Overview

↑ Back to topThe IOSS EU VAT for WooCommerce plugin helps non-EU sellers registered in the Import One Stop Shop (IOSS) to comply with the new European Union VAT rules.

The extension adds the following features to WooCommerce:

- Remove the VAT from orders when the value of the goods transported to the EU exceeds EUR 150.

- Displays a customizable message on the checkout page to inform the customer that he must pay the VAT and customs duties at delivery when the value of the goods exceeds EUR 150.

- Collect information related to the IOSS and display it on the edit order page.

- A new report to help sellers to submit the monthly IOSS VAT return.

Important: We’re not tax professionals, so our advice is on how to use our software. We recommend consulting a tax professional for advice on what or when to charge tax/VAT/GST or any other tax-specific question.

Using this extension does not guarantee that you are in compliance with the VAT rules. Use it after consulting a tax professional.

Installation

↑ Back to topIOSS EU VAT for WooCommerce requires WooCommerce 4.0+

There are two different methods to install your plugin:

One-Click Install Method

↑ Back to topYou can use a one-click install method if you have connected your WooCommerce.com account to your website. Go to WooCommerce > Extensions > My Subscriptions tab and click the Download button next to the IOSS EU VAT for WooCommerce extension.

This article explains how you can connect your WooCommerce.com account to your store.

File Upload

↑ Back to topLog in to your WooCommerce account and go to the Downloads page to download the zip file of the extension to your computer.

The Safari web browsers automatically unarchive downloaded Zip files. Make sure you disable this functionality from Safari > Preferences > General > and uncheck” “Open safe files after downloading.”

From your WordPress Dashboard, Go to Plugins > Add New and Upload Plugin. Select the zip file from your computer and click the Install Now button. Then click the Activate button to activate the IOSS EU VAT for WooCommerce plugin.

After activating the plugin, go to WooCommerce > Extensions > My Subscriptions tab and activate the subscription on your site to receive automatic updates. Review how to activate a subscription on your site in the WooCommerce docs.

Setup and Configuration

↑ Back to topEnable Taxes and Calculations

↑ Back to top- Go to: WooCommerce > Settings > General.

- Select the Enable Taxes and Tax Calculations checkbox.

- Save changes.

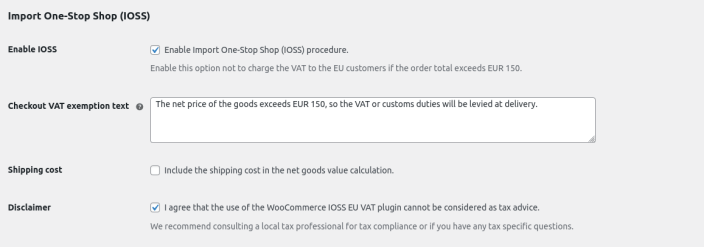

Plugin Settings

↑ Back to topGo to WooCommerce > Settings > Tax and scroll down the page.

- Enable IOSS – Enable this option not to charge the VAT to the EU customers if the value of the goods exceeds EUR 150.

- Checkout VAT exemption text – (Optional) Text to show on the checkout page if the VAT is exempt due to the IOSS procedure. You can leave this option empty to not display any text.

- Shipping cost – Enable this option to include the shipping cost in the net goods value.

- Disclaimer – Check to accept the disclaimer terms. It is required to enable the IOSS.

Set up EU VAT rates

↑ Back to topNon-EU sellers registered in the Import One Stop Shop (IOSS) must collect the VAT at the point of sale on consignments below EUR 150. So you have to input EU VAT rates into WooCommerce. Please see the Setting up Taxes in WooCommerce documentation.

You can find the latest VAT rates on the European Union website in a PDF document.

You can import the VAT rates to save time. Here are EU rates in CSV format: vat_rates.csv.

Please check the rates are correct after importing.

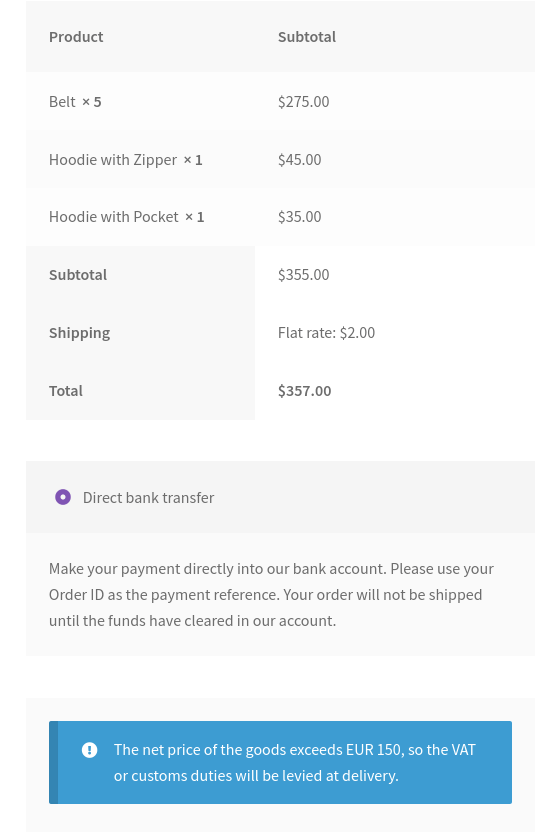

Checkout process

↑ Back to topIf the shipping country is an EU country and the net goods value exceeds 150 EUR, the plugin will remove the taxes and display the notice you defined in the settings.

Note: The plugin supports multiple currencies. It converts the net goods value to EUR using the current European Central Bank exchange rate.

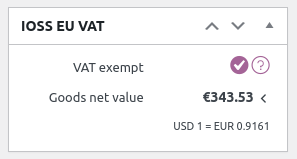

IOSS Order meta box

↑ Back to topIn the order view, it shows a meta box with the IOSS information:

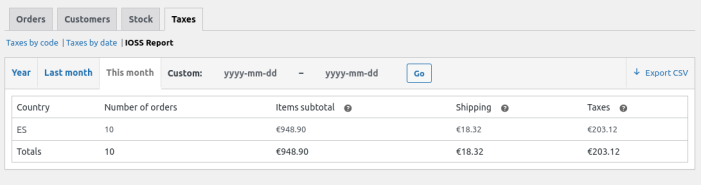

Report

↑ Back to topThe IOSS EU VAT for WooCommerce plugin includes one report that may be useful for submitting the monthly IOSS VAT return.

Go to WooCommerce > Reports > Taxes > IOSS Report. This report includes the taxes collected and order amounts in EUR grouped by country.