If your business is based in a country where you may need tax invoices, you can receive a monthly invoice showing our fees and the relevant tax (VAT/GST/CT) on those fees. We will require you to supply your business name, address, and tax ID number (if registered) the first time you access these invoices.

Invoices for the previous month are generated on the 10th day of each month.

Eligible countries

↑ Back to topYour business must be in one of the countries below to get tax invoices:

- Australia

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Japan

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- United Kingdom

Accessing documents

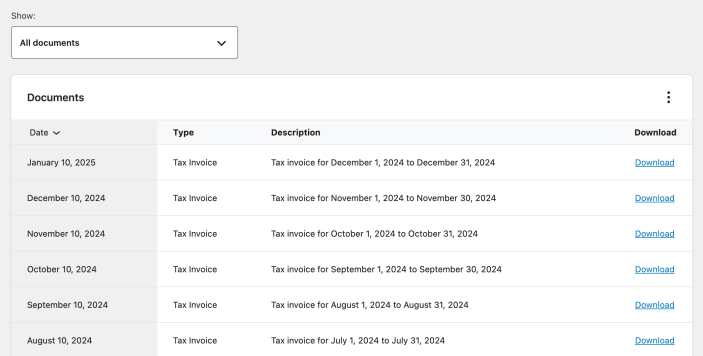

↑ Back to topTo access your documents, go to Payments > Documents menu in your dashboard. On this page, you can:

- View the list of documents.

- Sort the list by date.

- Filter the list by date and type.

- Download a specific document.

New invoice notification

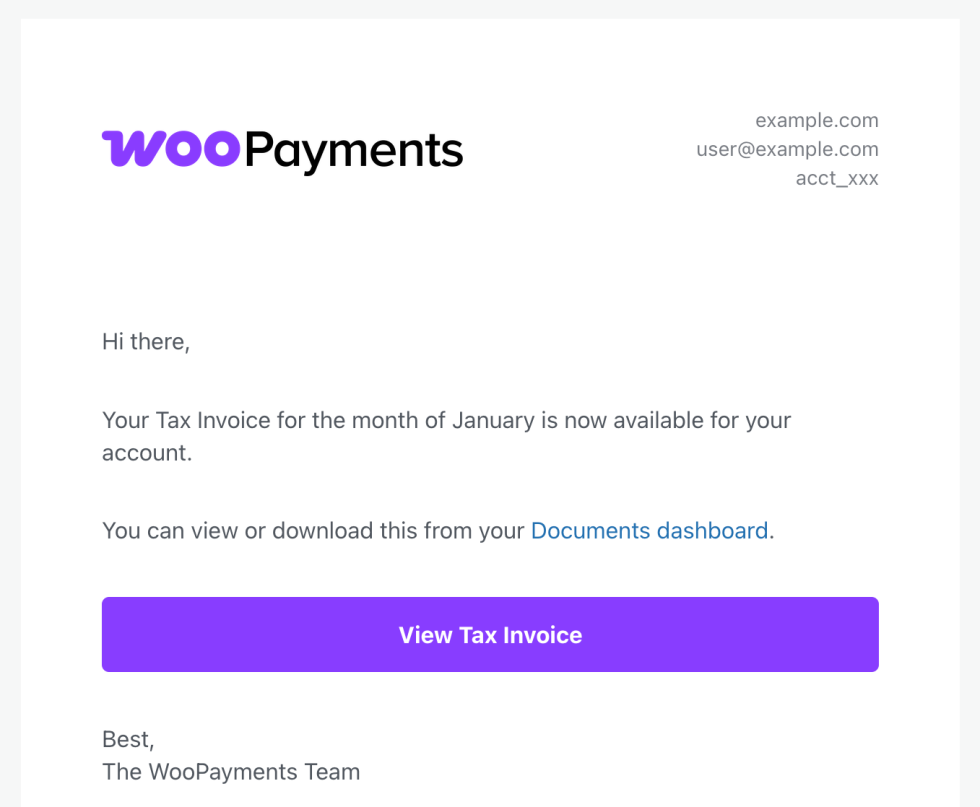

↑ Back to topInvoices for the previous month are generated on the 10th day of the each month. When a new invoice is available, you will receive an email notification like this:

When you click on the View Report button, you will be taken to the invoice just as if you had clicked on the Download button from the Payments > Documents page.

If you do not want to receive these notifications every month, you can use the unsubscribe link in the email footer. Even if you unsubscribe, you will still be able to access the invoices from your site’s dashboard.

Providing your tax details

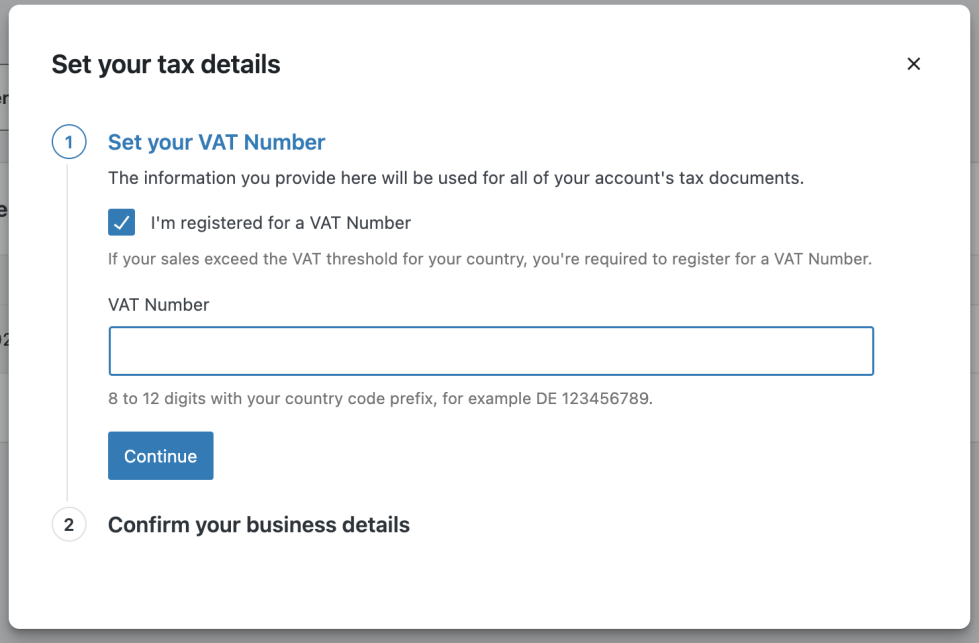

↑ Back to topIf you have not provided us with your tax details before downloading an invoice, you will be prompted to do so when you attempt to download one. The data submitted in this form will be applied to all of your invoices, and you will not be prompted again.

If you are not registered for a tax ID number, simply click on Continue without checking the box.

If you are registered for a tax ID number, please check the “I’m registered for a VAT number” box. The tax ID field with your country’s prefix should appear. Provide your tax ID number and click Continue to initiate the validation process for the provided tax ID number. In the event that the provided tax ID fails validation, you will be notified.

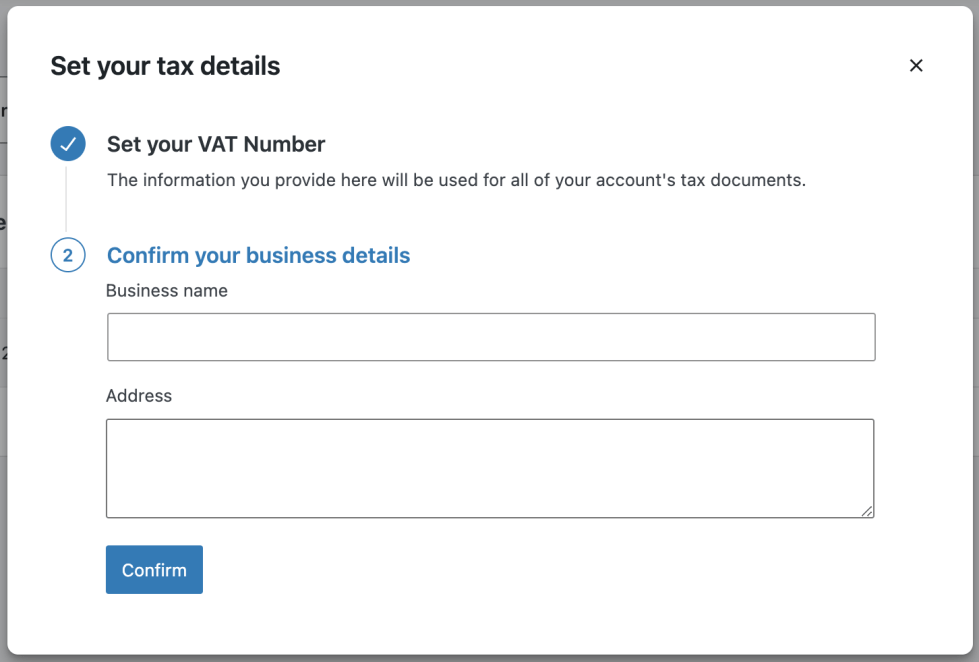

After clicking on Continue, you should be redirected to the second step of this form.

Please fill in your business name and address and click Confirm. After your details are successfully saved, you will be automatically redirected to the requested invoice.

NOTE: Providing your tax ID in this manner only applies to tax invoices. You may also need to update the tax ID on file for your account as a whole.

Adding tax details directly

↑ Back to topYou can also access the tax details form directly by adding ?woopayments-vat-details-redirect to the end of your site URL, like so:

https://www.example.com/?woopayments-vat-details-redirect

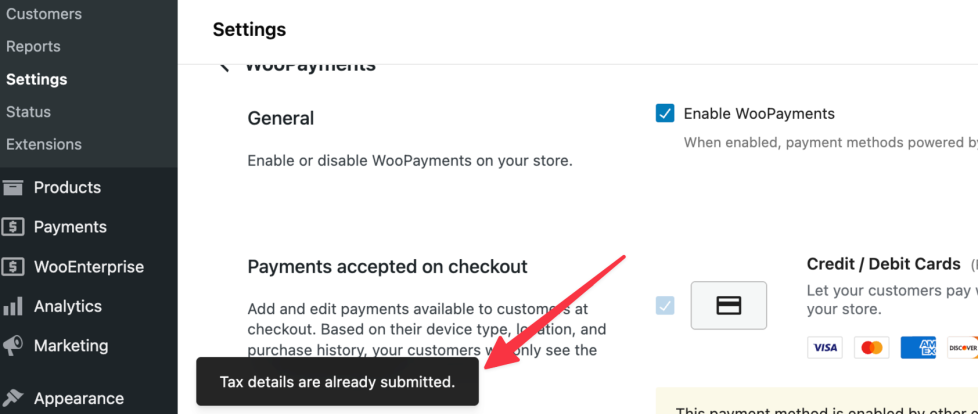

If you’ve already submitted your tax details, visiting this link will show a Tax details are already submitted notice instead of the form. This confirms that we already have your information on file.

NOTE: Providing your tax ID in this manner only applies to tax invoices. You may also need to update the tax ID on file for your account as a whole.

Editing your tax details

↑ Back to topIt is not possible to edit your tax details after submitting them. If you need to change your tax information, please contact support and provide us with the following:

- Company address

- Company name

- Company tax ID number

Downloading an invoice

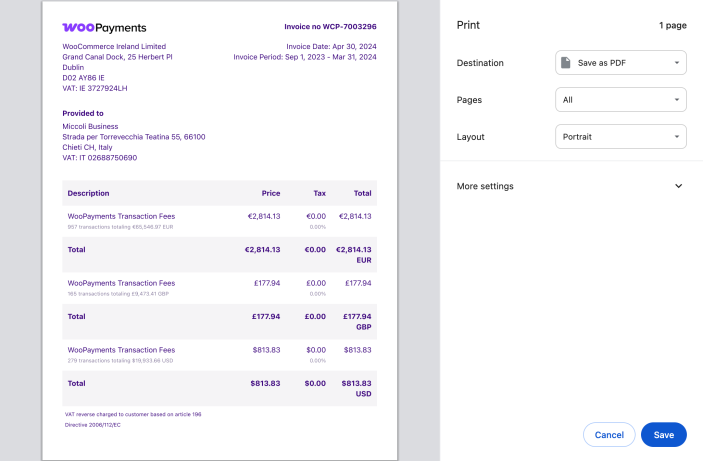

↑ Back to topAfter clicking on the View Report link from an email notification, or the Download button in the Payments > Documents page, a new tab will open with your invoice. A print dialog, which you can use to print the invoice or save the invoice as a PDF file, will be displayed automatically.

The document will contain a number, a date, and the time period being reported on. The information submitted in the tax details form will be used in the Provided To field.

If you have funds paid out in multiple currencies, the invoice will contain a line item for each currency. Each line item will show the number and total amount of the transactions processed in that currency in addition to the fees charged by WooPayments.

NOTE: The transaction data used in the invoice is based on the UTC timezone, which may cause some discrepancies between the transactions shown under Payments > Transactions and the invoice.

Site inaccessible

↑ Back to topIf your site is inaccessible for some reason (e.g., your host is down or you’ve deleted the site), you can contact support for a copy of any documents you need.