Buy now, pay later (also known as BNPL) payment methods allow your customers to pay for orders over time using a series of payments. For example, a customer could pay for a $2,000 USD product in four installments of $500 USD. You, the merchant, would still receive the full amount immediately — minus fees of course.

How BNPL methods work

↑ Back to topBNPL services are used by a variety of businesses to increase conversion, increase average order value, and reach new customers. The BNPL providers underwrite customers, manage the installments, and collect payments — so you can focus on your own business.

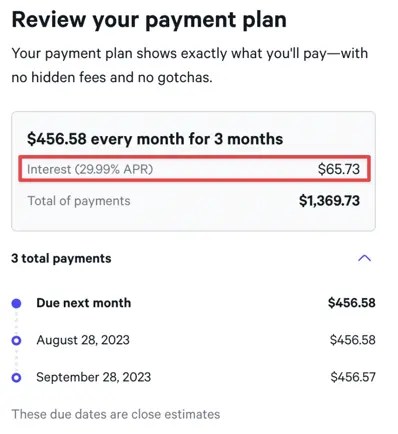

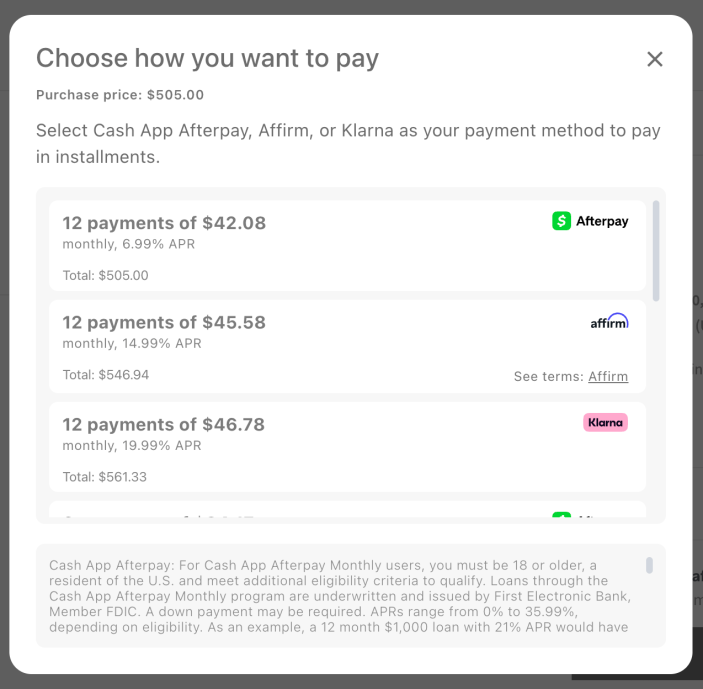

Customers will not see an increase in the product price. However, they may have an option to purchase products using a loan that accrues interest:

These loans are issued by the BNPL provider. As a result, these interest payments are collected by the BNPL provider and not by you or WooPayments.

Who should use BNPL methods

↑ Back to topBNPL payment methods may be a good fit for your business if:

- You sell high-value goods or services and want to increase conversion.

- You sell low-value goods or services and want to increase the average order value.

- You’re trying to reach customers who might not have access to credit cards.

- You want to sell to customers who may not be able to pay in full right away.

However, BNPL payment methods may not be a good fit for you if:

- You sell to businesses, as BNPL methods cannot be used for B2B transactions.

- You sell subscriptions, as BNPL methods cannot be used for subscription products.

- Most of your sales are international. BNPL methods cannot be used across borders.

BNPL fees

↑ Back to topPlease see our full fees page for a list of the fees associated with each BNPL provider.

Klarna “Pay Now” options

↑ Back to topIn addition to paying over time, Klarna sometimes offers certain customers the ability to pay the whole order amount immediately. This occurs after the customer has selected the Klarna payment method.

It’s important to note that the full Klarna fee applies in these cases, even if the customer uses Klarna’s “Pay Now” option to pay in full immediately using a card, bank transfer, or some other mechanism.

Supported providers

↑ Back to topWooPayments supports Affirm, Afterpay, and Klarna so that merchants in a wide range of countries can offer flexible ways for their customers to pay.

NOTE: Afterpay is known as “Cash App Afterpay” in the U.S. and “Clearpay” in the United Kingdom, but this page and our other documentation pages use the name Afterpay for the sake of simplicity.

Which BNPL provider(s) you can use depends on the country you chose during the WooPayments signup process.

| Account Country | Affirm | Afterpay | Klarna |

|---|---|---|---|

| Australia | ❌ | ✅ | ❌ |

| Austria | ❌ | ❌ | ✅ |

| Belgium | ❌ | ❌ | ✅ |

| Canada | ✅ | ✅ | ❌ |

| Denmark | ❌ | ❌ | ✅ |

| Finland | ❌ | ❌ | ✅ |

| France | ❌ | ❌ | Only “Pay in 3” |

| Germany | ❌ | ❌ | ✅ |

| Ireland | ❌ | ❌ | ✅ |

| Italy | ❌ | ❌ | ✅ |

| Netherlands | ❌ | ❌ | ✅ |

| New Zealand | ❌ | ✅ | ❌ |

| Norway | ❌ | ❌ | ✅ |

| Spain | ❌ | ❌ | ✅ |

| Sweden | ❌ | ❌ | ✅ |

| United Kingdom | ❌ | ✅ | ✅ |

| United States | ✅ | ✅ | ✅ |

| Other supported countries | ❌ | ❌ | ❌ |

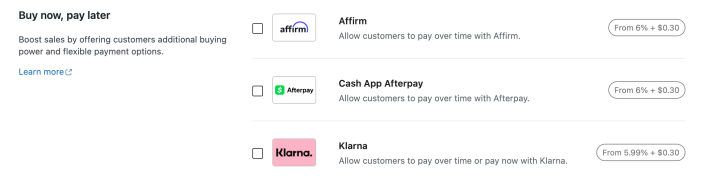

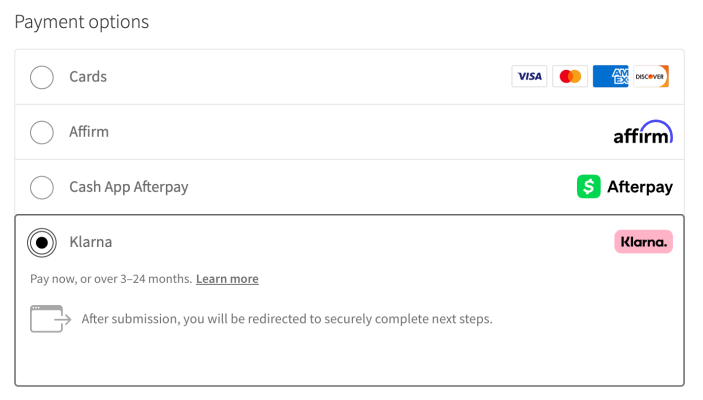

Enabling

↑ Back to topTo use a BNPL method, first navigate to Payments > Settings and find the Buy now, pay later section. From there, you can enable Affirm, Afterpay, and/or Klarna.

“More information needed”

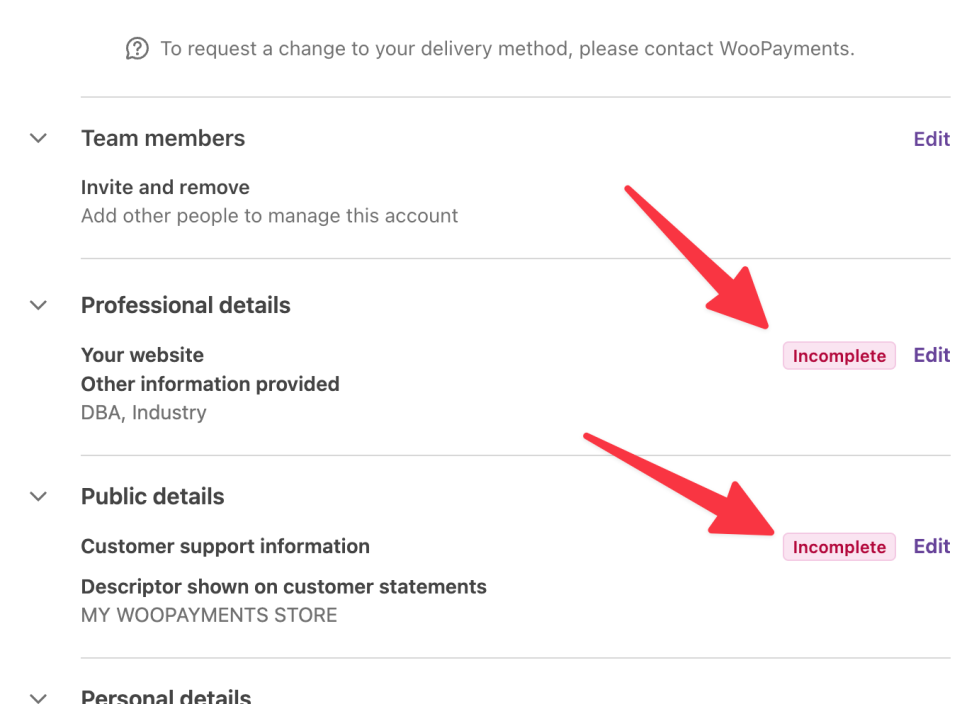

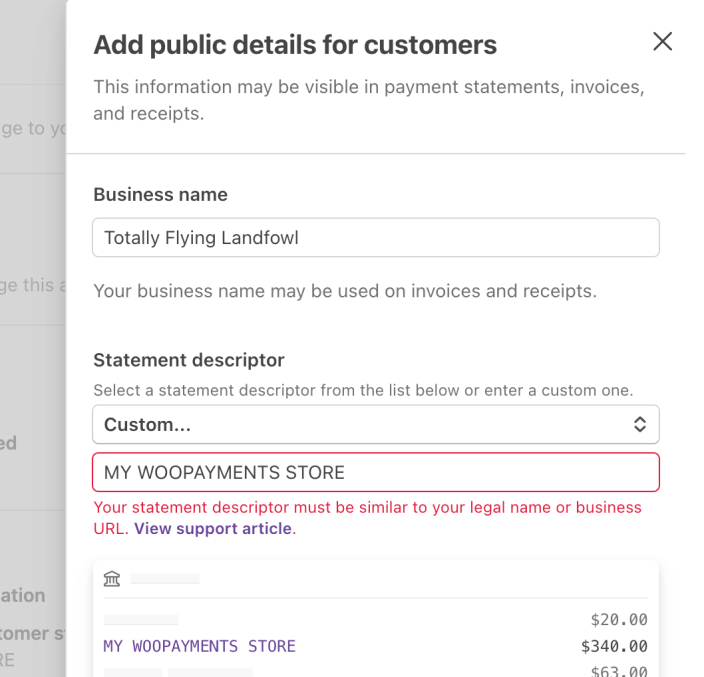

↑ Back to topIf you’re trying to enable a BNPL method, you may see a popup window that says that more information is needed. You might also see an alert next to the payment method details in Payments > Settings.

In these cases, it means that you need to provide more information before you can enable that particular BNPL payment method.

To do that, log into your Stripe dashboard and see if any information is missing there. If it is, you’ll see an alert in the Stripe dashboard.

Click the Edit link next to any sections with incomplete information and provide whatever missing details are required.

Be sure to save after you’re done. Once Stripe has verified the information you provided, the BNPL method should automatically be enabled.

Customer experience

↑ Back to topAfter you enable Affirm, Afterpay, and/or Klarna, those methods will be available to customers so long as all of the following are true:

- Their billing country matches your WooPayments account country.

- They are paying in your account country’s national currency.

- The cart total is within the minimum and maximum range.

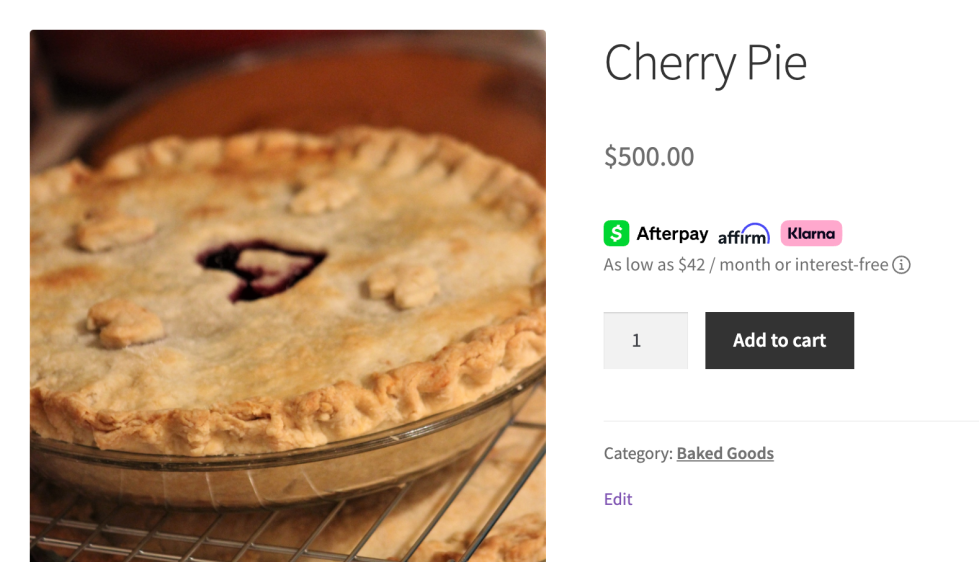

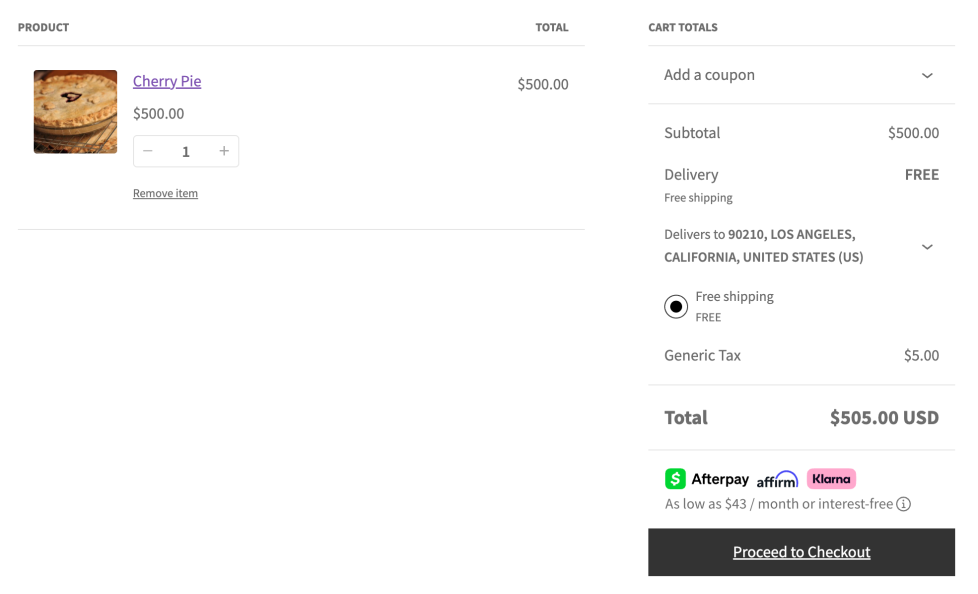

A small promotion for Affirm, Afterpay, and/or Klarna will also be shown on eligible product pages. This messaging will also be displayed on the cart page for eligible carts.

By clicking on this promotional text, customers can see a list of potential payment plans they can use during checkout. These options depend on their location, their currency, and the cart total.

Checking out

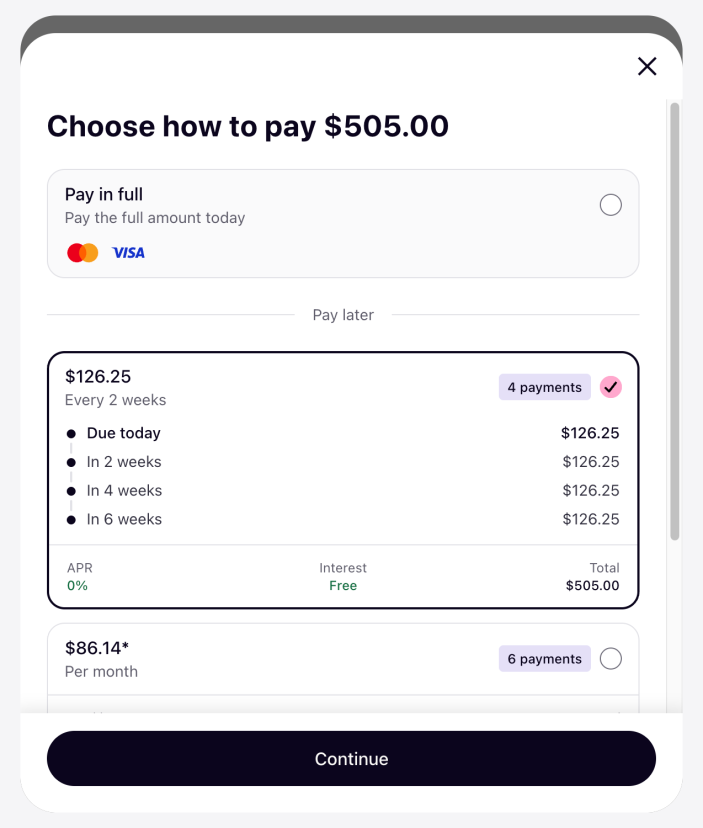

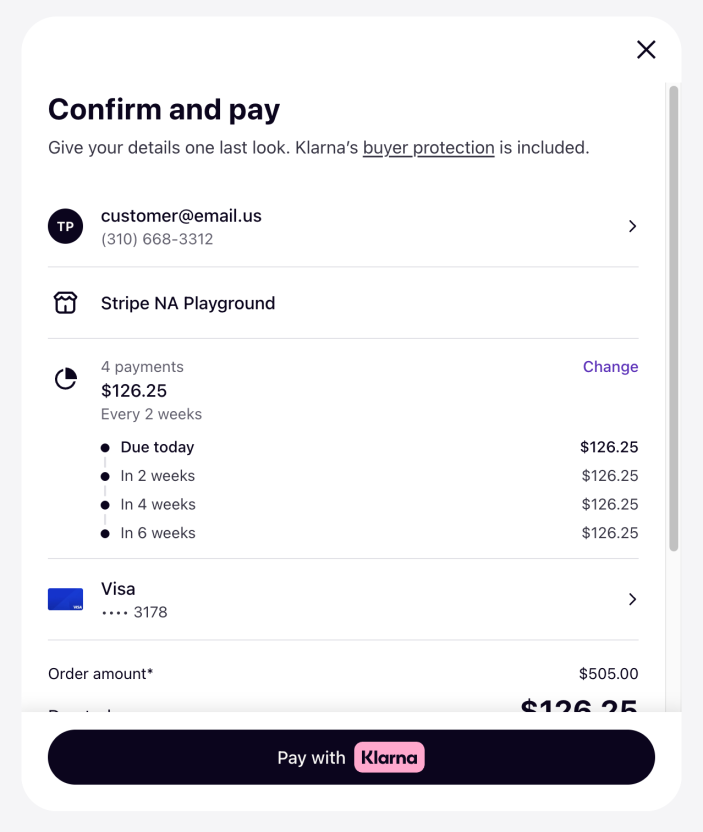

↑ Back to topDuring checkout, if the customer chooses to pay with a BNPL provider, they will be taken to that provider’s website after clicking the Place Order button. There, they can create (or log into) an account with that BNPL provider.

Next, they can accept or decline the terms of the payment plan(s) offered to them. Assuming they accept the terms, they will be returned to your site with the checkout process complete.

Affirm has a video demo and some screenshots of their customer experience. Afterpay’s documentation and Klarna’s documentation are a bit less detailed, but the customer experience is more or less the same: they log in or create an account, choose a payment plan, and finish checking out.

NOTE: BNPL providers will offer various payment plans to your customers depending on the purchase amount, the customer’s location, and other factors. Since merchants are paid in full as soon as the order is placed, the details of the customer’s payment plan (mostly) do not impact you.

Merchant experience

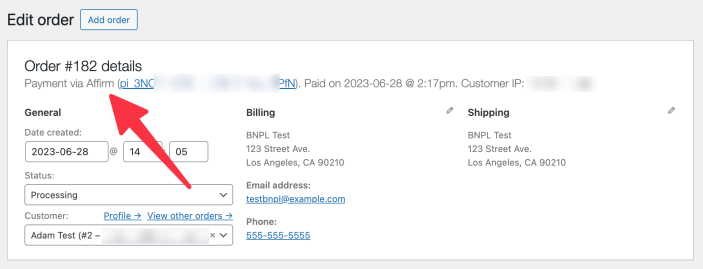

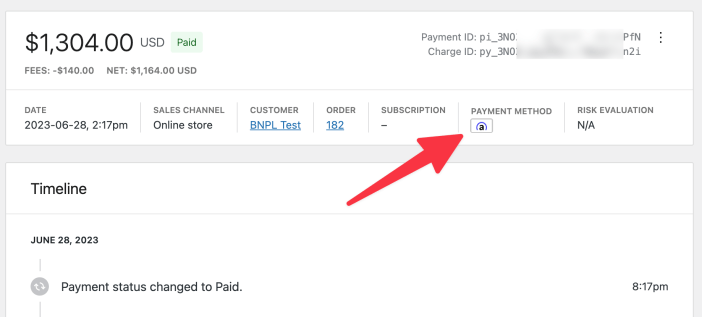

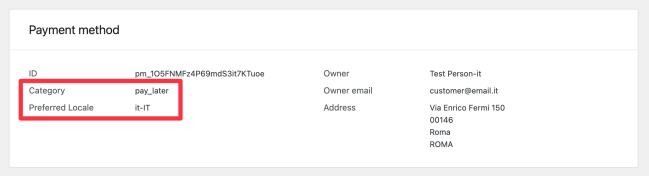

↑ Back to topOrders placed via a BNPL payment method will appear under WooCommerce > Orders and Payments > Transactions, just like orders placed with cards.

Orders paid via Klarna will have additional information on the Payments > Transactions page. This information includes:

- Category, which shares which Klarna payment method the customer chose.

- Preferred Locale, which provides locale information about the customer’s country and language.

When the transaction is complete, your WooPayments account receive the entire purchase amount immediately. The important thing to keep in mind is that the customers are not paying you over time, they are paying the BNPL provider over time.

Customer country and currency

↑ Back to topWooPayments does not support cross-border/international transactions using BNPL methods. As such, not all of your customers will be able to pay via BNPL.

Specifically, for them to be able to use BNPL methods, customers must:

- Use a billing country that matches your WooPayments account country, and

- Pay in the national currency of your account country, shown in the chart below.

| Your account country | To use BNPL, customers must be paying in… |

|---|---|

| Australia | AUD |

| Austria | EUR |

| Belgium | EUR |

| Canada | CAD |

| Denmark | DKK |

| Finland | EUR |

| France | EUR |

| Germany | EUR |

| Ireland | EUR |

| Italy | EUR |

| Netherlands | EUR |

| New Zealand | NZD |

| Norway | NOK |

| Spain | EUR |

| Sweden | SEK |

| United Kingdom | GBP |

| United States | USD |

Purchase minimums and maximums

↑ Back to topThere are minimum and maximum amounts that each BNPL provider can be used for, which can also vary by currency. These limits are shown in the charts below.

Affirm

↑ Back to top| Customer Country | Minimum Amount | Maximum Amount |

|---|---|---|

| Canada | $50 CAD | $30,000 CAD |

| United States | $50 USD | $30,000 USD |

Afterpay

↑ Back to top| Customer Country | Minimum Amount | Maximum Amount |

|---|---|---|

| Australia | $1 AUD | $2,000 AUD |

| Canada | $1 CAD | $2,000 CAD |

| New Zealand | $1 NZD | $2,000 NZD |

| United Kingdom | £1 GBP | £1,200 GBP |

| United States | $1 USD | $4,000 USD |

Klarna

↑ Back to topNOTE: Klarna allows customers to either buy now, pay later (BNPL), or pay immediately (Pay Now). Which of these are offered to customers depends on their country and the cart total. The maximums for BNPL and Pay Now are shown below for each country.

| Customer Country | Minimum Amount | Maximum BNPL Amount | Maximum Pay Now Amount |

|---|---|---|---|

| Austria | €0.10 EUR | €5,000 EUR | €10,000 EUR |

| Belgium | €1 EUR | €1,500 EUR | €10,000 EUR |

| Denmark | 1 DKK | 50,000 DKK | 100,000 DKK |

| Finland | €1 EUR | €5,000 EUR | €10,000 EUR |

| France | €35 EUR | €1,500 EUR | N/A |

| Germany | €0.10 EUR | €10,000 EUR | €10,000 EUR |

| Ireland | None | €1,000 EUR | €4,000 EUR |

| Italy | None | €1,500 EUR | €10,000 EUR |

| Netherlands | €1 EUR | €5,000 EUR | €15,000 EUR |

| Norway | None | 75,000 NOK | 100,000 NOK |

| Spain | None | €4,000 EUR | €10,000 EUR |

| Sweden | None | 100,000 SEK | 150,000 SEK |

| United Kingdom | None | £2,000 GBP | £4,000 GBP |

| United States | None | $10,000 USD | $4,000 USD |

Testing BNPL purchases

↑ Back to topBNPL methods can be used in test mode, just like other payment methods.

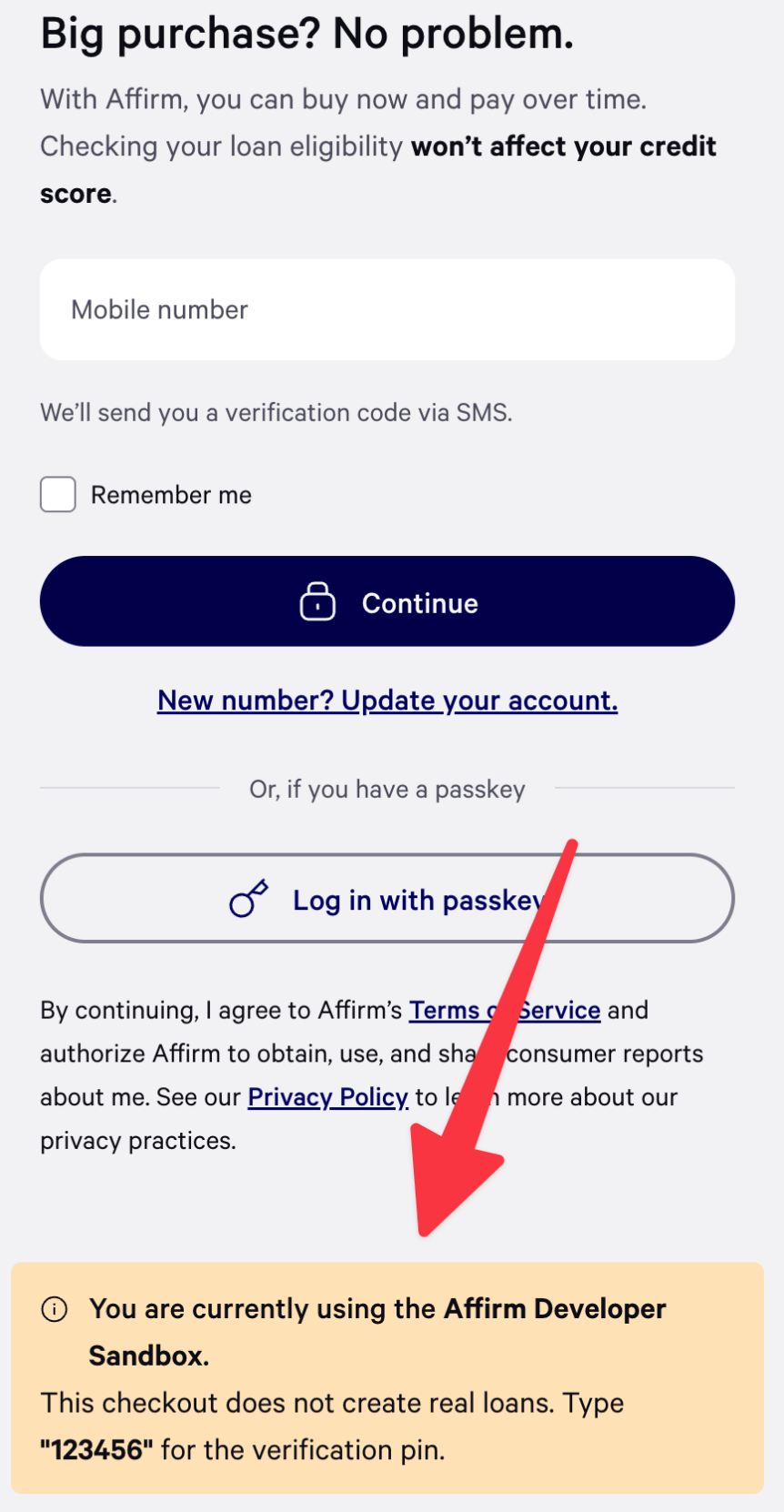

Affirm

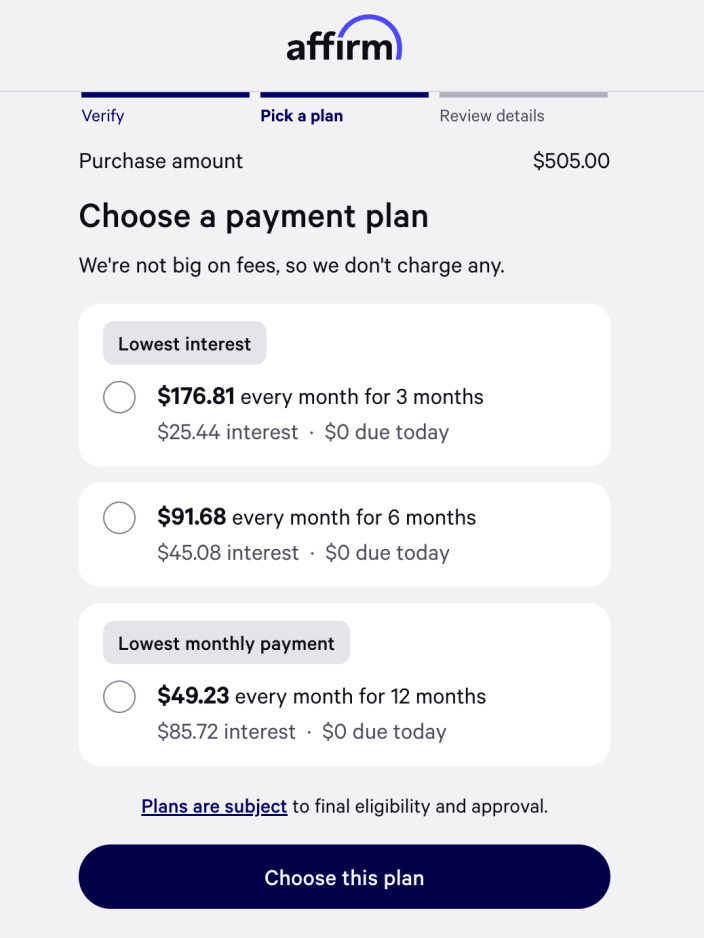

↑ Back to topYou’ll be shown the following screen after placing your test order:

Enter your mobile phone number, click Continue, and then enter 123456 as the verification code. If you’re asked for additional information, it’s best to use your real name, email, and so on to avoid triggering Affirm’s fraud detection system.

Choose from one of the available payment plans and click Choose this plan.

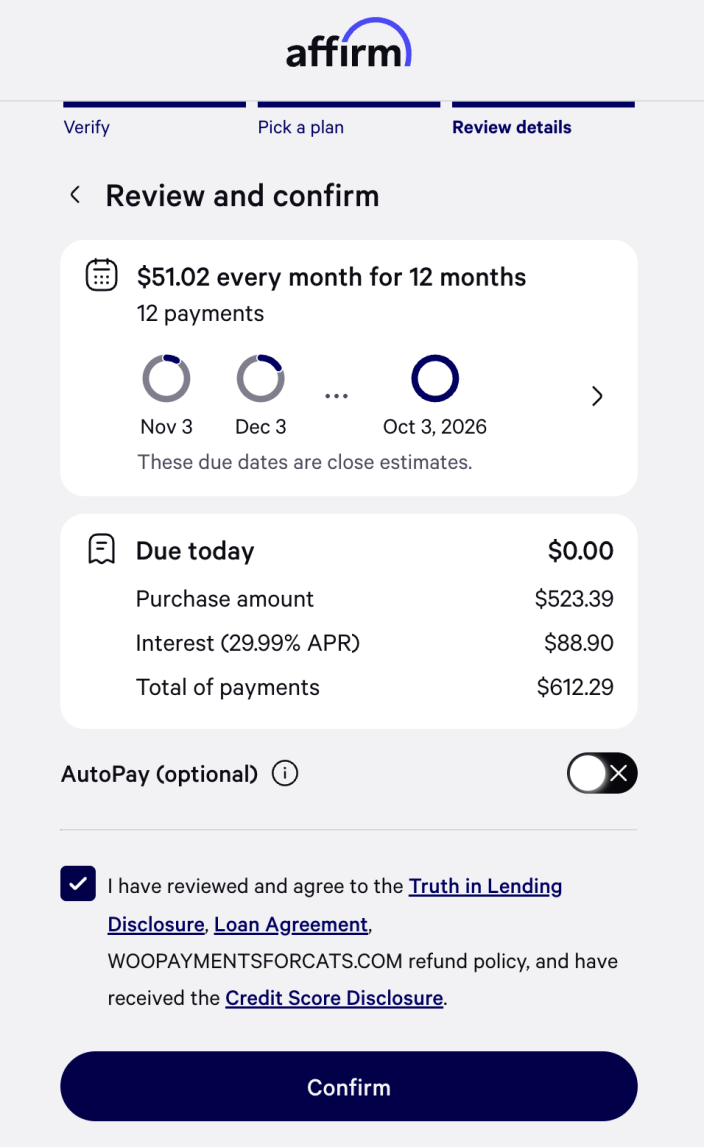

Finally, disable the AutoPay option on the summary page, check the terms and conditions checkbox, then click Confirm.

After confirming, you’ll be taken back to your site’s Order Received page as normal.

Afterpay

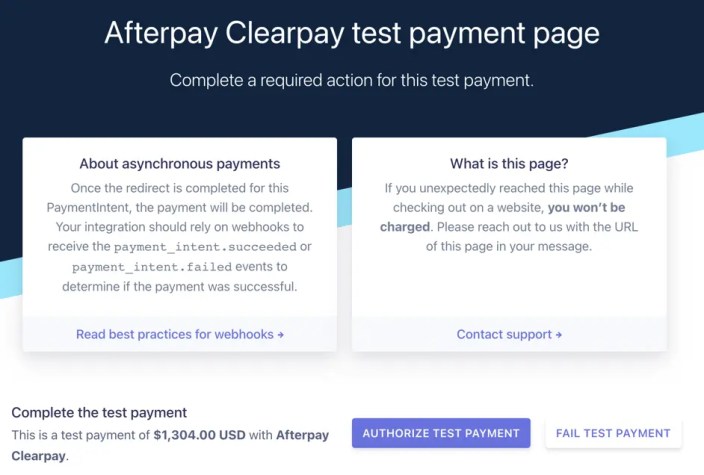

↑ Back to topYou’ll be shown the following screen after placing your test order:

Click Authorize Test Payment to test a successful order, or click Fail Test Payment to test a failed order. For successful order tests, you’ll be taken back to your site’s Order Received page as usual.

Klarna

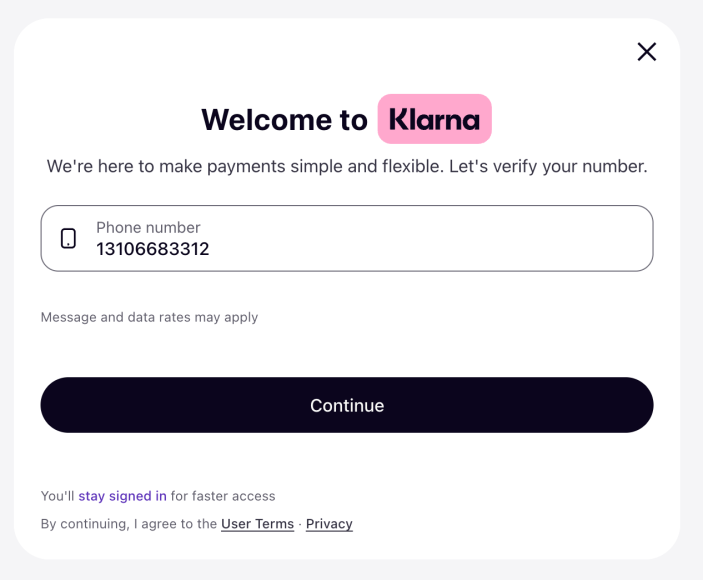

↑ Back to topIf you’re testing Klarna, you will go through a mockup of the Klarna account creation or signin flow before placing the test order. You’ll need to use a combination of Klarna’s test customer data and/or test payment data to achieve your desired outcome. (The example shown below uses U.S. data.)

After placing a test order via Klarna, you’ll be shown the following screen:

Enter a phone number from the Klarna test data and click Continue. For the SMS verification code, enter any six digits except for 999999.

Choose from one of the available payment plans and click Continue.

Click the Pay with Klarna button to finish checking out.

You’ll be taken back to your site’s Order Received page as normal.

Again, to test other purchase outcomes or situations, please see Klarna’s extensive test customer data and/or their test payment data.

Refunds

↑ Back to topYou can fully or partially refund BNPL orders just as you would for any other order. Each BNPL provider has a time window within which you must issue the refund.

| BNPL Provider | You must issue a refund within… |

|---|---|

| Affirm | 120 days of the order being placed |

| Afterpay | 180 days of the order being placed |

| Klarna | 180 days of the order being placed |

As with other payment methods in WooPayments, transaction fees are not refunded.

Disputes

↑ Back to topBecause customers must authenticate with their BNPL provider of choice during the purchase process, this helps reduce the risk of unauthorized payments. However, customers can still dispute BNPL transactions for other reasons.

Notably, the timelines for BNPL disputes can differ from those of regular card payment disputes, so we have outlined the relevant details below.

Customers must dispute the transaction within:

- Affirm: 60 days

- Afterpay: 120 days

- Klarna

- “Transaction unauthorized” disputes: 60 days.

- All other dispute reasons: 180 days.

Once a dispute has been created, you must submit evidence within:

- Affirm: 15 days

- Afterpay: 14 days

- Klarna: 13 days

After you submit evidence, the BNPL provider will decide within:

- Affirm: 15 days

- Afterpay: 30 days

- Klarna: 90 days

Aside from the timeline changes above, disputes for BNPL orders function the same as any other dispute (e.g., you can view them and submit evidence under Payments > Disputes).

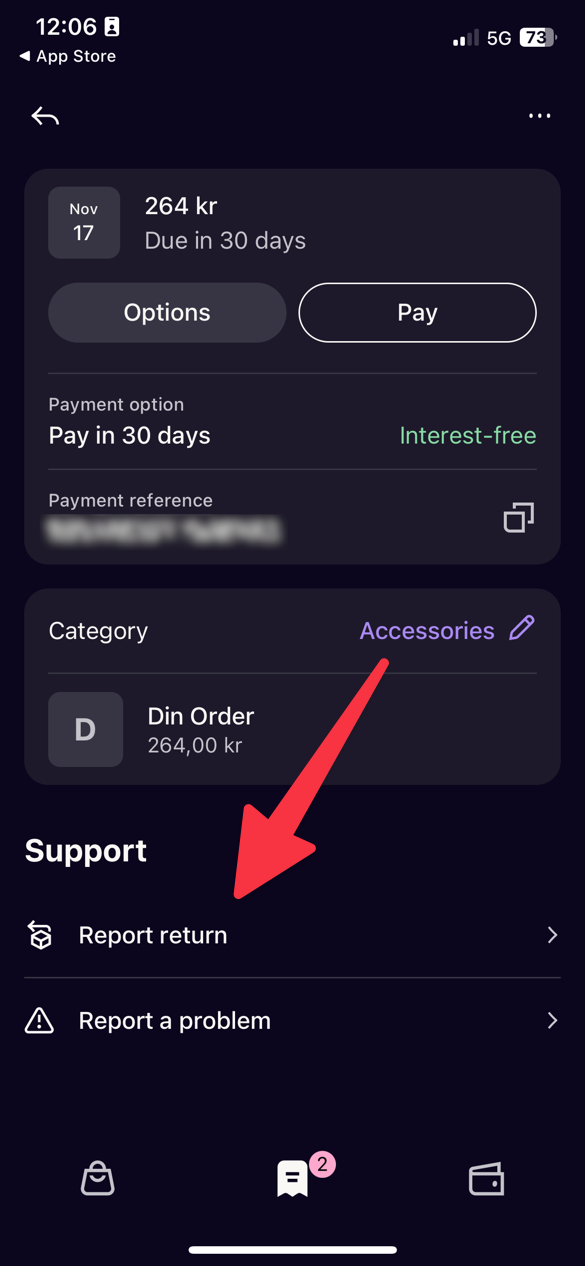

Klarna inquiries and returns

↑ Back to topThe Klarna returns process in their app and on their website is initiated by a Report return option. When a customer uses this option, and thereafter provides the return shipment information to Klarna (for physical goods), an inquiry is created.

When such an inquiry is opened, you’ll receive notifications by email and in your site’s dashboard, just as you would for any other inquiry or dispute.

Klarna inquiries do not impact your business’s rating with card networks or Klarna. However, they must be resolved within 21 calendar days. If no action is taken, the inquiry will automatically escalate to a dispute.

During the 21-day inquiry period, you cannot submit evidence. Instead, you can either:

- Resolve the inquiry by issuing a refund. (This does not result in a dispute fee.)

- Take no action and allow the inquiry to escalate to a dispute after 21 days.

Although inquiries can sound a bit alarming, they are often just part of a normal return process. We recommend contacting the customer to confirm if they’re returning the item(s). If so, you can wait for the return to arrive and then issue a refund as normal.

If the inquiry escalates to a dispute, Klarna will immediately withdraw the disputed amount and a dispute fee from your account. You’ll be notified and can choose to challenge or accept the dispute within 13 calendar days.

If you challenge the dispute and haven’t received the returned item(s), make sure to include that information in your response. After the dispute is reviewed and resolved, we will notify you through the standard dispute flow.

Prohibited products and businesses

↑ Back to topBecause BNPL payment methods inherently involve a third-party company, there are additional restrictions on the types of products you can sell with them. In addition to our general list of prohibited or restricted products, the restrictions below also apply.

Affirm

↑ Back to top- Home improvement services, including contractors

- Titled goods and auto loans, including cars, boats, and other motor vehicles

- Professional services, including legal, consulting, and accounting

- Non-fungible tokens (NFTs)

- Business-to-business (B2B)

- Subscription products

See the full list for more details.

WARNING: Affirm also requires that your site only be available in U.S. English (en_US), Canadian English (en_CA), and/or Canadian French (fr_CA). If your site is available in any other languages (e.g. via a multi-language plugin), Affirm may disable your access to their payment method.

Afterpay

↑ Back to top- Alcohol

- Donations

- Pre-orders

- Non-fungible tokens (NFTs)

- Business-to-business (B2B)

- Subscription products

See the full list for more details.

Klarna

↑ Back to top- Charities

- Political initiatives, organizations, or parties

- Subscription products

BNPL offers in Apple Pay and Google Pay

↑ Back to topApple Pay and Google Pay may offer buy now, pay later options via their interfaces. Please note that there is no way for WooPayments to control or disable these offerings, aside from disabling Apple Pay and Google Pay entirely.

Please check Apple’s and/or Google’s documentation for further details on what BNPL offerings might be included and how they work.

How do I switch from a BNPL extension?

↑ Back to topIf you already use a BNPL extension from our Marketplace (e.g., Affirm, Afterpay, or Klarna Payments), you should disable that extension before activating the matching BNPL payment method in WooPayments.