Heads up! We will soon retire this plugin in favor of Global Payments HPP with improved checkout security.

If you are a new customer, please check out our WooCommerce Global Payments HPP plugin.

If you are an existing Global Payments customer, you may continue to use this plugin without issue. Please stay tuned for migration instructions coming soon!

Overview

↑ Back to topGlobal Payments is one of Europe’s largest and fastest growing online payment gateways. The WooCommerce Global Payments gateway (formerly called “Realex”) allows your customers to pay for their order with a credit card directly on your eCommerce storefront when checking out, which results in a highly integrated checkout process. Customers can also securely store their credit cards in the Global Payments RealVault for easy future purchases with no security burden on your store, as these card numbers are tokenized and stored by Global Payments.

Please note: This plugin requires that you have an SSL certificate installed and active on your site for security.

Installation

↑ Back to top- Download the extension from your WooCommerce dashboard

- Go to Plugins > Add New > Upload and select the ZIP file you just downloaded

- Click Install Now, and then Activate

- Go to WooCommerce > Settings > Payments > Global Payments and read the next section to learn how to setup and configure the plugin.

Setup and Configuration

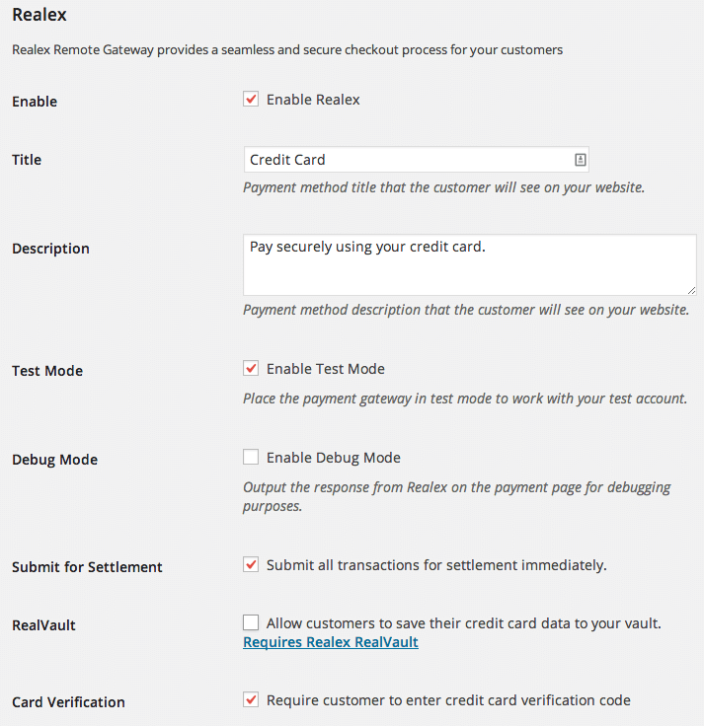

↑ Back to topTo configure the plugin, go to WooCommerce > Settings > Payments. You should see “Global Payments” as an option at the top of the screen. Click Global Payments to see the settings:

- Enable/Disable – This will enable the gateway to be used by customers to checkout.

- Title – This is the text shown for the payment during checkout and on the Order Received page.

- Description – This is the text shown under the title during checkout. Limited HTML is allowed. If you enable test mode, this section will also display a notice along with test credit card numbers.

- Test Mode – Enable this if you are using a developer/test account from Global Payments. Be sure to disable this prior to going live.

- Debug Mode – Enable this to place the gateway in debug mode, which will output the full response from the Global Payments servers on the payment page, for debugging purposes. As a best practice and for maximum performance, please do not enable this unless you are having issues with the plugin.

- Submit for Settlement – Choose whether to authorize the customers card for the purchase amount, or to both authorize and collect the funds. Not sure which is right for you? Check out this tutorial on Authorizing vs. Authorizing and Capturing.

- RealVault – Check this to enable securely saving your customers credit card to your vault. This requires RealVault service to be enabled on your Global Payments account.

- Checkout Save Card Text – Enter the text you would like to include next to the checkbox that saves the users credit card to their account. You can leave this blank if you do not have RealVault enabled.

- Manage My Cards Text – Enter the text you would like to be in the button that appears during checkout on users that have vaulted credit cards. This button takes the user to their account page so they can remove or update any existing cards on file.

- Card Verification – Enable this to require customers to supply their 3 or 4 digit Card Security Code which can be found on the back of most cards

- Address Verification Service (AVS) – Enable this to perform an AVS check on customers billing address

- 3DSecure – Enables RealMPI Payer Authentication (3D Secure, SecureCode) for Visa, MasterCard and Switch cards only. Note that you must contact Global Payments support to enable on your account.

- Liability Shift – This option is only available when 3DSecure is enabled, and ensures that only transactions with liability shift will be accepted, eliminating the chance of a customer chargeback. Note that this is not compatible with RealVault as transactions with vaulted credit cards do not support a liability shift.

- Accepted Cards – This controls the card logos that display during checkout. This is purely cosmetic and has no affect on the cards actually accepted by your merchant account. Hold CTRL (CMD on Mac) to select multiple card types.

- Merchant ID – Your Global Payments Merchant ID – contact your Global Payments rep for this information.

- Shared Secret – The shared secret for your account, provided by your Global Payments sales rep

- Test Account – Optional test account name, if not supplied the default will be used

- Live Account – Optional live account name, if not supplied the default will be used

- Amex Test Account – Optional test account name for American Express transactions, if not supplied the main test account will be used

- Amex Live Account – Optional live account name for American Express transactions, if not supplied the main live account will be used

Usage

↑ Back to topSecurely Storing Customer Credit Cards

↑ Back to topYou must have an active merchant account with Global Payments and RealVault enabled on your account in order to make use of this feature. To take advantage of the RealVault for storing of customer credit card info, contact your Global Payments salesperson and request that they enable RealVault for your account.

Address Verification Service (AVS)

↑ Back to topThe Address Verification Service (AVS) verifies the cardholder’s address by checking the information provided at the time of sale against the issuing bank’s records. If a transaction fails an AVS check it will not automatically be declined by your bank. It is an advisory service and requires that the details of non-matched information be checked by you. If this setting is enabled and the AVS result is a non-match the completed order note will be updated with the result of the AVS check, which will be one of the following:

- Not matched

- Problem with check

- Unable to check – not all countries are supported, and transactions run while in Test Mode will always return this

- Partial match

Test Transactions

↑ Back to topTo perform test transactions, enable Test Mode as described above and supply the test account names as needed. You must also request test card numbers from Global Payments.

Troubleshooting

↑ Back to topHaving trouble? Follow these steps to make sure everything is setup correctly before posting a support request:

- Check that your Merchant ID and Shared Secret are correct.

- Double-check that all Global Payments credentials are correct : )

- Enable debug mode to the checkout page and review the errors messages that the plugin is providing.

- Submit a support ticket, with the debug log as an attachment.

Frequently Asked Questions

↑ Back to topQ: Why do some order numbers not match between Global Payments and WooCommerce?

A: In some instances the order number displayed for a transaction within Global Payments will not match the corresponding order number shown in WooCommerce, for instance WC Order #500 might display as 500-3 in Global Payments. This is due to a limitation with the Global Payments gateway whereby each payment attempt must use a unique order number, combined with a limitation on the WooCommerce side whereby failed orders from redirect gateways such as this one must use the same order number for each payment attempt.

The solution this gateway plugin uses is to append an incrementing counter to the order number for all failed transaction attempts. So in our example of 500-3, this would indicate that the customer most likely tried to pay for order #500 3 times before succeeding.

Questions & Support

↑ Back to topHave a question before you buy? Please fill out this pre-sales form.

Already purchased and need some assistance? Get in touch with support via the help desk.