Taxamo Version 2 (API) is now supported

The latest version of this plugin supports the API v2. Please ensure your account with Taxamo supports the API v2 before upgrading. If you are unsure, please ask Taxamo, otherwise please don’t upgrade or buy this plugin until your Taxamo account supports it.

Taxamo Integration for WooCommerce connects you to the Taxamo SaaS solution for compliance with 2015 EU VAT rules.

Using Taxamo’s API, it provides correct TAX calculation, evidence collection, and registration of payments, plus covering EU MOSS settlement and audit services.

Requirements

↑ Back to top- A Taxamo account. More info at: Taxamo

- Please note, this plugin is compatible with the versions of WordPress and WooCommerce at the time of its release (June 2022).

Installation

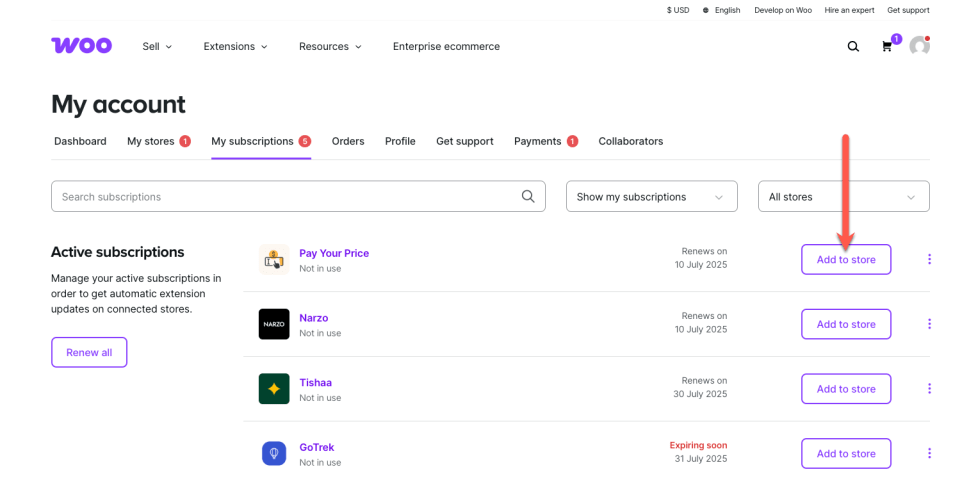

↑ Back to topTo start using a product from WooCommerce.com, you can use the “Add to store” functionality on the order confirmation page or the My subscriptions section in your account.

- Navigate to My subscriptions.

- Find the Add to store button next to the product you’re planning to install.

- Follow the instructions on the screen, and the product will be automatically added to your store.

Alternative options and more information at:

Managing WooCommerce.com subscriptions.

Setup and Configuration

↑ Back to topTo set up Taxamo:

- Go to: WooCommerce > Settings > Integration > Taxamo.

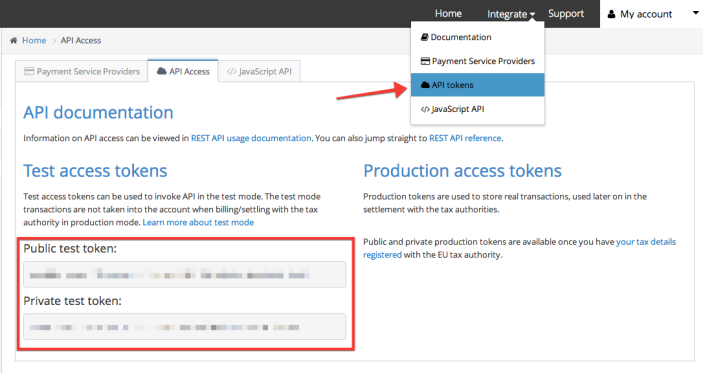

- Enter the Private Token and Public Token from your Taxamo account.

- Enable Self Declaration (recommended).

- Enable VAT Number Field (recommended).

- Select whether to Show Invoices.

- Select whether to Force Universal Pricing. This must be in line with your setup under WooCommerce > Settings > Tax.

- Save changes.

Get your personal API tokens from the Taxamo dashboard. Note that there are test and production tokens. We advise testing your integration first with the test tokens before using production tokens on your live website.

Product Setup

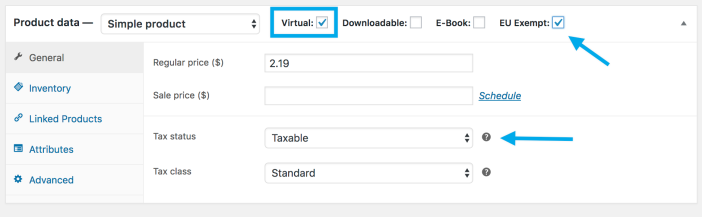

↑ Back to topThe Taxamo extension only updates taxes for virtual products and only when the customer is in the EU.

To set a product as virtual, edit the product and tick the Virtual checkbox. This prompts the EU Exempt checkbox to display.

If the product is an E-book also tick the E-Book checkbox, and it automatically becomes a virtual product. Set your product to Taxable by selecting this status in the dropdown under Tax Status.

Usage

↑ Back to topCustomer

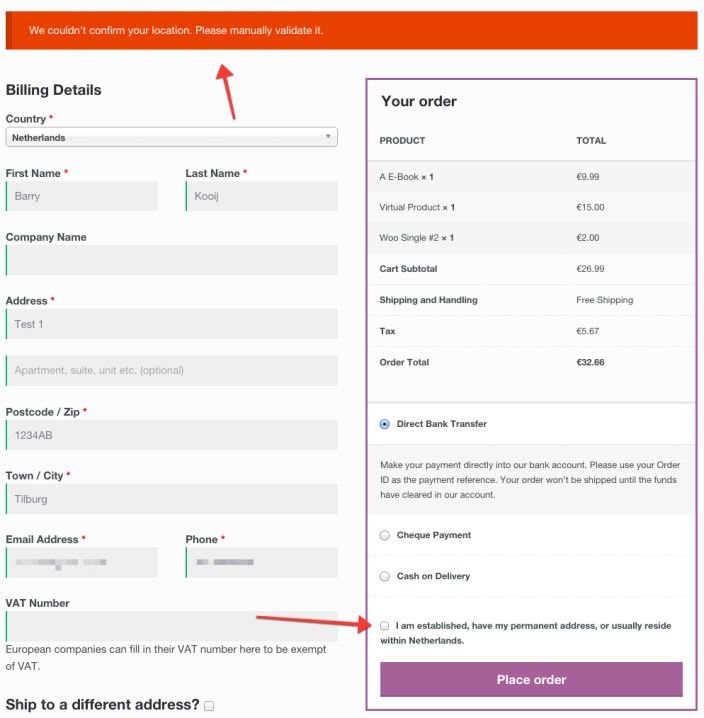

↑ Back to topTaxamo Integration for WooCommerce calculates the correct taxes on the checkout page, based on your customer’s location.

The order review section is updated automatically when the customer enters a billing address, applying correct taxes based on location. It displays and savse each applied tax as a separate tax rate.

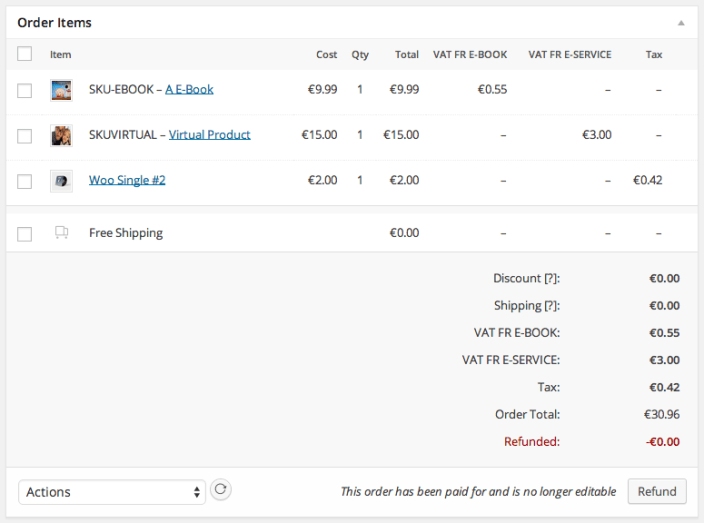

Shop owner

↑ Back to topItems in the order details screen will display applied taxes. Orders are also stored in your Taxamo account. Via your Taxamo dashboard, you can view more details about taxes applied to the order, evidence that were stored, and detailed reports on what taxes are collected.

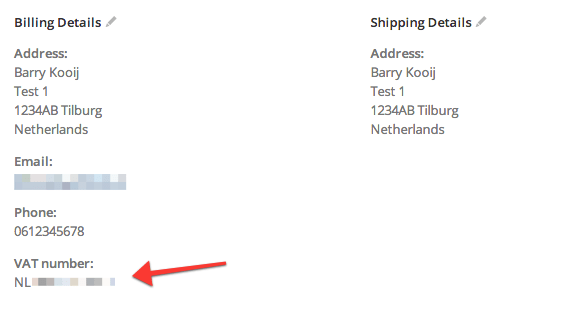

If your customer entered a valid VAT number, the tax rate is set to 0%. The VAT number is stored in your WooCommerce order and in your Taxamo account; and the My Account page of the customer.

Frequently Asked Questions

↑ Back to topWhat methods of customer location verification are done?

↑ Back to topThe customers billing country and IP address are sent to the Taxamo API. If they don’t match, the customer is asked to manually verify his location — this is called ‘self declaration’. Self Declaration is an option that’s enabled by default.

Which shop location is used when calculating taxes?

↑ Back to topThe shop location entered in your Taxamo dashboard is used when calculating taxes. Ensure that your WooCommerce shop location and Taxamo shop location always match.

Does Taxamo Integration for WooCommerce allow taxes to be exempt by entering a valid VAT number?

↑ Back to topYes, the Taxamo extension adds a VAT field to your checkout page. When a VAT number is entered the Taxamo API will be used to validate the VAT number and if correct the tax rate will be set to 0%.

Troubleshooting

↑ Back to topTaxes are not showing in my shop.

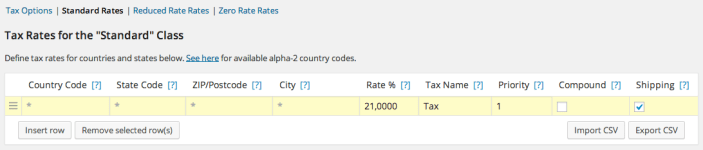

↑ Back to topBe sure that you have taxes set up under WooCommerce > Settings > Tax.

WooCommerce also needs at least one tax rate that can be used for default taxes when Taxamo isn’t used (non-digital products).

Taxes are not exempt when a valid VAT number is entered.

↑ Back to topTaxes are only exempt when the customer location differs from the shop location set in the Taxamo settings. Make sure your WooCommerce shop location matches the shop location entered in the Taxamo settings.

The correct tax label shows up but there VAT is set to 0.

↑ Back to topVerify that you have a billing country field on your checkout page. Without a billing country, the Taxamo extension cannot gather enough evidence on where the customer is located. EU law enforces you to have at least two (2) pieces of non-conflicting evidence of where your user is located.

Why do all my orders show up at Taxamo, even ones without EU VAT?

↑ Back to topDue legal requirements, the reports must contains all orders, regardless of their VAT status.

Questions and Feedback

↑ Back to topHave a question before you buy? Please fill out this pre-sales form.

Already purchased and need some assistance? Get in touch with the developer via the Help Desk.