Yes! Allowing your customers to securely save their payment methods to their account provides them with an easy way to make future purchases without having to re-enter all of their payment details.

If the Enable saved payment methods setting is enabled, there are two ways for customers to save their payment methods:

- During checkout

- On the My Account page

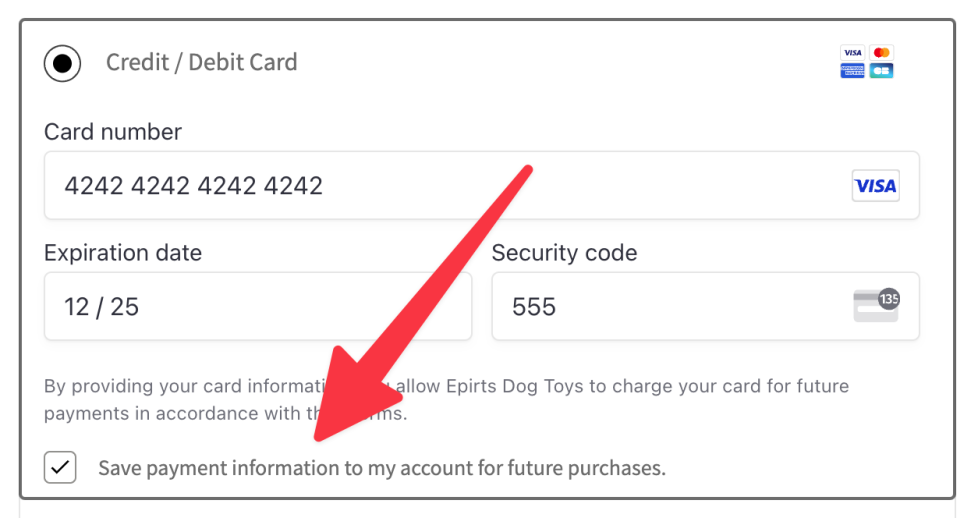

Saving payment details during checkout

↑ Back to topIf a customer is logged into your site during checkout, they will have the option to save their payment details to their account. To do so, they can check the Save payment information to my account for future purchases box.

Once the order is placed, the payment method they saved can be managed from their My Account page.

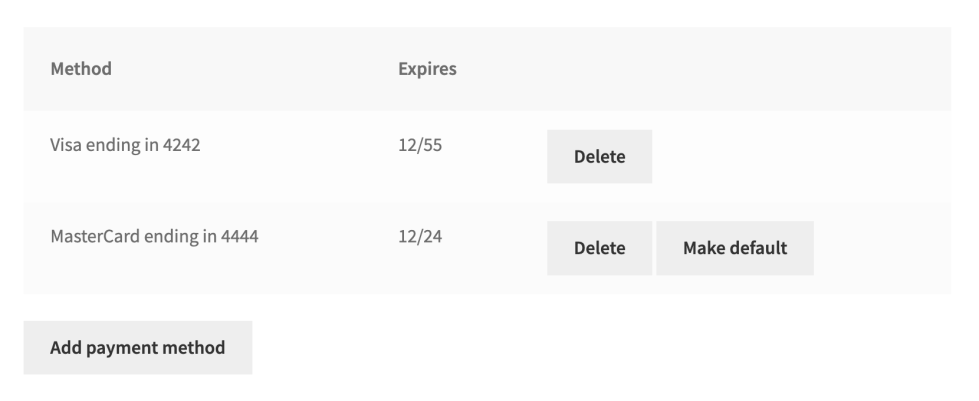

Saving payment details via the My Account page

↑ Back to topOn the My Account > Payment Methods page, customers can add, view, and remove saved payment methods. They can also specify a default payment method, which will be the first option selected when they return to your checkout page in the future.

Which payment methods can be saved?

↑ Back to topThe payments methods that can be saved to a customer’s account are:

- Credit/debit cards

- ACH

- BACS (only during checkout)

- Bancontact

- BECS

- Canada PADs

- iDEAL

- SEPA Direct Debit

Is saving a payment method secure?

↑ Back to topYes.

When a customer chooses to save their payment details for future use, or when they purchase a subscription product, your site needs to “remember” their payment details in order to use them again in the future.

The Stripe extension uses a method called “tokenization” to do this. In short, it means that the exact payment method details (such as the card number and CVC code) are not stored directly on your site.

For more information on how tokenization works, please see Stripe’s guide.