María, a shop owner based in the Canary Islands has been running her online store for a few years. In order to ease the burden around tax calculations for her online store, she would like to set the Canary Island General Indirect Tax (IGIC) directly in her WooCommerce tax rates. This will allow taxes to be calculated correctly during checkout.

Traditionally, using just the core WooCommerce plugin, María would only be able to configure tax rates for Spain as a whole since the state code isn’t available during checkout.

For this use-case, the following extensions are needed:

- Shipping Locations Pro – Used for adding the states/locations (and the state codes) for all of Spain, including its constituent islands.

To configure the special tax rate for the Canary Islands in Spain, follow these steps:

- Log in to your WordPress admin area;

- Ensure that Shipping Locations Pro is installed & active

- Navigate to WooCommerce > Settings > Shipping Locations

- From the country dropdown field, select Spain

- On the right-hand side, locate Las Palmas and Santa Cruz de Tenerife

- Make a note of the Region code –

GC and TF

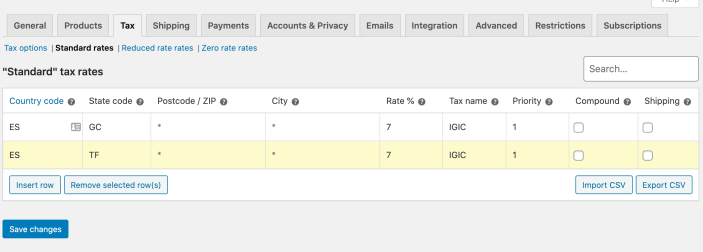

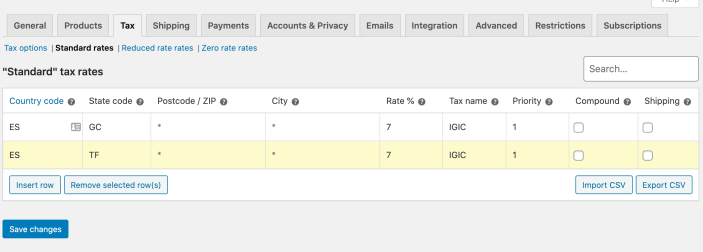

- Navigate to the WooCommerce tax rate settings at WooCommerce > Settings > Taxes > Standard Rates

- Add a new line, using

ES for the country code and GC as the state code with a tax rate of 7%

- Repeat step #8 but use

TF as the state code

- Select Save changes

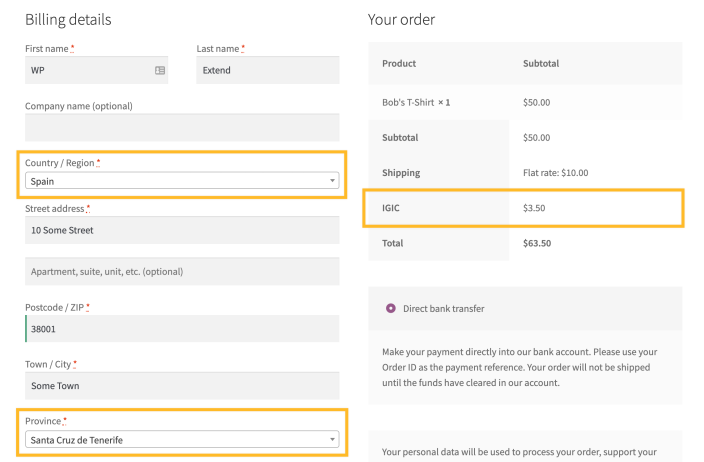

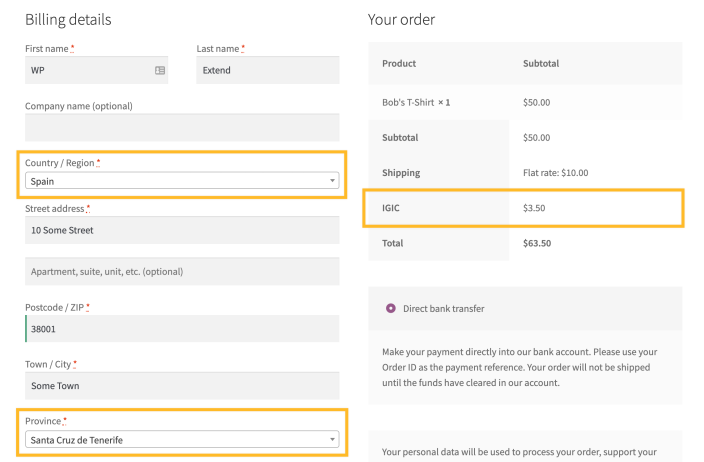

When configured correctly, the results are illustrated below: