A dispute (also called a “chargeback”) occurs when a cardholder contests a payment made with their card. Disputes can also be initiated by their bank as well, such as if the cardholder reports the card as having been stolen.

Handling disputes can be unpleasant, especially when you need to challenge one. But not responding to disputes would be worse, because it can lead to fines and/or being prohibited from charging certain types of cards.

This page explains how disputes work in general, as well as how to respond to them. Our guide to preventing disputes might also be of interest.

How disputes work

↑ Back to topThe dispute process usually follows these steps:

- The cardholder disputes a charge, or a portion of one, through their bank.

- The disputed amount and the dispute fee are immediately withdrawn from your account and returned to the card issuer.

- We alert you to the dispute in a few different ways.

- You challenge the dispute, accept the dispute, or do nothing.

- The card issuer decides the outcome.

- If you challenge the dispute and lose, accept the dispute, or simply do nothing, the card issuer returns the disputed amount to the cardholder. (The timing of that is at the card issuer’s discretion.) The dispute fee is kept by the card issuer.

- If you challenge the dispute and win, the disputed amount and dispute fee will be credited back to your account.

NOTE: The dispute outcome is determined solely by the cardholder’s bank. Neither we nor our payment processor can influence their decision. After disputes are decided, the outcome cannot be appealed or overturned.

Timelines

↑ Back to topBanks usually let cardholders file disputes up to 120 days after the original charge, but this time can be extended in certain cases. (For example, when payments are made long before an event occurs, such as a concert or a hotel booking.)

Once a dispute is filed, you have a limited time to respond, usually between 7-21 days. Similarly, if you decide to challenge the dispute and submit evidence, the cardholder’s bank has a limited time to decide the dispute, usually between 60-75 days.

NOTE: Disputes for buy now, pay later orders have different timelines. Please see the Disputes section of our BNPL document for details.

Dispute fees

↑ Back to topEach dispute will incur a separate dispute fee. You can see the amounts on our fees page. They will differ based on your country and the payment method used.

Dispute fees are immediately debited from your account when a dispute is received. The only way to get the disputed amount and the dispute fee back is to challenge the dispute with evidence and win.

Keep in mind that dispute fees are originally imposed by card networks. These fees get passed through to our payments processor and then to your WooPayments account. By charging you a dispute fee, we are only relaying the fee charged by card networks.

Disputed amounts

↑ Back to topMost disputes are for the entire amount of the original charge. However, sometimes the disputed amount can be different. These special cases are explained below.

- Sometimes the cardholder only disputes a portion of the original charge. For example, if they ordered several products but only one arrived damaged.

- If the original charge was in a different currency, the disputed amount might be higher or lower than the original amount due to fluctuations in the exchange rate.

- If the original charge was for a subscription, and the customer disputed multiple payments of that subscription, their bank will sometimes create a single dispute for the total amount, but only apply the dispute against one of the original charges.

- Customers can dispute the entire charge even if you already sent a partial refund.

Dispute notifications

↑ Back to topWhen a disputes is received, WooPayments will alert you in various ways:

- An email to the address we have on file for your account.

- An alert on the order page under WooCommerce > Orders.

- A red bubble next to the Payments > Disputes menu item.

Partial refunds and disputes

↑ Back to topIf you issue a partial refund, the customer may still lodge a dispute for the partially refunded purchase. When this happens, the customer’s card-issuing bank may file a dispute for the full order amount — even though a refund was already issued.

If this happens, you will need to provide some specific evidence to win that dispute, such as:

- A copy of your store’s refund policy.

- Information about the partial refund, such as:

- The amount of the refund.

- The date of the refund.

- A screenshot of the refund information from your site’s Transactions page.

SEPA disputes

↑ Back to topLike other payment methods, SEPA has a process for customers to dispute charges. However, their dispute process works differently than other payment methods.

Specifically, if a customer disputes a payment within 8 weeks of the date of the original charge, they will automatically and immediately win the dispute. After the 8 week window, customers will not automatically win, but there’s no evidence submission process for merchants.

In either case, we suggest trying to work with the customer to resolve the dispute. If you come to an agreement, and they’re willing to return the funds to you, they must initiate a brand new payment.

3D Secure disputes

↑ Back to top3D Secure (3DS) requires customers to complete an additional verification step with their bank during checkout. Typically, they are directed to an authentication page on their bank’s website, where they must enter a password associated with the card or a code sent to their phone.

In practice, this means you shouldn’t receive many “Transaction unauthorized” disputes for 3DS payments. However, if a customer disputes a payment for any other reason (e.g. “Product not received”), then the standard dispute process applies. Inquiries can also be filed against 3DS payments.

Cartes Bancaires disputes

↑ Back to topAlthough Cartes Bancaires cardholders can dispute charges, the rules around doing so are more strict, and there are fewer reasons they can use to file a dispute. However, once a dispute is filed, merchants cannot challenge it.

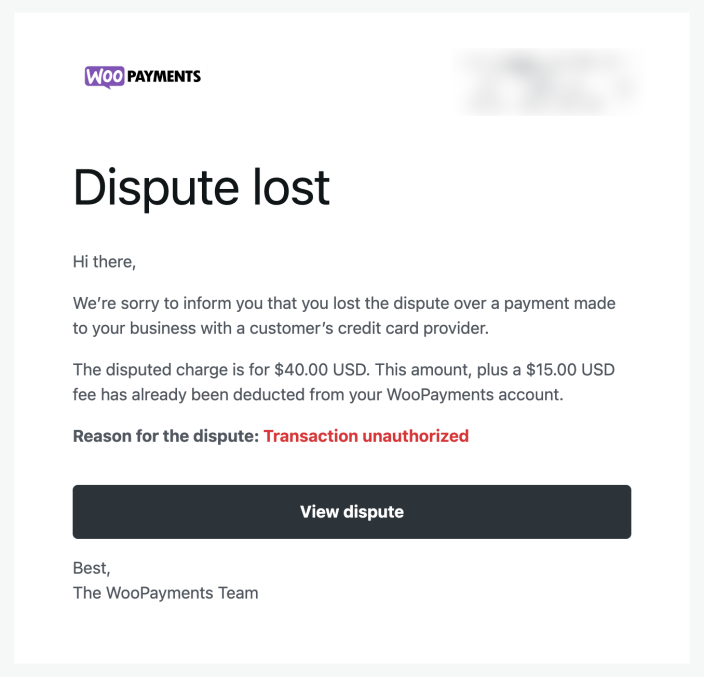

Thus, if a customer pays with a Cartes Bancaires card and later disputes the payment, you will receive a disputed payment email followed shortly by a dispute lost email.

There is no fee for Cartes Bancaires disputes.

Inquiries

↑ Back to topSome card issuers (mainly American Express and Discover) will occasionally utilize a pre-dispute step called an “inquiry.” An inquiry may also be referred to as a “retrieval” or a “request for information.”

During an inquiry, the bank will ask for some clarifying information about the payment, usually because their customer (the cardholder) does not recognize the transaction. You can resolve these without an additional fee by either:

- Sending any relevant evidence items to the bank, or…

- Issuing a full refund to the cardholder.

Card issuers can convert inquiries to disputes at their discretion. This usually occurs when you don’t respond to an inquiry, at which point it can become an unwinnable dispute. WooPayments will send you an email alert about this if it occurs.

Klarna also uses inquiries as part of their return process.

Responding to disputes

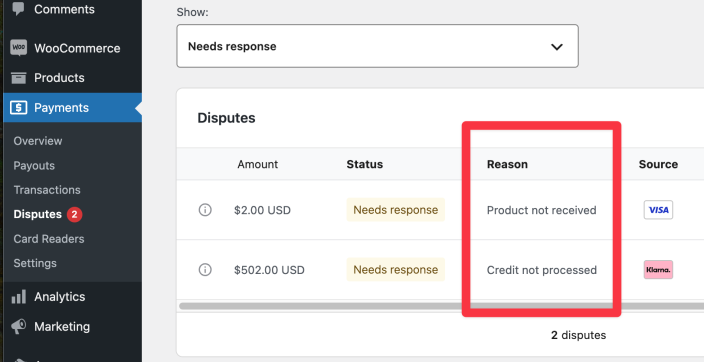

↑ Back to topDisputes are shown on the Payments > Disputes page, which by default shows only disputes that still need a response. They are sorted by the length of time until the response deadline, with the disputes closest to the deadline at the top.

When you click a particular dispute, you’ll be taken to the transaction details page to see more information, including the disputed amount, the dispute reason, customer information, and so on.

The steps you should take to resolve the dispute are also shown on the transaction details page. We’ve also explained them in more depth below.

1. Find the dispute reason

↑ Back to topThe reason the customer filed the dispute is noted in the list under Payments > Disputes, as well as on the transaction details page.

Each dispute reason has different evidence that may be needed, should you choose to challenge the dispute. Thus, it’s important to note the dispute reason as your first step.

2. Contact your customer

↑ Back to topWe suggest contacting your customer about their complaint, as it might give you a better understanding of the issue, and it could help you decide how to proceed.

Also, customers sometimes mistakenly dispute a charge. If they’re reminded of the transaction, you may be able to get them withdraw the dispute via their bank.

In any case, be sure to keep a record of all communication with your customer during this process, as it may be useful to submit as evidence later on.

3. Decide to challenge or accept

↑ Back to topOnce you understand the reasoning behind the customer’s dispute, you should next decide whether to accept it or challenge it.

Accepting means that you agree with the cardholder that the dispute was valid for the reason they gave. This is not considered an admission of wrongdoing, and indeed it is sometimes the most appropriate response.

Challenging the dispute allows you to submit evidence to the bank in an attempt to prove that the dispute is not valid. This is the only way to potentially get the disputed amount and the dispute fee back!

To help you decide, consider the following questions:

- Did the customer return the products, or did you not deliver them?

- Is the disputed amount large enough to be worth challenging?

- Do you have the evidence required to challenge the dispute?

- Can you convince the cardholder to withdraw the dispute?

Once you’ve decided, you can take action on the transaction details page.

If you’ve decided to accept the dispute, simply click the dispute to open it, and then click the Accept dispute button.

If you want to challenge the dispute, click Challenge dispute to open the evidence submission form, then select the product type from the list.

Depending on the product type you select, the form will specify different items which you should submit as evidence. Some items, such as the customer name, email, and address, will be pre-filled for you.

In addition to our evidence submission suggestions, please keep the following in mind:

- Banks look at thousands of disputes every day. Overly lengthy explanations won’t help your chances. Keep your response clear, concise, and professional in tone.

- For each file upload button (e.g. “Proof of shipping”), you can only submit one file. If you have several pieces of evidence for that item, you’ll need to combine them using Adobe’s free PDF merging tool or something similar.

- Check that your evidence files don’t exceed the combined size limit of 4.5 MB.

- Banks evaluating the dispute won’t look at external content, so don’t include audio or video files, links to other sites, or requests for them to call or email you.

Once you’ve collected and uploaded all the available evidence, click Submit evidence at the bottom to send everything to the cardholder’s bank.

If you wish to save the evidence you’ve collected so far without submitting it, you can also click Save for later. If you forget to come back to the dispute, we will automatically send the saved evidence on the deadline date for that dispute.

Note:

It’s important to be clear that you only have one chance to submit evidence and challenge a dispute. There’s no way to update the dispute, add more evidence or information, etc… There’s just the one chance to make your case and challenge a dispute, so take your time in collecting information and evidence.

4. Monitor the dispute status

↑ Back to topAfter you’ve submitted evidence to challenge the dispute, the cardholder’s bank will review it within a certain amount of time, usually 60-75 days. Once they’ve made their decision, you’ll receive an email notification about the outcome.

The outcome will also be noted on the transaction details page:

If you win, the disputed amount and the dispute fee are automatically credited to your WooPayments account balance. If you lose, the disputed amount and the dispute fee that were deducted from your account earlier are not returned.

NOTE: The dispute outcome is determined solely by the cardholder’s bank. Neither we nor our payment processor can influence their decision. After disputes are decided, the outcome cannot be appealed or overturned.

Dispute withdrawals

↑ Back to topAs we noted in the Contact your customer section above, the most effective way to win a dispute is by contacting your customer, addressing the issue that caused them to file a dispute, and then having them withdraw/retract the dispute via their bank.

NOTE: If the plan you make with your customer involves refunding them, know that it could be some time before you can do so. This is because you cannot refund a disputed charge until the bank decides the dispute in your favor.

If they agree to withdraw the dispute, consider asking for evidence of this, such as a copy of an email from their bank. It’s not required to submit this as evidence when you challenge the dispute, but it is very helpful.

Also, keep in mind the following information about withdrawn disputes:

- You must still challenge it with evidence in order to win!

- They are not resolved any more quickly than other disputes.

- They do not show up any differently in your dashboard.

- They still count against your dispute rate with the card network.

- Inquiries cannot be withdrawn.

Common mistakes

↑ Back to topBecause handling disputes can be stressful, merchants often feel a temptation to do almost anything to get rid of them, even though those actions are usually unwise.

Here’s a few common mistakes to avoid:

- Don’t ignore disputes and hope they go away. If you don’t respond to a dispute in time, the cardholder’s bank will automatically resolve the dispute in your customer’s favor.

- Don’t ignore disputes your customer withdrew. Even if your customer withdraws or cancels the dispute with their bank, you still need to challenge the dispute in order to get your money back and have the dispute fee returned.

- Don’t submit evidence before you’re ready. Dispute evidence can only be submitted one time per dispute, so be absolutely sure that you’ve filled out all the details and that you’ve included all the relevant information. Once evidence has been submitted against a dispute, there’s no way correct it or amend it.

- Don’t refund the customer in some other way. This is because the disputed amount is withdrawn from your account immediately when the dispute is first filed and sent back to the customer. Trying to refund the customer via some other method is likely to result in you losing twice as much money as you would have otherwise.

- Don’t let disputes pile up. If your dispute rate exceeds certain thresholds set by card networks (e.g. Visa or Mastercard), you could face monthly fines or other fees until your disputes return to acceptable levels. You can learn about ways to prevent disputes here.