Spanish version of this page | Aquí puedes encontrar la versión en español de esta página

Being aware of some of the basic concepts around fraud and disputes is a good idea for every merchant. As such, we’ve put together this page and the linked documents to help guide you through these complex topics.

The first thing to know is that a transaction is regarded as fraud if the cardholder didn’t authorize it. Unauthorized charges can be done by third parties using stolen physical cards or, more often, stolen card numbers. When the real cardholder sees the charge on their statement, or in their bank’s online system, they contest the payment. This is known as a dispute.

Handling fraud and customer disputes can be one of the most unpleasant parts of running a business. Our documentation pages on these topics will show you how to prevent fraud and disputes as much as possible, how to handle them when they do occur, and answer several common questions.

Preventing disputes

↑ Back to topThe best way to avoid having to deal with disputes is to stop them from occurring in the first place. There are a number of effective tactics you can use to do this.

That said, it’s important to keep in mind that there is always some risk that a customer will dispute their purchase, regardless of the payment gateway or platform you are using for your store. In other words, your goal should not be to have absolutely no disputes. Rather, your goal should be to minimize the odds of a dispute occurring.

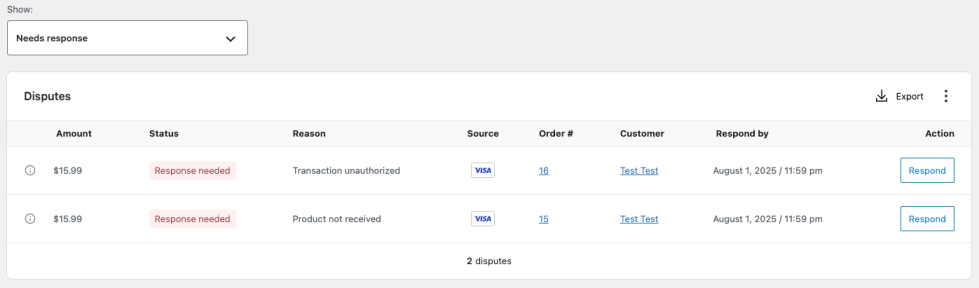

Managing disputes

↑ Back to topNot responding to disputes can lead to fines and the possibility of being prohibited from doing business by the card networks. Our guide to managing disputes provides you with some helpful advice on how to respond.

Keep in mind that, although WooPayments is used to submit evidence and challenge the dispute, the dispute outcome is determined solely by the customer’s bank. Neither we nor our financial service providers influence their decision. Unfortunately, once they are decided, dispute decisions can not be overturned.