The Disability VAT Exemption extension for WooCommerce allows customers and charities to declare themselves VAT Exempt in checkout.

Installation

↑ Back to top- Download the .zip file from your WooCommerce account.

- Go to: WordPress Admin > Plugins > Add New and Upload Plugin with the file you downloaded with Choose File.

- Install Now and Activate the extension.

More information at: Install and Activate Plugins/Extensions.

Settings

↑ Back to topTo configure the extension, go to: WooCommerce > Settings > Tax.

- Require Disability and Charity fields? – by default the fields are optional. If this option is not checked, a customer can select the Disability VAT Exemption (or Charity VAT Exemption, if selected) checkbox and proceed with checkout, without entering a name or reason

- Disability Introduction Message – adds a default disability message that automatically populates, and overwrites, the next field

- Disability Message – Shown above the disability information fields on the checkout.

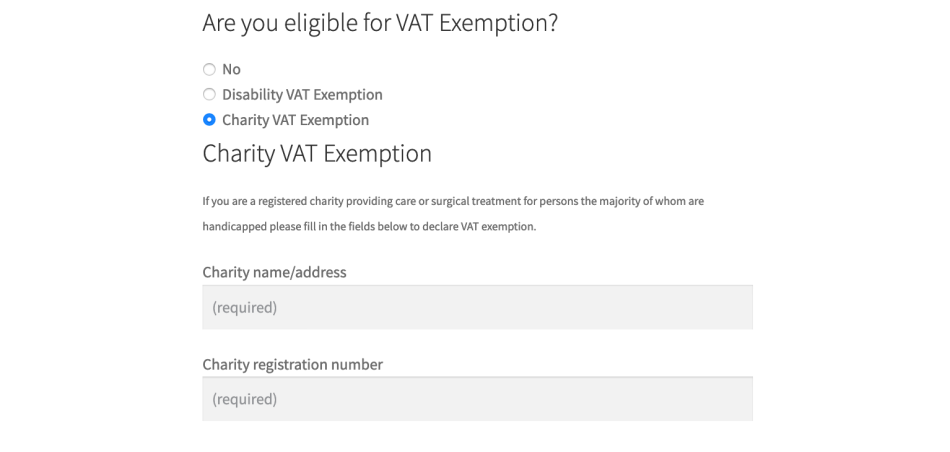

- Show charity form? – When checked, enables Charity VAT Exemption as an additional option

- Charity Introduction Message – adds a default charity message that automatically populates, and overwrites, the next field

- Charity Message – Shown above the charity information fields on the checkout.

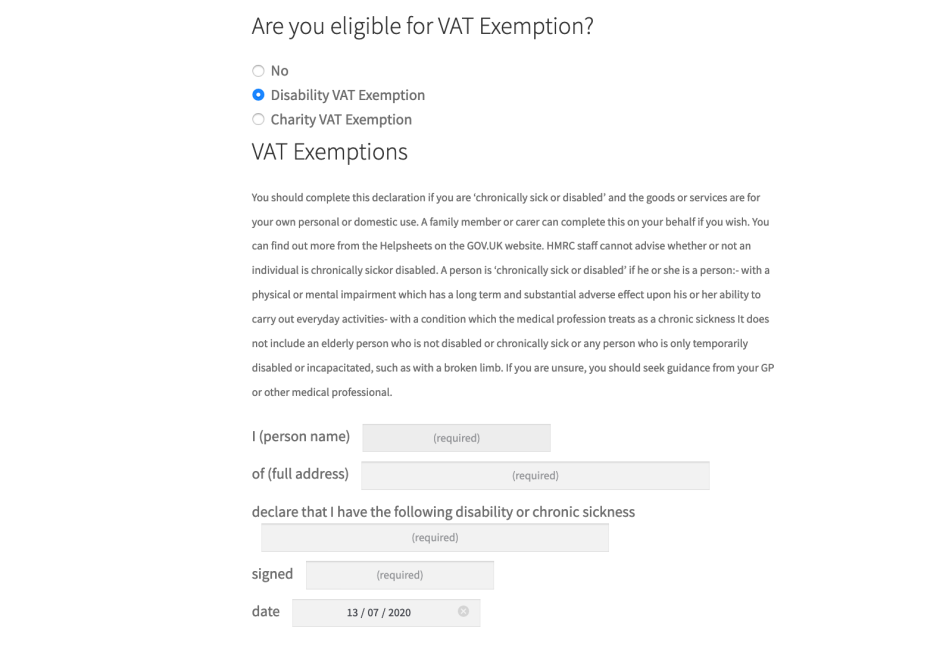

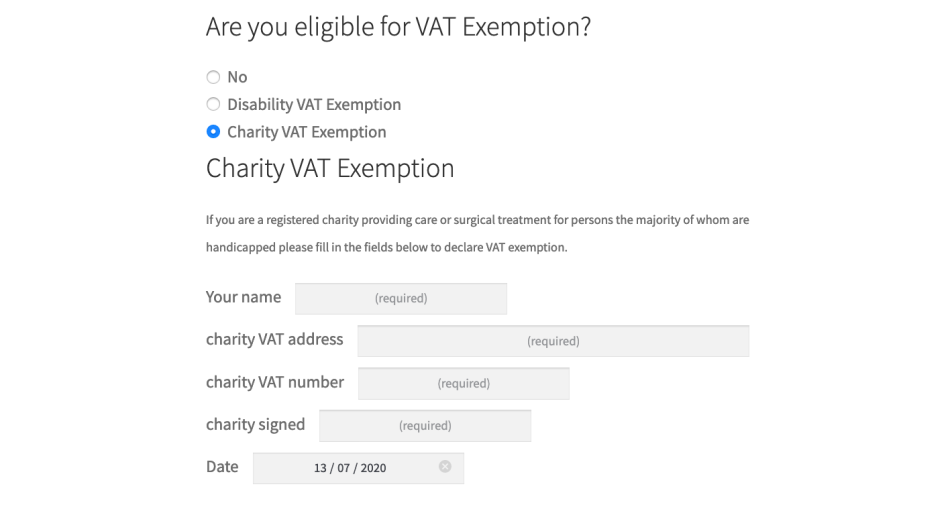

- Show Advanced Fields? – When checked, ads additional fields for Disability VAT Exemption (person’s name, address, disability or chronic sickness details, signed, date) and Charity VAT Exemption (person’s name, charity VAT address, charity VAT number, charity signed, date).

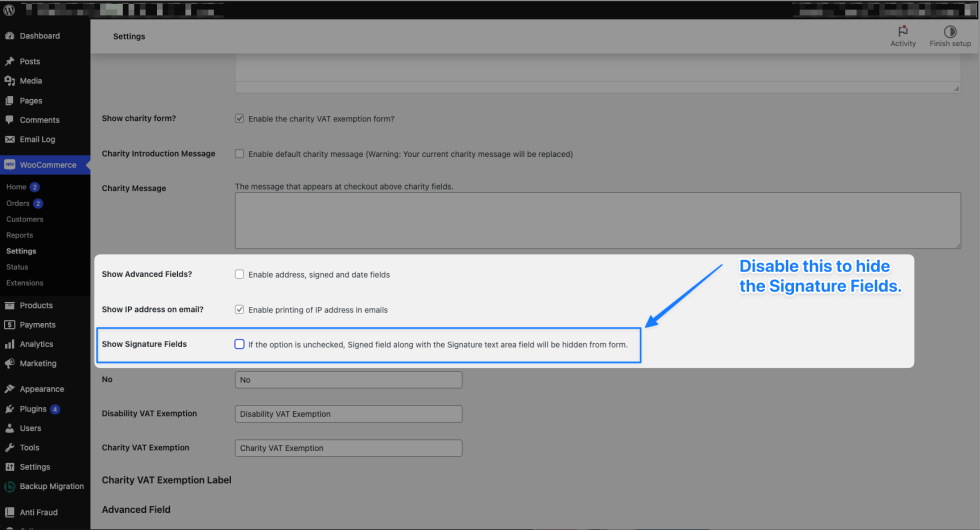

- Show IP address on email? – records and prints the IP address of the purchaser, in order-related emails.

Usage

↑ Back to topAdministration

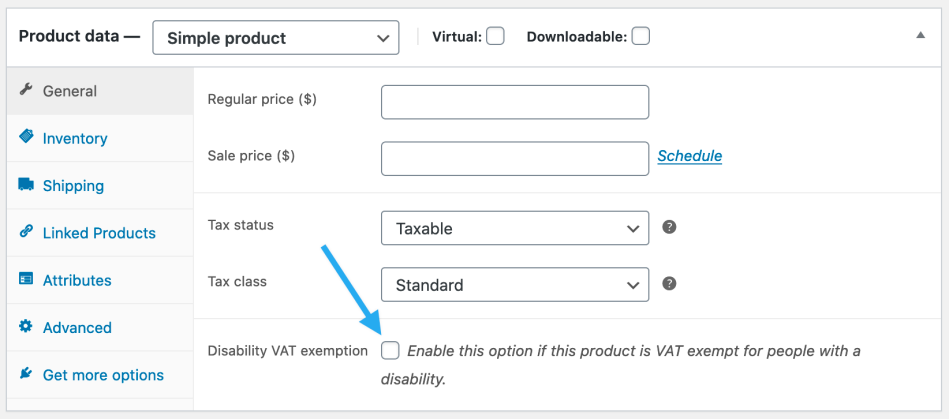

↑ Back to topTo add the Disability VAT Exemption to your products, select “Disability VAT exemption” in the Product Data box under the General tab.

Prices

↑ Back to topPrices are automatically displayed without tax if an eligible user is logged in.

Checkout Page

↑ Back to topOn checkout, a form is shown for disability reason and/or charity name and registration number, and will vary depending on the options selected in the Settings, as explained above:

After inputting either a disability reason, or a charity name and number, items are taxed at your zero rate. You must have a zero-rate tax class setup in WooCommerce > Settings > Taxes for this to work.

Reasons and other input are stored in the order’s custom fields, and also shown in order emails.

How to disable the Signature Fields?

Questions

↑ Back to topHave a question before you buy? Please fill out this pre-sales form.

Already purchased and need some assistance? Get in touch with a Happiness Engineer via the Help Desk.