The payment solutions your store offers can greatly impact your business’ success. You could miss out on sales if you only offer processors that your customer base doesn’t know or trust. So, if your eCommerce store focuses on the European market, you’ll need to use WooCommerce payment solutions that cater to that audience.

Finding the perfect tool can be challenging. In most cases, you’ll want to offer more than one payment processor so that customers have options.

In this article, we’ll compare six European payment solutions for WooCommerce. We’ll discuss how long it takes to get your money, the accepted currencies, the supported countries, and more. Let’s get to it!

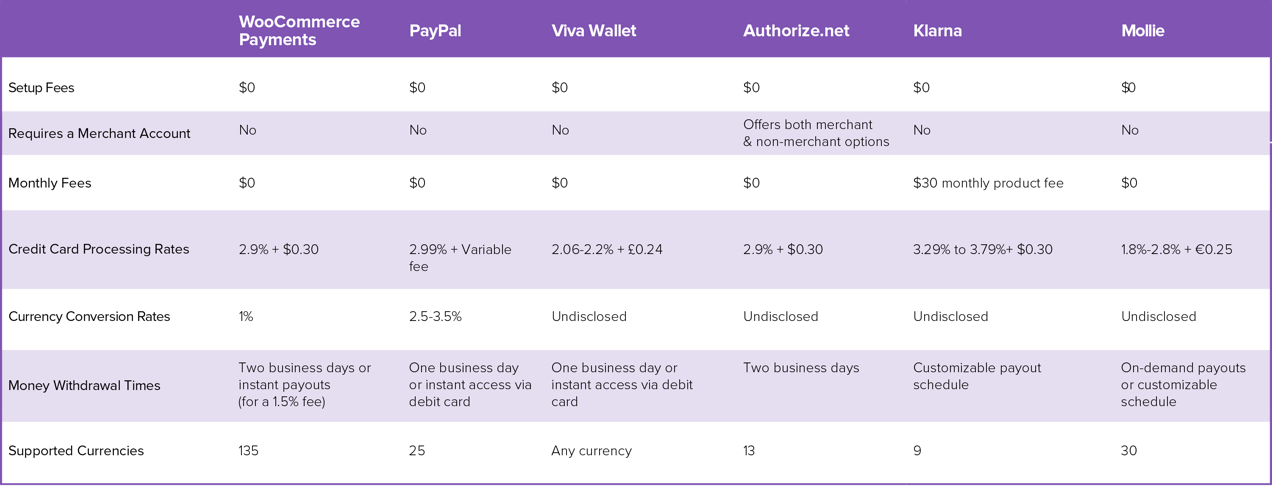

European payment solutions compared: in a nutshell

↑ Back to topBefore talking specifics about each one, let’s see how they compare by the numbers. Armed with this information, you’ll have a better idea of which European payment solutions you should consider using:

* based on Authorize.net merchant accounts, though they do offer non-merchant options

Keep in mind that there are more European-friendly payment solutions that you can use for your WooCommerce store. Still, these six options represent the payment gateways that are the simplest to implement.

Six European payment solutions: a detailed comparison

↑ Back to topThis discussion will focus on payment solutions that support multiple European countries. Additionally, some of these solutions work across the globe. This coverage means they could be perfect if you plan on selling to a global audience.

1. WooPayments

WooPayments was designed by the WooCommerce team for specific use on our platform. This means that it works seamlessly and enables you to manage everything directly from the WordPress dashboard. Because support is handled directly by WooCommerce, anyone you reach out to for assistance absolutely understands WordPress and the challenges store owners face.

You can sign up for WooPayments for free, and there are no monthly fees. The transaction fees are set at 2.9% plus $0.30 per charge, which is the standard across the industry.

This payment solution is available in more than ten European countries, Canada, and the United States, and supports more than 135 currencies. However, there is an extra 1% charge for transactions in currencies other than USD.

With WooPayments, customers can also use Apple Pay, P24, giropay, iDeal, Bancontact, Sofort, or SEPA to check out. Why is this important? Because it makes the checkout process much faster, allowing shoppers to use an existing account instead of hunting for their credit card.

Plus, you can charge recurring payments for subscriptions, memberships, payment plans, and auto-replenishments. The sky’s the limit!

Funds received with WooPayments can be paid out to your bank account on a two-day rolling basis.

Availability: WooPayments is available in the following European countries.

2. PayPal

PayPal is one of the most popular international payment solutions, boasting over 400 million active users across the globe.

With PayPal, customers can pay using money in their digital wallet, credit cards, debit cards, and bank transfers. Plus, the payment processor supports 25 currencies.

One thing to keep in mind with PayPal is that available payment methods and fees vary depending on which country your account is from. Moreover, PayPal charges 2.5-3.5% in currency conversion fees.

PayPal doesn’t force you to open a merchant account. Still, it’s recommended you make one if you plan on running an eCommerce business. For merchant accounts, PayPal charges a standard 2.99% for credit or debit cards transactions and 3.49% if you use PayPal Checkout. There’s also an additional fixed fee per transaction that varies depending on which currency you’re receiving.

If you use PayPal, you can withdraw earnings to your bank account within as little as one business day. The payment processor also offers its own debit card in some countries, enabling you to access your money instantly.

Availability: PayPal is available in the following European countries.

3. Viva Wallet

Viva Wallet is a payment solution by and for European businesses. It integrates with WooCommerce via the Viva Wallet extension, but you can also use it with other eCommerce platforms.

This payment solution enables you to open an account that doesn’t charge you any maintenance fees. You can also transfer money from Viva Wallet to any IBAN merchant account the day after a sale.

Furthermore, the processor supports all major credit cards. Viva Wallet also integrates with local European payment solutions like iDeal, Przelewy24, and PayU.

Regardless of which payment integrations you offer, all purchases take place within the Viva Wallet checkout. For credit card processing fees, Viva Wallet charges 2.06-2.2% plus an additional £0.24 per transaction.

When you open a Viva Wallet account, you can request a debit card to access your money instantly. The Viva Wallet platform supports all currencies and is available across most of Europe.

Availability: Viva Wallet is available in the following European countries. They also support CBD merchants (who meet certain guidelines) in France, Italy, Poland, Greece, and Portugal.

4. Authorize.net

Authorize.net is one of the most well-established online payment solutions worldwide and has been around for over two decades. During that time, it’s become one of the go-to solutions for international eCommerce stores.

With Authorize.net, you get a solution that can process credit card payments and e-checks. The platform also integrates with PayPal and Apple Pay, expanding your potential clientele base. Additionally, Authorize.net supports 13 different currencies.

It offers both merchant and non-merchant accounts. Non-merchant accounts cost $25 per month, and you get charged the standard 2.9% + $0.30 per transaction.

But, if you have a merchant account, Authorize.net reduces its fixed fee charges to $0.10 per transaction and, depending on your volume of sales, transaction percentages can be individually negotiated down per card type (e.g. Mastercard, Visa, Discover, etc.). For a large eCommerce operation, that can translate to massive savings.

In contrast, if you’re dealing with international transactions, Authorize.net fees rise to 4.4% + $0.30. While they accept a variety of currencies, they do not allow multiple currencies to be accepted on the same account.

On average, withdrawing money from Authorize.net takes around two business days.

Availability: Authorize.net is available for all businesses based in Europe.

5. Klarna

↑ Back to top

Klarna is a trusted eCommerce payment provider that offers flexible payment options. You can enable customers to split their purchases into four interest-free payments. Buyers can also choose to pay in full in 30 days or use monthly financing options.

Unlike most eCommerce payment solutions with financing options, Klarna makes the process simple by keeping credit checks in the background.

On top of pay-later options, Klarna can also process regular purchases made using credit cards and bank transfers. The platform charges $0.30 per transaction and an additional fee that ranges from 3.29% to 3.79% — depending on whether you keep customers on-page or send them off-page during checkout.

Klarna fees are a bit higher than other European payment solutions and it’s also worth noting that they charge a $30 monthly fee for each product you list.

From a seller’s perspective, Klarna provides you with full payments upfront and handles the financing. Plus, it helps drive traffic to member businesses through the app.

With Klarna, you get paid for sales directly into your bank account. However, payout processing times can vary depending on your arrangement.

Availability: Klarna is available in the following European countries.

6. Mollie

↑ Back to top

Mollie is a modern European payment solution that aims to be as upfront as possible about pricing. It also supports almost every payment method that you can think of.

With Mollie, you can accept credit cards, PayPal, Apple Pay, bank transfers (including SEPA transfers), and even gift cards. The payment solution also integrates with Klarna.

Mollie gives you full control over the types of payment options you want to enable. The platform supports one-off and recurring payments, as well as installments. You’re also free to customize the checkout experience and integrate it with your online store.

As far as payment processing fees go, Mollie charges €0.25 + 1.8%-2.8% for credit cards. It offers variable pricing depending on which payment options you make available for your customers. In many cases, Mollie charges less than the industry standards for credit card processing, such as Mastercard and American Express payments.

By default, Mollie pays out twice a week to your bank account and processing times usually range from one to two days. However, you can also configure custom payout schedules depending on your needs.

Availability: Mollie is available in the following European countries.

Payment gateways in summary

↑ Back to topIf you’re running a Europe-based eCommerce business, you can grow your sales by offering a payment solution that caters to as many of your customers as possible. European payment solutions can make it easier for shoppers in the region to make payments. They also simplify withdrawing that money to your bank account.

If you’re still not sure which European payment solution to use, here is a summary of six options for a quick comparison:

- WooPayments: This payment solution enables you to integrate multiple payment methods within your store and supports over 135 currencies. It simplifies the entire process by keeping management within the WordPress dashboard and provides high-quality, WordPress-specific support.

- PayPal: With PayPal, you get access to one of the largest user bases in the world, and a trusted global payments brand.

- Viva Wallet: Designed with European customers and businesses in mind, Viva Wallet supports all currencies and makes it easy for you to access your money.

- Authorize.net: This is one of the most well-established payment solutions globally. If you have a merchant account, Authorize.net offers some of the lowest processing fees, depending on your sales volume and how many international sales you make.

- Klarna: This payment solution offers financing options for your European customers.

- Mollie: With Mollie, you get variable processing fees and the ability to accept a broad range of payment methods.

View all available payment solutions in the Marketplace.

About