Because WooPayments is built in partnership with Stripe, it can sometimes be difficult to determine whether to use WooPayments or the Stripe plugin itself. In order to help you choose between the two, we’ve highlighted some important differences here.

It’s also possible to use both gateways at the same time, although this does cause a few issues to be aware of.

WordPress dashboard integration

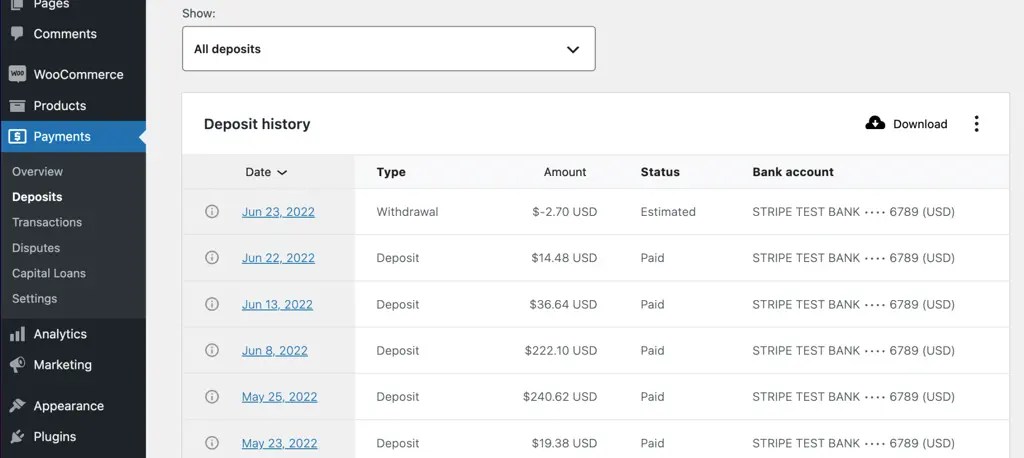

↑ Back to topWooPayments is designed to integrate closely with your WordPress website. It does this by displaying all your transaction data, deposit records, Capital loan details, and other information right within your site’s dashboard. This means you don’t need to leave your site’s admin interface to perform common business tasks.

The regular Stripe plugin is not so closely integrated with the WordPress dashboard. As a result, some tasks will require you to log into Stripe’s dashboard to complete them. (For example, reconciling your payments or challenging disputes.)

Accepting multiple currencies

↑ Back to topIf you sell your products to customers in multiple countries, you can use the multi-currency features in WooPayments to receive payments in various currencies. It can also give your customers a choice of currencies to pay in.

The regular Stripe plugin does not have this built-in. Instead, you would need to install a second plugin to enable multi-currency support.

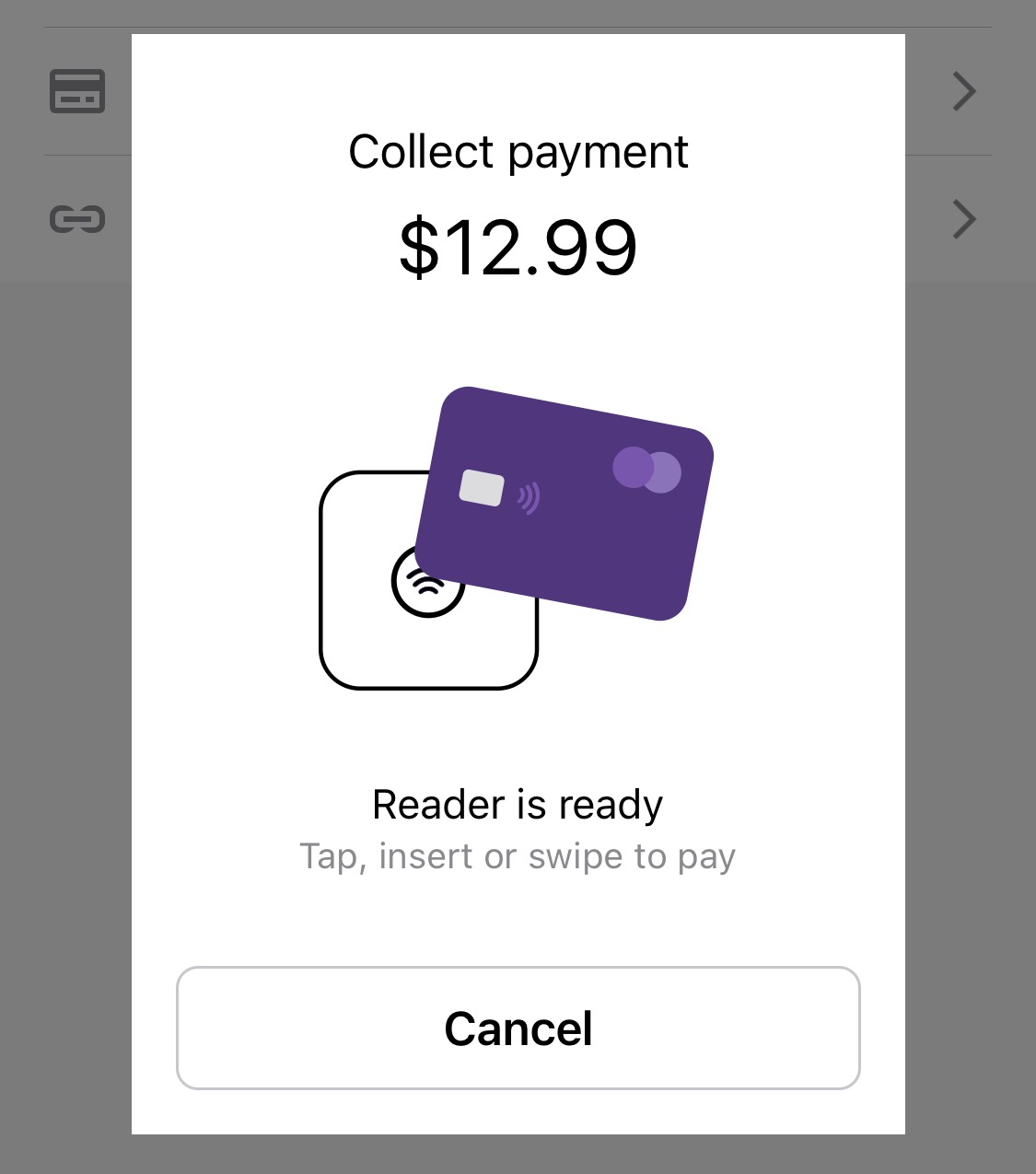

In-person payments for UK and Canada

↑ Back to topWooPayments offers merchants in the U.S., UK, and Canada the option to accept in-person payments using a card reader device.

The Stripe plugin only offers in-person payments for U.S. merchants.

Initial setup and API keys

↑ Back to topWooPayments creates a special kind of Stripe account for you during the signup process, called a Stripe Express account. This account is linked directly to your site, without you having to copy and paste any API keys. This makes the initial setup process less complex as compared to the Stripe plugin.

However, because WooPayments does not make the Stripe API keys available (even after setup is complete), it may not be suitable for certain merchants. For example, if you need to integrate with a third-party accounting service which requests the Stripe API keys, the Stripe plugin would be a better fit. This is because it connects to regular Stripe accounts, which do make their API keys available to you.

Country availability

↑ Back to topThe regular Stripe plugin supports businesses based in more countries than WooPayments at this time. You can tell us where you’d like to see WooPayments next by filling out this form.

Both plugins support the following:

- Australia

- Austria

- Belgium

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hong Kong

- Hungary

- Ireland

- Italy

- Japan

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- United Arab Emirates

- United Kingdom

- United States

The Stripe plugin also supports these:

- Brazil

- Gibraltar

- India (Preview)

- Liechtenstein

- Malaysia

- Mexico

Instant deposit requirements

↑ Back to topInstant deposits give eligible merchants a way to receive some or all of their account balance very quickly. To help prevent abuse, both WooPayments and Stripe have requirements that must be met before merchants can enable instant deposits.

WooPayments has slightly different requirements before merchants can enable Instant Deposits. Stripe’s Instant Payouts requirements are the relevant ones if you use the Stripe plugin. Here’s a comparison chart:

| WooPayments | Stripe | |

|---|---|---|

| Countries | U.S. | Australia, Canada, Singapore, UK, U.S. |

| Min. Account Age | 90 days | 60 days |

| Min. Volume | $1000 in last 90 days | $5000 total |

Advanced Stripe features

↑ Back to topThough WooPayments does take advantage of some of Stripe’s features, like Radar for fraud protection or (optionally) Billing for recurring subscriptions, the overall goal is to simplify the process of taking payments for your business.

If your business requires some of the more advanced features Stripe offers, you may wish to use the Stripe plugin in combination with a regular Stripe account.

Multiple businesses or websites

↑ Back to topWooPayments works by connecting to a single Stripe Express account and pulling all your transaction data and deposit information in the WordPress dashboard. This is very convenient and perfectly functional for most merchants.

However, if you need to take payments from multiple WooCommerce websites, but view reporting for those sites all in a single place, using the standalone Stripe plugin may be better.