When a cardholder disputes a payment via their bank, they have to submit evidence to back up their claim. As the merchant, you can respond to that claim and give the bank evidence supporting your position.

While WooPayments cannot affect the bank’s decision, we can still help you decide what evidence to submit. This page contains those suggestions.

To submit the best evidence against a dispute, you need to keep two things in mind: the product type that the customer is disputing, and the dispute reason they gave.

Product types

↑ Back to topProduct types can include:

- Physical products are material goods, either purchased in a store or shipped.

- Physical services are intangible things like haircuts, tutoring, massages, etc.

- Digital products or services are provided virtually, like website design work.

Dispute reasons

↑ Back to topDispute reasons can include:

- Credit not processed: The customer claims they’re entitled to a full or partial refund because they returned the purchased product or didn’t fully use it, or the transaction was otherwise canceled or not fully fulfilled, but you haven’t yet provided a refund or credit.

- Duplicate: The customer claims they were charged multiple times for the same product or service that they purchased.

- Product not received: The customer claims they did not receive the products or services that they purchased from you.

- Product unacceptable: The customer received the product but claims it was defective or damaged in some way, or was not described or represented in an accurate manner prior to purchase.

- Subscription cancelled: The customer claims that you continued to charge them after a subscription was cancelled.

- Transaction unauthorized: The cardholder claims that they didn’t authorize the payment. The cardholder might have made an error and failed to recognize a legitimate charge on their credit card statement, or they might have genuinely been a victim of someone using their card fraudulently.

- Unrecognized: The customer doesn’t recognize the payment appearing on their card statement. This is basically the same as “Transaction unauthorized.”

Evidence suggestions

↑ Back to topSome basic evidence items should be submitted for any dispute. These are:

- A description of the product or service that the customer purchased.

- The customer’s billing address.

- The customer’s name and email.

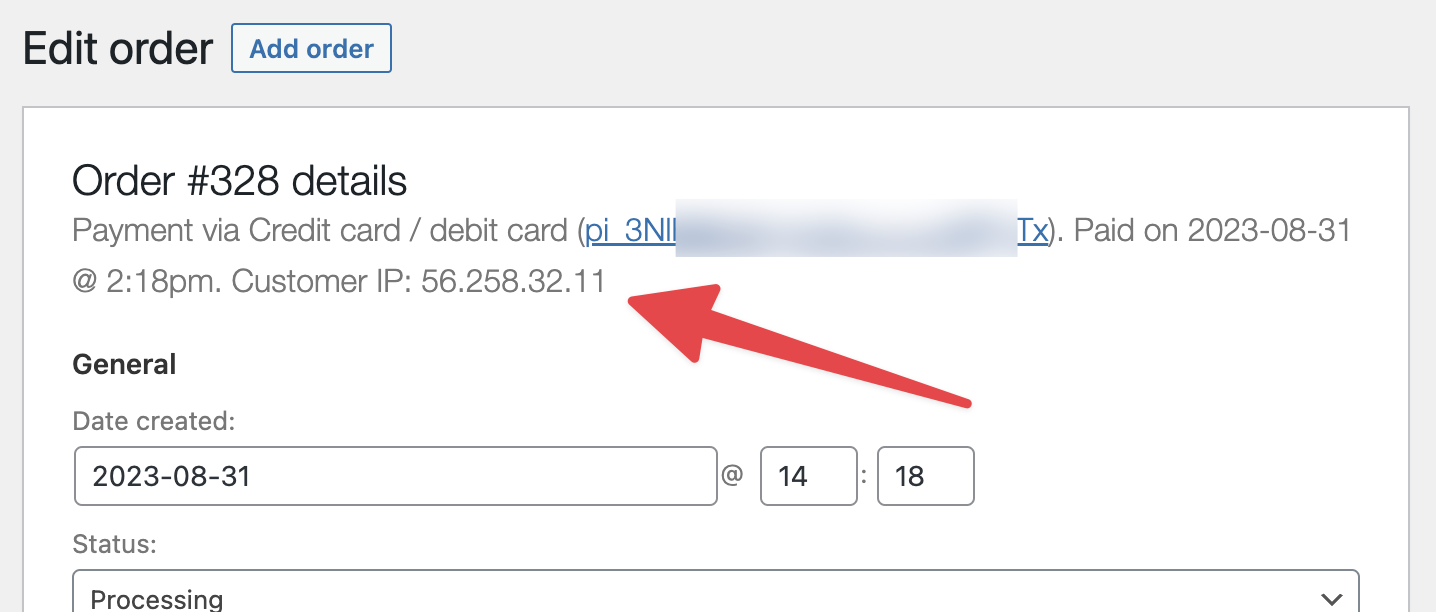

- The IP address the customer used.

- This can be found near the top of the order page:

- Any relevant document showing the customer’s signature, if you have one.

- Any communication with the customer relevant to your case.

- For example, any emails proving that they received the service, or that they used or were satisfied with the product.

- Any receipts or messages sent to the customer notifying them of the charge.

- Any documentation of the cardholder withdrawing the dispute, if they did so.

- Proof that you already compensated the customer before they filed the dispute, if you did so.

Aside from the general evidence suggestions described above, you should also submit evidence that’s more tailored to the specific dispute you are responding to. To find the specific evidence items we suggest, use the chart below.

First, find the column for the product type under dispute, then find the row for the customer’s dispute reason. The table cell where the row and column meet will link you directly to our evidence suggestions for that dispute.

| Physical Product | Physical Service | Digital Product or Service | |

|---|---|---|---|

| Credit not processed | See evidence | See evidence | See evidence |

| Duplicate | See evidence | See evidence | See evidence |

| Product not received | See evidence | See evidence | See evidence |

| Product unacceptable | See evidence | See evidence | See evidence |

| Subscription cancelled | See evidence | See evidence | See evidence |

| Transaction unauthorized | See evidence | See evidence | See evidence |

| Unrecognized | See evidence | See evidence | See evidence |

Physical Product

↑ Back to topCredit not processed

↑ Back to topTo try to win a “Credit not processed” dispute for a physical product, you should attempt to demonstrate that:

- You already issued the refund your customer is entitled to, or…

- The customer isn’t entitled to a refund, or…

- The customer withdrew their dispute.

You can do that by submitting the following items as evidence:

- The language of your refund policy, as provided to the customer. This might be:

- The text copied from your policy page.

- A screenshot of the policy on a receipt.

- A PDF of the applicable part of your business’s terms and conditions.

- An explanation of how and where the applicable policy was provided to your customer prior to purchase.

- Your explanation for why the customer isn’t entitled to a refund, or no further refund, if you already issued a partial refund.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Whether you already issued the refund the cardholder is entitled to.

- Whether or not the customer returned the merchandise in whole or in part. If they partially used the merchandise or returned it, or whether the dispute amount exceeds the value of the unused portion.

- Whether the cardholder withdrew the dispute.

Duplicate

↑ Back to topTo try to win a “Duplicate” dispute for a physical product, you should attempt to demonstrate that:

- Each payment was for a separate product or service, or…

- You already issued a refund to your customer, or…

- The customer withdrew their dispute.

You can do that by submitting the following items as evidence:

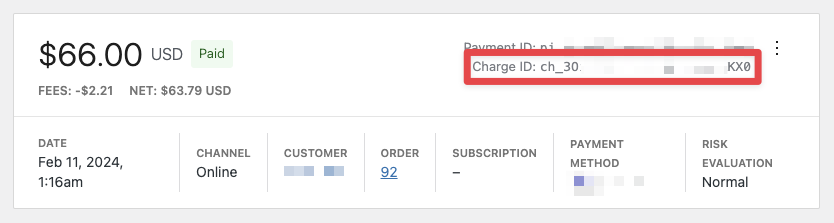

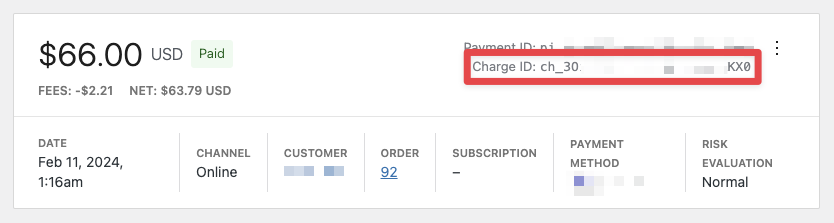

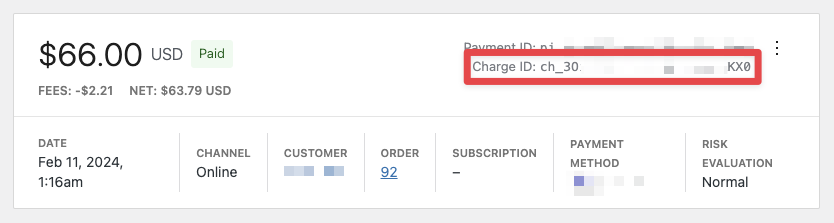

- The charge ID for the previous payment that appears to be a duplicate of the disputed one.

- The charge ID can be found in the transaction details of the duplicate payment.

- An explanation of the difference between the disputed payment and the one the customer believes it’s a duplicate of.

- Documentation for the prior payment that can uniquely identify it, such as a separate receipt. This document should be paired with a similar document from the disputed payment that proves the two are separate. This should also include a separate shipping label or receipt for the other payment. If multiple products were shipped together, provide a packing list that shows each purchase.

- A shipping label or receipt for the product the disputed payment is for.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Any and all information documenting that each payment was made separately, such as copies of receipts. If the receipts don’t include the items purchased, be sure to include an itemized list. Each receipt should clearly indicate that the payments are for separate purchases of items or services.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Product not received

↑ Back to topTo try to win a “Product not received” dispute for a physical product, you should attempt to demonstrate that:

- The product was in fact delivered or isn’t expected to have been delivered yet (for example, the agreed-upon delivery date is still in the future), or…

- You already issued a refund to the cardholder, or…

- The customer withdrew their dispute.

You can do that by submitting the following items as evidence:

- Evidence proving that the cardholder disputing the transaction is in possession of the products.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Evidence that someone signed for the products when they were picked up or delivered. If they collected the products from a physical location, make sure you provide:

- Cardholder signature on the pickup form.

- A copy of identification presented by the cardholder.

- Details of identification presented by the cardholder.

- The address you shipped a physical product to.

- Documentation showing you shipped the product to the cardholder at the same address the cardholder provided to you. Ideally include a copy of the shipment receipt or label, and show the full shipping address of the cardholder.

- The date that a physical product began its route to the shipping address in a clear, human-readable format.

- The delivery service that shipped a physical product, such as Fedex, UPS, USPS, and so on. If multiple carriers were used for this purchase, separate them with commas.

- The tracking number for a physical product, obtained from the delivery service. If multiple tracking numbers were generated for this purchase, separate them with commas.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Evidence that the agreed-upon delivery date hasn’t arrived yet.

- If the purchase was made up of multiple different shipments and some of them were delivered successfully, evidence that the dispute amount exceeds the value of the unreceived shipments.

- Evidence that delivery is being held by customs in the cardholder’s country.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Product unacceptable

↑ Back to topTo try to win a “Product unacceptable” dispute for a physical product, you should attempt to demonstrate that:

- The product or service was accurately represented prior to purchase, or…

- The product wasn’t damaged or defective, or…

- You already issued a refund to your customer, or…

- The customer withdrew their dispute.

You can do that by submitting the following items as evidence:

- A description of the product as you represented it to the customer, or images that display how you showed the product to the customer prior to purchase.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation

- A PDF of an email exchange

- A PDF of your written account of a phone conversation, including dates of contact

- The language of your refund policy and how you disclosed it to the customer prior to purchase. This might be:

- The text copied from your policy page

- A screenshot of the policy on a receipt

- A PDF of the applicable part of your business’s terms and conditions

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Whether or not the customer returned the product to you.

- If the product was partially used or consumed, whether the dispute amount exceeds the value of the unused portion.

- Whether you already issued the refund the cardholder is entitled to.

- Whether you have already provided a replacement product.

- Whether the cardholder withdrew the dispute.

Subscription cancelled

↑ Back to topTo try to win a “Subscription cancelled” dispute for a physical product, you should attempt to demonstrate that:

- The subscription was still active and that the customer was aware of, and did not follow, your cancellation procedure, or…

- You already issued a refund to your customer, or…

- The customer withdrew their dispute.

You can do that by submitting the following items as evidence:

- Your subscription cancellation policy, as shown to the customer.

- An explanation of how and when the customer was shown your cancellation policy prior to purchase.

- A justification for why the customer’s subscription was not canceled, or if it was canceled, why this particular payment is still valid.

- A notification sent to the customer of a renewal or continuation of the subscription, or an acknowledgement from the customer of their continued use of the product or service after the date they claim they canceled the subscription (if available).

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- If the product was consumed prior to the billing (in cases where billing occurs regularly, but consumption of whatever is being billed for happens prior to the billing).

- If the product was partially used, whether the dispute amount exceeds the value of the unused portion.

- If customer is mistaken about what the actual cancellation date was (for example, in cases where the cancellation was set for a future date).

- If the payment was actually an installment payment.

- Whether you already issued the refund the cardholder is entitled to.

- Whether you already provided a replacement service.

- Whether the cardholder withdrew the dispute.

Transaction unauthorized

↑ Back to topTo try to win a “Transaction unauthorized” dispute for a physical product, you should attempt to demonstrate that:

- That the legitimate cardholder—or an authorized representative (such as an employee or family member)—did in fact make the payment, or…

- You already issued a refund to the cardholder, or…

- That the payment was successfully authenticated with 3D Secure, or…

- The customer withdrew the dispute or otherwise acknowledged they recognize the charge and filed the fraud dispute in error.

You can do that by submitting the following items as evidence:

- Evidence (for example, photographs or emails) to prove a link between the person receiving products and the cardholder, or proving that the cardholder disputing the transaction is in possession of the products.

- Evidence that the person who signed for the products was authorized to sign for—or is known by—the cardholder. If the products were collected from a physical location, you should provide:

- Cardholder signature on the pickup form

- A copy of identification presented by the cardholder

- Details of identification presented by the cardholder

- The address you shipped a physical product to.

- Documentation showing the product was shipped to the cardholder at the same address the cardholder provided to you. This should ideally include a copy of the shipment receipt or label, and show the full shipping address of the cardholder.

- The date that a physical product began its route to the shipping address in a clear, human-readable format. This date is prior to the date of the dispute.

- The delivery service that shipped a physical product, such as Fedex, UPS, USPS, and so on. If multiple carriers were used for this purchase, separate them with commas.

- The tracking number for a physical product, obtained from the delivery service. If multiple tracking numbers were generated for this purchase, separate them with commas.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- A signed order form for products purchased by mail or phone order.

- Evidence that the transaction was completed by a member of the cardholder’s family or household.

- Evidence of one or more non-disputed payments on the same card.

- Evidence that payments on the same card had been disputed as unauthorized prior to the issuer authorizing this transaction.

- For recurring payments, evidence of a legally binding contract held between your business and the cardholder, that the cardholder is using the products, and of any previous payments not disputed.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

You can also increase your odds of winning a “Transaction unauthorized” dispute by providing information about two prior transactions with the same customer that meet the following criteria:

- No fraud activity has been reported on the past transactions.

- The same payment credential (i.e. credit or debit card) was used.

- The transactions occurred more than 119 days prior to the disputed transaction.

- The transactions occurred less than 366 days prior to the disputed transaction.

For transactions that meet these criteria, you must provide all of the following:

- Product descriptions for the disputed charge and the two chosen transactions.

- The device ID, device fingerprint, or the IP address of the customer.

- Proof that one or more of the following items match across both the non-fraud transactions and the transaction being disputed:

- Customer email.

- Delivery address.

- Device ID / device fingerprint.

- IP address.

This evidence can be submitted in the Additional Details field of the dispute form.

Unrecognized

↑ Back to topTo try to win a “Unrecognized” dispute for a physical product, you should attempt to demonstrate that:

- That the legitimate cardholder—or an authorized representative (such as an employee or family member)—did in fact make the payment, or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute or otherwise acknowledged they recognize the charge and filed the fraud dispute in error.

You can do that by submitting the following items as evidence:

- Evidence (for example, photographs or emails) to prove a link between the person receiving products and the cardholder, or proving that the cardholder disputing the transaction is in possession of the products.

- Evidence that the person who signed for the products was authorized to sign for—or is known by—cardholder. If they collected the products from a physical location, make sure you provide:

- Cardholder signature on the pickup form

- A copy of identification presented by the cardholder

- Details of identification presented by the cardholder

- The address you shipped a physical product to.

- Documentation showing the product was shipped to the cardholder at the same address the cardholder provided to you. This should ideally include a copy of the shipment receipt or label, and show the full shipping address of the cardholder.

- The date that a physical product began its route to the shipping address in a clear, human-readable format. This date is prior to the date of the dispute.

- The delivery service that shipped a physical product, such as Fedex, UPS, USPS, and so on. If multiple carriers were used for this purchase, separate them with commas.

- The tracking number for a physical product, obtained from the delivery service. If multiple tracking numbers were generated for this purchase, separate them with commas.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- A signed order form for products purchased by mail or phone order.

- Evidence that the transaction was completed by a member of the cardholder’s family or household.

- Evidence of one or more non-disputed payments on the same card.

- Evidence that payments on the same card had been disputed as unauthorized prior to the issuer authorizing this transaction.

- For recurring payments, evidence of a legally binding contract held between your business and the cardholder, that the cardholder is using the products, and of any previous payments not disputed.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Physical Service

↑ Back to topCredit not processed

↑ Back to topTo try to win a “Credit not processed” dispute for a physical service, you should attempt to demonstrate that:

- You already issued the refund your customer is entitled to, or…

- The customer isn’t entitled to a refund, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- The language of your refund policy, as provided to the customer. This might be:

- The text copied from your policy page.

- A screenshot of the policy on a receipt.

- A PDF of the applicable part of your business’s terms and conditions.

- An explanation of how and where you provided the applicable policy to your customer prior to purchase.

- Your explanation for why the customer isn’t entitled to a refund.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Whether you already issued the refund the cardholder is entitled to.

- If they partially used the service, or whether the dispute amount exceeds the value of the unused portion.

- Whether the cardholder withdrew the dispute.

Duplicate

↑ Back to topTo try to win a “Duplicate” dispute for a physical service, you should attempt to demonstrate that:

- Each payment was for a separate product or service, or…

- You already issued a refund to your customer, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- The charge ID for the previous payment that appears to be a duplicate of the disputed one.

- The charge ID can be found in the transaction details of the duplicate payment.

- An explanation of the difference between the disputed payment and the one the customer believes it’s a duplicate of.

- Documentation for the prior payment that can uniquely identify it, such as a separate receipt. Pair this document with a similar document from the disputed payment that proves the two are separate. Also include a separate shipping label or receipt for the other payment. If multiple products shipped together, provide a packing list that shows each purchase.

- A copy of a service agreement or documentation for the disputed payment.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Any information documenting that each payment was made separately, such as copies of receipts. If the receipts don’t include the items purchased, be sure to include an itemized list. Make sure that each receipt clearly indicates that the payments are for separate purchases of items or services. If you’ve been able to get in touch with the customer, make sure to address any concerns they had in your evidence.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Product not received

↑ Back to topTo try to win a “Product not received” dispute for a physical service, you should attempt to demonstrate that:

- The product was in fact delivered or isn’t expected to have been delivered yet (for example, the agreed-upon delivery date is still in the future), or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- Evidence proving that the cardholder disputing the transaction received the service.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Evidence that the service was signed for. If possible, you should provide:

- Cardholder signature.

- A copy of identification presented by the cardholder.

- Details of identification presented by the cardholder.

- Documentation showing that the service was provided to the cardholder, including the date that the cardholder received or began receiving the purchased service in a clear, human-readable format. This could include a copy of a signed contract, work order, or other form of written agreement.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Evidence that the agreed-upon service date hasn’t arrived yet.

- If the purchase was made up of multiple different shipments and some of them were delivered successfully, evidence that the dispute amount exceeds the value of the unreceived shipments.

- Evidence that delivery is being held by customs in the cardholder’s country.

- Whether you have already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Product unacceptable

↑ Back to topTo try to win a “Product unacceptable” dispute for a physical service, you should attempt to demonstrate that:

- That the product or service was accurately represented prior to purchase, or…

- That the product wasn’t damaged or defective, or…

- You already issued a refund to your customer, or…

- The customer withdrew the dispute

You can do that by submitting the following items as evidence:

- A description of the service as you represented it to the customer, or images that display how you advertised the service to the customer prior to purchase.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- The language of your refund policy and how it was disclosed to the customer prior to purchase. This might be:

- The text copied from your policy page.

- A screenshot of the policy on a receipt.

- A PDF of the applicable part of your business’s terms and conditions.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- If the service was only partially used, whether the dispute amount exceeds the value of the unused portion.

- Whether you already issued the refund the cardholder is entitled to.

- Whether you already provided a replacement service.

- Whether the cardholder withdrew the dispute.

Subscription cancelled

↑ Back to topTo try to win a “Subscription cancelled” dispute for a physical service, you should attempt to demonstrate that:

- The subscription was still active and that the customer was aware of, and did not follow, your cancellation procedure, or…

- You already issued a refund to your customer, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- Your subscription cancellation policy, as shown to the customer.

- An explanation of how and when the customer was shown your cancellation policy prior to purchase.

- A justification for why the customer’s subscription wasn’t canceled, or if it was canceled, why this particular payment is still valid.

- The date on which the cardholder received or began receiving the purchased service in a clear, human-readable format.

- Documentation showing proof that a service was provided to the cardholder. This could include a copy of a signed contract, work order, or other form of written agreement.

- A notification sent to the customer of a renewal or continuation of the subscription, or an acknowledgement from the customer of their continued use of the product or service after the date they claim they canceled the subscription (if available).

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- If the service was consumed prior to the billing (in cases where billing occurs regularly, but consumption of whatever is being billed for happens prior to the billing).

- If the service was partially used, whether the dispute amount exceeds the value of the unused portion.

- If the customer is mistaken about what the actual cancellation date was (for example, in cases where the cancellation was set for a future date).

- Whether you already issued the refund the cardholder is entitled to.

- Whether you already provided a replacement service.

- Whether the cardholder withdrew the dispute.

Transaction unauthorized

↑ Back to topTo try to win a “Transaction unauthorized” dispute for a physical service, you should attempt to demonstrate that:

- That the legitimate cardholder—or an authorized representative (such as an employee or family member)—did in fact make the payment, or…

- That the payment was successfully authenticated with 3D Secure, or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute or otherwise acknowledged they recognize the charge and filed the fraud dispute in error.

You can do that by submitting the following items as evidence:

- Evidence (for example, photographs or emails) to prove a link between the person receiving the service and the cardholder, or proving that the cardholder disputing the transaction has used or is still using the service.

- Evidence that the person who signed for the service was authorized to sign for—or is known by—the cardholder. Provide any of the following, if you have them:

- Cardholder signature on the pickup form.

- A copy of identification presented by the cardholder.

- Details of identification presented by the cardholder.

- Documentation showing that the service was provided to the cardholder, including the date that the cardholder received or began receiving the purchased service in a clear, human-readable format. This could include a copy of a signed contract, work order, or other form of written agreement.

- For passenger transportation or services or travel and expense transactions, evidence that the service was provided and any of the following:

- Proof that the ticket was received at the cardholder’s billing address.

- Evidence of payments related to the disputed payment, such as seat upgrades, extra baggage, and purchases made on board the passenger transport.

- Details of loyalty program rewards earned or redeemed, including address and phone number, that establish a link to the cardholder.

- Evidence that other payments related to the original payment, like upgrades, were not disputed.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- A signed order form for products purchased by mail or phone order.

- Evidence that the transaction was completed by a member of the cardholder’s family or household.

- Evidence of one or more non-disputed payments on the same card.

- Evidence that payments on the same card had been disputed as unauthorized prior to the issuer authorizing this transaction.

- For recurring payments, evidence of a legally binding contract held between your business and the cardholder, that the cardholder is using the products, and of any previous payments not disputed.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

You can also increase your odds of winning a “Transaction unauthorized” dispute by providing information about two prior transactions with the same customer that meet the following criteria:

- No fraud activity has been reported on the past transactions.

- The same payment credential (i.e. credit or debit card) was used.

- The transactions occurred more than 119 days prior to the disputed transaction.

- The transactions occurred less than 366 days prior to the disputed transaction.

For transactions that meet these criteria, you must provide all of the following:

- Product descriptions for the disputed charge and the two chosen transactions.

- The device ID, device fingerprint, or the IP address of the customer.

- Proof that one or more of the following items match across both the non-fraud transactions and the transaction being disputed:

- Customer email.

- Delivery address.

- Device ID / device fingerprint.

- IP address.

This evidence can be submitted in the Additional Details field of the dispute form.

Unrecognized

↑ Back to topTo try to win a “Unrecognized” dispute for a physical service, you should attempt to demonstrate that:

- That the legitimate cardholder—or an authorized representative (such as an employee or family member)—did in fact make the payment, or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute or otherwise acknowledged they recognize the charge and filed the fraud dispute in error.

You can do that by submitting the following items as evidence:

- Evidence (for example, photographs or emails) to prove a link between the person receiving the service and the cardholder, or proving that the cardholder disputing the transaction has used or is still using the service.

- Evidence that the person who signed for the service was authorized to sign for—or is known by—the cardholder. Provide any of the following, if you have them:

- Cardholder signature on the pickup form.

- A copy of identification presented by the cardholder.

- Details of identification presented by the cardholder.

- Documentation showing that the service was provided to the cardholder, including the date that the cardholder received or began receiving the purchased service in a clear, human-readable format. This could include a copy of a signed contract, work order, or other form of written agreement.

- For passenger transportation or services or travel and expense transactions, evidence that the service was provided and any of the following:

- Proof that the ticket was received at the cardholder’s billing address.

- Evidence of payments related to the disputed payment, such as seat upgrades, extra baggage, and purchases made on board the passenger transport.

- Details of loyalty program rewards earned or redeemed, including address and phone number, that establish a link to the cardholder.

- Evidence that other payments related to the original payment, like upgrades, weren’t disputed.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- A signed order form for products purchased by mail or phone order.

- Evidence that the transaction was completed by a member of the cardholder’s family or household.

- Evidence of one or more non-disputed payments on the same card.

- Evidence that payments on the same card had been disputed as unauthorized prior to the issuer authorizing this transaction.

- For recurring payments, evidence of a legally binding contract held between your business and the cardholder, that the cardholder is using the products, and of any previous payments not disputed.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Digital Product or Service

↑ Back to topCredit not processed

↑ Back to topTo try to win a “Credit not processed” dispute for a digital product or service, you should attempt to demonstrate that:

- You already issued the refund your customer is entitled to, or…

- The customer isn’t entitled to a refund, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- The language of the applicable cancellation or refund policy, as provided to the customer. This might be:

- The text copied from your policy page.

- A screenshot of the policy on a receipt.

- A PDF of the applicable part of your business’s terms and conditions.

- An explanation of how and where you provided the applicable policy to your customer prior to purchase.

- Your explanation for why the customer isn’t entitled to a cancellation or refund.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Whether you already issued the refund the cardholder is entitled to.

- Whether or not the customer used the digital product or service in whole or in part. If they partially used it, or whether the dispute amount exceeds the value of the unused portion.

- Whether the cardholder withdrew the dispute.

Duplicate

↑ Back to topTo try to win a “Duplicate” dispute for a digital product or service, you should attempt to demonstrate that:

- Each payment was for a separate product or service, or…

- You already issued a refund to your customer, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- The charge ID for the previous payment that appears to be a duplicate of the disputed one.

- The charge ID can be found in the transaction details of the duplicate payment.

- An explanation of the difference between the disputed payment and the one the customer believes it’s a duplicate of.

- Documentation for the prior payment that can uniquely identify it, such as a separate receipt. Pair this document with a similar document from the disputed payment that proves the two are separate. Also include a separate shipping label or receipt for the other payment. If multiple products shipped together, provide a packing list that shows each purchase.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Any information documenting that each payment was made separately, such as copies of receipts. If the receipts don’t include the items purchased, be sure to include an itemized list. Make sure each receipt clearly indicates that the payments are for separate purchases of items or services. If you’ve been able to get in touch with the customer, be sure to address any concerns they had in your evidence.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Product not received

↑ Back to topTo try to win a “Product not received” dispute for a digital product or service, you should attempt to demonstrate that:

- The product was in fact delivered or isn’t expected to have been delivered yet (for example, the agreed-upon delivery date is still in the future), or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- Server or activity logs showing proof that the customer accessed or downloaded the purchased digital product after the payment was made. Ideally include IP addresses, corresponding timestamps, and any detailed recorded activity.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Device geographical location at the date and time of transaction.

- Device ID, number, and name (if applicable).

- Evidence that the agreed-upon delivery date hasn’t arrived yet.

- If the purchase was made up of multiple different electronic deliveries and some of them were delivered successfully, evidence that the dispute amount exceeds the value of the unreceived items.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

Product unacceptable

↑ Back to topTo try to win a “Product unacceptable” dispute for a digital product or service, you should attempt to demonstrate that:

- That the product or service was accurately represented prior to purchase, or…

- That the product wasn’t damaged or defective, or…

- You already issued a refund to your customer, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- A description of the digital product or service as it was represented to the customer, or images that display how the customer was shown the product prior to purchase.

- Whether or not the customer attempted to resolve the issue with you prior to filing a dispute. If they didn’t reach out to you before the dispute, state that clearly.

- If you did communicate with them prior to the dispute, or if later conversations shed light on the facts of the case, submit this with your evidence. This could look like:

- A screenshot of a text conversation.

- A PDF of an email exchange.

- A PDF of your written account of a phone conversation, including dates of contact

- .Any server or activity logs showing proof that the cardholder accessed or downloaded the purchased digital product. This information should include IP addresses, corresponding timestamps, and any detailed recorded activity.

- The language of your refund policy and how you disclosed it to the customer prior to purchase. This might be:

- The text copied from your policy page.

- A screenshot of the policy on a receipt.

- A PDF of the applicable part of your business’s terms and conditions.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- If the product was partially used or consumed, whether the dispute amount exceeds the value of the unused portion.

- Whether you already issued the refund the cardholder is entitled to.

- Whether you already provided a replacement service.

- Whether the cardholder withdrew the dispute.

Subscription cancelled

↑ Back to topTo try to win a “Subscription cancelled” dispute for a digital product or service, you should attempt to demonstrate that:

- The subscription was still active and that the customer was aware of, and did not follow, your cancellation procedure, or…

- You already issued a refund to your customer, or…

- The customer withdrew the dispute.

You can do that by submitting the following items as evidence:

- Your subscription cancellation policy, as shown to the customer.

- An explanation of how and when the customer was shown your cancellation policy prior to purchase.

- A justification for why the customer’s subscription wasn’t canceled, or if it was canceled, why this particular payment is still valid.

- A notification sent to the customer of a renewal or continuation of the subscription, or an acknowledgement from the customer of their continued use of the product or service after the date they claim they canceled the subscription (if available).

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- What controls you have in place for customers to regulate automated spending, monitor their own usage, and prevent inadvertent automated billing.

- If the digital product or service was consumed prior to the billing (in cases where billing occurs regularly, but consumption whatever is being billed for happens prior to the billing).

- If the product was partially used, whether the dispute amount exceeds the value of the unused portion.

- If the customer is mistaken about what the actual cancellation date was (for example, in cases where the cancellation was set for a future date).

- If the payment was actually an installment payment (some networks permit this dispute reason code only for genuinely recurring transactions, not installments of a single payment).

- Whether you already issued the refund the cardholder is entitled to.

- Whether you already provided a replacement product or service.

- Whether the cardholder withdrew the dispute.

Transaction unauthorized

↑ Back to topTo try to win a “Transaction unauthorized” dispute for a digital product or service, you should attempt to demonstrate that:

- That the legitimate cardholder—or an authorized representative (such as an employee or family member)—did in fact make the payment, or…

- That the payment was successfully authenticated with 3D Secure, or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute or otherwise acknowledged they recognize the charge and filed the fraud dispute in error.

You can do that by submitting the following items as evidence:

- Server or activity logs showing proof that the customer accessed or downloaded the purchased digital product after they made the payment. This should ideally include IP addresses, corresponding timestamps, and any detailed recorded activity.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Device geographical location at the date and time of transaction.

- Device ID, number, and name (if applicable).

- Evidence that the transaction was completed by a member of the cardholder’s family or household.

- Evidence of one or more non-disputed payments on the same card.

- Evidence that payments on the same card had been disputed as unauthorized prior to the issuer authorizing this transaction.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.

You can also increase your odds of winning a “Transaction unauthorized” dispute by providing information about two prior transactions with the same customer that meet the following criteria:

- No fraud activity has been reported on the past transactions.

- The same payment credential (i.e. credit or debit card) was used.

- The transactions occurred more than 119 days prior to the disputed transaction.

- The transactions occurred less than 366 days prior to the disputed transaction.

For transactions that meet these criteria, you must provide all of the following:

- Product descriptions for the disputed charge and the two chosen transactions.

- The device ID, device fingerprint, or the IP address of the customer.

- Proof that one or more of the following items match across both the non-fraud transactions and the transaction being disputed:

- Customer email.

- Delivery address.

- Device ID / device fingerprint.

- IP address.

This evidence can be submitted in the Additional Details field of the dispute form.

Unrecognized

↑ Back to topTo try to win a “Unrecognized” dispute for a digital product or service, you should attempt to demonstrate that:

- That the legitimate cardholder—or an authorized representative (such as an employee or family member)—did in fact make the payment, or…

- You already issued a refund to the cardholder, or…

- The customer withdrew the dispute or otherwise acknowledged they recognize the charge and filed the fraud dispute in error.

You can do that by submitting the following items as evidence:

- Server or activity logs showing proof that the customer accessed or downloaded the purchased digital product after making the payment. Ideally include IP addresses, corresponding timestamps, and any detailed recorded activity.

- Any argument invalidating the dispute reason, such as a PDF or screenshot showing:

- Device geographical location at the date and time of transaction.

- Device ID, number, and name (if applicable).

- Evidence that the transaction was completed by a member of the cardholder’s family or household.

- Evidence of one or more non-disputed payments on the same card.

- Evidence that payments on the same card had been disputed as unauthorized prior to the issuer authorizing this transaction.

- Whether you already issued the refund the cardholder is entitled to.

- Whether the cardholder withdrew the dispute.