Spanish version of this page | Aquí puedes encontrar la versión en español de esta página

One of the largest concerns of any for-profit business is getting paid. The documents in this section explain how often your balance is paid out and how to manage your deposits.

NOTE: You may have heard other payment gateways or processors refer to these as “payouts.” Although the terms are different, they refer to the same thing.

The basics

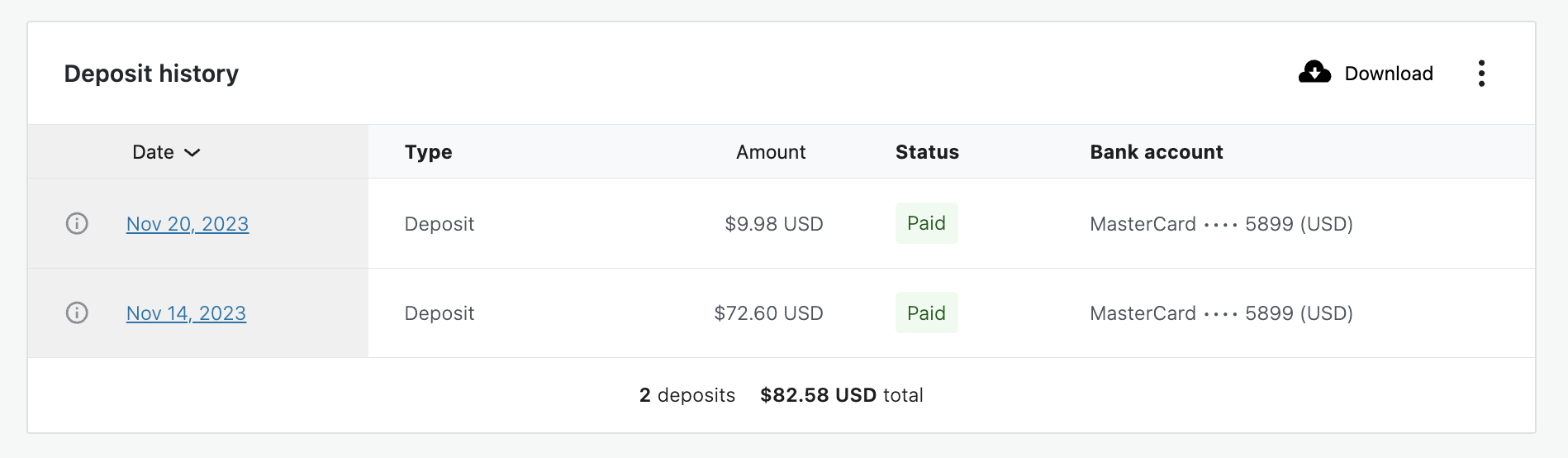

↑ Back to topMost basic information about deposits is found on our Managing Money page. This includes how to view a list of your deposits, filter them, and download them to a spreadsheet.

Deposit timing

↑ Back to topThe main page to review on deposits is our deposit schedule document. It explains how often your balance will be paid out depending on your business location, as well as other important details to keep in mind when it comes to getting your money.

We also have a document on why your deposits might be suspended and what to do about it.

Managing deposits

↑ Back to topIn some cases, it is possible to change your deposit schedule to better suit the needs of your business. You can also change the bank account that deposits are routed to.

If your store accepts multiple currencies, you may also want to add more than one bank account in order to avoid currency conversion fees.

Instant deposits

↑ Back to topInstant deposits are a way of getting even faster access to your money. Our Instant Deposits guide provides an overview of the feature and who is eligible for instant deposits. Additionally, this page explains the differences between Instant Deposits and scheduled deposits.