threshold.

- Make sure you’re charging sales tax at the correct amount for all your customers.

And if this sounds like a chore and you want to dramatically reduce the burden of tax compliance? Find a tax compliance extension and ease your mind today.

About