When a credit or debit card is charged via WooPayments, we submit the card security code (also called a CVC, CVV, or CSC) and parts of the billing address to the card issuer for verification. The issuer then checks these against the information they have on file.

If the information given by your customer doesn’t match the information returned by the card issuer, one or more of the verification checks will fail. This may or may not cause the entire transaction to fail.

You can see the result of the verification checks by opening a specific transaction under Payments > Transactions and scrolling down to the Payment method section.

Card security code checks

↑ Back to topThe card security code (again, usually called a CVC, CVV, or CSC) is the 3 or 4-digit number printed on the card itself. When the cardholder places an order, the card security code they entered is verified with the card issuer.

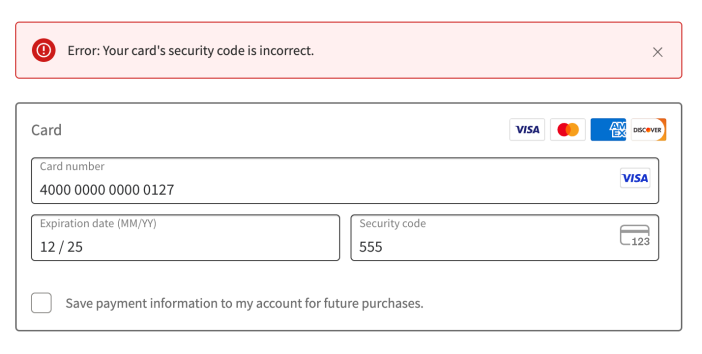

If the code they entered is incorrect, the transaction will fail and the customer will be alerted to that during checkout:

Some types of card payments, like express checkouts and subscription renewals, do not utilize CVC checks. These transactions will still be processed though, because not using the CVC check is not equivalent to the check actually failing. (Some banks also opt not to perform the CVC check, which has the same effect: a successful transaction.)

The CVC check cannot be disabled, and a CVC check failure will always result in the transaction being blocked. This behavior cannot be modified in any way.

Billing address checks

↑ Back to topBilling address checks (also called AVS checks) ensure that the address and postal code entered by the customer match the information on file with the card issuer.

Failing one or both of the AVS checks will not automatically block the transaction. This is because AVS checks often fail for legitimate reasons, such as:

- The customer simply entered their address incorrectly.

- The customer moved and failed to inform their bank.

For example, if the customer includes a typo in their street name, but the CVC and post code were entered correctly, the charge will succeed despite the failed check.

If you wish, you have the option to use the WooPayments fraud protection rules to block transactions if the postal code check fails. This may help reduce fraud.

Availability

↑ Back to topThe availability of AVS checks varies by country and card issuer. Most cards issued in the U.S., Canada, and the UK support it, but availability is limited in other regions.

For example, some countries don’t use postal codes at all, and some card issuers don’t support street address verification. In such cases, the checks will say “Unavailable” or “Not checked.” Similar to the CVC check, this will not block the transaction.

Temporary authorizations

↑ Back to topWooPayments must exchange data with card issuers in order to run the CVC and AVS checks. As a result, your customer’s online banking interface may temporarily show an authorization for the charge amount. This can occur even if the charge is blocked.

These authorizations should disappear after a few days.