Sales are often won or lost at checkout, so giving customers more flexibility at that critical moment can make a big impact. Buy now, pay later (BNPL) options make it easier for shoppers to commit to larger purchases without putting extra risk on your business.

As a merchant, you still get paid in full up front, while the BNPL provider handles credit checks and collects customer payments.

In this post, we’ll provide a complete overview of what BNPL is, how it can help your shop, and several ways to offer it through WooCommerce. By the end, you’ll be able to confidently get started with the right BNPL provider to reduce checkout friction and increase conversions.

What is buy now, pay later?

↑ Back to topBuy now, pay later (BNPL) allows customers to split their purchases into smaller installments while merchants receive full payment upfront.

The BNPL provider handles the tasks of underwriting customers, dealing with any credit bureaus, and managing and collecting payments so store owners can focus on their business. And, if a customer files a fraud-related dispute, BNPL lenders take on the risk and any associated costs.

Offering BNPL can improve your average order value, increase conversions, and simply provide a better experience that leads to happier customers.

Let’s dive into other ways BNPL can benefit your store, especially if you sell high-value items.

Five reasons to add buy now, pay later to your online store

↑ Back to topShoppers appreciate choice. They pay using a variety of methods and value streamlined payment solutions that help them do more with less. Here are five reasons offering BNPL is a win-win:

1. You can convert more visitors

In his book Almost Alchemy, marketing legend Dan Kennedy tells the story of a client who was selling an item for $29.95. Kennedy advised him to sell it in two payments of $19.95. He sold twice as many units, even though the purchase price was $10 higher.

The hard data backs up this theory, with Afterpay retailers reporting an average 22% increase in cart conversions. You’ll sell more products if customers can make flexible, interest-free payments instead of paying all at once.

You can offer an installment payment option for orders with multiple products, too — it’s not limited to higher-value items. Say a customer wants to buy a $200 product. Offer the option of paying the total up front or paying in four installments of $50. Fewer buyers will have second thoughts about the total cost if there’s an option to pay monthly.

2. You’ll increase your margins

Flexible payments are a great alternative to traditional discounting. Buyers are able to get more of what they need by avoiding large lump-sum payments. In turn, you’ll be able to protect your margins on products.

Here’s an online business selling a course with three options for payment: a lump sum, four payments of $225, or ten payments of $99.

Not only have they won 27% more customers since they began offering monthly payments, but 90% of their customers who choose to pay monthly choose ten payments, even though it costs $100 more than the four-payment plan. This means that 90% willingly pay more in total, just to get a lower monthly payment amount for larger purchases.

A recent study even found that Afterpay retailers see an average 40% increase in order value, plus more repeat customers.

3. You can offer buyers more choices

Offering a variety of payment choices communicates that you want to make things as easy as possible for your customers. You’re trying to meet them where they are with more flexible payment options.

Neil Patel reports that 56% of customers expect a variety of payment options on a checkout page. Many of your shoppers want the ability to pay in equal installments — and in times of economic uncertainty, even more people look for ways to pay flexibly.

The goodwill you’ll generate, even from non-buyers, can only be a good thing for your business and can lead to positive word-of-mouth recommendations, better reviews, and greater customer loyalty.

4. You can reduce overhead and admin costs

Facilitating down payments and monthly payment plans yourself invites several frustrating administrative problems, and potentially deprives you of revenue if the customer stops making payments before completing them all.

Managing payment plans is a time-consuming, everyday job. Credit cards can expire before all the payments have been made, requiring you to follow up. You have to remind customers of upcoming payments. Facilitating product returns becomes more complicated because you may have to sort through payment history to understand the proper refund to issue. You’ll spend time chasing late fees that are nearly impossible to recover.

But dedicated BNPL solutions take care of all these things. Once a shopper completes a purchase, you’re paid for the full transaction within days. The buy now, pay later provider services the account and takes on the risk, from chargebacks to fraud.

Ultimately, the process is seamless for both you and your customer, and you don’t have to shoulder any of the risk.

6. You’ll reach more customers

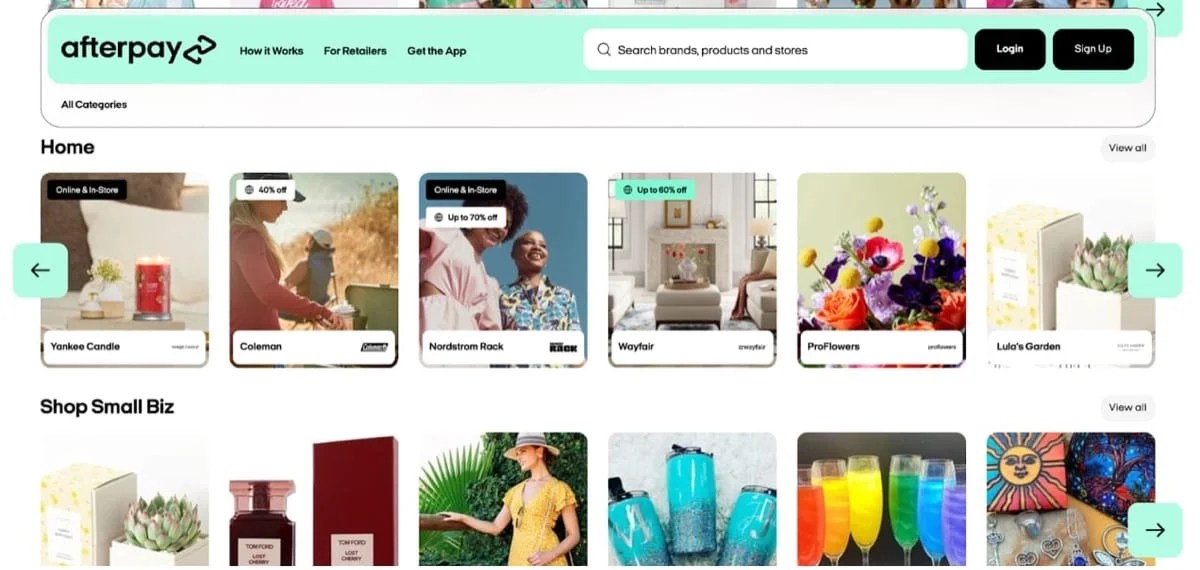

Affirm, Afterpay, and Klarna have directories where customers can find trusted stores offering a BNPL plan. Each provider has millions of users and nearly unlimited potential for sending highly-valuable traffic to your store.

Klarna also offers a performance-based media mix that places your business in front of high-intent shoppers across multiple channels — from awareness to conversion — leveraging rich shopper insights and point-of-purchase attribution across Klarna surfaces.

BNPL offerings are especially attractive to younger customers who may have lower credit scores, no credit card, or no ability to pay for large purchases in a single payment. In fact, Afterpay’s network of 20 million global customers is made up of 73% Gen Z and millennial users.

According to Afterpay, retailers find that 30% of Afterpay shoppers are new to their brand, making it a great way to reach and win new customers.

BNPL options for WooCommerce

↑ Back to topAs always, WooCommerce allows for incredible flexibility when it comes to BNPL options. Stores can integrate with Affirm, Afterpay, and Klarna using three primary methods:

- Standalone extensions: All three BNPL providers — Affirm, Afterpay, and Klarna — offer individual extensions that you can install from the WooCommerce marketplace. This is a great way to go if you want to add to an existing payment stack.

- WooPayments: With WooPayments, you can offer BNPL options to your customers in addition to credit and debit cards, digital wallets like Apple Pay, Tap to Pay (for in-store purchases), and more. There’s no need for additional extensions or switching between tabs. Plus, existing WooPayments users benefit from a streamlined approval process.

- The Stripe extension: If you’re already using Stripe on your store, you can seamlessly add BNPL options through the official Stripe for WooCommerce extension.

All three of these methods will enable you to offer BNPL on your store — the best option depends on how you want to manage your overall payment stack.

Choosing the right options

↑ Back to topAffirm, Afterpay, and Klarna are all excellent BNPL providers. So how do you choose between them? And does it make sense to use more than one?

Ultimately, this will depend on the needs of your business, your global reach, and the preferences of your audience. You can also use more than one BNPL provider if that makes sense for your business.

In some cases, merchants may choose to offer multiple BNPL options depending on regions served and payment preferences.

Here’s a table that summarizes some of the key differences between the three providers:

| Affirm | Afterpay | Klarna | |

| Regional availability | U.S., Canada, U.K. | U.S., Canada, U.K., Australia, New Zealand | Available globally in 26 markets, including the U.S., Canada, Mexico, the U.K., most of Europe, Australia, New Zealand |

| Payment methods | Pay in 30, Pay in 4, and monthly installments up to 36 months, for carts of $35 to $30,000 | Pay in 4, monthly installments | Pay in 30 days, Pay in 3 or 4, Financing, and Pay in Full |

| Support options for merchants | A dedicated merchant support, a Client Success Manager for larger businesses, a self-service merchant portal, a knowledgebase | A dedicated Technical Merchant Services lead, a Partner Marketing lead, an Account Manager, 24/7 access to technical support | Onboarding assistance, a dedicated merchant portal, 24/7 support for technical and operational queries |

| Support options for customers | 24/7 support through a variety of channels, a self-serve customer help center, an in-app and web support | A help center, a support ticketing system | 24/7 support via live chat or phone |

| Best for | Stores with high-value products or high AOV, and customers planning major life purchases | An AOV of up to $3,000 (for Pay-in-4), purchase totals of between $100 and $10,000 (for Pay Monthly), a target audience made up of students | Businesses of all sizes and verticals looking for all-in-one payment method |

Now, let’s dive a bit further into each solution.

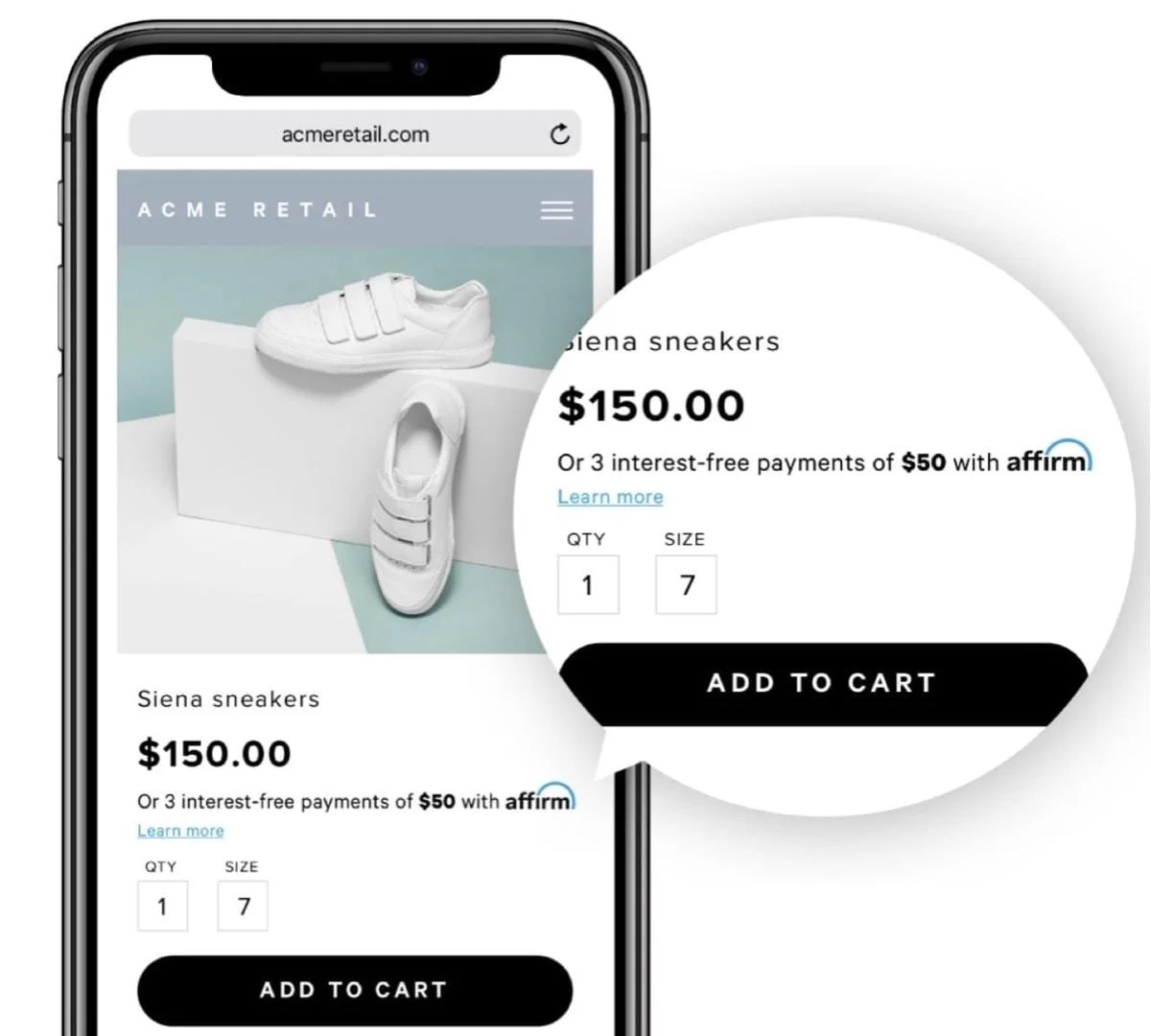

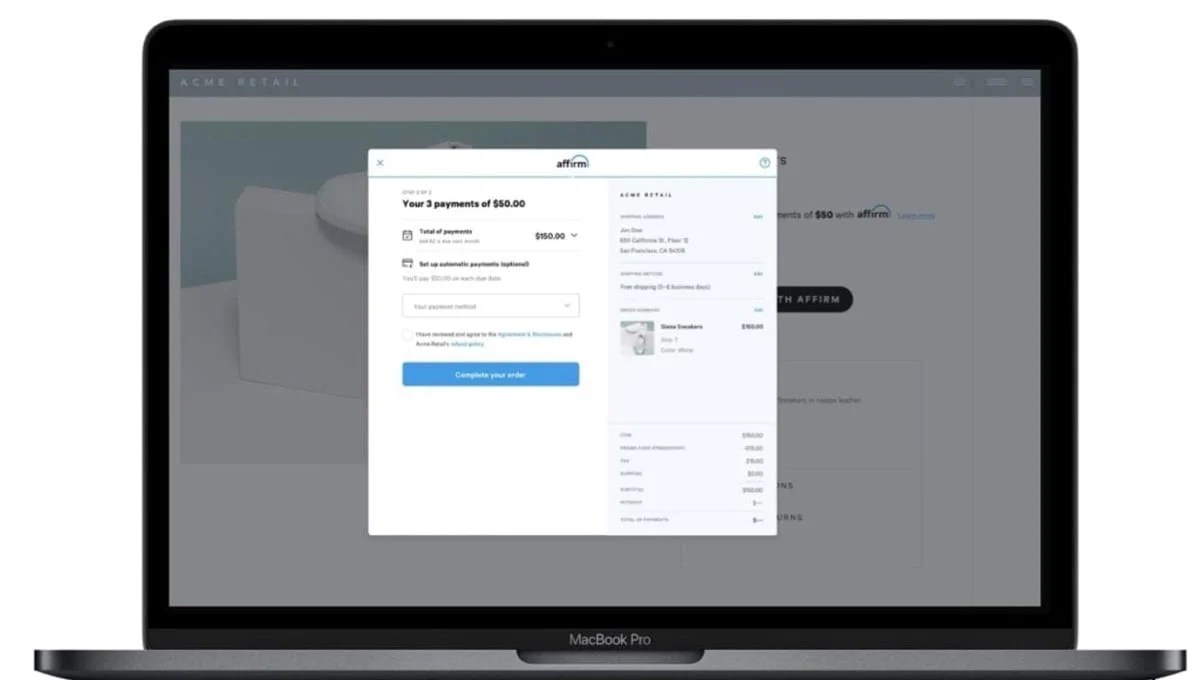

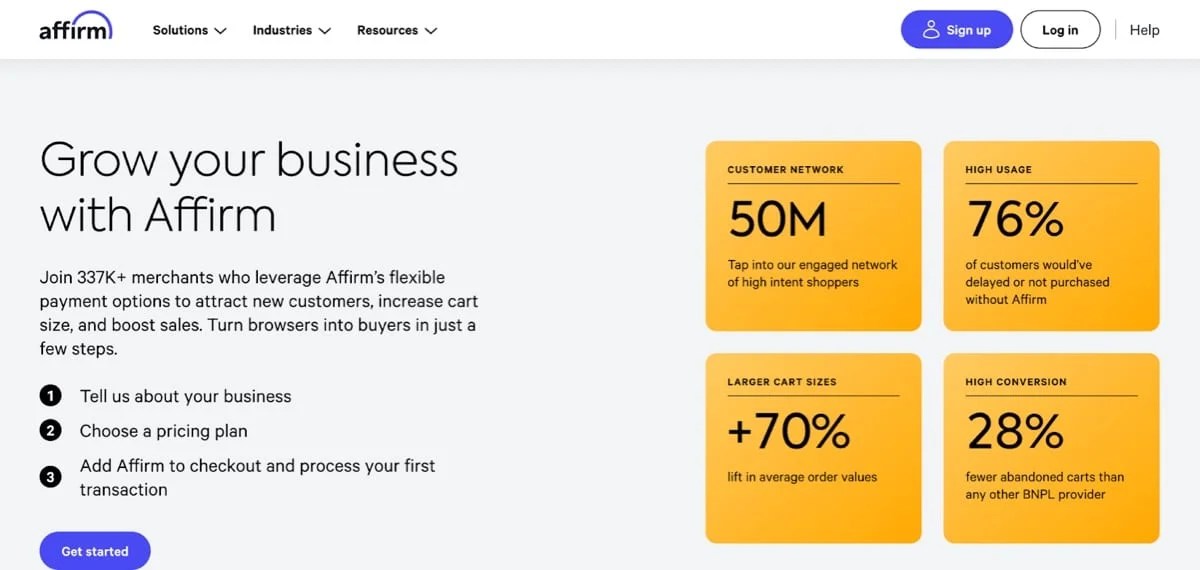

Affirm

Affirm is a buy now, pay later solution that allows customers to purchase items immediately and pay for them over time in fixed, transparent installments.* Retail partners get paid for the purchase upfront, just like a credit card transaction, with no repayment risk. By offering Affirm at checkout, qualified shoppers have more payment flexibility and higher purchasing power, which can increase sales, boost average order value, and build customer trust.

*Subject to eligibility. See lending terms at affirm.com/disclosures.

Quick stats:

- Merchants that offer Affirm report an over 70% lift in average cart sizes.

- Merchants have seen a 20% average increase in conversion rates after offering Affirm.

- Affirm has a highly-engaged network, with 94% of transactions coming from repeat customers.

What sets Affirm apart:

- No late fees or hidden costs: Affirm never charges customers late fees, prepayment fees, or any other hidden service fees. The purchase amount that shoppers see at checkout is what they’ll pay.

- Advanced underwriting: Affirm uses a proprietary, AI- and machine learning-powered underwriting model that assesses a customer’s ability to repay in real time. This allows for a more nuanced credit decision than a simple “one-size-fits-all” approach and leads to more customer approvals without hard credit checks.

- Maximum flexibility in terms: Affirm offers the broadest range of repayment options in the industry, from the standard interest-free “Pay in 4” option to longer monthly installment plans up to 36 months or more for high-value purchases.

- A focus on higher AOV: While suitable for smaller carts, Affirm’s model is particularly effective for merchants that sell higher-priced goods, as longer-term financing makes expensive items more accessible.

Best for:

- High-value products like furniture, home goods, electronics, fitness equipment, travel packages, luxury fashion, and auto parts/services.

- Stores with a high average order value (AOV).

- Budget-conscious consumers who want to spread their payments out over time without the risk of compounding interest or hidden fees.

- Customers planning major life purchases (e.g., furnishing a new home, buying an engagement ring, etc.).

Afterpay

With Cash App Afterpay, merchants can tap into 57M+ incremental monthly active customers. Let shoppers pay in four installments or pay monthly, while driving incremental sales and growth for your business. Cash App Afterpay is trusted by more than 425K top brands globally.

Quick stats:

- 95% of Afterpay installments are paid on time and 98% do not incur a late fee.

- Afterpay has more than 57 million monthly active users.

- Nearly 50% of Afterpay consumers’ annual spending is with Afterpay.

- 97% of Afterpay customers never contact support with problems.

What sets Afterpay apart:

- Its popularity with Millennials and Gen Z: Approximately 50% of Millennials and Gen Z consider Afterpay to be the most trusted BNPL brand.

- An advanced underwriting model: Cash App’s proprietary underwriting model is powered by first-party data from customers’ money movement, such as paycheck deposits and peer-to-peer payments. It’s significantly more effective at predicting positive outcomes and reducing risk, particularly for younger consumers who are often underbanked and underserved by traditional financial institutions.

- A loyal customer base: There are several points along the purchase journey where Afterpay ensures that customers understand the value proposition and their repayment schedules. That trust translates into unmatched buyer loyalty, with the most frequent customers shopping with Afterpay 24 times per year.

Best for:

- Merchants with an average order value of up to $3,000 (for Pay-in-4).

- Stores with average purchase totals of between $100 and $10,000 (for Pay Monthly).

- A target audience made up of students — Afterpay was named the best BNPL solution for students.

Klarna

Klarna provides a unified platform for payments, checkout, and post-purchase experiences. Its infrastructure powers a commerce network designed to improve efficiency and conversion across the purchase journey.

Quick stats:

- Klarna partners see 20% higher checkout conversion rates and 46% higher repeat purchase frequency.

- Flexible options with Klarna increase average order value by 40%.

What sets Klarna apart:

- The ability to drive more sales: Klarna increases conversions by offering flexible, trusted payment choices that align with customer expectations.

- A seamless and secure online shopping experience: Klarna merchants report a 46% increase in purchase frequency, driven by the trust and convenience that comes with a quality, simple checkout.

- The ability to reach new shoppers: Tap into Klarna’s global network of more than 114 million high-intent shoppers. In-app placements, campaigns, and marketing tools increase merchant visibility and discovery across key markets.

- Upfront payment with full protection: As a licensed bank, Klarna assumes both credit and fraud risk so merchants are paid up front, every time, with full payment guarantees and robust fraud protection.

- Growth beyond checkout: Klarna extends its commerce network beyond payments by helping merchants influence shoppers before they reach checkout, with performance-driven placements and point-of-purchase attribution across Klarna surfaces.

Best for:

Klarna works well for a wide range of merchants and supports both low and high AOV transactions. Klarna is particularly popular with Gen Z and Millennial audiences, so it could be a good choice if those generations are a key part of your target demographic.

How to add BNPL to your WooCommerce store

↑ Back to topReady to increase conversions and average order values while providing a helpful resource to customers? There are a few different ways to start offering buy now, pay later options on your store:

Standalone extensions

As we mentioned earlier on, Affirm, Afterpay, and Klarna each provide their own extensions, available from the WooCommerce Marketplace. Remember, you can use more than one at a time.

Once your chosen extensions are installed, you can set up BNPL within the payment settings in your WooCommerce dashboard. For provider-specific instructions, visit the WooCommerce Documentation hub and search for the extension you’d like to use.

WooPayments

With the WooPayments BNPL integration, you can view all orders and transactions from a single dashboard — no more jumping between windows! And you don’t need to install and manage an extra extension.

If you don’t already use WooPayments, there’s never been a better time to start. Not only will you benefit from the BNPL services discussed here, but you’ll be able to:

- Keep all of your transactions in a single place.

- Offer contactless payments, digital wallets like Apple Pay and Google Pay, and Tap to Pay.

- Sync order information and inventory updates between your online and offline sales.

- Accept 135+ currencies.

- Integrate with tools for subscriptions, memberships, and more.

Once the WooPayments extension is installed and activated, you can enable BNPL options directly from your dashboard, alongside cards, wallets, and other payment methods.

Review the official WooPayments documentation for fast installation and instructions for getting started.

Stripe

If you’re using Stripe, you can activate BNPL through your existing Stripe extension settings in your WooCommerce dashboard. Read the official documentation from Stripe and the WooCommerce extension for full details about using BNPL.

Get more conversions, higher AOVs, and happier customers with BNPL

↑ Back to topBuy now, pay later gives customers more flexibility at checkout and drives stronger results for stores. Services like Affirm, Afterpay, and Klarna let shoppers spread out payments without delaying their purchase, which leads to higher order values and fewer abandoned carts.

Are you curious about BNPL? Learn more about how it can benefit your store.

Ready to dive in? Activate BNPL using WooPayments, Stripe, or an extension from Affirm, Afterpay, or Klarna.

Frequently asked questions (FAQ)

↑ Back to topIs BNPL risky for merchants?

Buy now, pay later providers handle customer approval and pay merchants the full purchase amount up front so it doesn’t impact payment flow. They also assume responsibility for fraud and repayment problems, so the process is risk-free for merchants and provides nearly unlimited upside potential.

Do you need any special tools to offer buy now, pay later with WooCommerce?

Merchants using WooPayments or Stripe already have access to BNPL solutions from Affirm, Afterpay, and Klarna. You can activate one or more of these providers in your dashboard and get rolling right away.

If you don’t use WooPayments or Stripe, you’ll need to install an extension like those provided directly from Affirm, Afterpay, and Klarna. Each one will have specific registration and activation instructions. Other payment gateways may also support integrations with these providers in certain regions, and this may change over time.

Are there limits to BNPL?

Yes, the ability to offer BNPL solutions on your site is subject to merchant approval and customers’ ability to make purchases using BNPL is subject to their own approval and limits. There are maximum order values for each platform, as well as limitations based on geography, currency, payment history, and more.

About