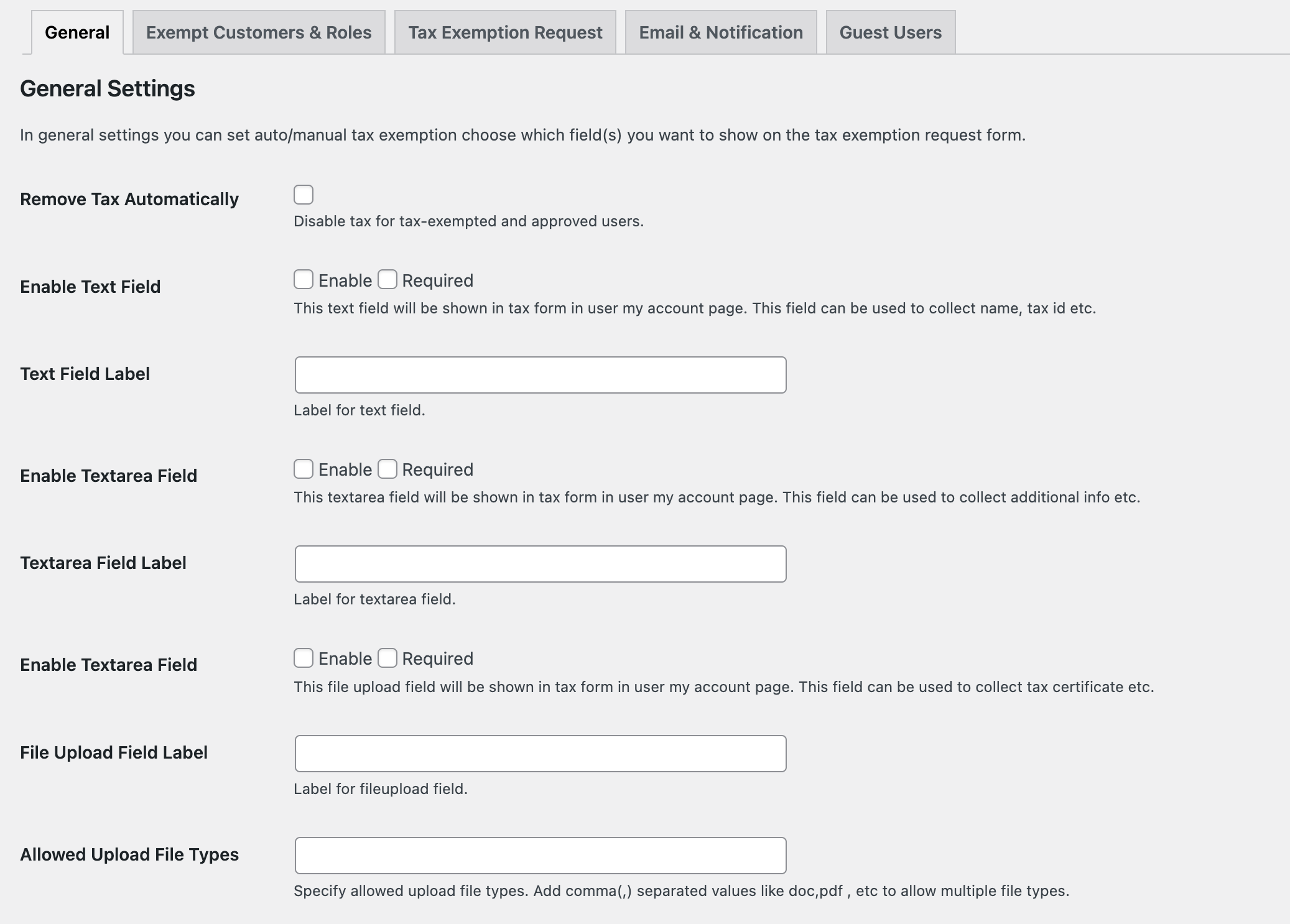

After activating Tax Exempt plugin for WooCommerce, you can see the “Tax Exemption” under the WooCommerce menu. Click to open the settings page.

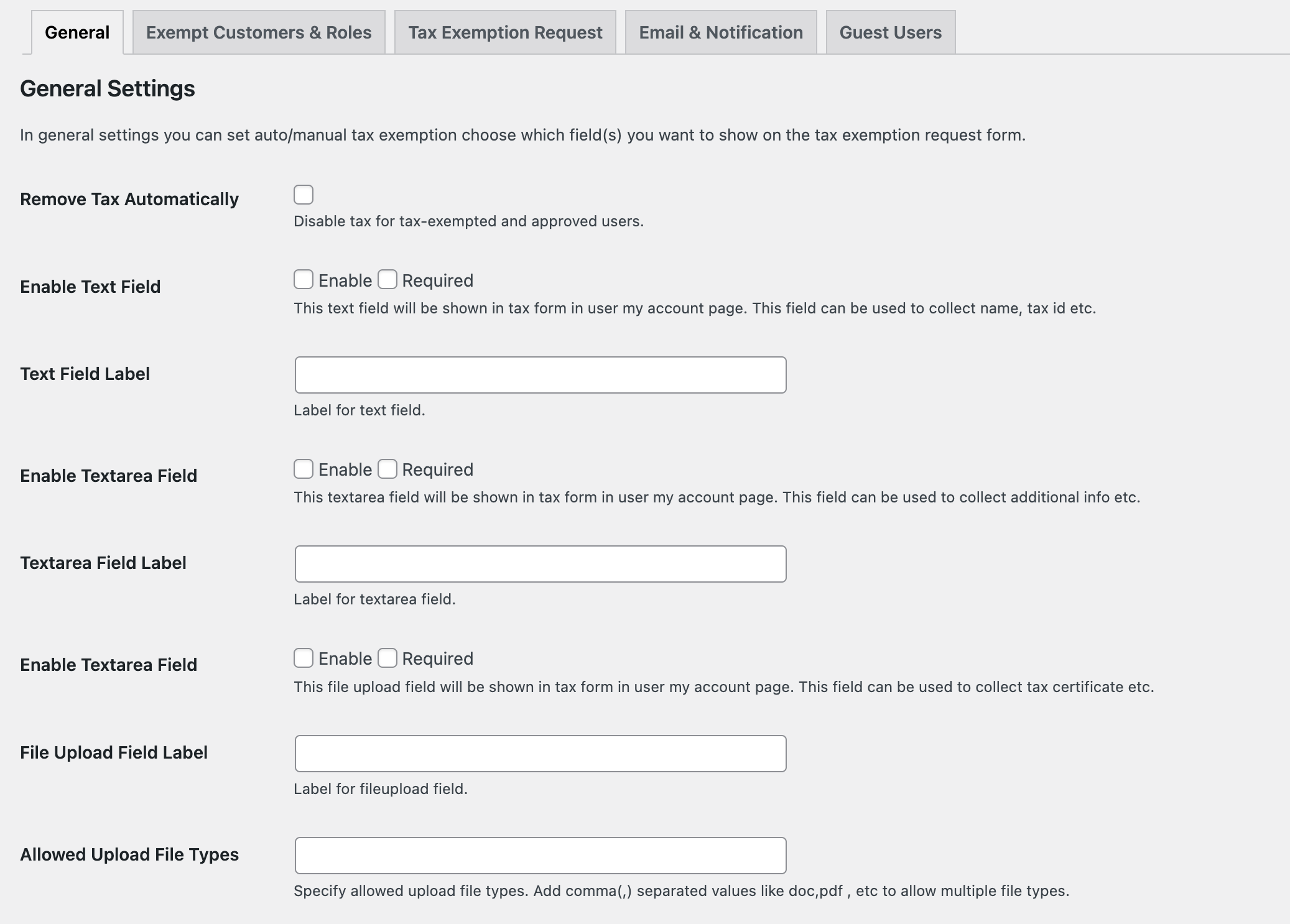

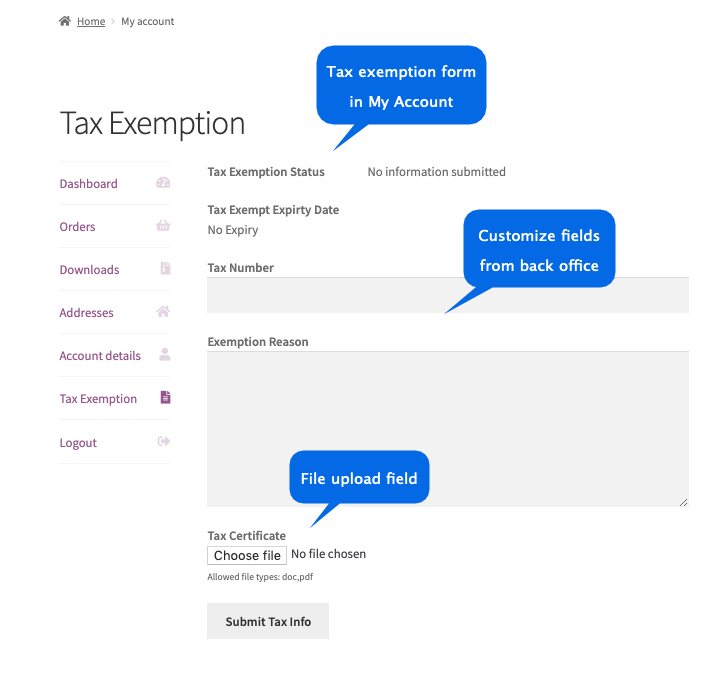

In the general setting, you can customize tax exemption form fields. This form appears in the customers’ “My Account” section from where customers can upload tax exemption files and provide necessary details to request the tax exemption. Once the form is submitted admin will receive an email notification to approve or disapprove tax exemption requests from users’ detail page in Backoffice.

Remove Tax Automatically:

This feature allows you to show or hide checkbox on checkout page that allows tax exempted customers to manually remove the tax from order. This feature is helpful in cases where not all orders are eligible for tax exemption and the customer can choose to keep or remove the tax.

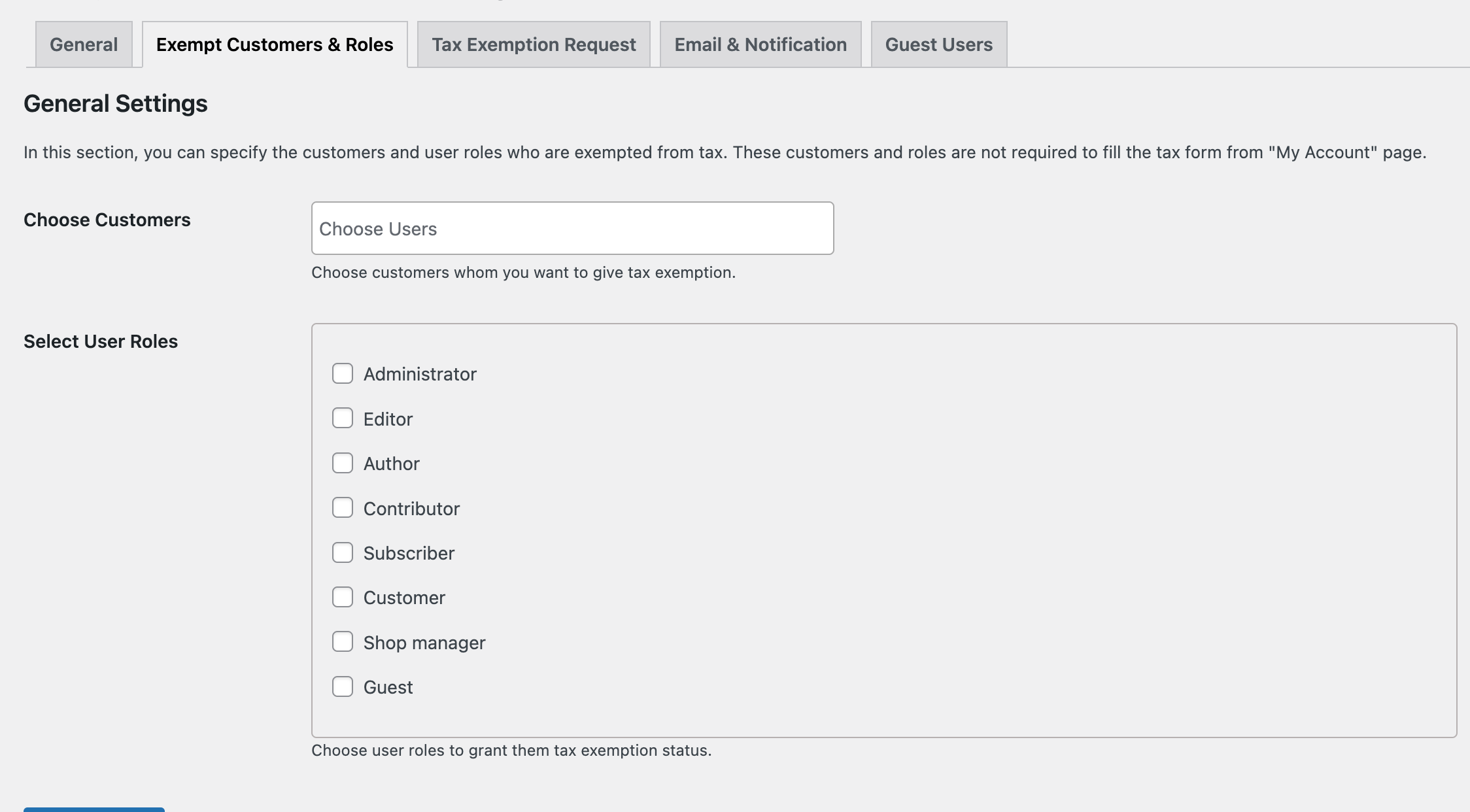

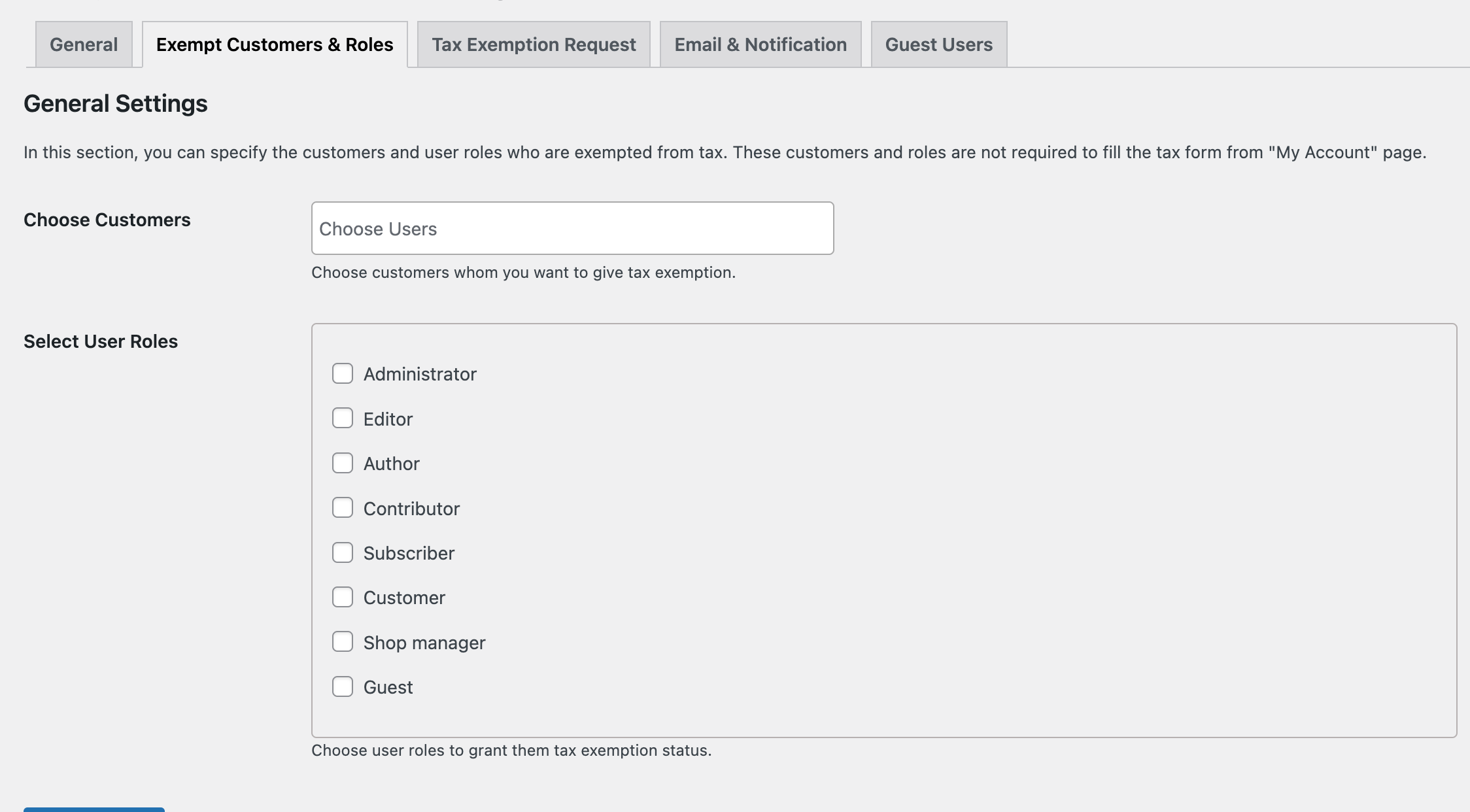

In this section, you can specify multiple customers to grant tax exemption. These customers do not need to upload any tax exemption information as they are approved by the admin upfront. These customers will see the checkbox on the checkout page to claim the tax exemption for any order.

You can also specify user roles which are exempted from tax.

In this section, you can specify multiple customers to grant tax exemption. These customers do not need to upload any tax exemption information as they are approved by the admin upfront. These customers will see the checkbox on the checkout page to claim the tax exemption for any order.

You can also specify user roles which are exempted from tax.

In this section, you can specify which user roles are allowed to submit tax exemption form. If you want to enable it for all customers, select all user roles. Only the customers with the specified roles will be able to see the tax-exemption form in “My Account. After submitting tax information and getting approval from admin, they can see tax-exempt checkbox in checkout page to claim tax exemption for any order.

In this section, you can specify which user roles are allowed to submit tax exemption form. If you want to enable it for all customers, select all user roles. Only the customers with the specified roles will be able to see the tax-exemption form in “My Account. After submitting tax information and getting approval from admin, they can see tax-exempt checkbox in checkout page to claim tax exemption for any order.

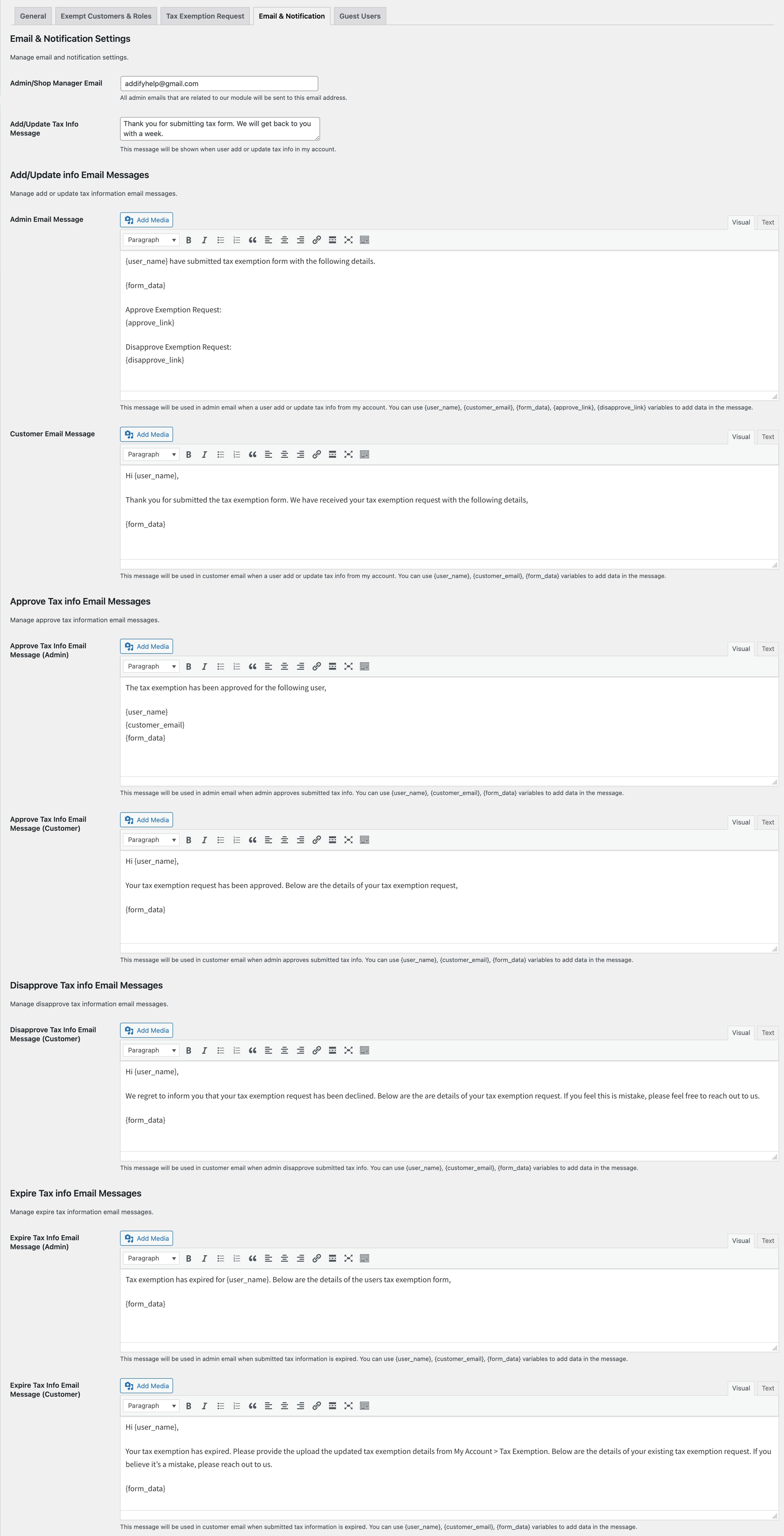

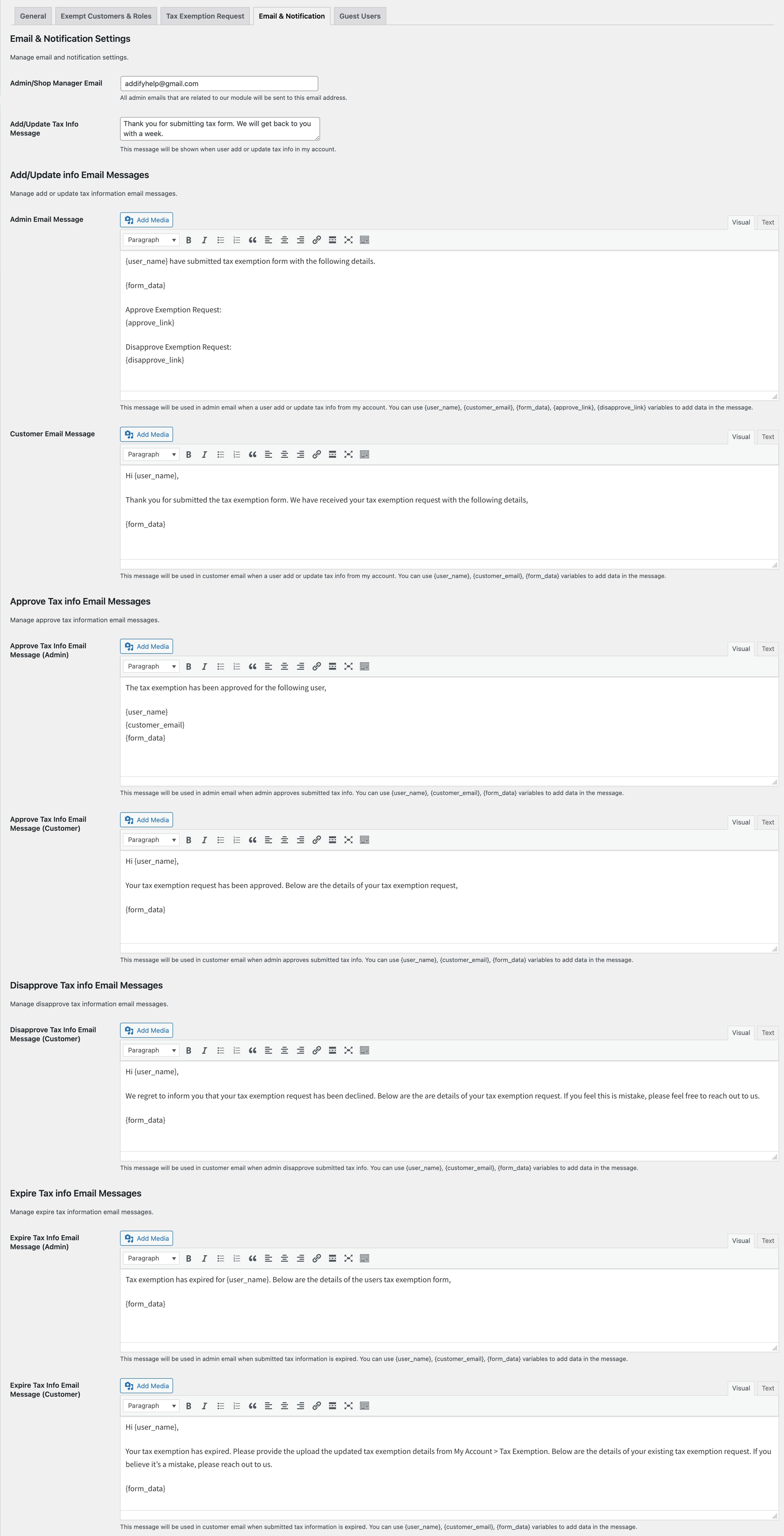

In this section, you can customize submission success message, admin email address and email notifications. The email can be disabled from WooCommerce > Settings > Emails. You can also customize their templates by following the steps given in each template under WooCommerce > Settings > Emails.

In this section, you can customize submission success message, admin email address and email notifications. The email can be disabled from WooCommerce > Settings > Emails. You can also customize their templates by following the steps given in each template under WooCommerce > Settings > Emails.

While customizing email text, you can use different variables to fill form date, user name and more.

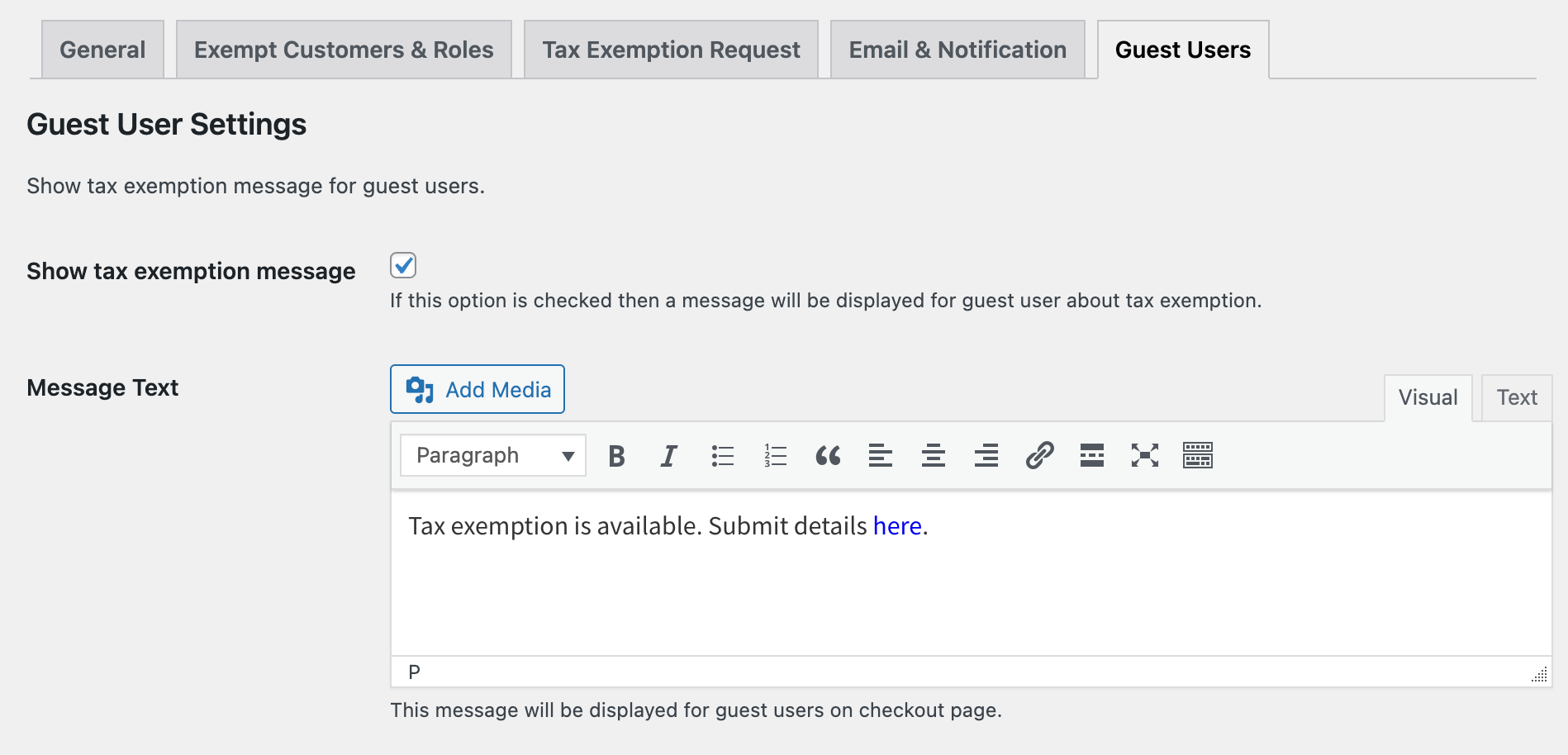

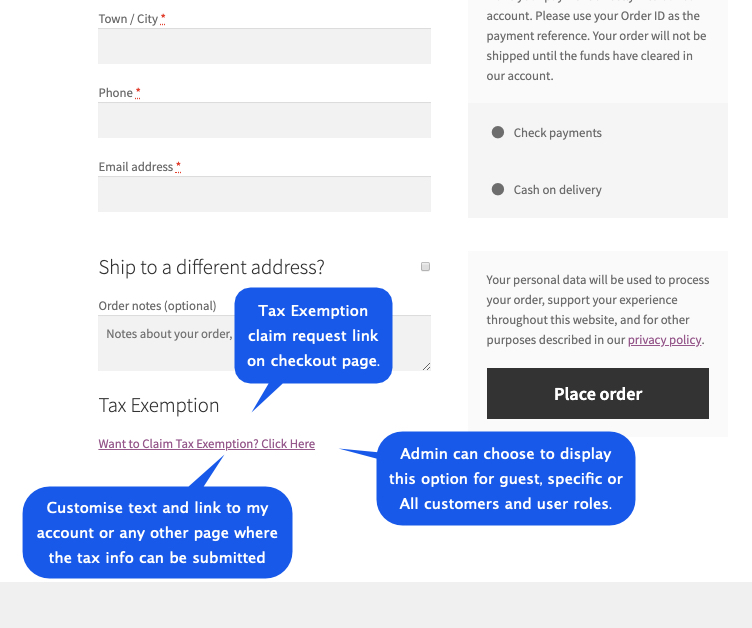

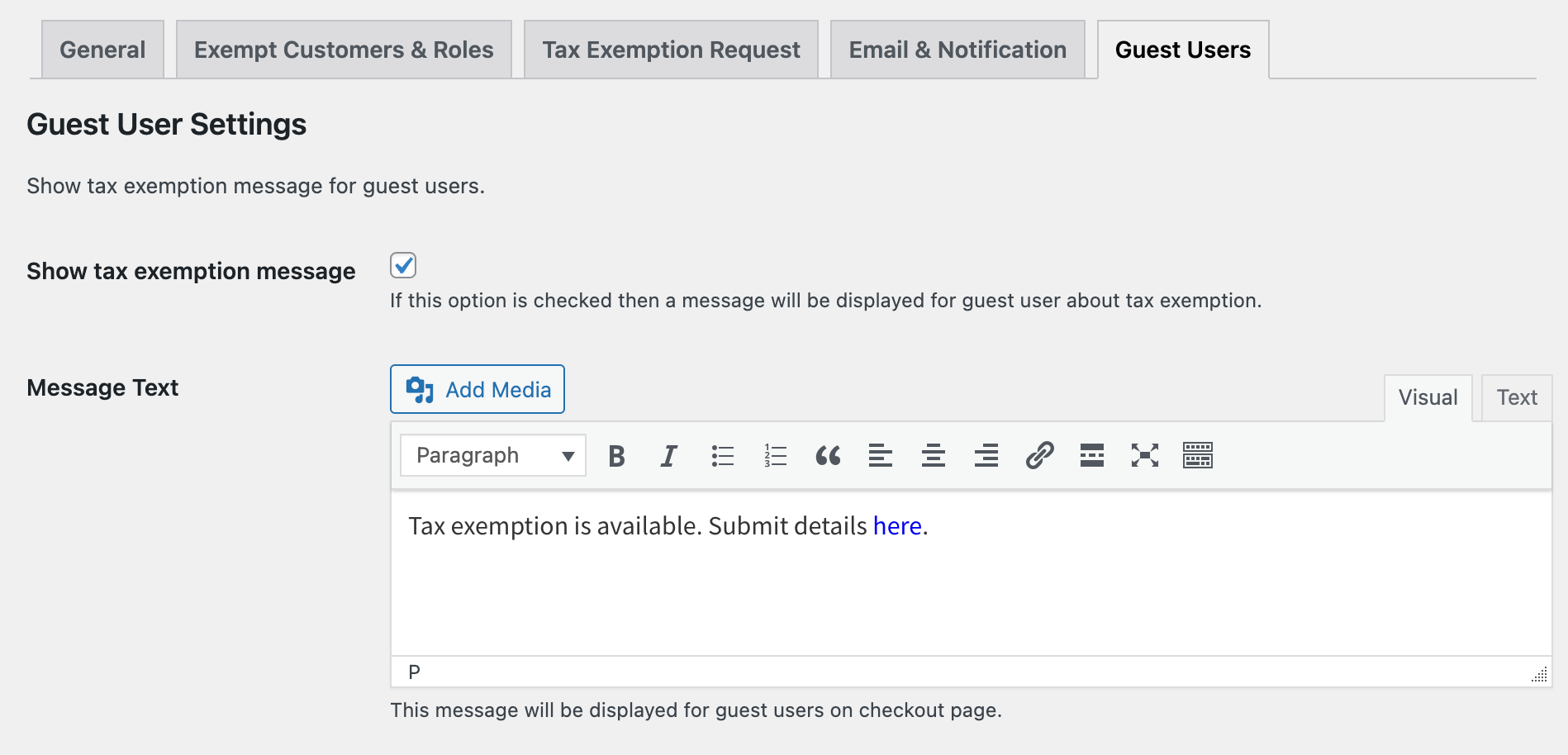

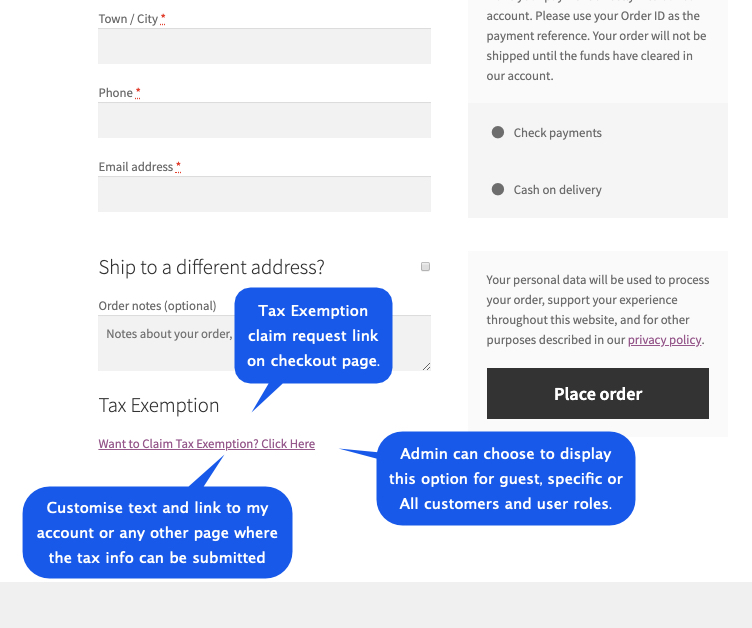

In this section, you can enable the tax exemption message for guest users. During the checkout guest customer will see the message “Want to Claim Tax Exemption? Click Here”. Admin can customize the message and send the user to a general tax exemption information page or to the “My Account” page from where they can login/register and provide information in order to claim the tax exemption.

In this section, you can enable the tax exemption message for guest users. During the checkout guest customer will see the message “Want to Claim Tax Exemption? Click Here”. Admin can customize the message and send the user to a general tax exemption information page or to the “My Account” page from where they can login/register and provide information in order to claim the tax exemption.

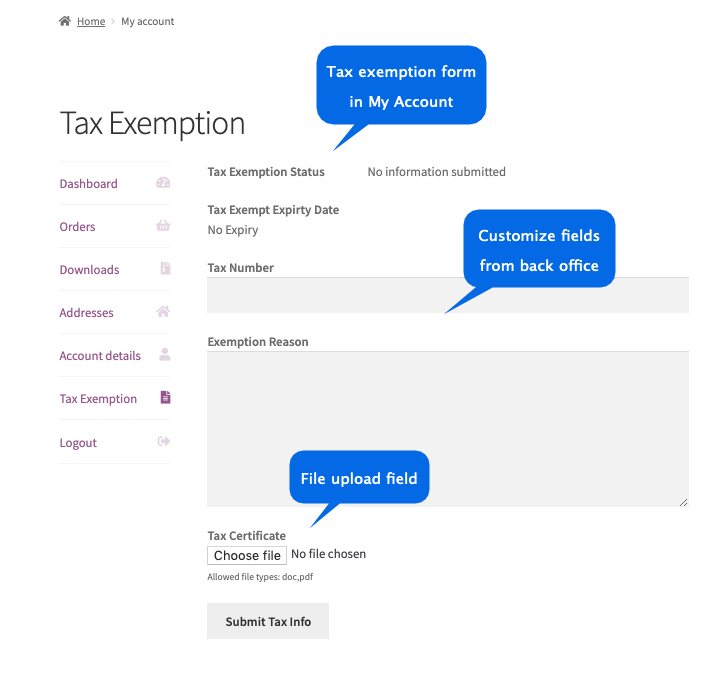

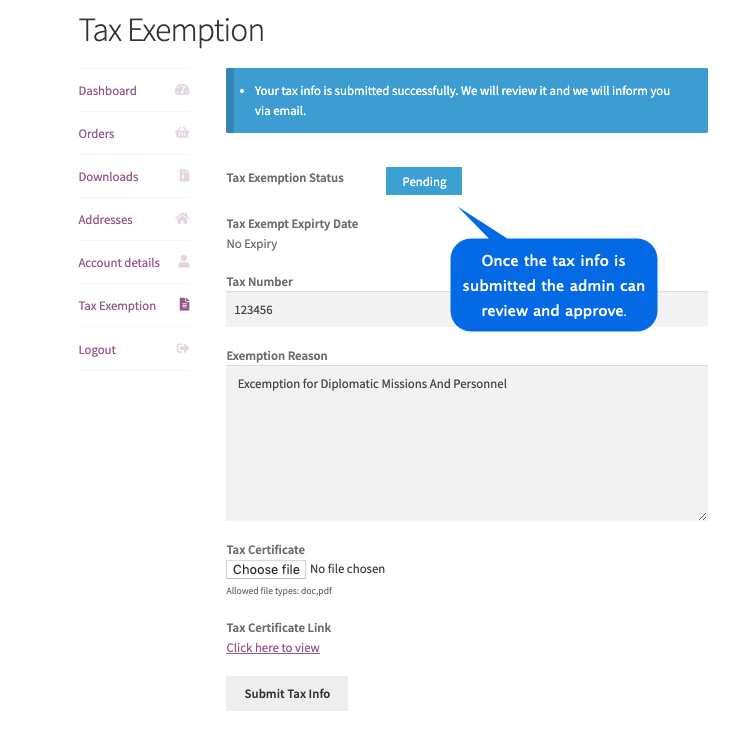

This is the frontend “My Account” page screenshot. You can see the “Tax Exemption” tab and fields. The user can see the tax exemption status as well.

This is the frontend “My Account” page screenshot. You can see the “Tax Exemption” tab and fields. The user can see the tax exemption status as well.

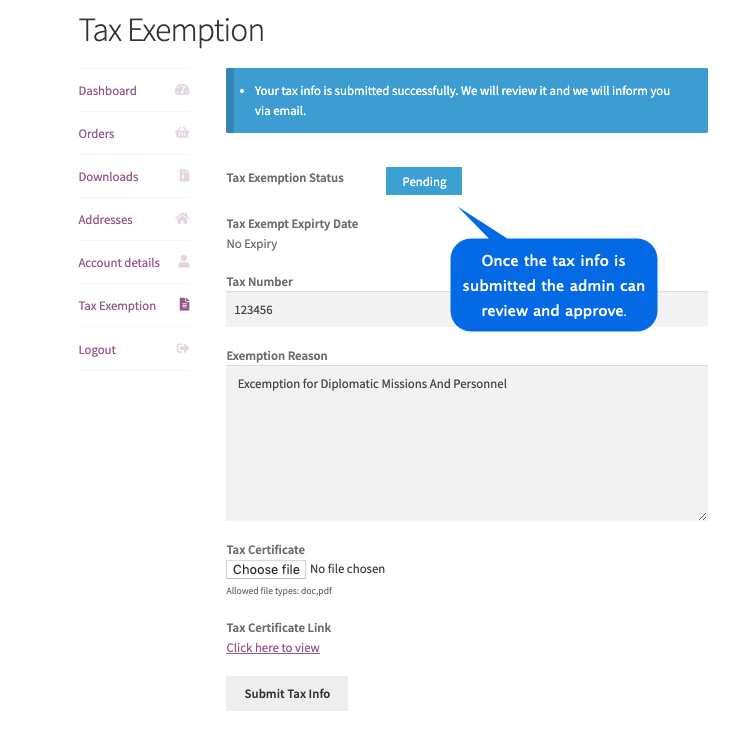

Once tax info is submitted, the request is sent to admin for approval. Users will see a message on my account.

Once tax info is submitted, the request is sent to admin for approval. Users will see a message on my account.

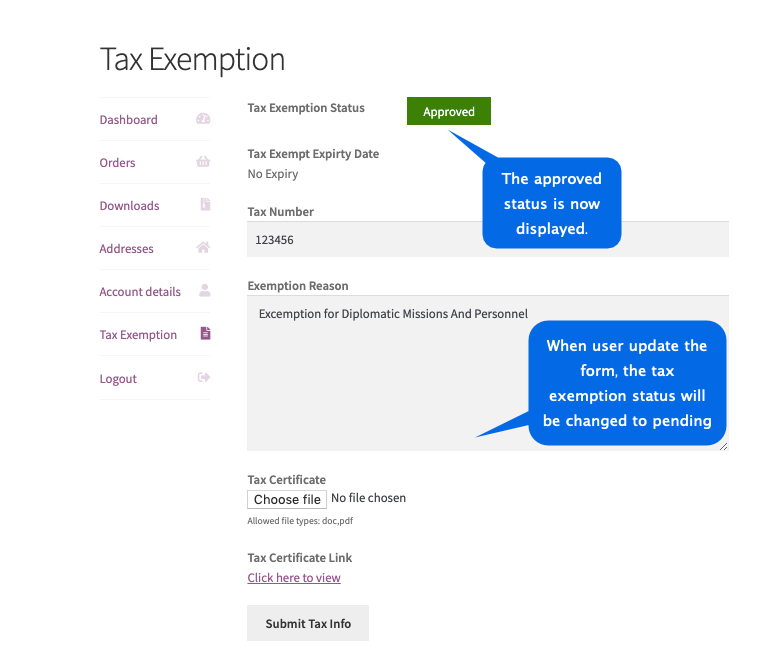

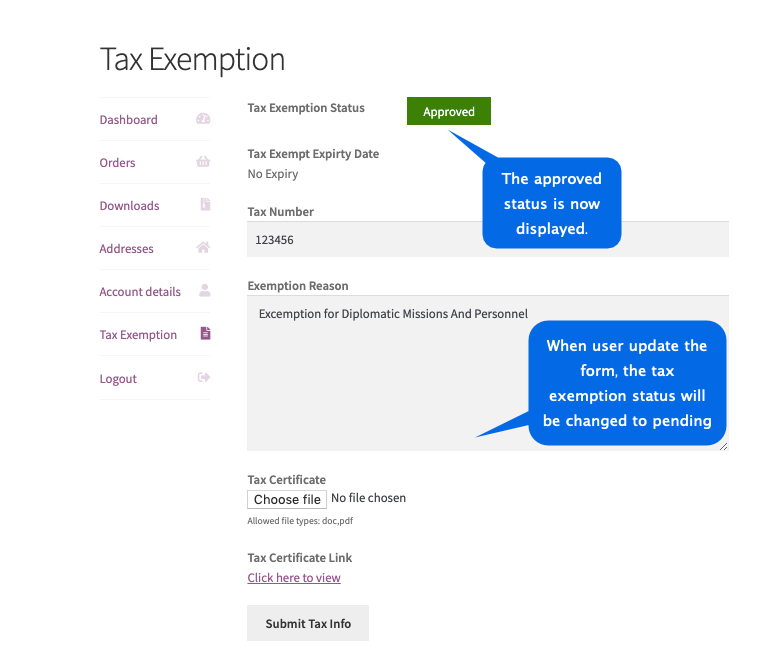

When the request is approved by admin, the tax exemption status will be displayed as “approved”.

When the request is approved by admin, the tax exemption status will be displayed as “approved”.

Tax-Exempt checkbox will be displayed on the checkout page, from where the user can claim tax exemption for the specific order. The checkbox only appears to approved customers.

Tax-Exempt checkbox will be displayed on the checkout page, from where the user can claim tax exemption for the specific order. The checkbox only appears to approved customers.

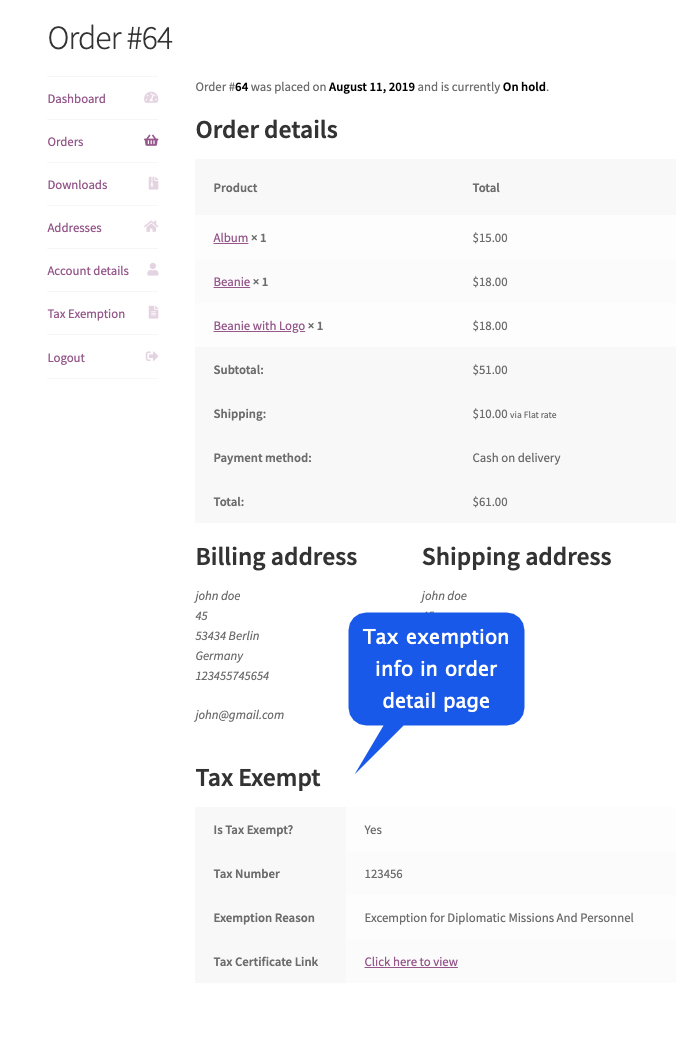

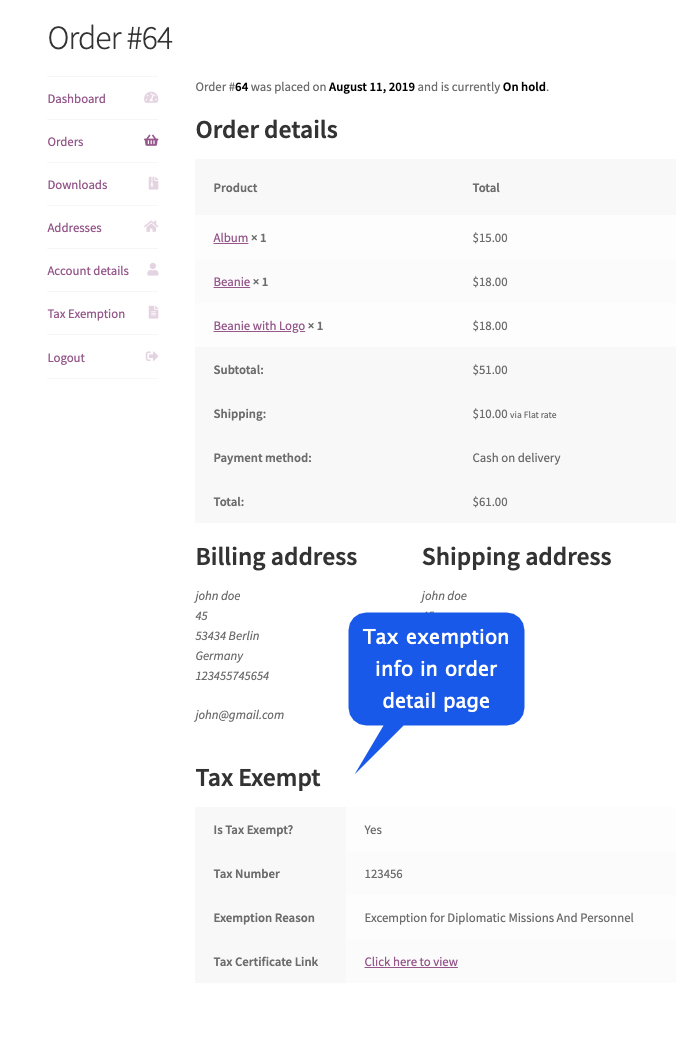

When a user selects the tax-exempt checkbox on the checkout page, the tax is automatically removed from the order. The tax exemption information will be displayed at

When a user selects the tax-exempt checkbox on the checkout page, the tax is automatically removed from the order. The tax exemption information will be displayed at

- Thankyou page

- Customer’s order detail page

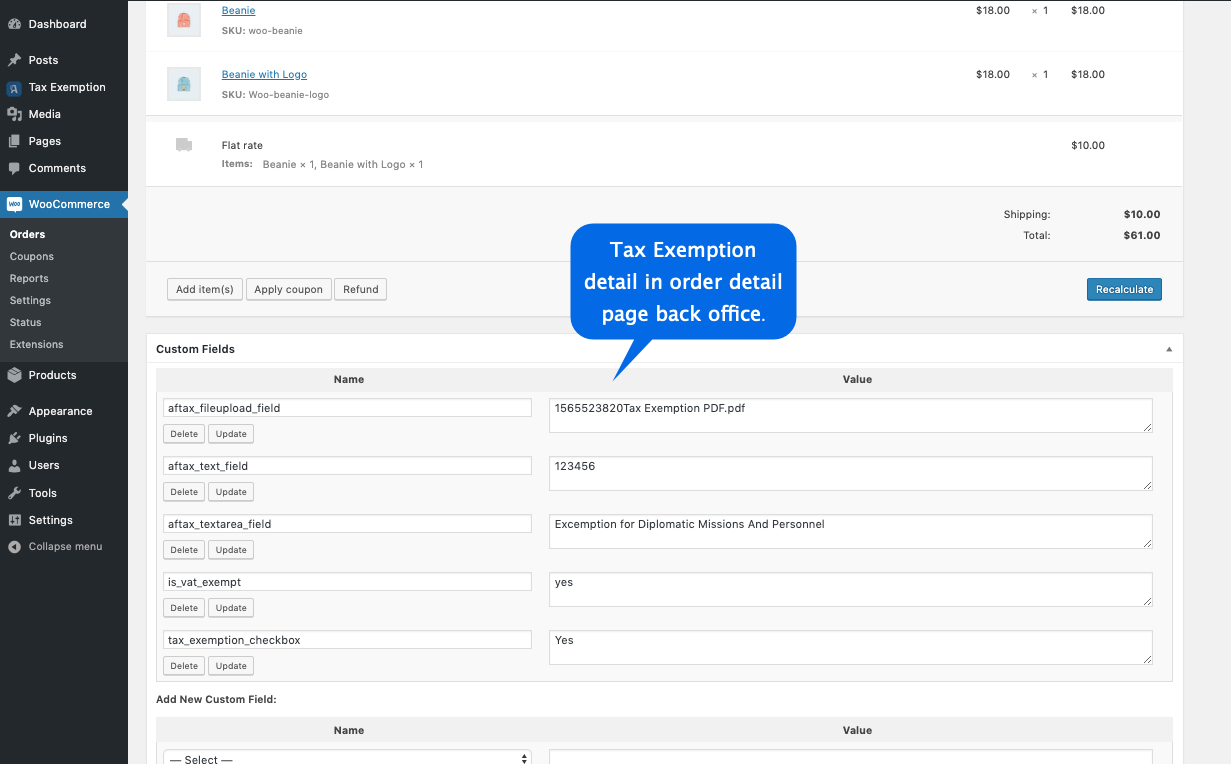

- Admin’s order detail page

- Order email

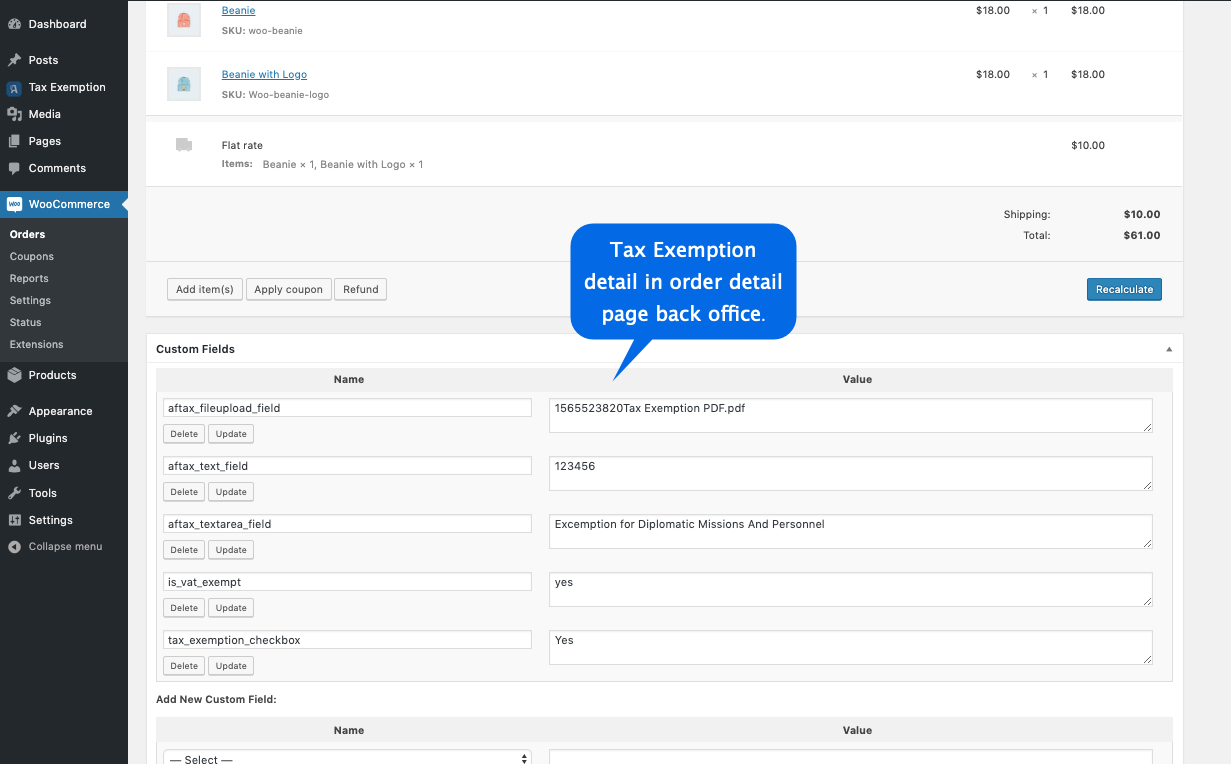

Tax data can be seen in the admin order detail page.

Tax data can be seen in the admin order detail page.

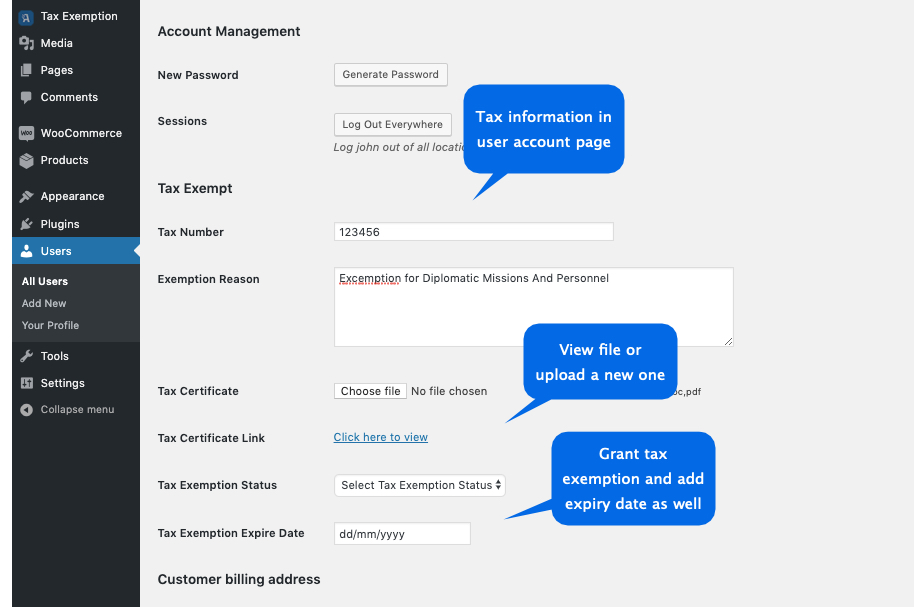

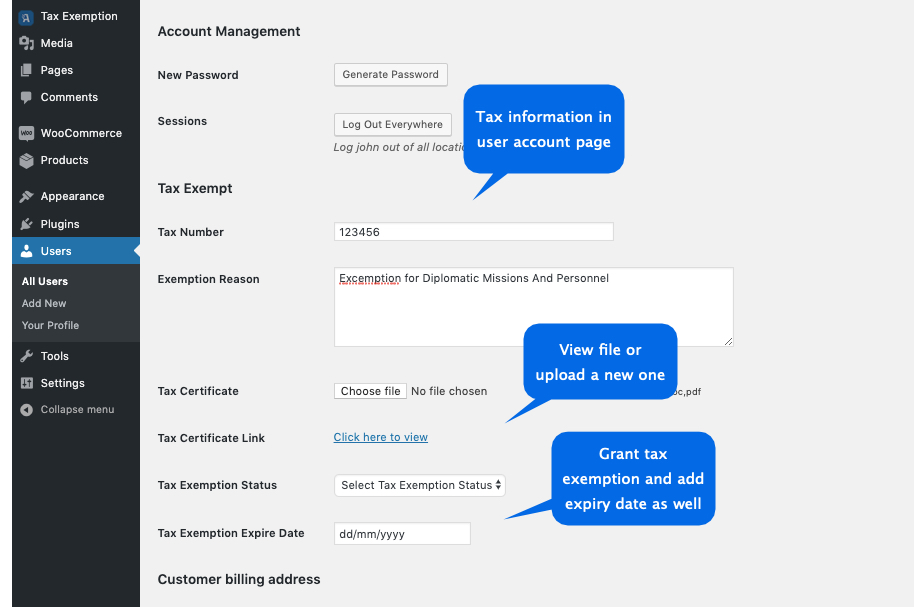

User-submitted data will be shown in the admin user edit page from where admin can approve/disapprove tax exemption request, also admin can set an expiry for tax exemption.

User-submitted data will be shown in the admin user edit page from where admin can approve/disapprove tax exemption request, also admin can set an expiry for tax exemption.

You can let users know that tax exemption is available and write instructions about how they can apply.

You can let users know that tax exemption is available and write instructions about how they can apply.

Is it compatible with AvaTax tax plugin?

Yes, its partially compatible with WooCommerce AvaTax plugin. The checkbox to manually remove tax from checkout isn’t compatible with AvaTax. The tax has to be removed automatically. The “Remove Tax Automatically” checkbox needs to be checked from WooCommerce > Tax Exemption > General to automatically remove tax from order.

Can I give partial tax exemption? The tax is being charged at 14% and want to give exemption for 7% only?

No, the tax will be fully removed. Currently, it is not possible to provide partial tax exemption.

I want to exclude the state tax and keep the federal tax, Is it possible?

If you applying 2 different taxes, both taxes will be removed. Currently, it’s not possible to remove one tax and keep the other one.

Is it compatible with AvaTax tax plugin?

Yes, its partially compatible with WooCommerce AvaTax plugin. The checkbox to manually remove tax from checkout isn’t compatible with AvaTax. The tax has to be removed automatically. The “Remove Tax Automatically” checkbox needs to be checked from WooCommerce > Tax Exemption > General to automatically remove tax from order.

Can I give partial tax exemption? The tax is being charged at 14% and want to give exemption for 7% only?

No, the tax will be fully removed. Currently, it is not possible to provide partial tax exemption.

I want to exclude the state tax and keep the federal tax, Is it possible?

If you applying 2 different taxes, both taxes will be removed. Currently, it’s not possible to remove one tax and keep the other one.