Form 1099-K is an information filing required by the Internal Revenue Service (IRS) of the United States. WooPayments is required to issue a Form 1099-K to U.S. persons with payments processed that exceed thresholds determined by the IRS.

NOTE: Some states have a lower threshold than the IRS, so you may receive a 1099-K even if your gross sales are less than the IRS amounts. We recommend consulting with your tax advisor for additional information and to understand which threshold applies in your state.

Receiving a Form 1099-K

↑ Back to topYou may have questions about receiving your Form 1099-K. This section contains information that will allow you to better determine how and when you may receive your Form 1099-K.

What is the tax process?

↑ Back to topNOTE: We have built WooPayments in partnership with Stripe; expect some communication from Stripe with regard to your 1099-K. We recommend adding express@stripe.com to your address book so the email isn’t marked as spam.

There are two distinct phases of the tax process:

- The verification phase.

- The delivery phase.

Verification phase

In November, merchants who are eligible to receive a 1099-K will be sent a verification email from WooPayments and Stripe. This email will have a link for you to confirm:

- Your identity.

- Tax information.

- Delivery method.

- You will be asked if you consent to e-delivery (meaning you will receive your 1099-K form electronically if you consent).

Should you need to update your information, you can do so via the link in the email. If you have any questions or need help, please reach out to WooCommerce support.

If you are unable to access the link, or you do not consent to eDelivery, you will be mailed a physical 1099-K form.

Delivery phase

Starting in early January of the following year, WooPayments in partnership with Stripe will send you your Form 1099-K. If you consented to e-delivery, your Form 1099-K will be made available to view and download in Stripe Express account dashboard. You’ll need this form to file your taxes.

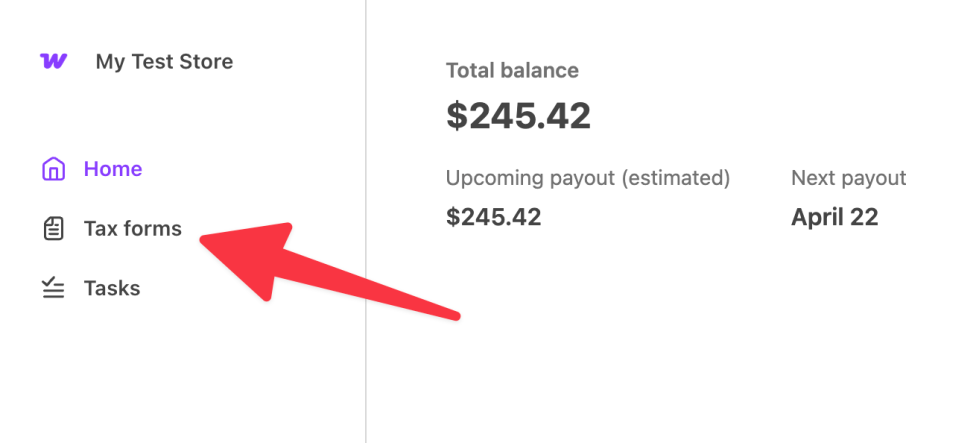

Once you’re in the Stripe Express dashboard, you can find the 1099-K by clicking on the Tax Forms page.

In the event that you did not opt in to e-delivery, you will be mailed a physical copy of your Form 1099-K.

NOTE: We cannot confirm exactly when you will receive a 1099-K due to delivery delays with the postal service. If you have any questions, please contact WooCommerce support.

Is the email from Stripe legitimate?

↑ Back to topYes! WooPayments partners with Stripe to deliver tax details to eligible merchants.

Is e-delivery secure?

↑ Back to topYes! Stripe Express e-delivery is secure and compliant with IRS guidelines. This includes:

- Confirming recipient consent.

- Providing an option to withdraw consent and receive a paper copy.

- Making the form accessible via a secure login from February through October.

How do I change the email address associated with this account?

↑ Back to topPlease see this document for instructions.

Navigating your Form 1099-K

↑ Back to topOnce you receive your Form 1099-K, you may have questions about its contents why you received it. This section contains information so that you can better understand the Form 1099-K.

What does the amount on Form 1099-K include?

↑ Back to topA Form 1099-K includes gross sales, without regard to:

- Refunds.

- Fees.

- Chargebacks.

- Other reductions.

Why did I receive a Form 1099-K?

↑ Back to topWe issue a 1099-K if a merchant meets either the federal filing threshold or a lower threshold applicable in their state.

What if I didn’t meet the IRS threshold but still got a Form 1099-K?

↑ Back to topA Form 1099-K may be issued for a few reasons, even if the IRS threshold is not met:

- Many states have a lower threshold than the federal government.

- A form will be filed if either the state or federal threshold is met.

- There are multiple accounts with the same tax identification number (TIN).

- Accounts using the same TIN are combined to determine if a filing is required.

- Even if all accounts are individually below the filing threshold, each account under the same TIN will receive a 1099-K if the combined total transaction and payment volumes exceed the threshold.

- A TIN, or Tax Identification Number, is the number used for business reporting by the IRS.

- This may be the owner’s Social Security Number (SSN) or an Employer Identification Number (EIN), which you can get via the IRS website.

- More information can be found on the IRS website here.

- A TIN, or Tax Identification Number, is the number used for business reporting by the IRS.

How can I reconcile my payouts to my Form 1099-K?

↑ Back to topA reconciliation between Form 1099-K and your payouts and/or account balance can be requested by contacting WooCommerce support.

How do I report the information on my Form 1099-K?

↑ Back to topWe recommend consulting with your tax advisor for additional information.

Resolving issues with and errors on your Form 1099-K

↑ Back to topWhen you receive your Form 1099-K, you may notice that some of the information is incorrect or not what you expected. This section contains some information on steps you can take to make corrections or better understand why the information may not appear as anticipated.

Why doesn’t the amount reported match the payouts I’ve received?

↑ Back to topBecause a Form 1099-K is required to include gross sales, it will include amounts that are not paid out into your bank account, such as:

- Refunds

- Fees

- Disputed charges

- Funds reserved

- Transactions that haven’t been paid out yet

What if details on my Form 1099-K are wrong?

↑ Back to topSome information can be updated via the Stripe Express dashboard, such as:

- Address details

- Name

- Tax ID

My Form 1099-K is issued to me personally but should be issued to my business.

↑ Back to topForm 1099-Ks are issued according to how merchants should report the activity of their business. Consult the following chart to determine how Form 1099-K should be issued.

To change from an individual/sole proprietor to a business (or vice versa), please:

- Contact Stripe directly to have your account updated.

- Reach out to our support team so we can help resolve the issue.

A corrected Form 1099-K will be filed once your WooPayments account is updated.

I haven’t claimed my account yet and I think the information on my account is wrong. How do I change it so I can claim my account?

↑ Back to topPlease see this document for instructions on how to log into your Stripe Express account for WooPayments.

From there, you can update various details for your account, including your SSN, email address, home address, etc.

For account updates on your Form 1099-K or additional assistance please reach out to the Stripe Express team. If you need assistance with WooCommerce or WooPayments, please create a ticket.